(About to set off on another business trip. I will spend the next two weeks in Asia. The updates will be sporadic. Thanks for your patience.)

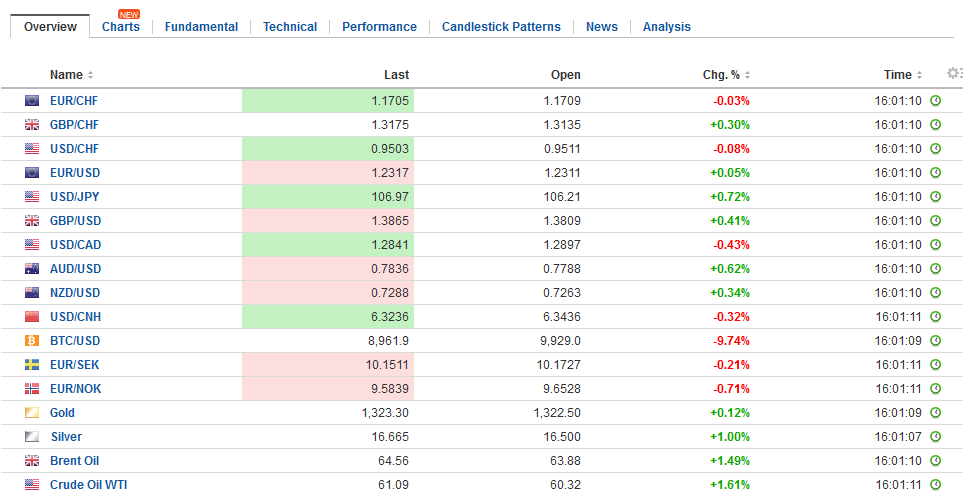

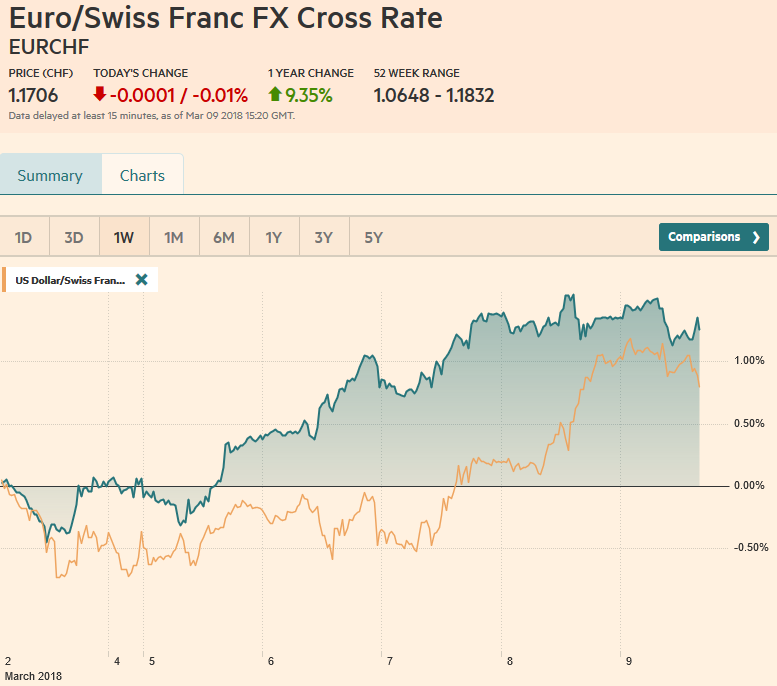

Swiss FrancThe Euro has fallen by 0.01% to 1.1706 CHF. |

EUR/CHF and USD/CHF, March 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe US Administration has softened its initial hardline position of no exemptions for the new steel and aluminum tariffs. There is little doubt that the actions will be challenged at the World Trade Organization and the idea that national security includes the protection of jobs for trade purposes will be tested. At the same time, US President Trump has agreed to meet North Korea’s Kim Jong Un. We argued that when North Korea claimed to have a nuclear missile that can strike the US mainland, the conditions would allow for talks. Of course, the US will maintain that it is its tough line that brought North Korea to the table. South Korea will maintain that through its gestures, including the cooperation over the Olympics, that made for the break-through. |

