Tag Archive: China Consumer Price Index

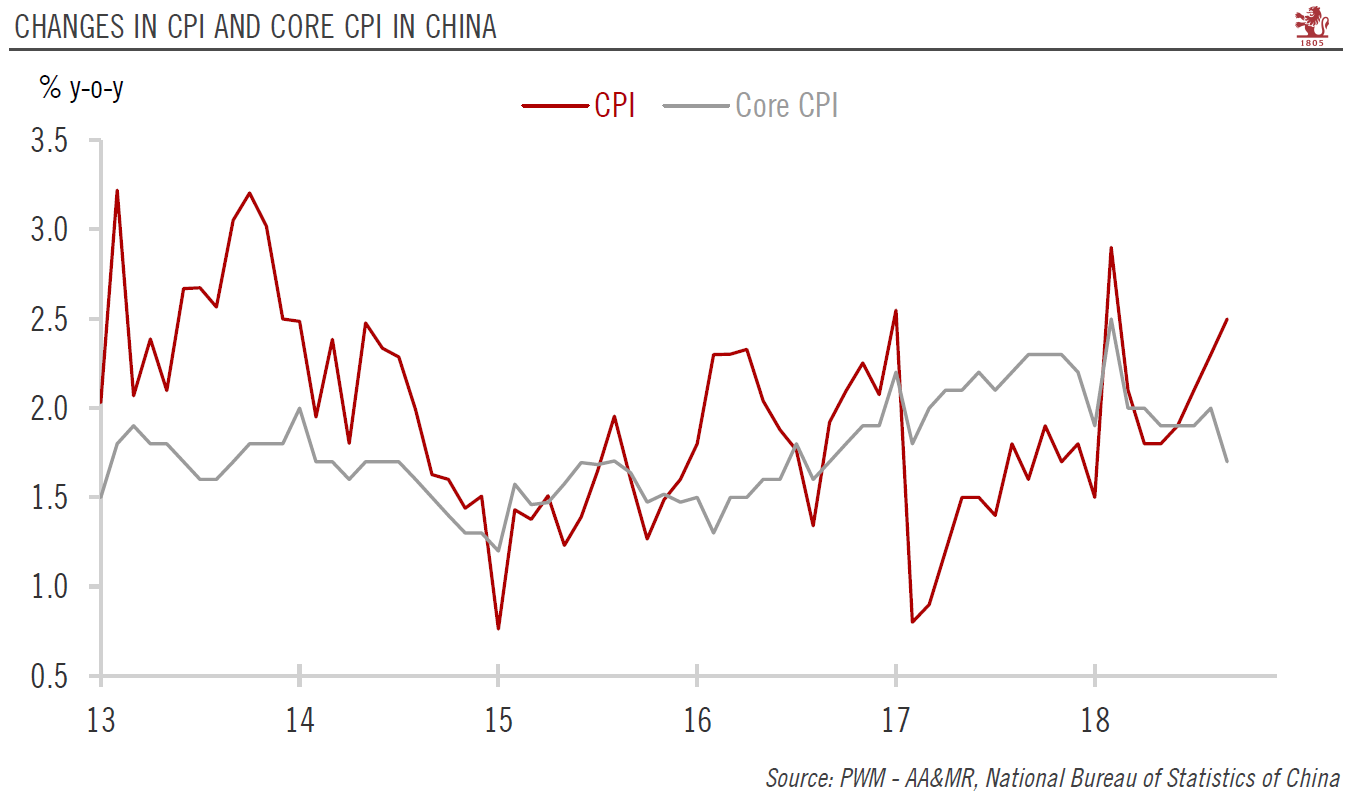

The Consumer Price Index (CPI) measures the change in the price of goods and services from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

Data Dependent: Interest Rates Have Nowhere To Go

In October 2015, Federal Reserve Vice Chairman Bill Dudley admitted that the US economy might be slowing. In the typically understated fashion befitting the usual clownshow, he merely was acknowledging what was by then pretty obvious to anyone outside the economics profession.

