Tag Archive: Chart Update

Bank of England QE and the Imaginary “Brexit Shock”

Mark Carney, Wrecking Ball. For reasons we cannot even begin to fathom, Mark Carney is considered a “superstar” among central bankers. Presumably this was one of the reasons why the British government helped him to execute a well-timed exit from the Bank of Canada by hiring him to head the Bank of England (well-timed because he disappeared from Canada with its bubble economy seemingly still intact, leaving his successor to take the blame).

Read More »

Read More »

A Fully Automated Stock Market Blow-Off?

About one month ago we read that risk parity and volatility targeting funds had record exposure to US equities. It seems unlikely that this has changed – what is likely though is that the exposure of CTAs has in the meantime increased as well, as the recent breakout in the SPX and the Dow Jones Industrial Average to new highs should be delivering the required technical signals.

Read More »

Read More »

The VIX Breaks Out – Market Risk Continues to Surge

The Sharp Move in the VIX Accelerates In Monday’s trading session, the upward move in the volatility index VIX (which measures the implied volatility of SPX options) continued unabated, vastly out of proportion with the move in the underlying stock...

Read More »

Read More »

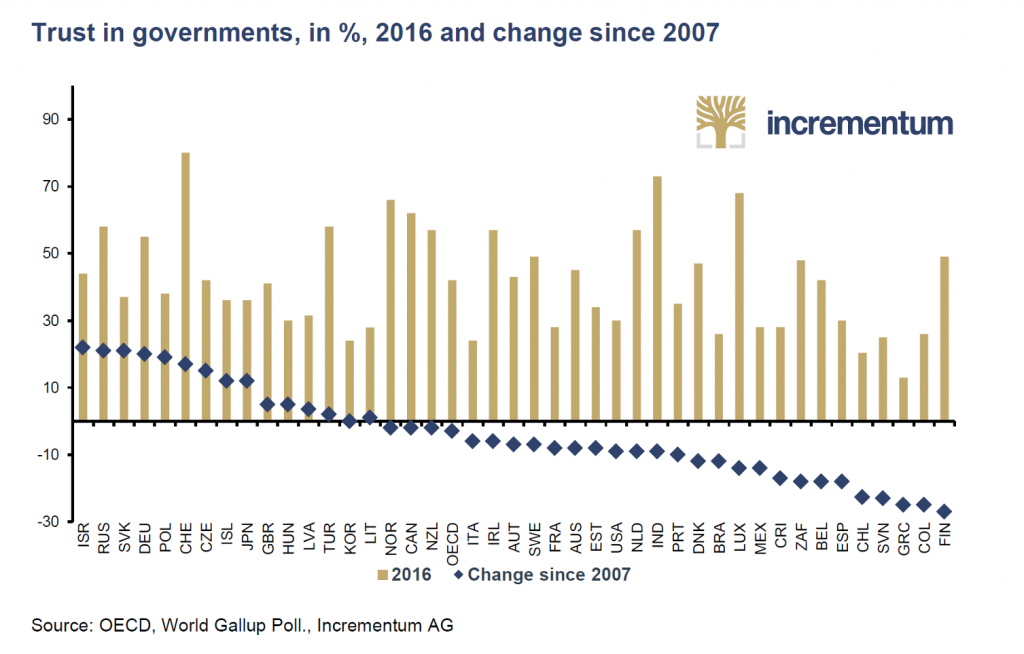

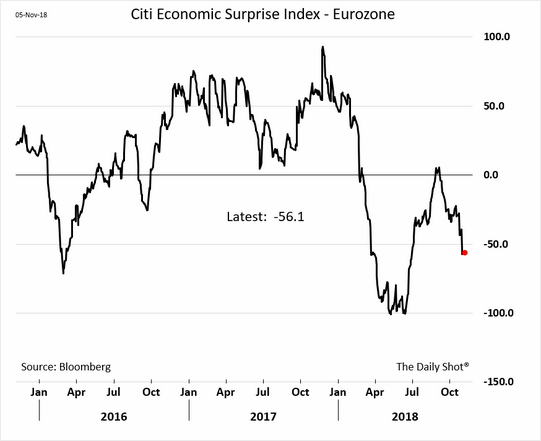

Brexit Paranoia Creeps Into the Markets

European Stocks Look Really Bad… Late last week stock markets around the world weakened and it seemed as though recent “Brexit” polls showing that the “leave” campaign has obtained a slight lead provided the trigger. The idea was supported by a not...

