Tag Archive: Germany Exports

The term export means shipping in the goods and services out of the jurisdiction of a country. The seller of such goods and services is referred to as an “exporter” and is based in the country of export whereas the overseas based buyer is referred to as an “importer”. In international trade, “exports” refers to selling goods and services produced in the home country to other markets.

FX Daily, May 08: Dollar Races Ahead

The US dollar's surge continues. The Dollar Index is testing the space above 93.00. A month ago it was below 90. It does not appear to require fresh developments. The market continues to trade as if there are short dollar positions that are trapped at higher levels and the briefest and shallow pullbacks are new opportunities to adjust positions.

Read More »

Read More »

FX Daily, April 09: Asian and European Equities Shrug Off US Decline

US shares slumped before the weekend amid concern that Trump Administration was prepared to escalate the trade tensions with China. However, cooler heads are prevailing, and there is a recognition that the conflict is still in the posturing phase. No sanctions have gone to into effect. As the Economist points out, nearly 100 of the Chinese products the US proposed slap a tariff on are not currently being exported to the US. The US has a 60-day...

Read More »

Read More »

FX Daily, March 09: Today is about Jobs, but Not Really

The US Administration has softened its initial hardline position of no exemptions for the new steel and aluminum tariffs. There is little doubt that the actions will be challenged at the World Trade Organization and the idea that national security includes the protection of jobs for trade purposes will be tested. At the same time, US President Trump has agreed to meet North Korea's Kim Jong Un.

Read More »

Read More »

FX Daily, February 08: Dollar Firms, While Equities Search for Stability

The swings in the equity markets are subsiding, bond yields are firm and the US dollar is extending its recovery. Although US equities closed lower, the MSCI Asia Pacific Index snapped a four-day drop by posting a 0.25% gain. However, the MSCI Emerging Markets Index is off nearly as much, though the range was modest. European markets are also lower, and the range for the Dow Jones Stoxx 600 is the smallest in more than a week.

Read More »

Read More »

FX Daily, January 09: Dollar Correction Extended

The US dollar's upside correction that began before the weekend has been extended in Asia and Europe today. The main exception is the Japanese yen. The yen's modest gains have been registered despite the firmness in US rates and continued advance in equities; both factors associated with a weaker Japanese currency.

Read More »

Read More »

FX Daily, October 10: Dollar Pullback Extended

The US dollar's advance faltered before the weekend after rise average hourly earnings and a new cyclical low in unemployment and underemployment initially fueled greenback buying. There is no doubt the data was skewed by the storms, though the upward revision to the August hourly early cannot be attributed to the weather distortions. The reversal in the dollar before the weekend has carried over into the early trading this week. Even the Turkish...

Read More »

Read More »

FX Daily, May 09: Dollar Firms amid Position Adjustments

The election of Macron as French President has set off a bout of position adjustment that has seen the euro push back into the $1.0850-$1.0950 range that had confined activity for the two weeks between the first and second rounds of the French presidential election.

Read More »

Read More »

FX Daily, February 09: Dollar Bounce in Asia is Sold in the European Morning

The US dollar is firmer against most of the major currencies in fairly quiet Asian turnover, but is seeing those gains pared in early Europe. The highlights include the RBNZ meeting that left rates on hold, as widely expected. The concern about the strength of the Kiwi saw the market reduce the perceived likelihood of a rate hike. NZD came off.

Read More »

Read More »

FX Daily, January 09: Sterling Pounded by May’s Hard Brexit

Sterling has stolen the US dollar's spotlight. The issue facing market participants was if the rise in hourly earnings reported as part of the pre-weekend release of US December jobs data was sufficient to end the dollar's downside correction. Instead, May's comments over the weekend indicating not just a desire but strategic thrust to abandon the single market in exchange for regaining control over immigration and not being subject to the...

Read More »

Read More »

