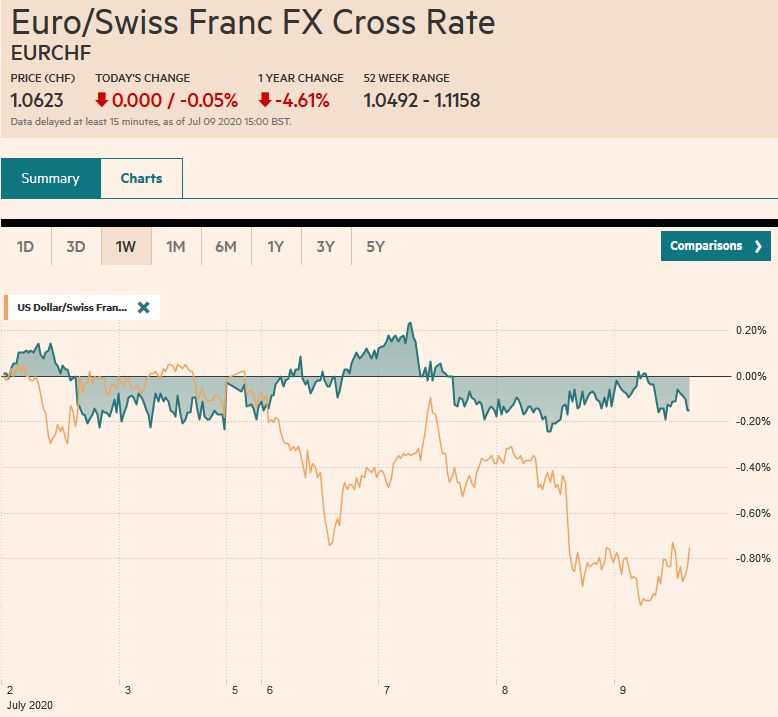

Swiss FrancThe Euro has fallen by 0.05% to 1.0623 |

EUR/CHF and USD/CHF, July 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Investors continue to clamor into risk assets. Led by Chinese shares, the MSCI Asia Pacific Index pushed higher for the third session this week to new five-month highs. Europe’s Dow Jones Stoxx 600 is trying to snap a two-day decline with the help of better than expected revenues for its largest tech company. US shares are little changed after yesterday’s 0.8% rally in the S&P 500 and new record high close in the NASDAQ. Bonds are sidelined. Asia Pacific yields edged higher, but mostly flat in Europe. The US 10-year benchmark is hovering around 65 bp. The dollar is on its back foot, trading heavily against most major and emerging market currencies. Sterling and the Swedish krona led the majors with a 0.20-0.25% gain through the European morning. The dollar punched below CNY7.0 for the first time in almost four months. Gold is holding above $1800 an ounce and looks set to push higher above $1818 seen yesterday. Oil is little changed as the August WTI contract is confined to a narrow range (~$40.60-$41.00) |

FX Performance, July 9 |

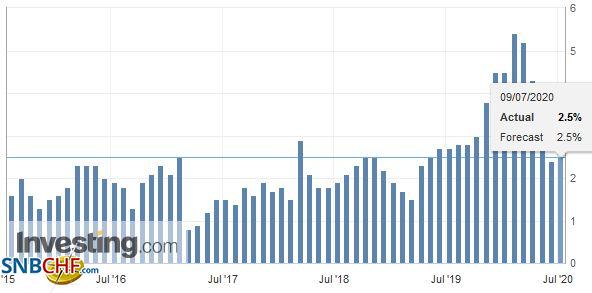

Asia PacificAs widely anticipated, China’s CPI firmed to 2.5% in June from 2.4%. This was in line with expectations. Food prices are still an important culprit. They are up over 11% year-over-year. The 81.6% increase in pork prices accounts for 2.05 percentage points of CPI. Non-food prices rose 0.3% year-over-year. Producer prices showed somewhat less deflation. PPI fell 3% year-over-year after a 3.7% decline in May. We anticipate more stimulus, but it may be targeted rather than broadly delivered. |

China Consumer Price Index (CPI) YoY, June 2020(see more posts on China Consumer Price Index, ) Source: investing.com - Click to enlarge |

Japan reported core machinery tool orders rose 1.7% in May. It follows a 12% slump in April. Economists had projected another decline. The rise in new orders was driven by the service sector, which underscores the weakness in the manufacturing sector seen in other economic reports. Manufacturing orders fell.

Home loan values fell by 11.6% in Australia. This was more than twice the decline expected by the median forecast in the Bloomberg survey. It is the third decline in the past four months. Meanwhile, tensions are rising between Australia and China. It suspended the extradition treaty with Hong Kong while seeking to draw Hong Kong residents that want to flee in light of the new security lows, and have begun strengthening its ability to resist Beijing’s cyber attacks.

