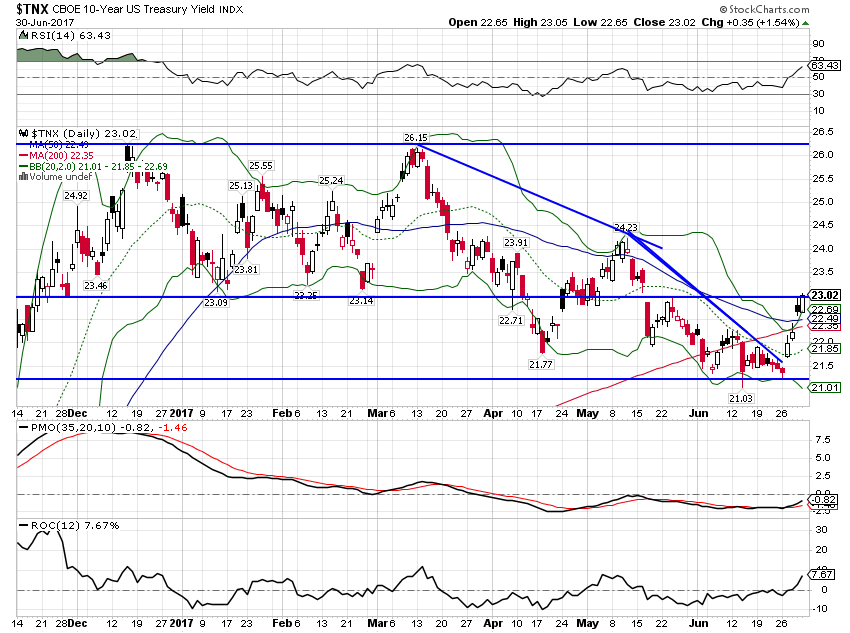

In my last update two weeks ago I commented on the continued weakness in the economic data. The economic surprises were overwhelmingly negative and our market based indicators confirmed that weakness. This week the surprises are not in the economic data but in the indicators. And surprising as well is the source of the outbreak of optimism in the bond market and the yield curve.

We’re growing at 2% or so and it is apparently going to take something big to move us off that number. Investors thought for a while that the new Trump administration would supply that something big in the form of tax cuts, regulatory reform and healthcare reform. All that has faded as the reality of governing in a deeply divided country bites into expectations for rapid change.

The Trump agenda was marked to market over the last few months and came up a bit shy. Bond yields fell, the yield curve flattened, gold rose and economically sensitive commodities fell. The dollar also fell as economic growth expectations equalized between the US and the rest of the world. And it appears more and more that the equalization is equal parts worse in the US and better everywhere else. The global economy is not supposed to be a zero sum game but it sure has looked that way in recent years.

The economic data contained some positive information but generally the tone of the data hasn’t changed much. The positive surprises were supplied by housing as both new and existing sales were better than expected. The enthusiasm was dented a bit by a disappointing pending sales index but housing had been softening so I’ll take some good news on the sector.

Personal income was another bright spot, up 0.4% and a tad better than expected. That’s a qualified bright spot though; the gain was not from wages and salaries. And the 3.5% year over year change is historically more the bottom of the range outside recession so it’s a positive but not much of one. It certainly wasn’t enough to do anything about consumption as savings improved more than spending. That isn’t a bad thing in my opinion but it gives Keynesians the shakes. Spending was down in durables and non, only services registering a positive.

Q1 GDP was revised higher but that’s so far in the past no one cares. Jobless claims continue to track at low levels, albeit somewhat higher ones than a few weeks ago. Some of the regional activity surveys were positive with Chicago leading the way, jumping over 60 for the first time since 2014. Dallas and Richmond were both positive but less than expected while KC was positive and better. That about does it for the positives and none of it looks all that positive for Q2 GDP.

I continue to point out the positives where I can but the negatives seem more substantial and consistent. Durable goods orders were down month to month which should surprise exactly no one. Orders have been going sideways since 2012 and are still floating along at less than the 2007 level. I don’t know if I’d call it a lost decade but it might ought to at least stop and ask directions.