Read More »

Read More »

Commodities – Will the Rally Continue?

Pros and Cons The recent rally in commodity prices has surprised many market participants and has greatly supported the stock market’s rebound. It has also made bulls out of a number of former stock market bears, as one of its side effects was to c...

Read More »

Read More »

Bank of Japan: The Limits of Monetary Tinkering

After waking up on Thursday, we quickly glanced at the overnight market action in Asia and noticed that the Nikkei had tanked rather noticeably. Our first thought upon seeing this was “must be the yen” – and so it was. The BoJ cannot manipulate the yen anymore.

Read More »

Read More »

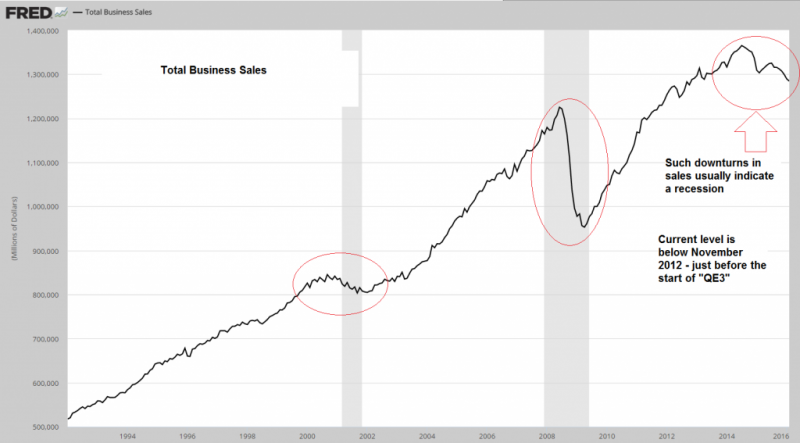

US Economy – Gross Output Continues to Slump

The Cracks in the Economy’s Foundation Become Bigger Last week the Bureau of Economic Analysis has updated its gross output data for US industries until the end of Q4 2015. Unfortunately these data are only available with a considerable lag, but th...

Read More »

Read More »

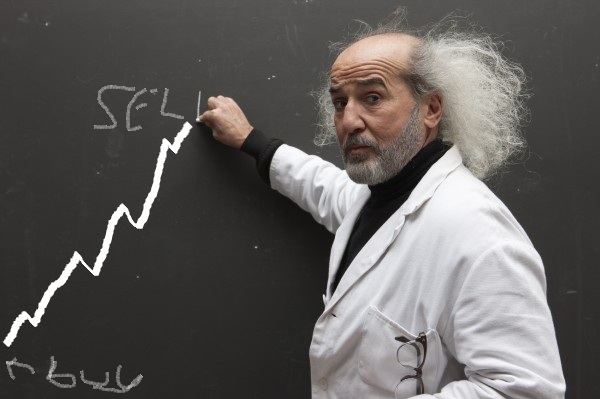

Is the Stock Market Overvalued?

Dismal Earnings, Extreme Valuations The current earnings season hasn’t been very good so far. Companies continue to “beat expectations” of course, but this is just a silly game. The stock market’s valuation is already between the highest and third ...

Read More »

Read More »

US Economy – Ongoing Distortions

Business under Pressure A recent post by Mish points to the fact that many of the business-related data that have been released in recent months continue to point to growing weakness in many parts of the business sector. We show a few charts illust...

