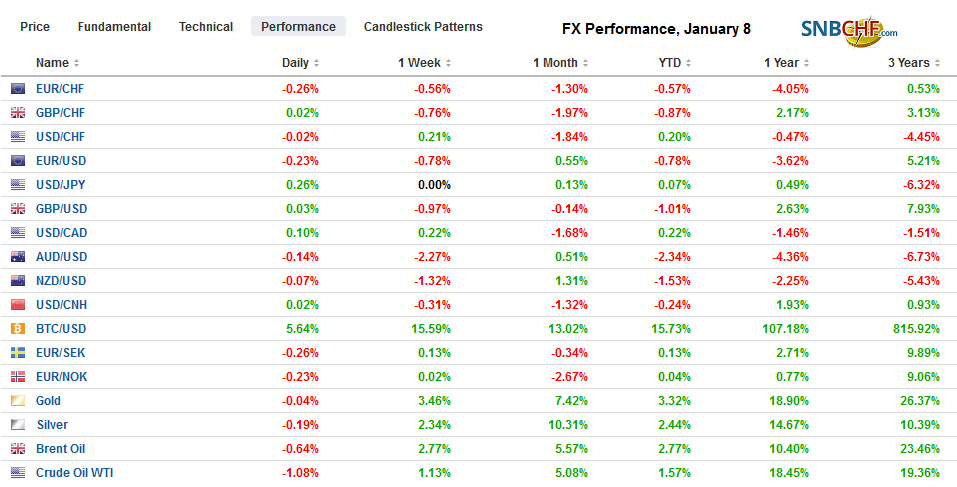

Swiss FrancThe Euro has fallen by 0.27% to 1.079 |

EUR/CHF and USD/CHF, January 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The Iranian retaliatory missile strike on Iraqi-bases housing US forces initially sparked a dramatic risk-off response throughout the capital markets. The muted response by the US coupled with signals from Tehran that it had “concluded” its proportionate measures saw the markets retrace the initial reaction. It was too late for equities in the Asia Pacific region, and several markets (Japan, China, Korea, Malaysia, and Thailand) fell more than 1%. Europe is faring better, despite the disappointing decline in German factory orders. The Dow Jones Stoxx 600 is off marginally in late morning turnover, while US shares are trading fractionally higher. Bonds initially rallied strongly, with the US 10-year yield tumbling 12 bp to 1.70% at the extreme. Now it is now back at 1.80%, and European yields are slightly higher. In the foreign exchange market, the yen rallied on the initial news, with the dollar dropping to around JPY107.65. The greenback has subsequently recovered in full, and in the European morning was back to the JPY108.40-JPY108.50 area. Overall the dollar is little changed against the major currencies. While many emerging market currencies are lower, the South African rand, the Mexican peso, and Turkish lira are among the firmest. Gold had shot up to $1611 but is back near $1580 in Europe, and February WTI has surrendered the gains that had carried it to around $65.65 and is trading around $63. |