The trade report showed a rise in exports and a drop in imports. Consumer goods imports were down 3.8% and vehicle imports were down 2.4% so it isn’t just domestic goods US consumers are shunning. Advance reports showed both retail and wholesale inventories rising sharply. Maybe a positive for this quarter’s GDP but probably not a good thing since sales are sluggish. A big part of the retail inventory surge was autos, sales of which appear to have peaked.

House prices were reported up more by both FHFA and Case-Shiller. That is probably viewed favorably by existing home owners but won’t do much to solve that pesky slow sales problem. There isn’t any inflation in the CPI or the PCE deflator the Fed monitors but this is just one hint of a potential change in that dynamic. Another was a pretty decent rise in farm prices, up 2.1% month to month and 4.8% year over year. Commodities in general are trying to make a bottom after years of falling during the strong dollar period. I don’t know how long the recently weak dollar will continue but these trends are generally measured in years not months.

The Chicago Fed National Activity Index, a weighted average of 85 monthly indicators, came in at -0.26 confirming what we already know. Economic activity had a brief rebound from a weak first quarter but appears to be slipping back. We are now growing at less than trend – again – and the trend frankly isn’t anything to write home about. The CFNAI isn’t shouting recession but it is clearing its throat, more of a hoarse whisper, a raspy ahem.

As I said at the top, the surprise since the last update was in the market based indicators we follow. Global bond markets awoke early last week, nudged out of their slumber by Mario Draghi’s declaration that deflation on the continent was morphing into reflation. It may be that, upon seeing the speaker was one of those so often wrong central bankers, the bond markets will roll over and resume their soporific ways but for now I’ll acknowledge the moves and wait for confirmation it is something more than a blip.

So on to those indicators.

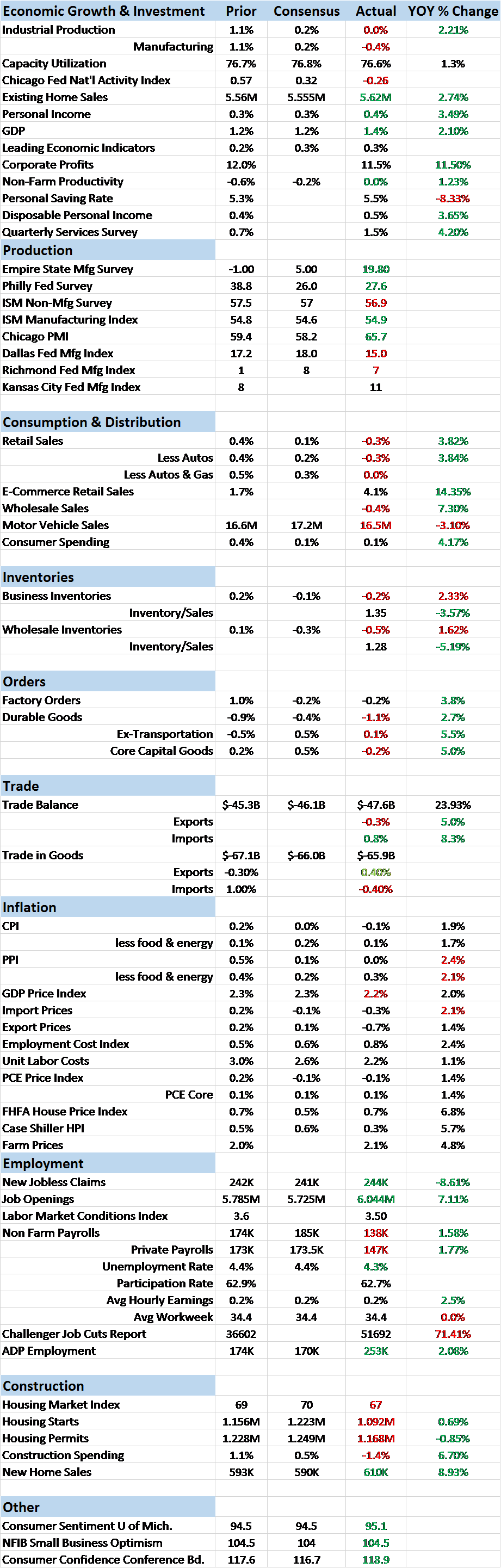

| The yield curve steepened by just 5 basis points since my last update but 11 from the Draghi speech. |

