Category Archive: 1) SNB and CHF

Swiss Franc extends losses on Swiss interest rate outlook

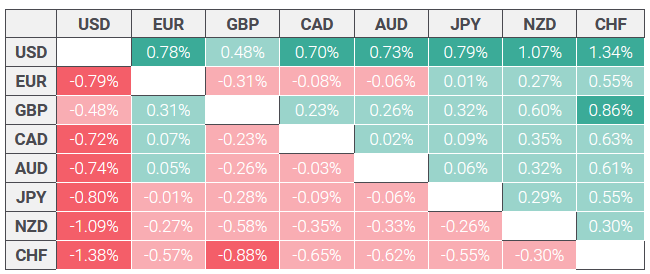

The Swiss Franc (CHF) edges lower against the US Dollar (USD) on Wednesday as traders continue to bet on a less-inflationary outlook for Switzerland, supporting a relatively low interest rate policy and dampening foreign capital inflows.

Read More »

Read More »

Vorwort des Buches « L’Humanité vampirisée ». Philippe Bourcier de Carbon (version Allemande)

Philippe Bourcier de CarbonIngenieur der Hochschule Polytechnique, DemographGründungsvorsitzender von AIRAMA, « Internationale Allianz für die Anerkennung der Beiträge des Nobelpreisträgers Maurice Allais »

Read More »

Read More »

USD/CHF Price Analysis: Trades back and forth around 0.8800

USD/CHF trades sideways near 0.8800 as the focus shifts to US economic data.

The Swiss economy is expected to have growth at a moderate pace of 0.1% in the last quarter of 2023.

Fed policymakers support holding interest rates unchanged in the range of 5.25%-5.50%.

Read More »

Read More »

EUR/CHF hits ten-week highs above 0.9550 as Franc continues to soften

EUR/CHF up over 3% from December’s lows.

ECB President Lagarde looks ahead to growth rebound.

Swiss Franc is broadly weaker across the majors market.

Read More »

Read More »

Sichtguthaben bei der SNB ziehen leicht an

Die Einlagen von Bund und Banken lagen am 23. Februar bei 480,5 Milliarden Franken nach 477,1 Milliarden in der Woche davor, wie die SNB am Montag mitteilte. Das ist ein Anstieg um 3,4 Milliarden Franken.

Read More »

Read More »

Parlamentskommission reicht in Credit-Suisse-Untersuchung Anzeige ein

Die Sonderkommission des Schweizer Parlaments zur Untersuchung des Credit-Suisse-Debakels geht gegen Indiskretionen vor.

Read More »

Read More »

Forex Today: Pound Sterling weakens on soft UK inflation, US Dollar consolidates gains

The US Dollar Index consolidates it's gains early Wednesday after rising 0.7% to a fresh three-month high near 105.00 on Tuesday. Eurostat will release fourth-quarter Gross Domestic Product (GDP) data in the European session and there won't be any high-tier data releases from the US later in the day.

Read More »

Read More »

Gold price consolidates post-US CPI losses, seems vulnerable near two-month low

Gold price (XAU/USD) extends its sideways consolidative price move and remains depressed below the $2,000 psychological mark, or a two-month low heading into the European session on Monday. The stronger-than-expected US consumer inflation report released on Tuesday fueled speculations that the Federal Reserve (Fed) will wait until the June policy meeting before cutting interest rates.

Read More »

Read More »

USD/CHF retraces its recent gains on risk appetite, inches lower to near 0.8730

USD/CHF attempts to recover its recent gains registered in the previous session. The USD/CHF pair edges lower to near 0.8730 during the European hours on Thursday. The improved risk appetite weakened the US Dollar (USD) against the Swiss Franc (CHF). Additionally, the subdued US bond yields are contributing downward pressure to undermining the Greenback.

Read More »

Read More »

USD/CHF heading for 0.8500 as Swiss Franc climbs into four-month high against Greenback

The USD/CHF slipped through the 0.8600 handle on Thursday as broader markets push over the US Dollar (USD), bolstering all other major currencies across the board and lifting the Swiss Franc into a new twenty-week high against the Greenback.

Read More »

Read More »

2023-12-20 – 4/2023 – Business cycle signals: SNB regional network

Report submitted to the Governing Board of the Swiss National Bank for its quarterly monetary policy assessment The appraisals presented here are based on discussions between the SNB’s delegates for regional economic relations and members of management at companies throughout Switzerland. In its evaluation, the SNB aggregates and interprets the information received. A total of 239 company talks were conducted between 10 October and 28 November.

Read More »

Read More »

SNB’s Jordan: I’m not sure whether if the terminal rate has been reached

High risk warning: Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance.

Read More »

Read More »

SNB’s Jordan: Another interest rate move is possible if current monetary policy is not restrictive enough

In an interview with local television station TeleZueri, Swiss National Bank (SNB) Chairman Thomas Jordan said that he doesn’t rule out more interest rate hikes ahead.

Read More »

Read More »

CHF traders take note – SNB Chair Jordan is speaking on Tuesday

High risk warning:

Foreign exchange trading carries a high level of risk that may not be suitable for all investors. Leverage creates additional risk and loss exposure. Before you decide to trade foreign exchange, carefully consider your investment objectives, experience level, and risk tolerance. You could lose some or all your initial investment; do not invest money that you cannot afford to lose. Educate yourself on the risks...

Read More »

Read More »

2023-11-09 – Thomas Moser: Implementing monetary policy with positive interest rates and a large balance sheet: First experiences

In September 2022, the Swiss National Bank (SNB) raised its policy rate back into positive territory. At the same time, it adopted a new approach to implementing monetary policy in the money market. This approach employs two levers: the tiered remuneration of reserves, also referred to as reserve tiering, and reserve absorption.

Read More »

Read More »

2023-11-09 – Martin Schlegel: A pillar of financial stability – The SNB’s role as lender of last resort

As part of its contribution to the stability of the financial system, the Swiss National Bank acts as lender of last resort. In this role, it makes emergency liquidity assistance available to banks when, in crisis situations, they need substantial liquid funds which they are no longer able to obtain on the market.

Read More »

Read More »

Karsten Junius: «Schweizer Aktien bieten das attraktivste Kurspotenzial»

Auf welchem Pfad wird sich die Schweizerische Nationalbank (SNB) bewegen? Den Zinspeak haben wir auch in der Schweiz gesehen, selbst wenn Präsident Thomas Jordan jüngst noch einmal bekräftigt hat, dass die SNB die Zinsen falls nötig erneut erhöhen würde. Ich bin allerdings fest davon überzeugt, dass dies nicht der Fall sein wird.

Read More »

Read More »

Weniger SNB-Zinsen: UBS entgehen wohl 135 Millionen Dollar Einnahmen

Mit der verringerten Verzinsung von Sichtguthaben bei der Schweizerischen Nationalbank (SNB) dürften der UBS Einnahmen in Höhe von 135 Millionen Dollar entgehen.

Read More »

Read More »

-638453232816314704-800x305.png)

-638351136132631444-800x359.png)