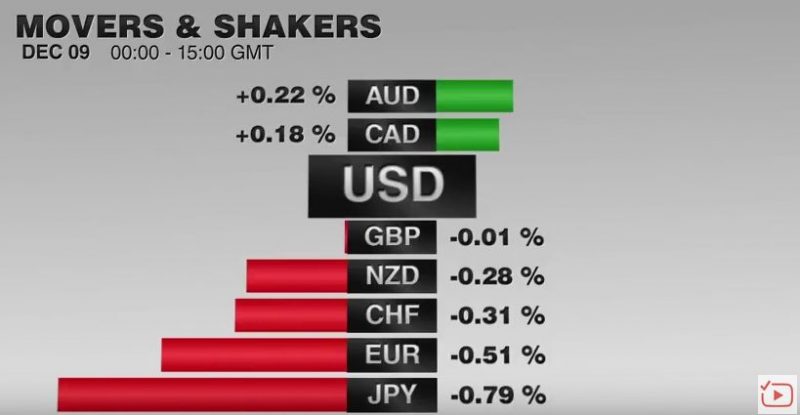

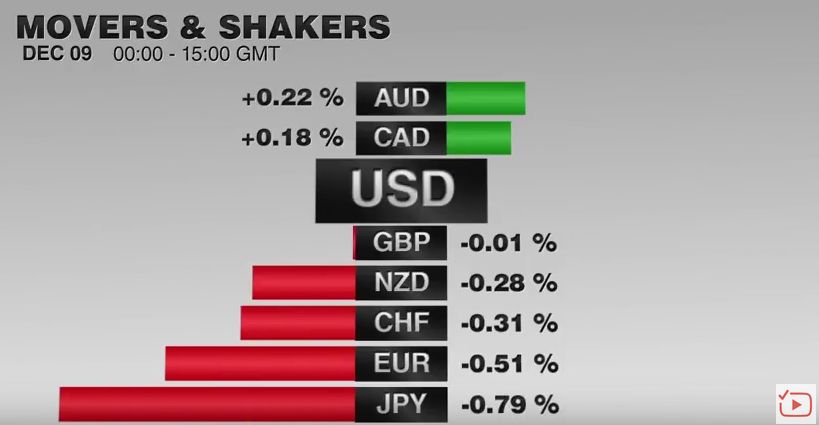

FX Daily, December 09: Euro Chopped Lower before Stabilizing

The euro has stabilized after extending yesterday's ECB-driven losses. The euro's drop yesterday was the largest since the UK referendum to leave the EU. Ahead of the weekend, there may be some room for additional corrective upticks, but they will likely be limited, with the $1.0650 area offering initial resistance. In the larger picture, this week's range, roughly $1.05 to $1.0850 likely will confine the price action for the remainder of the...

Read More »

Read More »

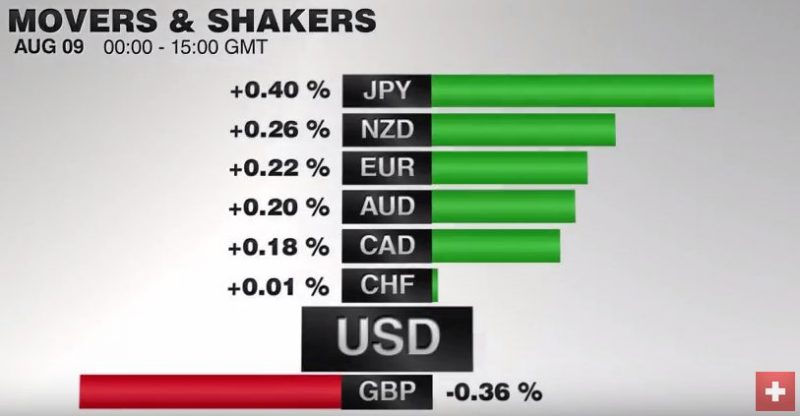

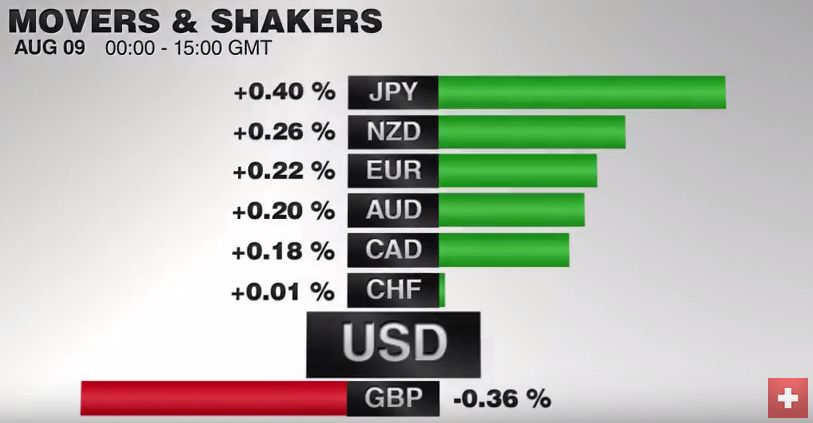

FX Daily, August 09: Sterling Slips to a Four-Week Low, EUR/CHF still trending up

In an otherwise uneventful foreign exchange market, sterling's slide for its fifth consecutive session is the highlight. It was pushed below $1.30 for the first time since July 12. Initial resistance for the North American session is seen near $1.3020, while the $1.2960 area corresponds to a minor retracement objective.

Read More »

Read More »

Fundamentals,FX,Gold and CHF:Week November 18 to November 22

Fundamentals with highest importance: The HSBC Flash Purchasing Manager Index (PMI) for China weakened from 50.8 to 50.4. In particular, new export orders, output prices and employment started to decrease again, while output increased. The preliminary Markit manufacturing PMI for the United States edged up to 54.3 (vs. 52.3 expected), a 9-month high after the …

Read More »

Read More »

Pictet Become “Secular Dollar Bulls” and Gold Bashers: Our Response

Precisely at the moment when the dollar undergoes a secular bashing with a 6% loss against the yen and 3% against the euro, Pictet publish their “secular dollar bull era” video and recommend investors to avoid gold. “Secular movements” in currency markets are mostly driven by current account (CA) surpluses or deficits, while housing …

Read More »

Read More »