US 10 - Year Treasurt Constant Maturity Minus 2 - Year Treasury Constant Maturity, July 2012 - July 2017 |

| Obviously, it isn’t much and the long term trend is still toward flat. But it would be positive if it continues to steepen as it did last week – long rates rising faster than short rates. |

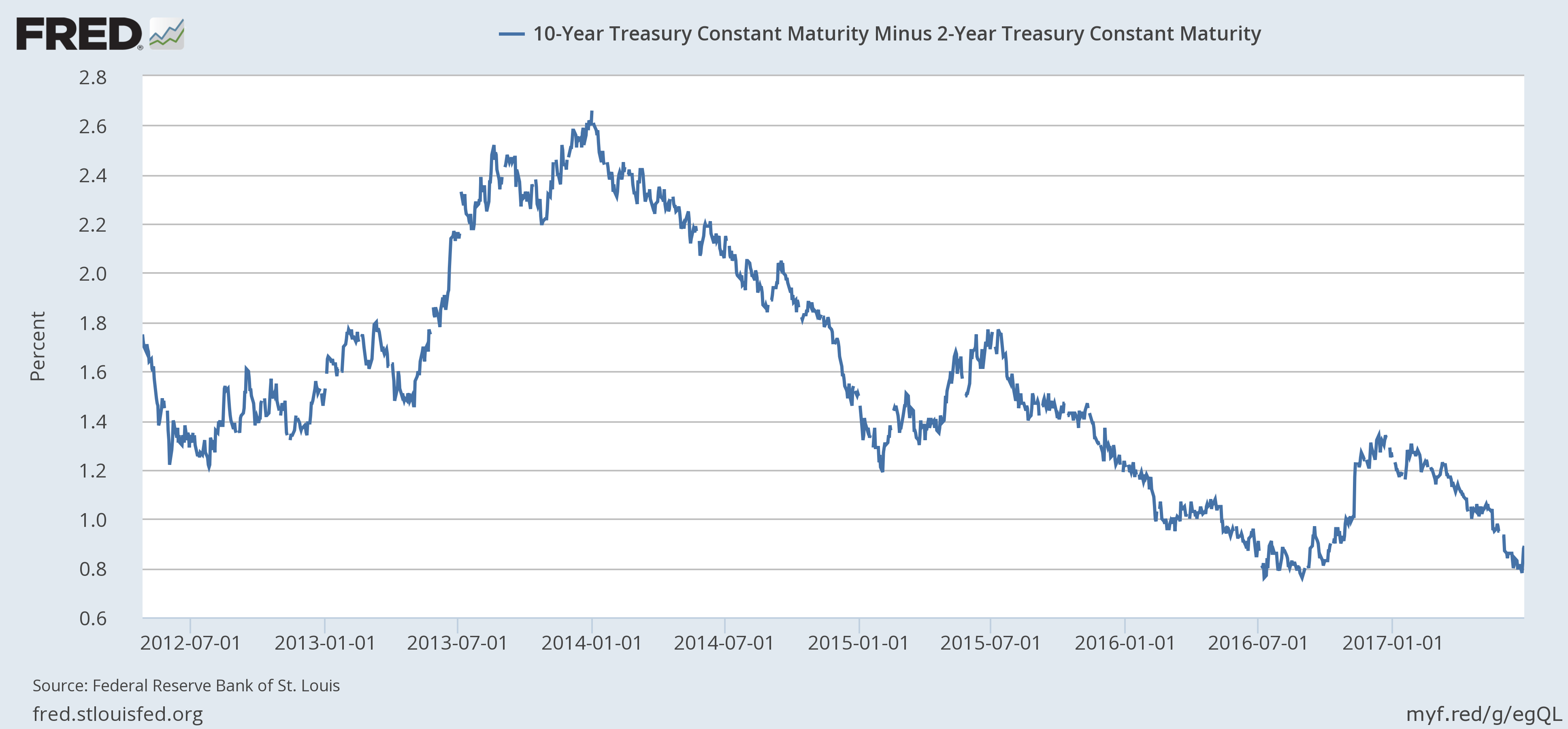

US 10 - Year Treasurt Constant Maturity Minus 2 - Year Treasury Constant Maturity, 1988 - 2017 |