Read More »

Read More »

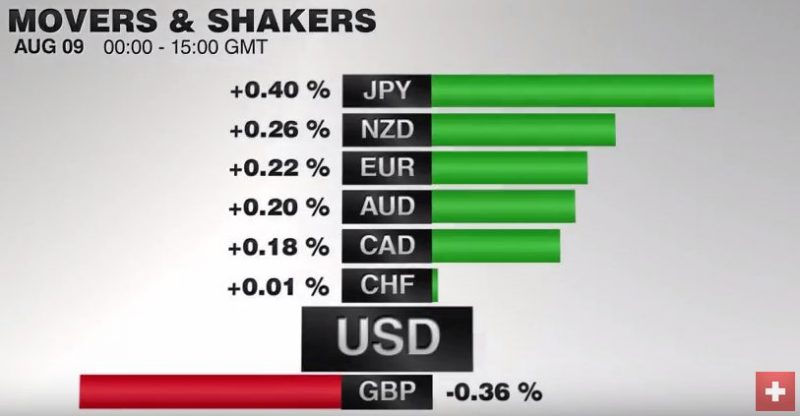

FX Daily, August 09: North Korea lets EUR/CHF Collapse

The bellicose rhetoric from the US and North Korean officials is the main driver today. We would qualify that assessment by noting that first, the market moves are rather modest, suggesting a low-level anxiety among investors. Second, pre-existing trends have mostly been extended. Turning to Asia first, the Korea's equity market fell 1.1%. The Kospi has fallen for the past two weeks (~2.2%).

Read More »

Read More »

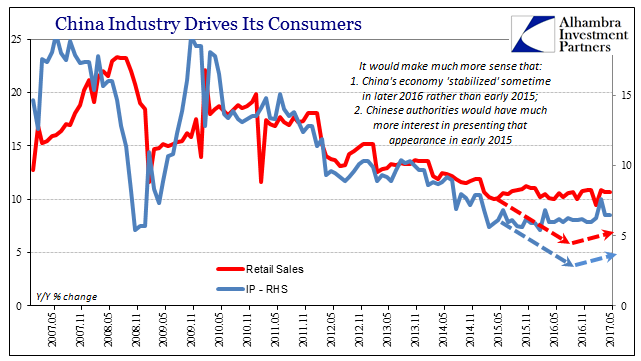

Competing CPI,PPI, Industrial Production and Retail Sales: No Luck China, Either

Former IMF chief economist Ken Rogoff warned today on CNBC that he was concerned about China. Specifically, he worried that country might “export a recession” to the rest of Asia if not the rest of the world. I’m not sure if he has been paying attention or not, but the Chinese economy since 2012 has been doing just that to varying degrees often just shy of that level.

Read More »

Read More »

FX Daily, July 10: Firm Dollar Tone may be Challenged by Softer Yields

The US dollar has begun the new week on a firm note, but the decline in yields limit the gains. The US 10-year yield is pulling back from the 2.40% area, which is it not been able to sustain gains above since Q1. European bond yields are also 1-3 basis points lower today after jumping last week.

Read More »

Read More »

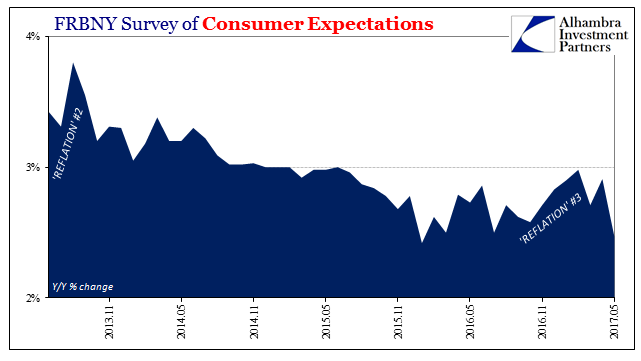

American Expectations, Chinese Prices

The Federal Reserve Bank of New York has for the past almost four years conducted its own assessment of consumer expectations.Though there are several other well-known consumer surveys, FRBNY adding another could be helpful for corroborating them. Unfortunately for the Fed, it has.

Read More »

Read More »

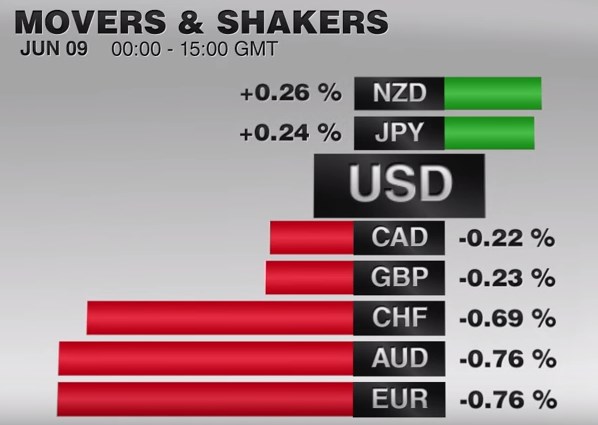

FX Daily, June 09: Sterling Shocked, Dollar Broadly Firmer

What looked like a savvy move in late April has turned into a nightmare. Collectively, voters have denied the governing Conservative party a parliamentary majority. The uncertainty today does not lie yesterday with the known unknown, but with the shape of the next government and what it means for Brexit.

