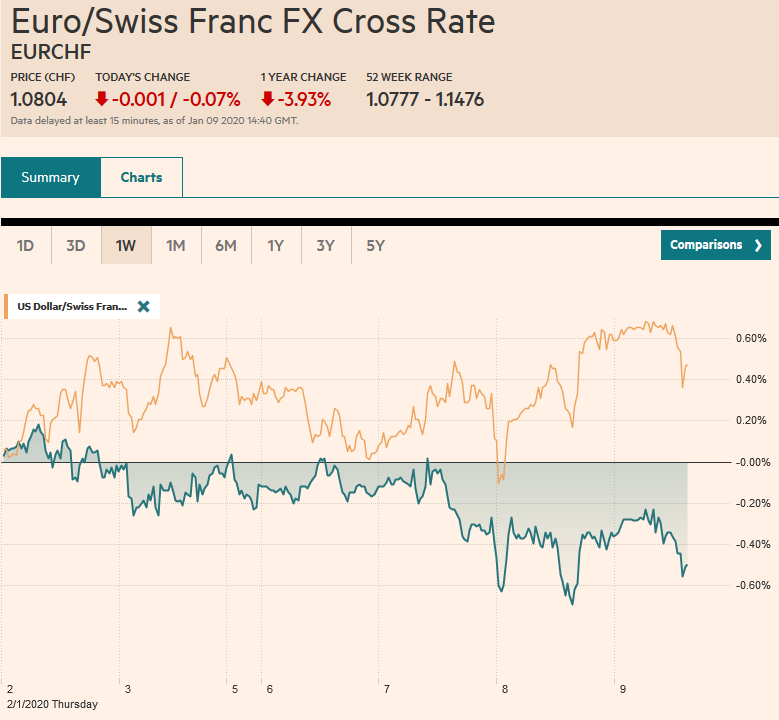

Swiss FrancThe Euro has fallen by 0.07% to 1.0804 |

EUR/CHF and USD/CHF, January 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The S&P 500 recovered from a 10-day low to reach a new record high, which set the tone for the Asia Pacific and European markets today. The MSCI Asia Pacific Index jumped by the most in a month with the Nikkei’s 2% advance leading the way. More broadly, the markets in Taiwan, South Korea, Hong Kong, India, and Thailand all rose more than 1%. Europe’s Dow Jones Stoxx 600 was up a milder 0.5%, but its third successive advancing session has seen new record highs. US shares are trading firmer as well. Yields in the Asia Pacific region were pushed higher by the backing up of yields seen in the US yesterday, but European yields are narrowly mixed, and the US 10-year is little changed near 1.87%. The dollar is building on yesterday’s gains against the major currencies, but the risk-on mood is evident in the strength of the emerging market currencies. Except for Eastern and Central Europe, emerging market currencies are mostly higher, led by the nearly 1% rally in the South Korean won. The JP Morgan Emerging Market Currency Index is pushing higher and testing the 200-day moving average. Gold and oil staged big key reversals yesterday. After reaching a peak near $1611 yesterday, gold reversed lower and finished near $1556. Today it saw $1540 before stabilizing. February WTI reached $65.65 before plummeting to almost $59. Oil prices unwound the earlier knee-jerk gains and were given an extra push by the unexpected build of US crude inventories, according to the EIA. It is consolidating around $60 today. |

FX Performance, January 9 |

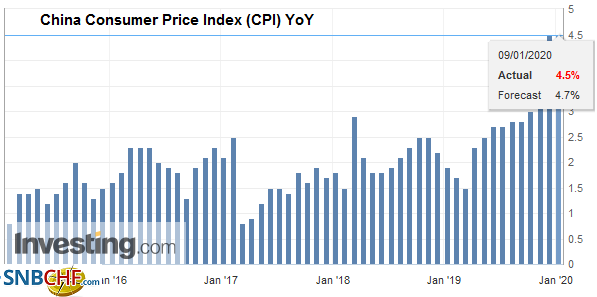

Asia PacificConsumer prices steadied in China at the end of last year. December’s CPI was unchanged from November’s 4.5%. The market had looked for a small increase. Food prices continue to be a key driver. Pork prices are up 97% from a year ago. Vegetable prices were 10.8% higher, and the price of eggs was 6.2% above year-ago levels. However, there is some sign that pork prices may have peaked. They actually fell by 5.6% in December. Importantly core inflation remained at 1.4%. The elevated CPI did not prevent the PBOC from cutting reserve requirements late last month as officials look through the supply-driven rise in food prices. Today’s report does not change things: disinflation remains an underlying issue. Producer prices fell 0.5% year-over-year in December, which was a bit more than expected, though a slower pace than the 1.4% decline in November. The Lunar New Year, later this month, will distort price, output, and sales figures, and a clean read might not be available until March. |

China Consumer Price Index (CPI) YoY, December 2019(see more posts on China Consumer Price Index, ) Source: investing.com - Click to enlarge |

Earlier today, Australia reported a larger than expected November’s trade balance, even when taking into account the downward revision in the October series. It is a good reminder that last year as many countries experienced slower exports, Australia’s trade surplus exploded. Consider that Australia reported an A$5.8 bln surplus in November. That is just above the average through November of A$5.75 bln. In the first 11 months of 2018, the average monthly trade surplus was near A$1.75 bln. Data from Port Hedland showed the iron ore exports surged in December.