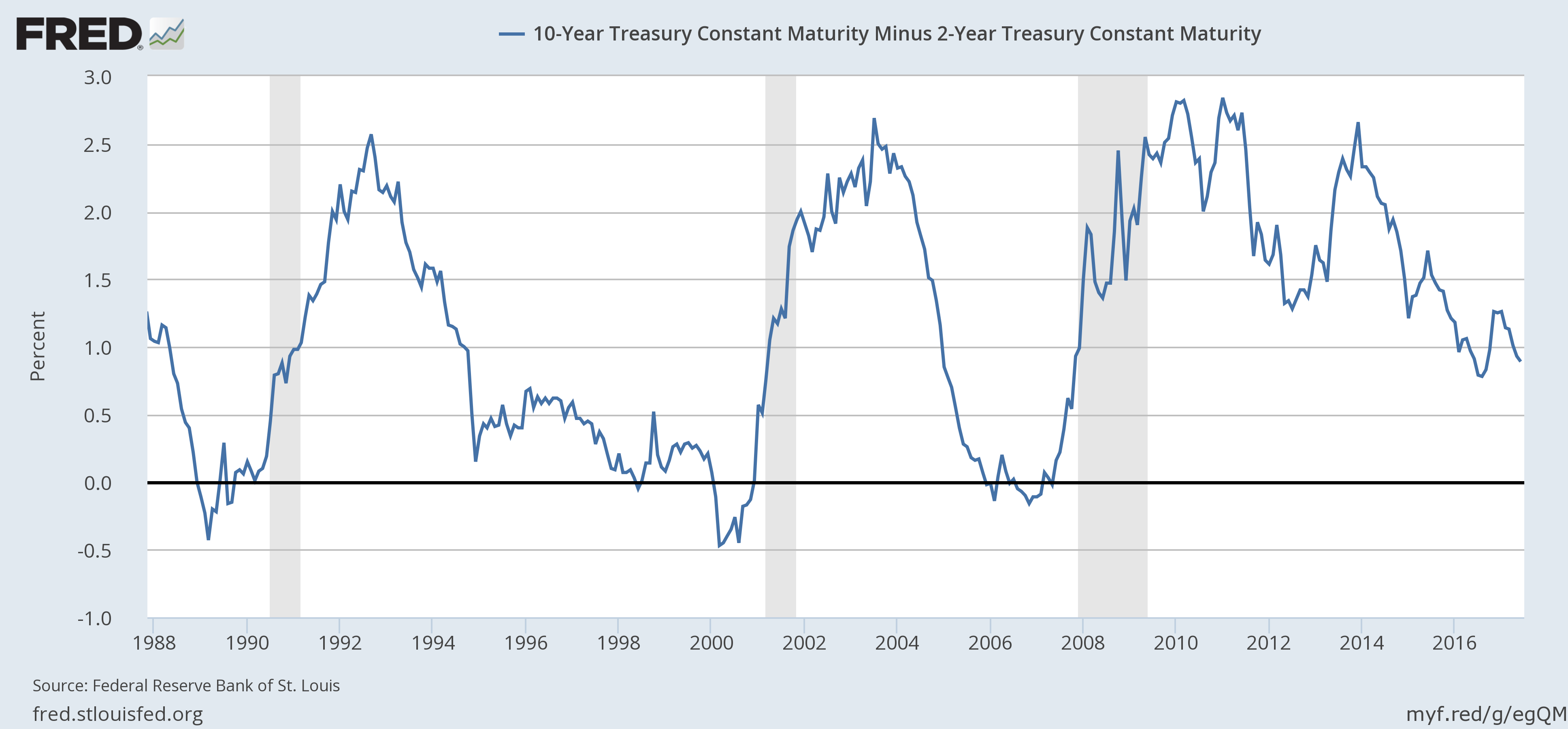

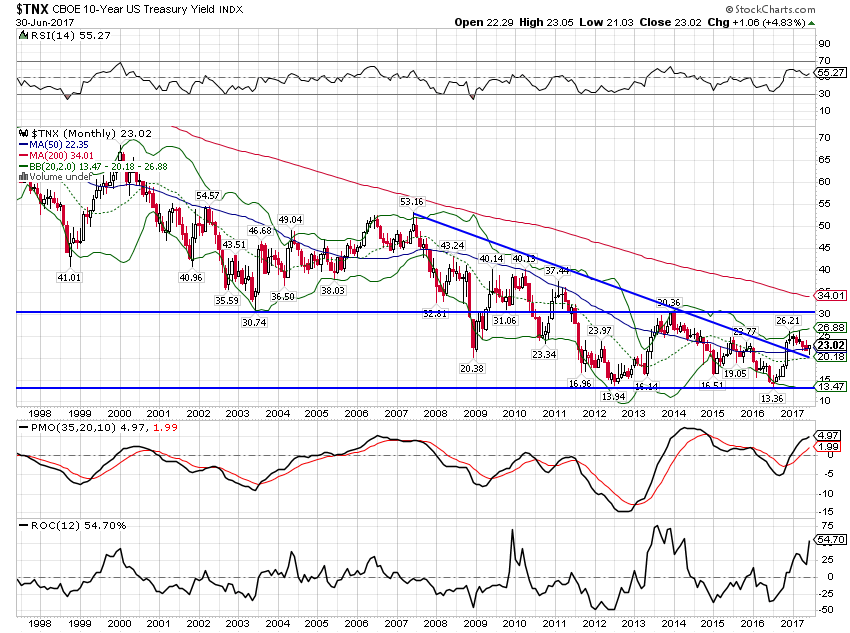

| The 10 year nominal Treasury note yield rose strongly after the speech: |

US 10 - Year Treasury Yield, December 2016 - July 2017 |

| Long term the yield has accomplished what I expected technically and now appears ready to move higher. I expect another push lower in yield (bonds higher in price) but I’m beginning to think the bottom may be in. |

US 10 - Year Yield Long Term, 1998 - 2017 |

| TIPS yields also moved higher but less than nominal bond yields so inflation expectations rose more than real growth expectations. |

US 10 - Year Treasury Inflation Indexed Security and Constant Maturity, January 2013 - July 2017 |