Read More »

Read More »

FX Daily, May 10: Markets Adjust to North Korean Threat, Fifth Fall in US Oil Inventories and Trump Drama

Investors absorbed a few developments that might have been disruptive for the markets with little fanfare. North Korea's ambassador to the UK warned that his country would go ahead with its sixth nuclear test, as South Korea elected a new president who wants to reduce tensions on the peninsula.

Read More »

Read More »

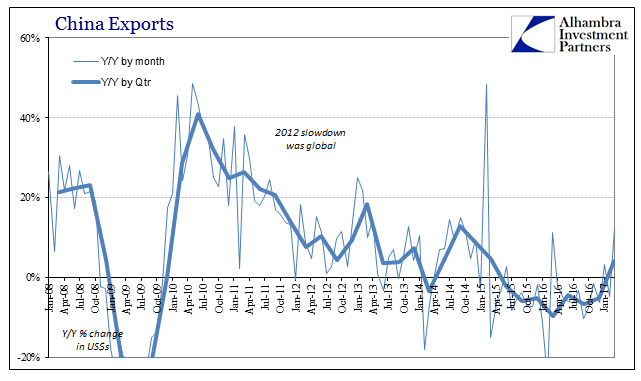

What Was Chinese Trade in March?

As with all statistics, there are discrepancies that from time to time may obscure the meaning or validity of the particular estimate in question. For the vast majority of the time, any such uncertainties amount to very little. Overall, harmony among the major accounts reduces the signal noise from any one featuring a significant inconsistency.

Read More »

Read More »

FX Daily, April 12: Investors Catch Breath, Markets Stabilize

Markets are calmer today. The significant movers yesterday have stabilized. The dollar has been unable to resurface above JPY110, but after plumbing to new lows near JPY109.35 in Asia, the dollar has recovered back levels since in North America late yesterday. The decline in the US 10-year yield was also initially extended in Asia before stabilizing and returning to levels seen in the US afternoon.

Read More »

Read More »

FX Daily, March 09: Pre-ECB Squaring Lifts Euro in a Strong USD Context

The euro tested the lower of its range near $1.05 in Asia before short covering in Europe lifted back toward yesterday's highs near $1.0575. However, buoyed by the upside surprise in the ADP estimate of private sector jobs growth, the dollar is firmer against most other currencies today. The US 10-year yield is up 20 bp this week.

Read More »

Read More »

FX Daily, February 14: Markets Showing Little Love on Valentines

Corrective pressures are gripping the major capital markets today.The Dollar Index's nine-day advancing streak is being threatened by the position adjustment ahead of Yellen's testimony later today. Despite record high closes in the main US equity markets yesterday, Asia could not follow suit. It tried to initially, and recorded new highs since July 2015, but sellers emerged and the MSCI Asia Pacific Index closed marginally lower on the lows of the...

Read More »

Read More »

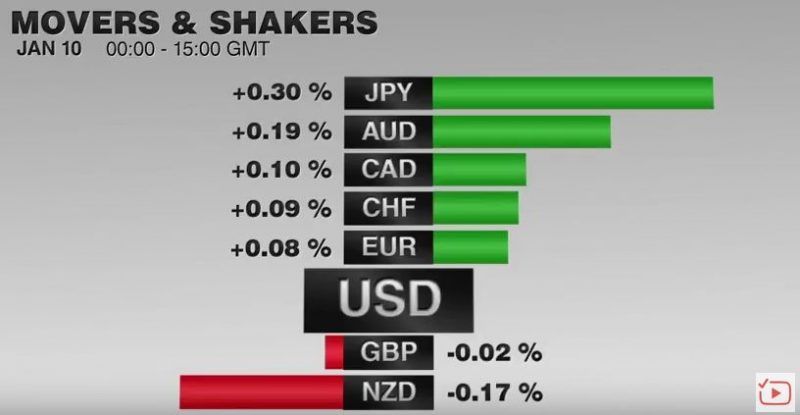

FX Daily, January 10: Positioning more than Fundamentals Give Traders Pause

After strong moves to start the year, the capital markets continue to consolidate. Many observers are suggesting a fundamental narrative behind the loss of momentum, but in discussions with clients and other market participants, it seems as if the main source of caution is coming from an understanding of market positioning rather than a reevaluation of the macro drivers.