Read More »

Read More »

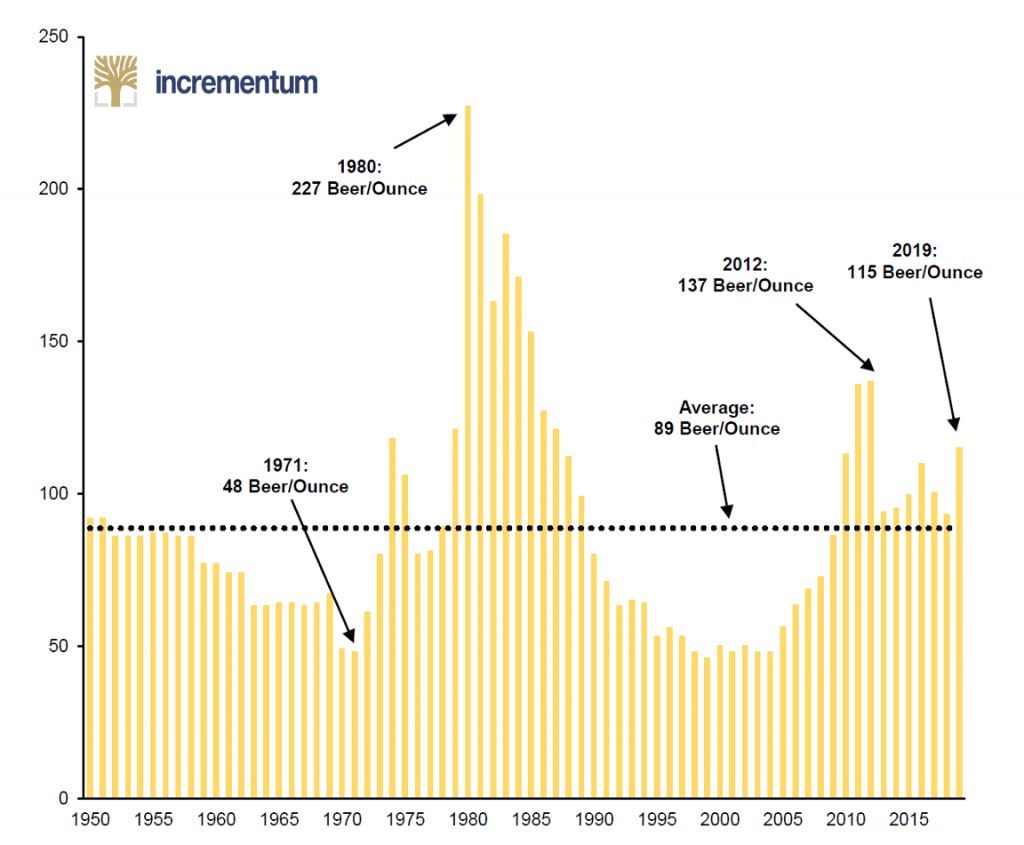

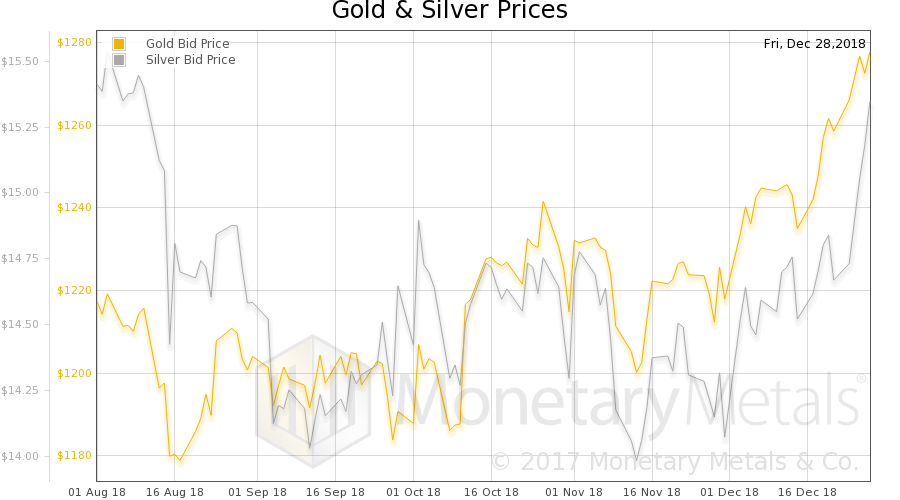

Gold Stocks Break Out

No Correction Yet Late last week the HUI Index broke out to new highs for the move, and so did the XAU (albeit barely, so it did not really confirm the HUI’s breakout as of Friday). Given that gold itself has not yet broken out to a new high for th...

Read More »

Read More »