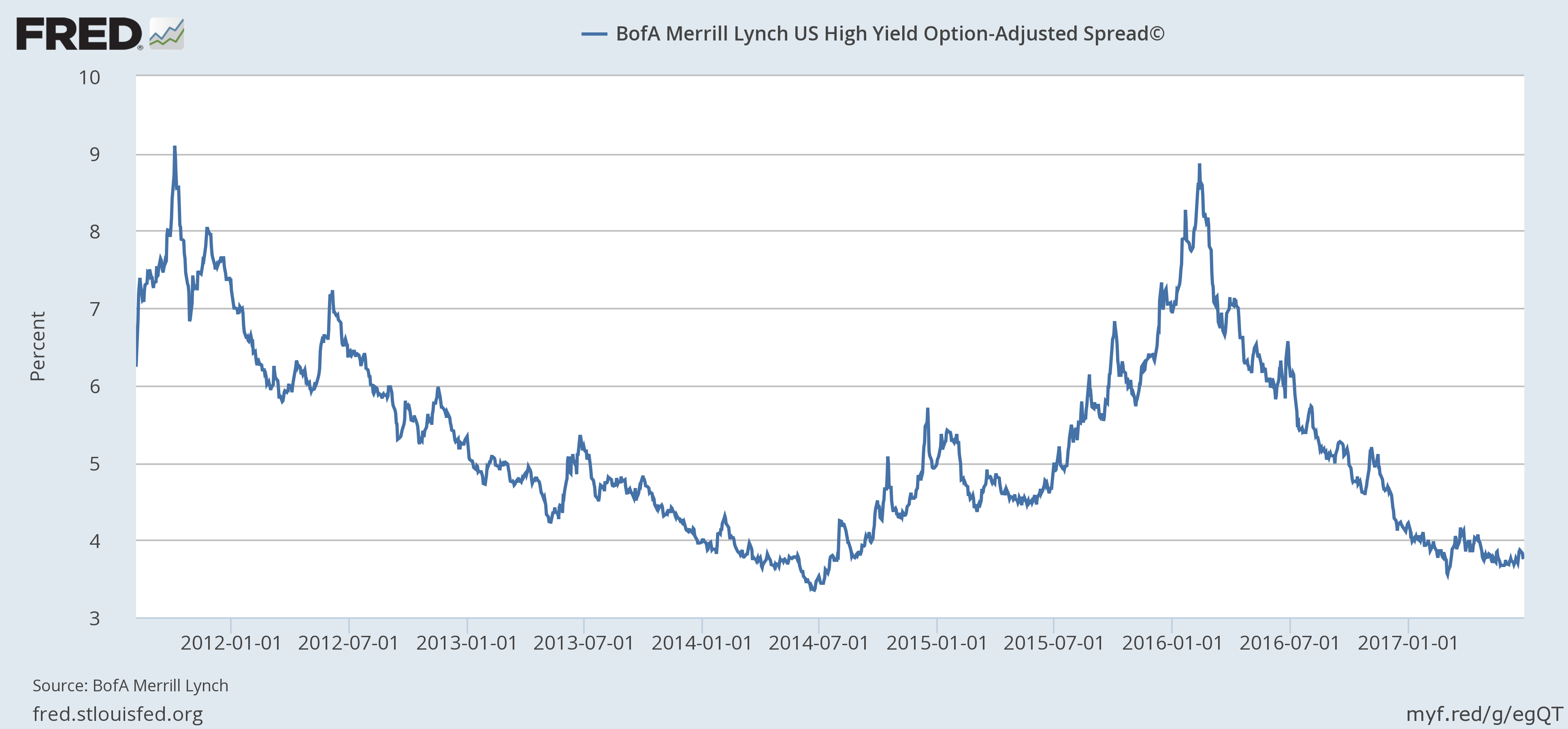

| Credit spreads were unchanged since the last update but they have stopped improving. Spreads have moved in recent times in response to oil prices but that correlation may be over. In any case, the bear case for crude oil is getting crowded and I suspect prices are poised to move higher. Whatever happens in the future, spreads are not right now indicating any stress. |

US BofA Merril Lynch High Yield Option Adjusted Spread, January 2012 - July 2017 |

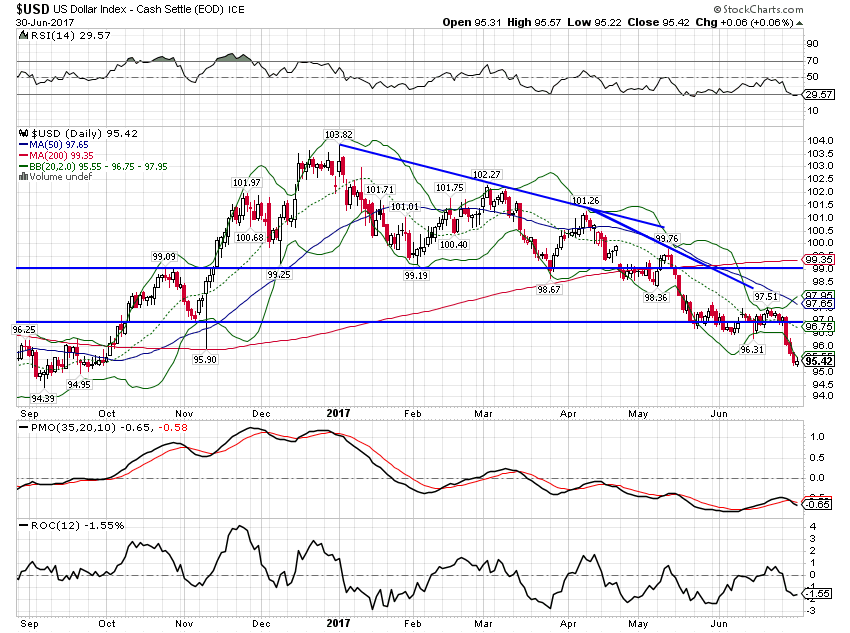

| The dollar broke decisively lower on the Draghi speech. |

US Dollar Index, September 2016 - July 2017(see more posts on US Dollar Index, ) |