Read More »

Read More »

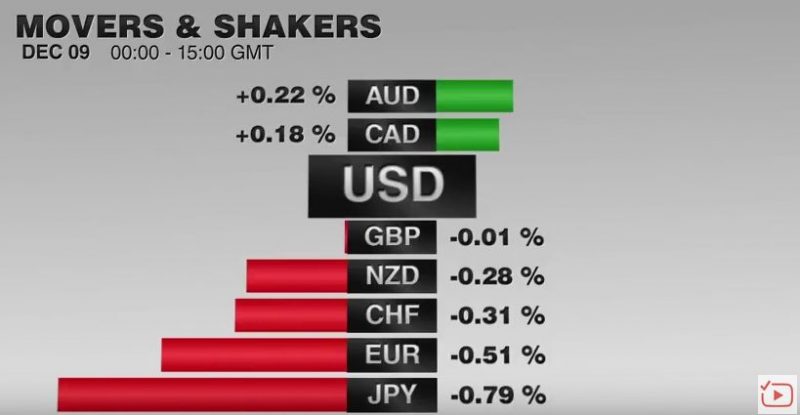

FX Daily, December 09: Euro Chopped Lower before Stabilizing

The euro has stabilized after extending yesterday's ECB-driven losses. The euro's drop yesterday was the largest since the UK referendum to leave the EU. Ahead of the weekend, there may be some room for additional corrective upticks, but they will likely be limited, with the $1.0650 area offering initial resistance. In the larger picture, this week's range, roughly $1.05 to $1.0850 likely will confine the price action for the remainder of the...

Read More »

Read More »

FX Daily, October 14: Firm Dollar Consolidating, Awaiting US Retail Sales

The US dollar is firm against most of the major currencies, but within yesterday's ranges, which seems somewhat fitting amid the light new stream. The high-yielding Australian and New Zealand dollars are resisting the stronger greenback, while on the week the Aussie and the Canadian dollar are the only majors to gain.

Read More »

Read More »

FX Daily, August 09: Sterling Slips to a Four-Week Low, EUR/CHF still trending up

In an otherwise uneventful foreign exchange market, sterling's slide for its fifth consecutive session is the highlight. It was pushed below $1.30 for the first time since July 12. Initial resistance for the North American session is seen near $1.3020, while the $1.2960 area corresponds to a minor retracement objective.

Read More »

Read More »

FX Daily, June 9: Greenback is Mostly Firmer, but Yen is Firmer Still

The euro continues to weaken against the franc at 1.0922. But the speed of the descent has slowed. The dollar is stronger, in particular against EUR, CHF and AUD.

The US dollar is posting modest upticks against most of the

European currencies and the Canadian and Australian dollars. However, it has fallen against the yen and taken out the

recent low, leaving little between it and the May 3 l...

Read More »

Read More »

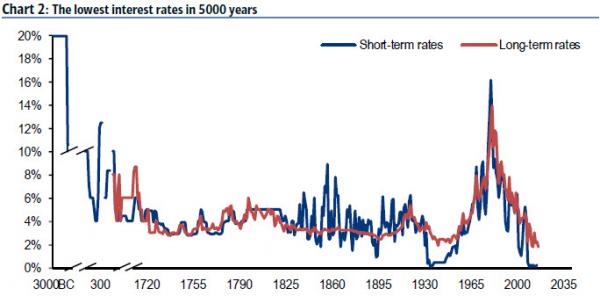

Visualizing “The 5000 Year Long Run” In 18 Stunning Charts

In the long run, as someone once said, we are all dead, but in the meantime, as BofAML's Michael Hartnett provides a stunning tour de force of the last 5000 years illustrates long-run trends in the return, volatility, valuation & ownership of financi...

Read More »

Read More »

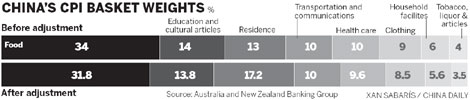

(2.3) Differences in global CPI baskets

Typically poorer countries have a basket with a higher weight for food and other consumption goods, but richer states give them a smaller weight. Here the full details over different countries

Read More »

Read More »