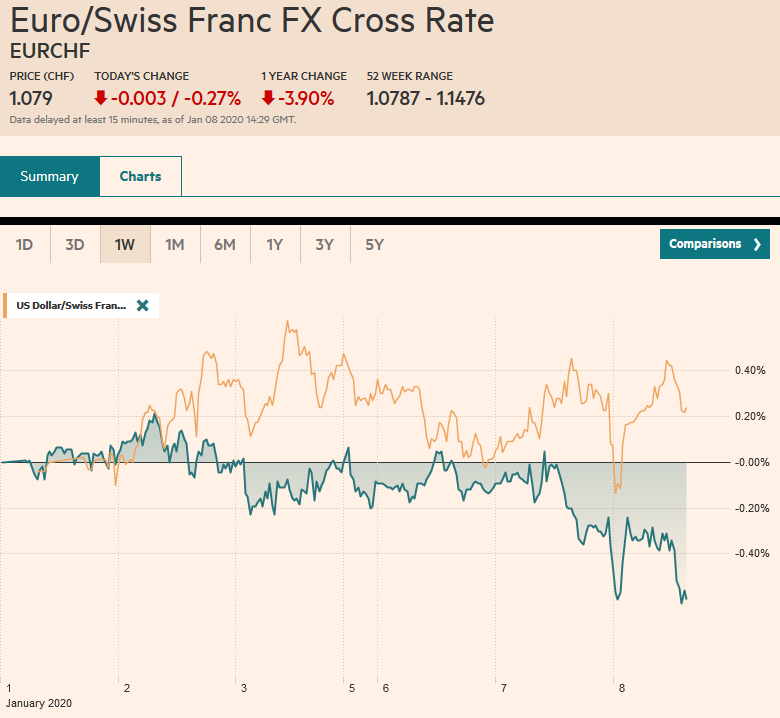

FX Performance, January 8 |

Asia Pacific

While many countries in the Asia-Pacific region saw their December PMI readings increase, Japan stands out as an exception. The December composite PMI fell to new cyclical lows in this relatively new time-series for Japan of 48.6 from 49.8. Once again, Tokyo has increased the tax on consumption, and the economy weakened. Yes, there are other challenges, such as the typhoon, and slowing global trade, but tax stands out as directly self-inflicted. Increasing the VAT was once encouraged by multilateral lenders as a way to reduce the government’s debt. Yet, just as we have learned that the symbol and what it is supposed to represent (symbolize) can be separated, so too did hiking the VAT take on a political life of its own distinct from its economic purpose. Earlier today, Japan reported real cash earnings were down 0.9% year-over-year in November, matches the year’s average. The average over the past five years (60 months) and 10-years (120 months) is -0.3% and -0.4%, respectively. The time series suffers from some sampling issues. Attempting to correct for these produces a better reading, the base pay also weakened to its lowest level since May.

The dollar spiked to JPY107.65 in Asia, its lowest level since the first half of October, and quickly returned to the JPY108.20-JPY108.50 range. The 200-day moving average is found near JPY108.60, near yesterday’s high, and that might be a sufficient cap ahead of US President Trump’s statement expected later today. Over the slightly longer-term, the technical indicators suggest the path of least resistance for the dollar is higher. The Australian dollar lost a little more than 1% yesterday, and the losses were initially extended today to $0.6850, but it has stabilized. It is still threatening to extend the losing streak to the sixth session. A jump November building approvals (11.8%) was overshadowed by the geopolitical developments. A close above $0.6860, the (61.8%) retracement objective of the rally from the late November lows (~$0.6750) would be a preliminary sign that the selling pressure may have exhausted itself. Also lost in today’s developments were better than expected Q4 earnings from Samsung that provides more evidence that the semiconductor overhang has been absorbed and prices have begun to firm. The Chinese yuan is little changed on the day after strengthening nearly 0.4% yesterday. It remains near its best level since early August.

EuropeGermany’s November factory orders badly missed market expectations for a small rise and instead fell by 1.3%, the largest fall since July. Bulk orders seemed to be the driver, but foreign orders for capital equipment also fell, and consumer goods orders were little changed. The Bundesbank warned that the German economy likely stagnated in Q4 19. If there is any support for our contention that Germany has passed the worst, it may be that the October series was revised to show a 0.2% gain rather than the 0.4% contraction initially reported. Taken together, it means that factory orders have been essentially flat int he three-months through November. Brexit bills are passing the House of Commons, and although Prime Minister Johnson does not have a majority in the House of Lords, it is expected not to stand in the way of the popular will. However, since the election, this has mainly been taken for granted, and frankly, is a bit anticlimactic. The focus has shifted toward the UK-EU trade negotiations that are about to begin. Johnson will meet with EC President von der Leyen today. Reports suggest that the UK government will seek a free-trade agreement but not one based on regulatory harmony. The new EC President has expressed skepticism that a deal can be negotiated by the end of the year, as the UK is insisting. |

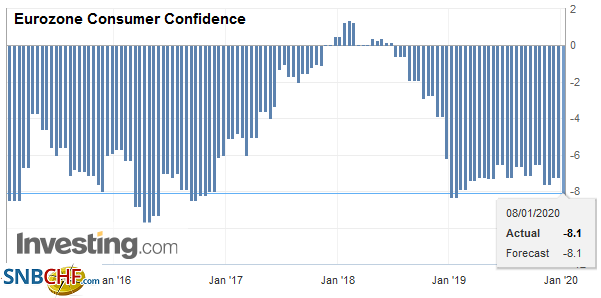

Eurozone Consumer Confidence, December 2019(see more posts on Eurozone Consumer Confidence, ) Source: investing.com - Click to enlarge |