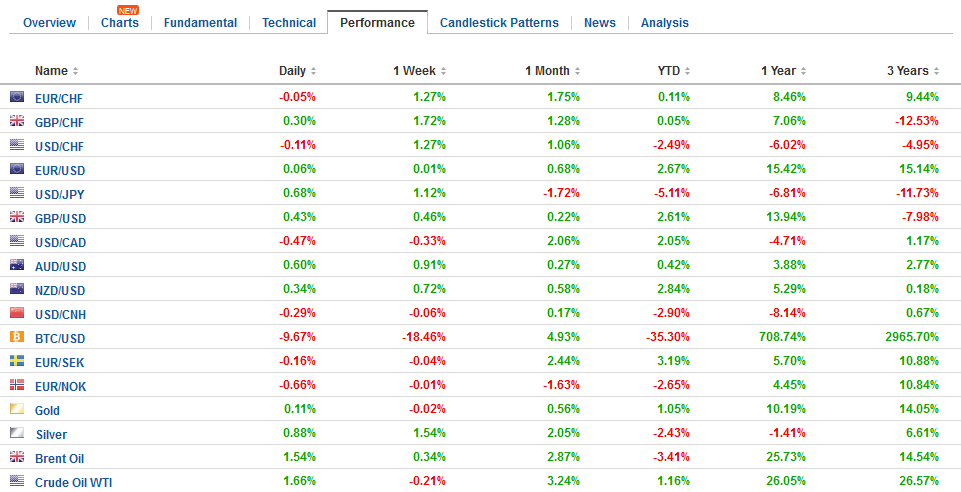

FX Daily Rates, March 09 |

| In any event, the meeting diffuses some investor anxiety. Asian stocks rallied, led by the over 1% gain in Korea’s Kospi. The MSCI Asia Pacific Index rose 0.3%, matching the weekly advance coming into today. The dollar also rallied to almost JPY107. It finished last week near JPY105.75. The dollar has not closed above its 20-day moving average against the yen since January 8. It is found near JPY106.75 today. There is a $1.2 bln option struck at JPY106.50 and another $4.1 bln struck at JPY107 that expire today.

More broadly, the dollar is mixed. The risk-on mood is expressed in the foreign exchange market today with stronger dollar-bloc and Scandi currencies. While the yen is the heaviest, the euro, Swiss franc, and sterling are nursing small losses. |

FX Performance, March 09 |

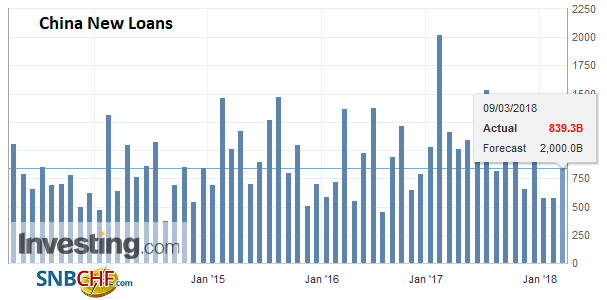

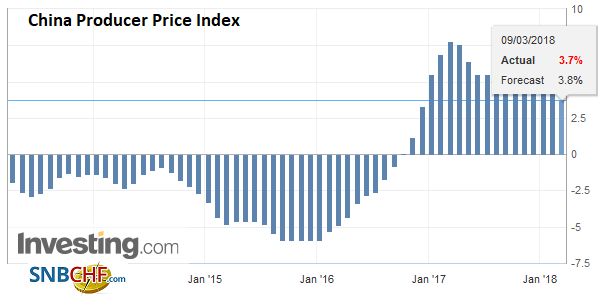

ChinaChina reported its inflation and lending figures. Inflation appears to have jumped (February CPI 2.9% after 1.5% in January), but we are all familiar with the Lunar New Year distortions. Producer prices slowed, in contrast, to 3.7% from 4.3%. Aggregate lending slowed sharply from January’s CNY3.06 trillion to CNY1.17 trillion. Chinese politics seems to be a more popular talking point than its economics presently. |

