Category Archive: 1) SNB and CHF

USD/CHF Price Analysis: Golden cross loom, bulls hopeful target 0.9100

Share:

USD/CHF finds support at 0.9010, with buyers lifting pair to 0.9057 in late North American session.

'Golden cross' formation of 50-day moving average crossing above 200-day moving average opens door for bullish resumption.

Sellers must push prices below 0.9000 mark and reclaim latest cycle low at 0.8887 to maintain control.

The USD/CHF finds some support at around the...

Read More »

Read More »

2023-03-23 – Monetary policy assessment of 23 March 2023

The SNB is tightening its monetary policy further and is raising the SNB policy rate by 0.5 percentage points to 1.5%. In doing so, it is countering the renewed increase in inflationary pressure. It cannot be ruled out that additional rises in the SNB policy rate will be necessary to ensure price stability over the medium term. To provide appropriate monetary conditions, the SNB also remains willing to be active in the foreign exchange market as...

Read More »

Read More »

Übernahme der Credit Suisse kostet jeden Schweizer 12’500 Franken

Für den Bundesrat ist der Übernahme-Deal zwischen UBS und Credit Suisse keine Staatsrettung. Dennoch tragen die Steuerzahler mit den Staatsgarantien enorme Risiken.

Read More »

Read More »

Swiss National Bank provides substantial liquidity assistance to support UBS takeover of Credit Suisse

UBS today announced the takeover of Credit Suisse. This takeover was made possible with the support of the Swiss federal government, the Swiss Financial Market Supervisory Authority FINMA and the Swiss National Bank.

Read More »

Read More »

«Status quo keine Option mehr»: Bekannter Bank-Experte sieht Übernahme der Credit Suisse durch UBS als Szenario Nummer Eins

Die Krise der Credit Suisse wird nach Einschätzung eines renommierten Branchenexperten von JPMorgan mit einer Übernahme der Bank enden.

Read More »

Read More »

While the focus was on Powell Tuesday there were also remarks from the ECB and SNB

Swiss National Bank Chair Jordan threatened FX intervention!

A couple of posts from Tuesday ICYMI while Powell was hogging the spotlight:

ECB Knot: ECB can be expected to keep raising rates for quite some time after March

ECB can be expected to keep raising rates for quite some time after March

And, SNB Chairman: We cannot rule out that we will have to tighten monetary policy again

We can use interest rates but also sell foreign...

Read More »

Read More »

Wie viele Arbeitsjahre bis zur Traumwohnung notwendig sind

Viele Menschen in der Schweiz können sich Wohneigentum nicht leisten. Und wer es kann, muss länger sparen als früher.

Read More »

Read More »

SNB dumps FANGS. Should You?

John Rubino and Patrick Highsmith of Firefox Gold return as guests on this week’s program.

The Swiss National Bank (SNB) loaded up on some of the largest cap stocks in the world like MSFT, GOOG, AMZN, TSLA, XOM and many more in order to weaken the Swiss francs vis-a-vis the Euro and the Dollar.

Read More »

Read More »

2023-02-16 – Markus K. Brunnermeier to hold the 2023 Karl Brunner Distinguished Lecture

The Swiss National Bank has named Markus K. Brunnermeier as the next speaker for its Karl Brunner Distinguished Lecture Series. Markus K. Brunnermeier is Professor of Economics at Princeton University and also Director of the Bendheim Center for Finance. His research focuses on the interaction between financial markets and the macroeconomy.

Read More »

Read More »

14R day shorting GBP and USD/CHF, oil was a setup

In this video I showcase the setups for selling into built-up longs in the NY session in cable and USD/CHF using SB strategy and an indicator template that I'm working on with rules...work in progress.

Read More »

Read More »

Rekordzahlen ZKB: Das sagt die Kantonalbank zum CS-Effekt

Die Zürcher Kantonalbank profitierte von der Krise der CS und machte im vergangenen Jahr Rekordgewinne. Das sagt die ZKB-Führung dazu.

Read More »

Read More »

The most critical questions about the Swiss central bank’s huge losses

The Swiss National Bank (SNB) booked a CHF132 billion ($143 billion) loss in 2022 and suspended profit-sharing transfers to the Confederation and cantons. What does that mean exactly? And how does the SNB fare in international comparison?

Fabio Canetg

More from this author

Last year, the SNB lost more money than ever before. And it is not alone: central banks around the world also recorded heavy losses. As a...

Read More »

Read More »

Die Schweizerische Nationalbank wird zur Devisenverkäuferin

Während die Schweizerische Nationalbank zur Schwächung des Frankens lange Zeit Fremdwährungen gekauft hatte, ist seit einigen Monaten das Gegenteil der Fall. Die Hintergründe.

Read More »

Read More »

Why can’t the Swiss National Bank go bankrupt?

The Swiss National Bank (SNB) will make a loss of CHF132 billion in 2022, and distribution of profits to the confederation and the cantons will be suspended. What does this mean for the stability of the SNB and what would happen if it faces another large loss?

Read More »

Read More »

Swiss-Life-Ökonomen erwarten nur noch wenige Zinsschritte

Das meinen die Ökonomen des Versicherungskonzerns Swiss Life und sagen deshalb für die USA, die Eurozone und die Schweiz nur noch leichte Zinserhöhungen voraus. Konkret erwartet Swiss-Life-Asset-Managers-Chefökonom Marc Brütsch von der Schweizerischen Nationalbank (SNB) im Frühling nur noch eine Erhöhung des Leitzinses um 0,25 Prozentpunkte auf 1,25 Prozent. Danach sei Schluss.