After staging a massive upside reversal against the yen yesterday, the dollar is extending its gains today. The greenback fell to JPY107.65 amid the knee-jerk reaction yesterday and then rallied to almost JPY109.25. Late in the European morning, it is approaching JPY109.50. Recall that in the second half of last month, the dollar encountered stubborn resistance near JPY109.70. The two yen rally in 24-hours leaves the short-term technical indicators over-extended. There is a $2.4 bln option at JPY109.25 that expires today that might attract prices. The Australian dollar is not drawing much comfort from the risk-on mood or the trade figures. The Aussie is pinned near yesterday’s lows (~$0.6850). The next downside target is found near $0.6820. The Chinese yuan has continued to strengthen and reached a five-month high today (~CNY6.9220). While some observers debate whether the US will lift the “fx manipulator” designation, it does not seem to have mattered much.

EuropeGermany surprised. The mood was sober after the poor factory orders data that was reported yesterday. Today, Europe’s economic engine reported a larger than expected 1.1% rise in November industrial output, the most in a year and a half. October’s 1.7% decline was revised to only a 1% fall. The year-over-year contraction moderated to -2.6% from a revised -4.6%. This is the smallest year-over-year decline since March. While German retail sales have been robust and foreign demand remains problematic. Germany reported today that exports in November fell 2.3%, much worse than expected and the second-worst of last year. Imports were also weaker than expected, falling 0.5%, which offset the gain in October. The overall trade surplus narrowed to 18.3 bln euros from 21.3 bln. Sterling is the weakest of the major currencies today, shedding about 0.5% by around midday. Three considerations appear to be weighing on the pound. First, BOE Carney comments suggest the debate about cutting rates continues within the MPC and that if the economy weakens more, it would be compelled to act quickly. Short-term rates in the UK fell on the comments. Second, UK retail sales over the holidays seemed to be boosted by discounts, and share prices of the UK’s largest retailers are under pressure today. Third, the fear that the UK-EU negotiations could fail to reach an agreement this year, which, without delay, would be very disruptive a year out. |

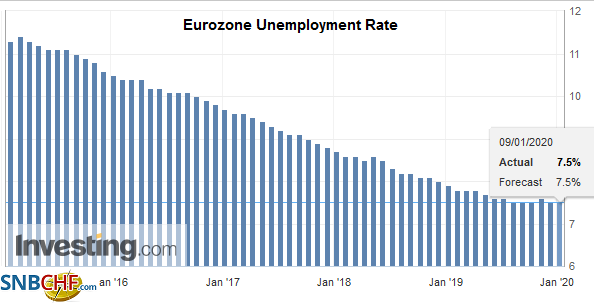

Eurozone Unemployment Rate, November 2019(see more posts on Eurozone Unemployment Rate, ) Source: investing.com - Click to enlarge |

The euro has frayed support at $1.1100, but it appears to be steadying in the European morning. There are options for 2 bln euros struck between $1.1090 and $1.1110 that expire today. A move above $1.1125, where another expiring option for 650 mln euros has been placed, is needed to help lift the technical tone. There is a third set of options placed at $1.1150 for 1.2 bln euros. Sterling was sold to about $1.3020 in Europe before finding a bid. Initial resistance is likely to be seen in the $1.3050-$1.3070 area, with the upper end of the range holding a nearly GBP270 mln option that will be cut today.

America

The light US economic calendar today keeps the focus on tomorrow’s employment data. The ADP data was stronger than expected but may not have generated much insight into the official report. ADP 2019 averaged 162.7k and 163k in the last two months. In 2018, the average was 219k. The US nonfarm private payrolls rose an averaged 165k a month through November. The average in the first 11-months of 2018 was 214k. Month-to-month, the ADP shows great volatility with the Bureau of Labor Statistics, but averages show that there is a good fit. It also means that the ADP estimate, which was stronger than expected, tells investors little about Friday’s employment report.

No fewer than six Fed officials speak today. In addition to Governor Clarida, two other voting members are on tap (NY’s Williams, and Minn’s Kashkari). Barkin, Evans, and Bullard will also be speaking. There appears to be as close to a consensus at the Fed as there has been in some time. The dissents to last year’s rate cuts have rotated off the Fed, and the forecasts from last month showed 14 of the 17 officials expect policy to be on hold this year.

Canada reports December housing starts, and November permits today. However, the data, which are not typically market movers in the first place, are overshadowed by tomorrow’s employment report. Recall Canada lost 71k jobs in November, and that set the tone for a string of disappointing economic reports, except for CPI, which remained firm. Another disappointing report would likely spur speculation that the Bank of Canada may have to contemplate easing policy. Mexico reports December CPI figures today. Less price pressures will keep the door open to Banxico easing this year. The official interest rate target rate is 7.25%. Inflation appears to be running near 2.8% year-over-year. The high real and nominal yields attract interest-hungry savings but also weighs on the weak economy. Brazil reports November’s industrial production figures. The 0.7% decline expected would be enough to push the year-over-year rate back below zero for the first time since August.

We have been looking for the US dollar to recover against both the Canadian dollar and Mexican peso. The former is cooperating. The greenback has bounced from around CAD1.2950-CAD1.2960 at the start of the week to nearly CAD1.3060 in Europe today and approached the (50%) retracement objective of the last leg down. Above CAD1.3065 would likely target the CAD1.3090-CAD1.3100 area. The Mexican peso has ignored our call for a correction. The risk-on mood and Mexico’s high yields are keeping the greenback pinned near MXN18.80. The risk-off spike to MXN19.00 seemed to have attracted new dollar sales. The dollar has been trading in a clear range against the Brazilian real since mid-December or BRL4.00-BRL4.10. Our bias is for a higher dollar, perhaps toward BRL4.15-BRL4.18 over the next week or so.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Brazil,China,China Consumer Price Index,Currency Movement,EUR/CHF,Eurozone Unemployment Rate,Germany,newsletter,U.K.,USD/CHF