China Consumer Price Index (CPI) YoY, Apr 2013 - Mar 2018(see more posts on China Consumer Price Index, ) Source: Investing.com - Click to enlarge |

China Producer Price Index (PPI) YoY, Apr 2013 - Mar 2018(see more posts on China Producer Price Index, ) Source: Investing.com - Click to enlarge |

|

China New Loans, Apr 2013 - Mar 2018(see more posts on China New Loans, ) |

|

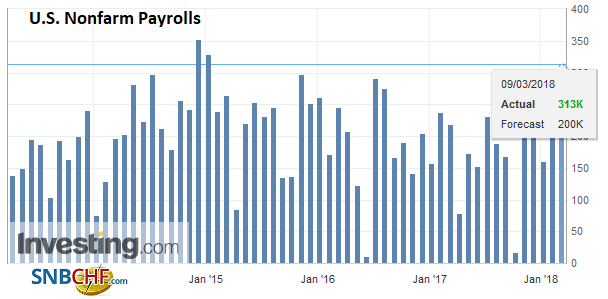

United StatesThe 12-month moving average of non-farm payrolls peaked in 2015. The slowing since has been gradual. The zenith was about 282k. It stood at 176k in January. However, there has been a recent acceleration and the four-month average is 212k. in February 2017, the US created 200k jobs and the expectation is for about the same this year. |

U.S. Nonfarm Payrolls, Apr 2013 - Mar 2018(see more posts on U.S. Nonfarm Payrolls, ) Source: Investing.com - Click to enlarge |

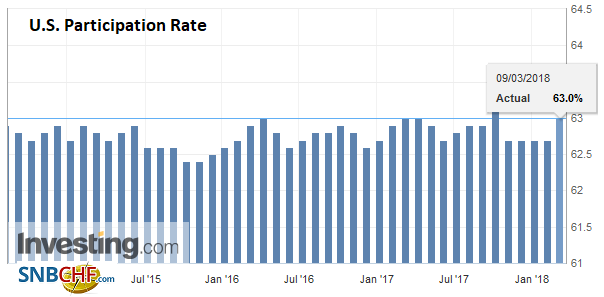

| Investors appreciate that the job growth remains strong. However, the issue now is about the pace of Fed tightening, and this hinges, in part, on wage pressure. |

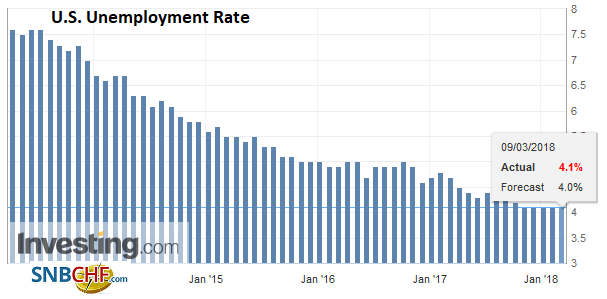

U.S. Unemployment Rate, Apr 2013 - Mar 2018(see more posts on U.S. Unemployment Rate, ) Source: Investing.com - Click to enlarge |

| In broad terms, Fed officials accept that headline inflation converges to core inflation (not the other way around) and that wages drive core inflation. |

U.S. Participation Rate, Sep 2014 - Mar 2018(see more posts on U.S. Participation Rate, ) Source: Investing.com - Click to enlarge |

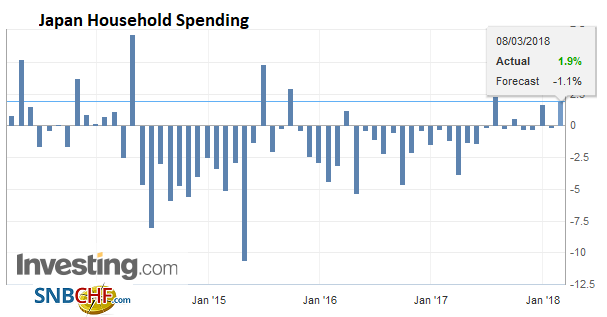

Japan |

Japan Household Spending YoY, Mar 2013 - 2018(see more posts on Japan Household Spending, ) Source: Investing.com - Click to enlarge |