The dollar has been confined to about a fifth of a yen range above JPY107.20. There are nearly $800 mln in options that expire today struck between JPY107.10 and JPY107.25. There is also a $1.1 bln option at JPY107.50 that will be cut today. The Australian dollar is firm and managed to briefly trade above $0.7000 for the first time since June 11. However, here too, a consolidative tone persists. Support is seen in the $0.6960-$0.6970 area. Downward pressure on the dollar against the Chinese yuan has been building, and today it broke out. The greenback fell to CNY6.9825, its lowest level since mid-March. It had been sold through the 200-day moving average (now about (CNY7.0420) and has barely looked back. The next important technical area is near CNY6.95.

Europe

The ECB’s figures showed grew by almost 72 bln euros last week to a record high of nearly 6.29 trillion euros or 53% of GDP. The increase was split between asset purchases (~33 bln euros) and the revaluation of gold (~39 bln euros). In comparison, the Federal Reserve’s balance sheet is about a third of the US GDP. Data out later today will show whether its balance sheet shrank again as it has over the past three weeks. The Bank of England’s balance sheet is a little more than 30% of GDP. The Bank of Canada has been more aggressive than many may realize, and its balance sheet is now almost 25% of GDP. The Bank of Japan’s balance sheet is nearly 120% of GDP. The balance sheet expansions have two functions: Stabilize markets and ensure an easy monetary setting in an extremely low-interest-rate environment.

Sterling rallied in a soft dollar backdrop yesterday and is extended those gains today. They may and may have been encouraged by the additional measures announced by Sunak, the Chancellor of the Exchequer. These included a reduction in the VAT for hospitality and tourism and a cut in the tax on home purchases (up to GBP500). What will catch the eye of some policy wonks elsewhere, including in the US is the offer to pay the company 1000 pounds per employee that returns form furlough. Meanwhile, the UK’s International Trade Secretary formally warned that the post-Brexit border plan, particularly how Northern Ireland is treated by risk being challenged before the World Trade Organization.

German trade figures show the world’s third-largest economy is recovering. The trade surplus nearly doubled to 7.1bln euros in May from April. Exports rose 9% in May, a dramatic improvement after a 24% slump in April, even if not the 14% the Bloomberg polls showed was the median forecast. Imports rose by 3.5% after declining by 16.2% in April.

The euro rose to a high near $1.1370 in Asia before falling to session lows in early Europe near $1.1320. It is likely to base ahead of $1.1300, where there is a 1.8 bln euro expiring option. There is nearly a billion euro option at $1.1375 that also expires today. The euro has been in a large $1.1170-$1.1400 range since the end of May. Sterling is at its best level since mid-June, reaching $1.2650 in the European morning. Today is the fifth consecutive advance in sterling that began close to $1.2440. The next target is in the $1.2680-$1.2700, which houses the mid-June high and the 200-day moving average. The June high was set near $1.2815.

America

The EIA reported more than twice the 2 mln barrel build that the API estimated. The 5.6 mln barrels that went into inventory was the most in four weeks. Cushing accumulated 2.2 mln barrels, the first addition in nine weeks. The larger than expected inventory build plays on fears that the new virus outbreaks are disrupting demand.

Weekly US jobless claims are on tap. Although economists expect some improvement, they have recently been over-estimating the decline. This is the first report that covers the start of Q3 (week through July 4), and despite the holiday-shortened week, it is expected that nearly 1.4 mln people applied for unemployment insurance for the first time.

Canada reports June housing starts. A small uptick is expected. Yesterday’s fiscal update pointed to a 16% budget deficit this year (1.5% in 2019), and the debt rising to almost 50% from 31%. Its debt to GDP would still be the lowest within the G7. June jobs will be reported tomorrow. The median forecast in the Bloomberg survey is for about 700k increase, which follows a nearly 290k rise in May.

June inflation likely ticked up in Mexico from the 2.84% year-over-year increase in May. The central bank would probably feel more comfortable if the headline pace remained below the 3% target. It could slow its willingness to cut the overnight target rate of 5.0%. That said, the Banxico does not meet again until mid-August, giving it plenty of time to monitor the situation. Separately, Brazil’s Senate approved a bill that the central bank has advocated that is designed to make it more efficient for financial institutions in Brazil to hedge their foreign currency exposures.

The US dollar is slipping through its 200-day moving average against the Canadian dollar near CAD1.35 in the European morning after posting an outside down day yesterday. There is an option for almost $790 mln at CAD1.3500 that expires today. Nearby support is seen around CAD1.3470. Like yesterday, the dollar is consolidating in the upper end of Tuesday’s range against the Mexican peso when it almost MXN22.87. The next area of support is seen between MXN22.44 and MXN24.53.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$CNY,Australia,balance sheet,China Consumer Price Index,Currency Movement,Featured,newsletter