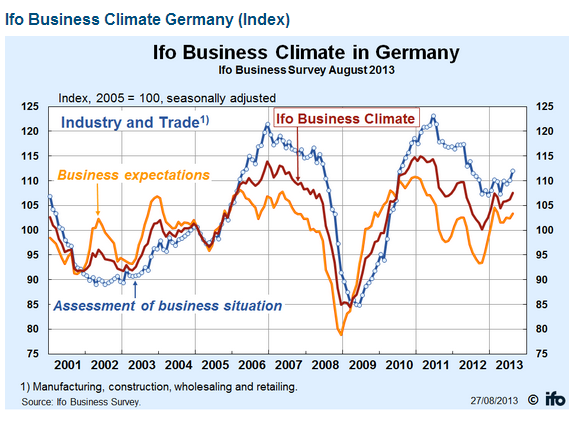

High German Pay Rises: The End of the German Bunds Bubble

Yesterday’s German CPI has given a first insights of what is coming these years: German inflation. For years excessive risk averseness put pressure on German yields. Most recently, energy prices helped to push down inflation and on German yields possibly for a last time. But many ignore that the main reason for inflation are rising …

Read More »

Read More »

Jim O’Neill’s Bullish BRICS Outlook until 2020 and our Critics

Perfect charts by Goldman's Jim O'Neill that help to understand the former and future growth of different emerging, "growth markets", the BRICS. We criticise his partially over-optimistic views.

Read More »

Read More »

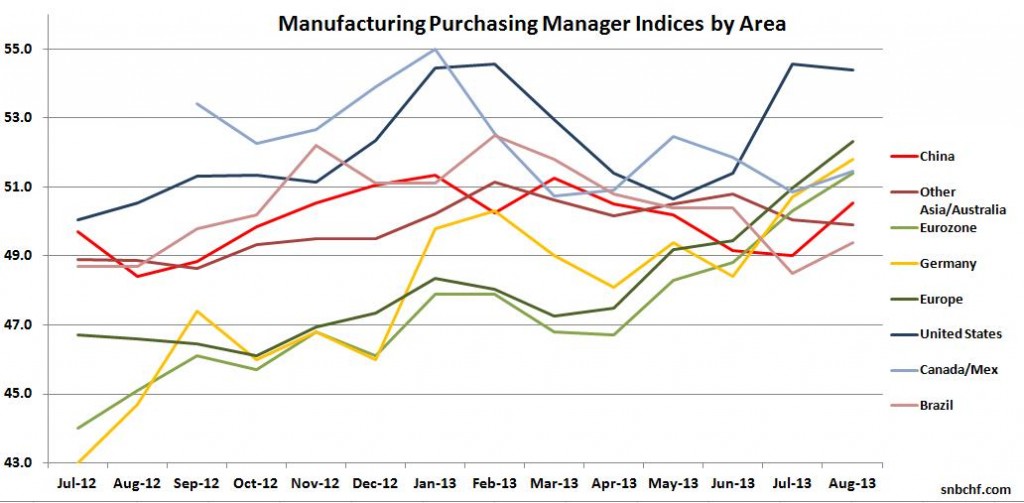

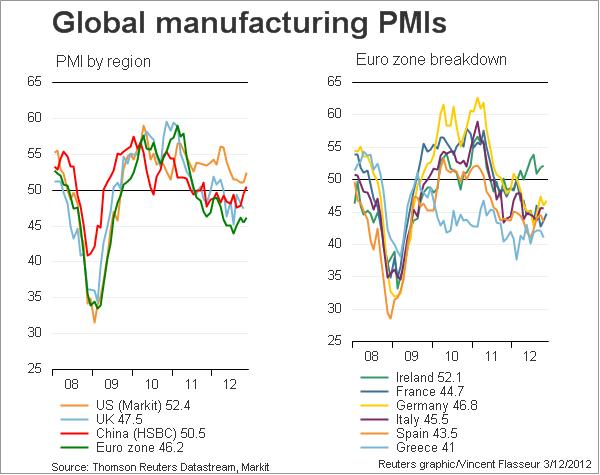

Global Purchasing Manager Indices

Manufacturing Purchasing Manager Indices (PMIs) are considered to be the leading and most important economic indicators. August 2013 Update Emerging markets: Years of strong increases in wages combined with tapering fears have taken its toll: Higher costs and lower investment capital available. EM Companies have issues in coping with developed economies. Some of them …

Read More »

Read More »

Global Purchasing Manager Indices, Update January 25

Manufacturing PMIs are considered to be the leading and most important economic indicators. After a strong slowing in summer 2012 and the Fed’s QE3, this is the fourth month of improvements in global PMIs January 25th Expansion-contraction ratio: There are 15 countries that show values above 50 and 14 with values under 50. Positive-negative-change ratio: …

Read More »

Read More »

Global Purchasing Manager Indices, Update December 17

Manufacturing PMIs are considered to be the leading and most important economic indicators. Since the Fed’s QE3, this is the third month of improvements in global PMIs after a strong slowing in summer 2012. January 25th Expansion-contraction ratio: There are as many countries that show values above 50 as under 50. Positive-negative-change ratio: 18 countries …

Read More »

Read More »