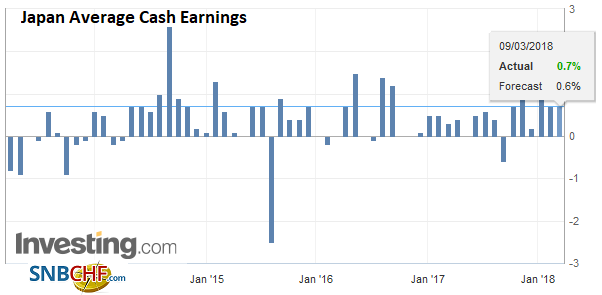

Japan Average Cash Earnings YoY, Apr 2013 - Mar 2018(see more posts on Japan Average Cash Earnings, ) Source: Investing.com - Click to enlarge |

|

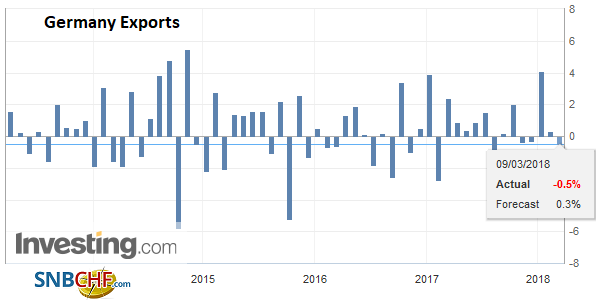

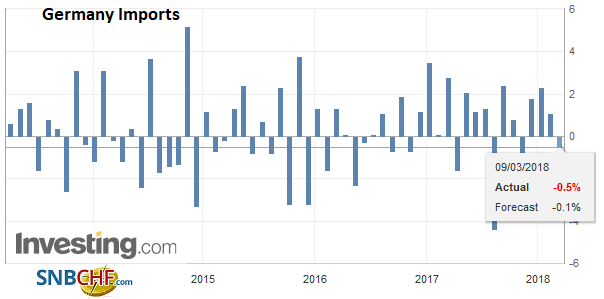

Germany |

Germany Trade Balance, Mar 2013 - 2018(see more posts on Germany Trade Balance, ) Source: Investing.com - Click to enlarge |

Germany Exports, Apr 2013 - Mar 2018(see more posts on Germany Exports, ) Source: Investing.com - Click to enlarge |

|

Germany Imports, Apr 2013 - Mar 2018(see more posts on Germany Imports, ) Source: Investing.com - Click to enlarge |

|

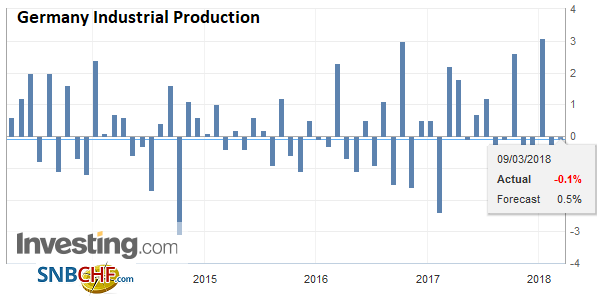

Germany Industrial Production, Apr 2013 - Mar 2018(see more posts on Germany Industrial Production, ) Source: Investing.com - Click to enlarge |

|

France |

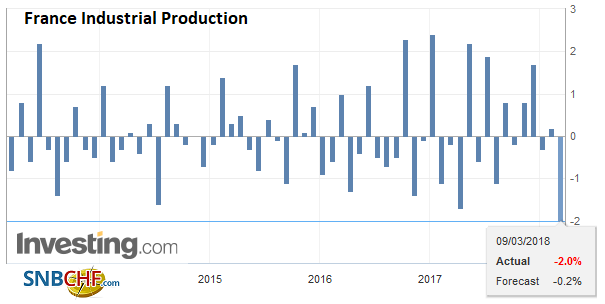

France Industrial Production, Mar 2013 - 2018(see more posts on France Industrial Production, ) Source: Investing.com - Click to enlarge |

