Category Archive: 1) SNB and CHF

A “Hawkish Cut”? Traders’ Sleepless Nights Dominated By Indecision & Confusion

The avalanche of central bank meetings is rapidly winding down. We’ve had cuts, holds and a raise. The surprises have been minimal. Yet it didn’t prevent the inevitable knee-jerk reactions in the market. In truth, put together as a whole, we are no wiser nor better or worse off. I count that as a success. Especially because there was no projection of panic in any of the decisions.

Read More »

Read More »

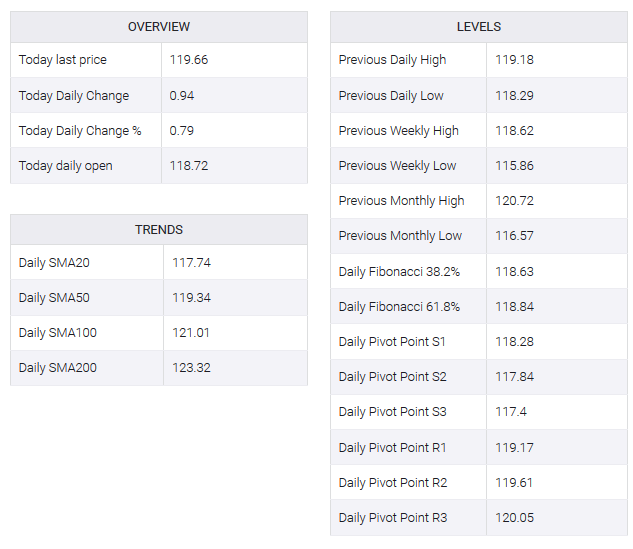

AUD/CHF technical analysis: Bears looking for a run to a 50 percent mean reversion

AUD/CHF is in the midst of a sell-off which could extend beyond a 38.2% retracement for a 50% reversion. A subsequent pull-back, however, to the resistance and another sell-off will likely make for a high probability set up. AUD/CHF is in the midst of a sell-off which could extend beyond a 38.2% retracement of the August lows to September highs, located at 0.6715, and target the 50% retracement at 0.6674 (meeting the 2019 lows) should the markets...

Read More »

Read More »

Switzerland’s international investment position: Focus article ‘Breakdown of changes in stocks’ and extension of data offering

The Swiss National Bank has today published a focus article on its data portal entitled ‘Switzerland’s international investment position – breakdown of changes in stocks’ (data.snb.ch, Resources, International economic affairs, Focus articles).

Read More »

Read More »

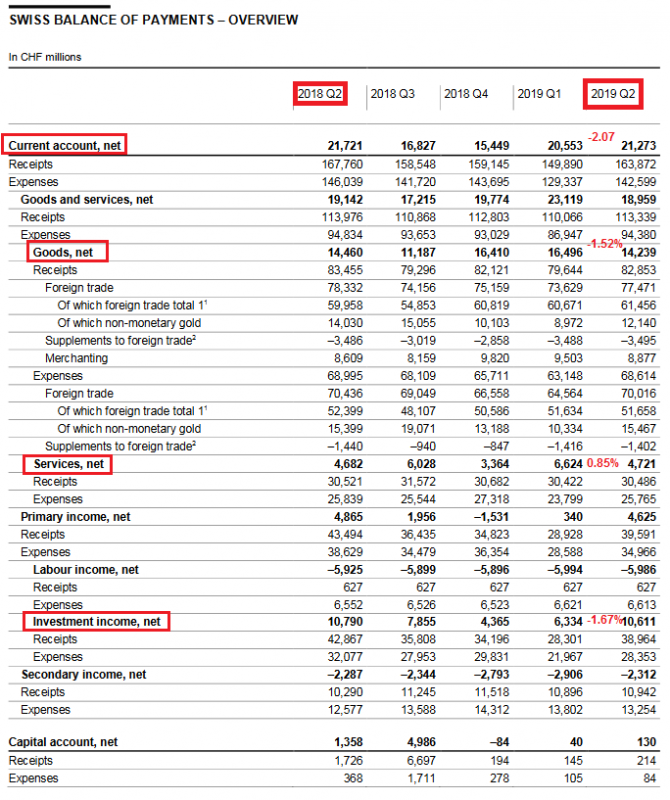

Swiss Balance of Payments and International Investment Position: Q2 2019

The assets side of the financial account registered a total net acquisition of CHF 11 billion (Q2 2018: net reduction of CHF 30 billion). Other investment contributed CHF 7 billion to this net acquisition (Q2 2018: net reduction of CHF 36 billion), in part because the SNB increased its foreign claims in connection with repo transactions.