The euro began the week near $1.12 and is extending its pullback today, reaching $1.1125 in the European morning. A trendline drawn off the late November lows is found there today. There is a one billion euro option at $1.1120 that will be cut today. A break of $1.1100 would target the $1.1060 area. Sterling is steady around $1.3120 as it continues to consolidate between roughly $1.3050, where a GBP265 mln option has been struck that expires today and about $1.3200.

America

US President Trump’s statement is expected in the North American morning. The risk of a disproportionate response, in light of the recent tweetstorm, appears to have eased. The sense is that Iran made a mostly symbolic response and that a formal US military response is not necessary. Still, tensions remain elevated. With Phase 1 of the US-China trade deal to be signed next week, the confrontation with Iran has replaced it as the source of market tension. The US sees the ADP private-sector job estimate today. Recall in November, its estimate was 67k, while the government reported that private nonfarm payrolls jumped by 254k. The EIA will report US oil inventories. They are expected to have fallen but by less than the nearly 6 mln barrel decline estimated by the API yesterday. Late in the session, the US reports November consumer credit. It is expected to have risen by about $16 bln. The average through October was $15.56 compared with a $14.80 bln average in the first ten months of 2018.

The new year has begun, and the Fed’s role in manually ensuring that its transmission mechanism works properly has not diminished. Yesterday’s term repo (14 days) was oversubscribed, the first one in three weeks. Banks wanted $41.12 bln while the Fed only offered $35 bln. The overnight repo was undersubscribed. Banks demanded a little more than half of the $120 the Fed made available. Separately, the Fed also bought $7.5 bln of three-month bills from dealers who were willing to sell $25. 3 bln.

These measures are not about monetary policy itself, which is on hold, and 14 of 17 Fed officials thought last month that no change in policy will be needed this year. No matter how much or how long the car needs oil, it does not transubstantiate into petrol. That the transmission itself needs exogenous support is uncomfortable and affirms that something is awry. The rise in ISM services to a four-month high and a smaller than expected trade deficit did not offset the negative impact seen last week in response to the manufacturing ISM report. The December 2020 fed funds futures contract closed with an implied yield for 1.325% for the lowest since December 13. It finished 2019 at 1.40%. The current effective average is 1.55%, indicating that the market has one cut discounted.

The US reported the November trade deficit was the smallest in three years, falling to $43.12 bln. Exports rose by 0.7%, and imports fell by 1.0%. Net exports will likely contribute to GDP. Several cross-currents are impacting the trade flows. The shale revolution, for example, has driven crude oil imports to 28-year lows, while oil and gas exports rose. Boeing’s problems are also a headwind on exports. The 800-pound giant is China. Consider that through November, the US ran a $563 bln trade deficit in goods and services in 209. In the same period in 2018, the US recorded a shortfall of $567 bln, The improvement plus some can be fully explained by China. To wit: the US trade deficit to China fell to almost $320 bln from $381 bln in 2018. Of course, US buyers pay the tariff on goods from China, and as one would expect, the higher price is deterring buying of China-made goods. November saw a 5.3% drop in cellphone and other household goods. However, as could be expected, the US imported more goods from nearly all of its other major partners.

The Canadian economic calendar is light today but picks up tomorrow with housing start and permits ahead of Friday’s employment report. The dollar continues to look as if it is bottoming against the Canadian dollar. It reached CAD1.3030 yesterday and has continued to straddle the CAD1.30-area today, where a $580 mln option is set to expire. Initial support is seen near CAD1.2980. Mexico’s calendar is also light today, ahead of tomorrow CPI and Friday’s industrial production figures. Once again, the dollar bounce above MXN19.00 was sold. Support has been forged near MXN18.80, and a break would spur a test on last year’s lows near MXN18.74.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Brexit,Currency Movement,EUR/CHF,Eurozone Consumer Confidence,federal-reserve,Iran,Japan,newsletter,OIL,Trade,USD/CHF