Read More »

Read More »

Swiss central bank posts record CHF132 billion loss for 2022

The Swiss National Bank (SNB) has posted an annual loss of CHF132 billion ($143 billion) for 2022, the biggest in its 115-year history. “The loss on foreign currency positions amounted to around CHF131 billion and the loss on Swiss franc positions was around CHF1 billion. A valuation gain of CHF400 million was recorded on gold holdings,” the SNB said in a statement on Monday.

Read More »

Read More »

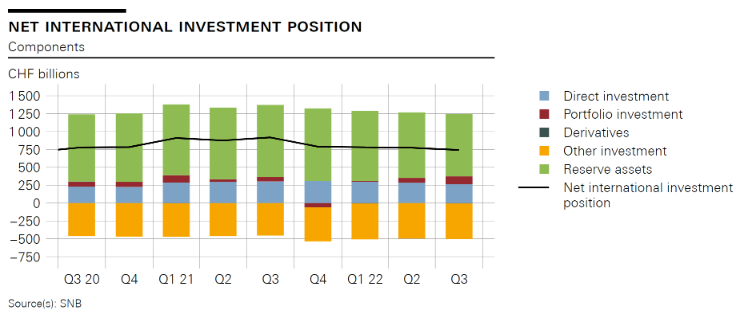

Swiss balance of payments and international investment position: Q3 2022

In the third quarter of 2022, the current account surplus amounted to CHF 24 billion – a very high figure from a long-term perspective. This was attributable to the high surplus in goods trade and the relatively low deficits in services trade and in primary income. Compared to the same quarter of 2021, however, the increase in the current account balance (CHF 2 billion) was moderate because the basis for comparison was also high.

Read More »

Read More »

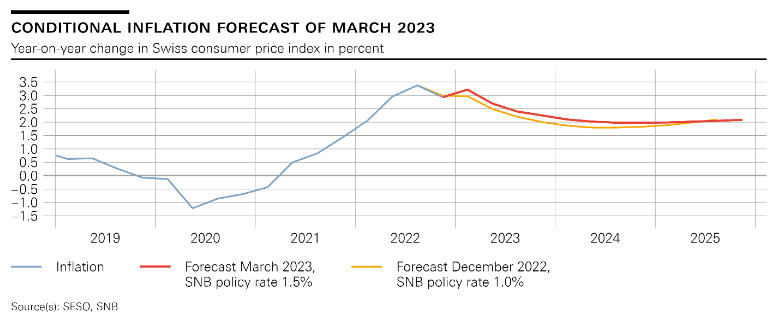

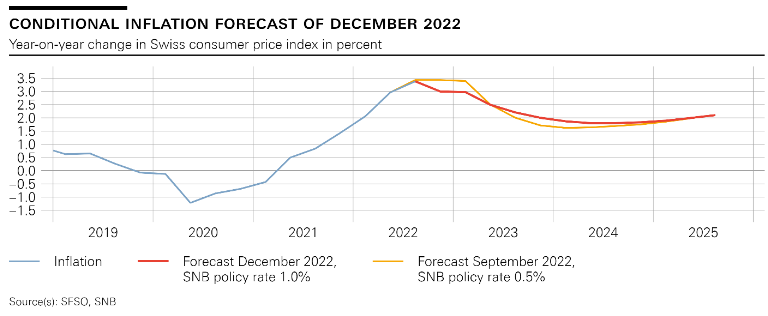

Quarterly Bulletin Q4/2022

Report for the attention of the Governing Board of the Swiss National Bank for its quarterly assessment of December 2022. The report describes economic and monetary developments in Switzerland and explains the inflation forecast. It shows how the SNB views the economic situation and the implications for monetary policy it draws from this assessment.

Read More »

Read More »

Thomas Jordan: Introductory remarks, news conference

Ladies and gentlemen

It is my pleasure to welcome you to the news conference of the Swiss National Bank. I would also like to welcome all those who are joining us today online. After our introductory remarks, the members of the Governing Board will take questions from journalists as usual.

Read More »

Read More »

Martin Schlegel: Introductory remarks, news conference

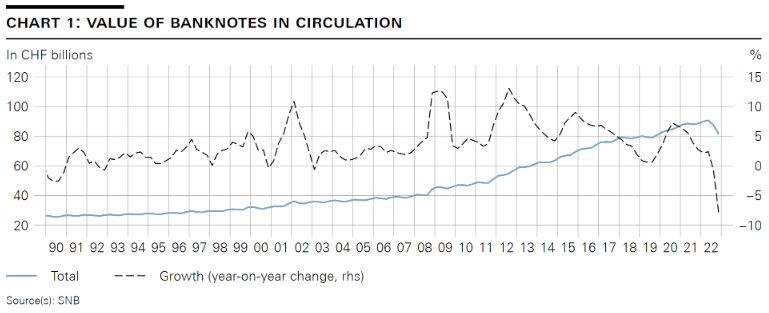

I am pleased to give you an assessment of current developments with regard to cash. Since June, after many years of strong growth, we have seen a significant decline in banknote circulation. To contextualise this decline of approximately 10%, let me first say a few words about the above-average growth in recent years.

Read More »

Read More »