Spain |

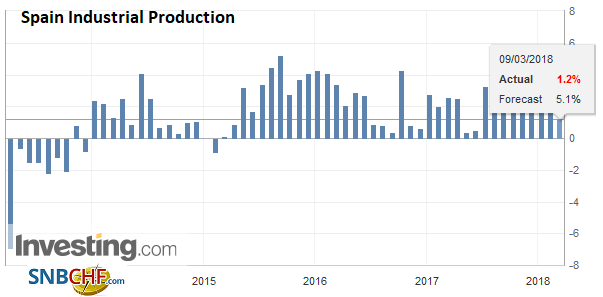

Spain Industrial Production YoY, Apr 2013 - Mar 2018(see more posts on Spain Industrial Production, ) Source: Investing.com - Click to enlarge |

United Kingdom |

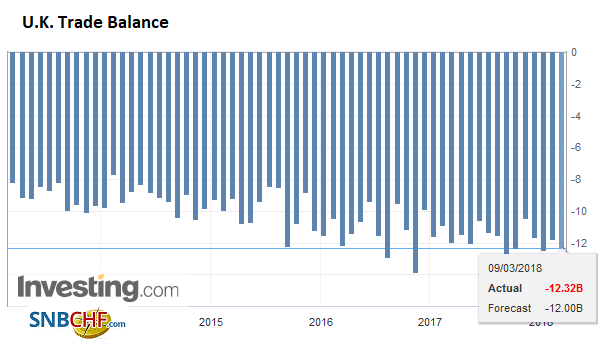

U.K. Trade Balance, Mar 2013 - 2018(see more posts on U.K. Trade Balance, ) Source: Investing.com - Click to enlarge |

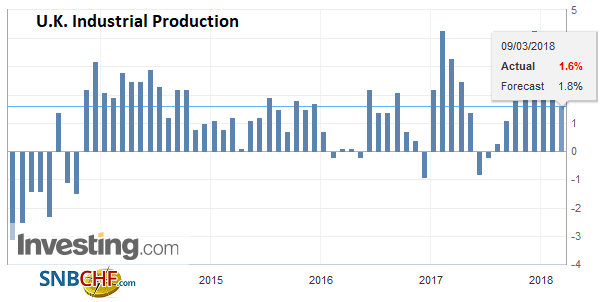

U.K. Industrial Production YoY, Mar 2013 - 2018(see more posts on U.K. Industrial Production, ) Source: Investing.com - Click to enlarge |

There is a 2.1 bln euro option struck at $1.23 that will be cut today and 2.3 bln option struck at $1.2350 that expires. The euro broke down yesterday as Draghi seemed more patient in his persistence that many expected, even though the explicit pledge to buy more assets if needed was dropped.

For several weeks, the euro has been consolidating the run-up that began early last November. It has moved mostly between $1.22 and $1.25, and give another half cent on both extremes. On the downside, a break of $1.2150 would support ideas that a top of some importance is in place. On the upside, several important technical levels are found between $1.25 and $1.27. A move above there would suggest potential into the $1.30-$1.35 area.

European shares have not been able to match the gains seen in the US yesterday and Asia today. The Dow Jones Stoxx 600’s four-day rally is at risk, but much depends on US leadership today. US shares are flat in early European turnover.

It’s jobs day for the United States and Canada. Since at least the Great Financial Crisis, it is the single most important report for the US. The market’s focus has shifted. Barring a significant surprise, the pace of job growth has lost some of its punch.

Even if there are some temporal challenges with it, there still seems to be the conviction that businesses eventually pass rising costs on to their customers–which is the essence of the Phillips Curve. The Beige Book, compiled for the upcoming FOMC meeting did in fact report that many districts are experiencing tight labor markets and wage pressure.

Anecdotes are one thing, and that is what the Beige Book is, data is another. That is what the average hourly earnings are about. This is where the most attention will be paid, ceteris paribus. Here this is some risk of disappointment. The rise in January average hourly earnings to 2.9%, the highest since 2009 fanned ideas that inflation was here and the Fed would become more aggressive.