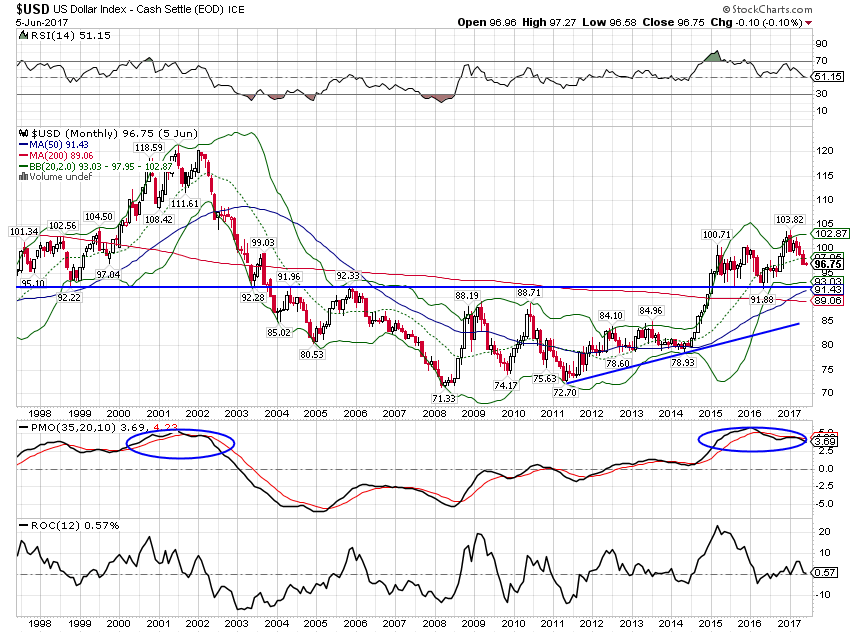

| The dollar weakness has persisted since the beginning of the year, but longer term is in a wide trading range. The index appears to have a date with the low end of that range around 91. After that, we’ll see what happens but again, currency trends tend to be long lasting so if this is the beginning of a dollar bear market it has a long way to go. |

US Dollar Index Monthly, 1998 - 2017(see more posts on U.S. Dollar Index, ) |

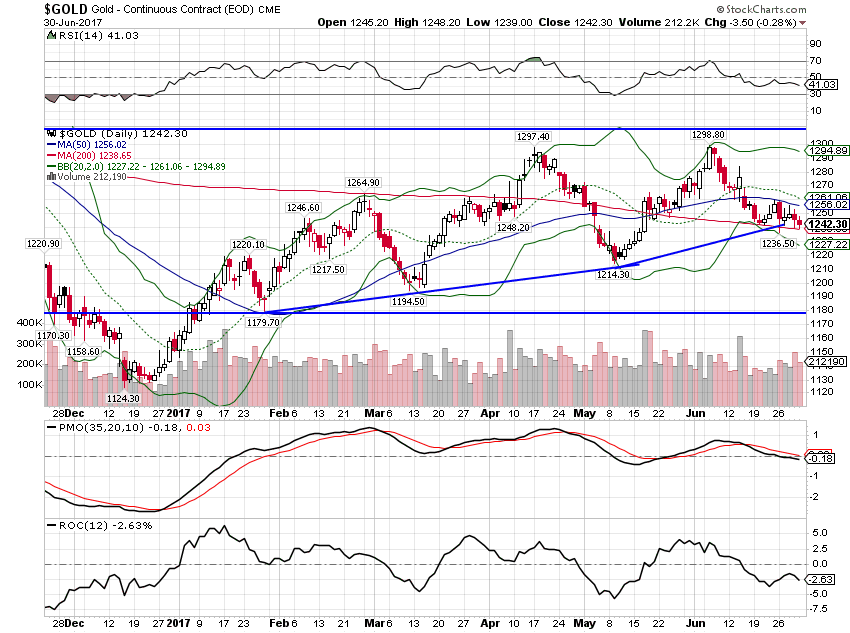

| With the dollar on a downward track one would expect gold to rally but the inverse correlation isn’t perfect. If the dollar keeps falling, I’d expect gold to catch up but it wasn’t happening last week: |

US Gold Continuos Contract, December 2016 - July 2017(see more posts on Gold, ) |