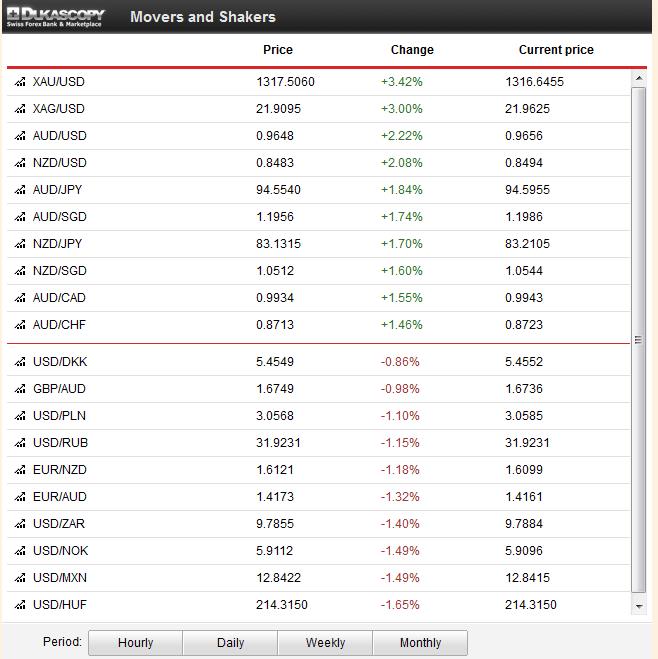

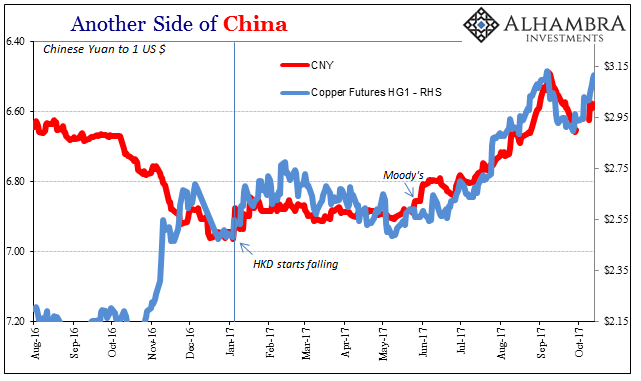

Week October 14 to 18, A Close Look at China’s Fundamental Data

Weekly Overview of FX Rates Movements The week was driven by the following factors: Solid Chinese economic data including a 7.8% rise in GDP. The end of the debt ceiling debate, at least for now. The expectation by the Fed member Evans that the government shutdown has delayed Fed tapering. San Francisco Fed’s Williams …

Read More »

Read More »

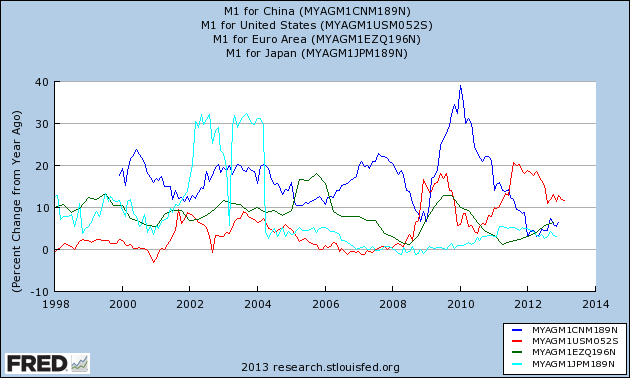

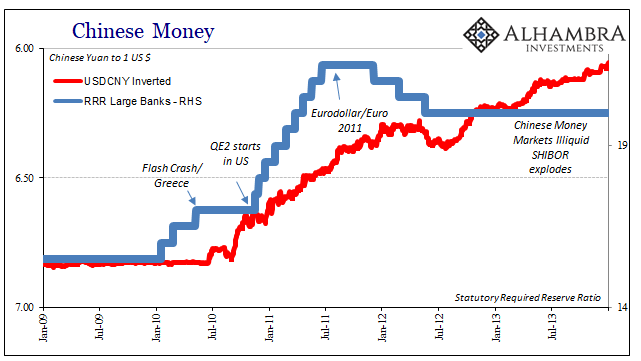

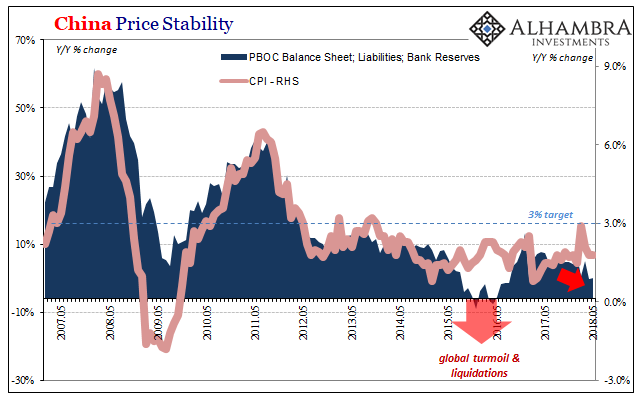

The Inflation Lie? Why and When Inflation Will Come Back

The so-called "inflation lie" : money printing does not create inflation. The cyclical slowing in emerging markets shows that it actually did cause inflation, just not in developed economies yet.

Read More »

Read More »