However, there seemed to have been some distortions that may have exaggerated the increase. In the second leg of his testimony last week, Fed Chair Powell seemed to suggest that there was no significant wage acceleration underway. Given the base effect, average hourly earnings need to rise by 0.3%, or the year-over-year rate will slow.

Over the last six, 12, and 24 months, the year-over-year pace has been steady at 2.6%. Just like the durable goods and factory orders did not seem to have been immediately bolstered by that the capex associated with the tax cuts, it may be difficult to ferret out the bonuses and pay increases that made the headlines earlier this year.

In any event, the market has come to nearly fully discount a third hike this year, which is what the median Fed forecast in December indicated. Assuming the average effective Fed funds rate rises 75 bp this year on the back of three hikes, fair value for the January 2019 Fed funds futures contract is 2.17%. It settled at 2.155% yesterday.

Expectations for the Bank of Canada have gone in the opposite direction. At the start of February, the OIS implied a little more than a 60% chance of a rate hike in April and a 76% chance of a move in May. Now the odds are almost 39% and 54% respectively.

The central bank thinks that the removal of additional liquidity (rate hikes) will be needed, as the economic slack has been largely absorbed. It recognizes the significance of the uncertainty arising from trade issues. While Deputy Governor Lane suggested that the quality of the growth in Q4 was better than the optics suggested, he maintained the cautious tone of Governor Poloz, which encourages us to favor a May move over April.

Canada averaged 57.9k new jobs a month in Q4 17. This is the rough equivalent of the US creating 600k jobs a month. The job creation hit a wall in January when Canada reported a loss of 88k jobs. The fact that part-time jobs bled 137k jobs, while full-time gained a still-robust 49k jobs, sparked various explanations, including an increase of minimum wage in some provinces.

The median expectation in the Bloomberg survey is for Canada to have created 21k new jobs. It averaged 35.6k in 2017 and 18.5k in 2016. Barring a significant surprise, the employment data is unlikely to sway investors about the timing of the next hike.

The US dollar has tried pushing through the CAD1.30 level several times. If it does not happen soon, we suspect momentum traders will look to deploy their capital elsewhere. The MACD and Slow Stochastics are rolling over. Two large options expire today against the Canadian dollar. The first is a $520 mln option at CAD1.2860 and the other $1.9 bln struck at CAD1.30.

Today’s BOJ meeting rounds out the G3 and the monetary policy stance is clear. Governor Kuroda tells us that policy framework will remain in place until inflation is much closer to its target. Currently, the BOJ projects this to be the case in FY19. However, the BOJ’s ability to forecast inflation is not particularly strong and a further delay cannot be ruled out.

The ECB sent two signals. By dropping its explicit pledge to buy more assets if necessary, and raising the growth forecast, its confidence in the economy is on display. On the other hand, the paring of next year’s CPI forecast point in the other direction.

One of the takeaways, it appears, though not explicitly addressed, is that the cautiousness on inflation reinforces the expectation that the ECB tapers in Q4 rather than stop net purchases in September. And that is important in its own right, but also because, as Draghi reaffirmed, sequentially, the longer the purchases the later the rate hike.

At the Federal Reserve, a stronger consensus appears to have formed. Governor Brainard’s comments seemed to underscore the greater confidence that the dual mandate is within reach. The evolution of conditions, including the depreciation of the dollar, firmer oil prices, tax cuts and spending increases, coupled with the stronger world growth provide a favorable backdrop. Whether the Fed will raise rates three or four times this year does not have to be decided in March, but that is the direction of movement rather than two hikes.

Are you the author? Previous post See more for Next postTags: #USD,$CAD,$EUR,$JPY,China Consumer Price Index,China New Loans,China Producer Price Index,EUR/CHF,France Industrial Production,Germany Exports,Germany Imports,Germany Industrial Production,Germany Trade Balance,Japan Average Cash Earnings,Japan Household Spending,newslettersent,Spain Industrial Production,u-k-trade-balance,U.K. Industrial Production,U.S. Nonfarm Payrolls,U.S. Participation Rate,U.S. Unemployment Rate,USD/CHF