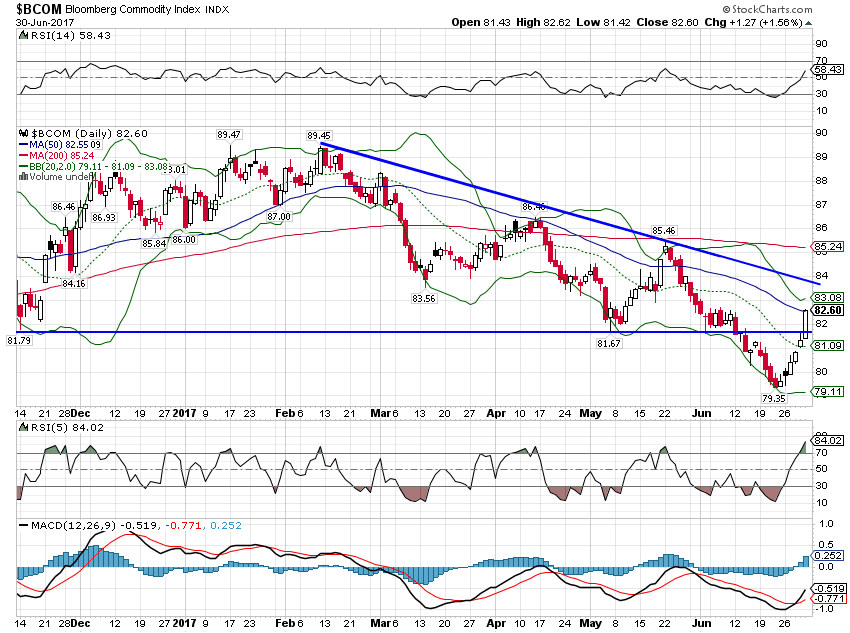

| The Bloomberg commodity index rallied smartly though. That would seem to point to changing global growth expectations as the driver of general commodities and gold. So far, it is just a rally in a downtrend, a comeback from very oversold conditions. But if it continues and breaks the downtrend, we might have something. |

US Bloomberf Commodity Index, December 2016 - July 2017(see more posts on Bloomberg Commodity, ) |

The implication of Draghi’s optimism – and it should be noted that the ECB spent most of the next day walking that back – is of course that QE may someday come to an end in Europe. Not exactly earth shattering news I suppose but then the Bank of Japan is still QEing along 16 years after it first tried the monetary nostrum. In any case, the immediate response by markets was to sell bonds and dollars. One might even suspect there was a bit of a carry trade going on.

The movements in the bond and currency markets were somewhat contradictory. The yield rise at the long end of the Treasury curve and a rise in TIPS yields are indications of improving growth expectations. But a falling dollar would seem to indicate the opposite. Or more likely the falling dollar says that growth expectations improved everywhere but more in the rest of the world than in the US. We don’t have much in the way of hard evidence on any improvement in US growth but apparently hope springs eternal.

There is another possibility but central bankers would never believe it. It could be that QE is actually a depressant rather than a stimulant and that ending it means better global growth. I know that sounds counterintuitive but consider that ending QE may make the banks of the world have to actually work to make a buck (or Euro) rather than just front run the world’s central banks. Maybe they could actually do something useful like make a loan rather than just manufacturing paper to sell to the ECB. You know, act like a bank. Just a thought….

Mario Draghi single-handedly last week produced a dramatic move in the global bond markets. It isn’t the first time – whatever it takes – and the man does have a way with words. Inflation and growth expectations both rose and the Euro and Pound rallied against the dollar. But so far these moves are nothing more than counter-trend; commodities are still down nearly 6% on the year. And the 10 year yield is still a long way from its high this year around 2.61%. We’ll see how this plays out in coming weeks but so far nothing much has changed except the rhetoric.

Full story here Are you the author? Previous post See more for Next post

Tags: Alhambra Research,Bi-Weekly Economic Review,Bloomberg Commodity,Bonds,commodities,credit spreads,currencies,Donald Trump,ECB,economy,Euro,Gold,House Prices,Markets,newslettersent,TIPS,Trade,U.S. Dollar Index,US Dollar Index,Yield Curve