Read More »

Read More »

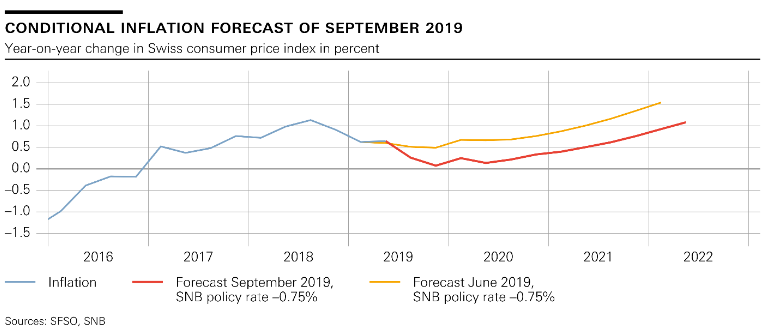

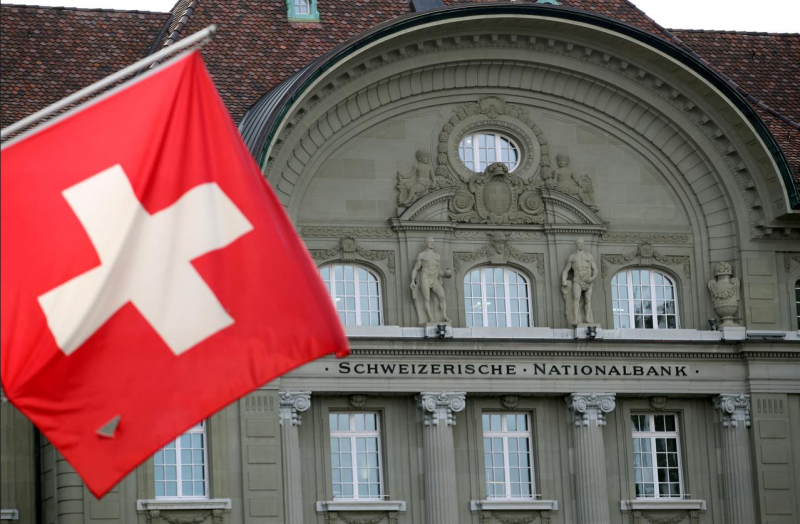

SNB leaves policy rate unchanged at -0.75 percent

SNB announces its latest monetary policy decision - 19 September 2019. Sight deposits rate unchanged at -0.75%Willing to intervene and will remain active in FX market as necessaryExpansionary monetary policy continues to be necessary.

Read More »

Read More »

Schweizerische Nationalbank – Weshalb die SNB ihre Munition nicht verpulvern wird

Noch vor wenigen Wochen galt es am Markt bereits mehrheitlich als ausgemacht, dass die Schweizerische Nationalbank am Donnerstag den Leitzins von minus 0,75 Prozent auf minus 1 Prozent weiter absenken wird. Ich konnte die Marktmeinung nie nachvollziehen. Der Wind hat nun tatsächlich gedreht. Eine weitere Absenkung der Zinsen scheint nun so gut wie ausgeschlossen.

Read More »

Read More »

Morgan Stanley forecasts a surprise 25 basis point cut from the SNB

The Swiss National Bank needs to respond to the strong currency and lower rates from the ECB, according to Morgan Stanley. The consensus for Thursday's meeting is no change from -0.75% but Morgan Stanley and UBS are two firms that are forecasting a surprise 25 bps cut.

Read More »

Read More »

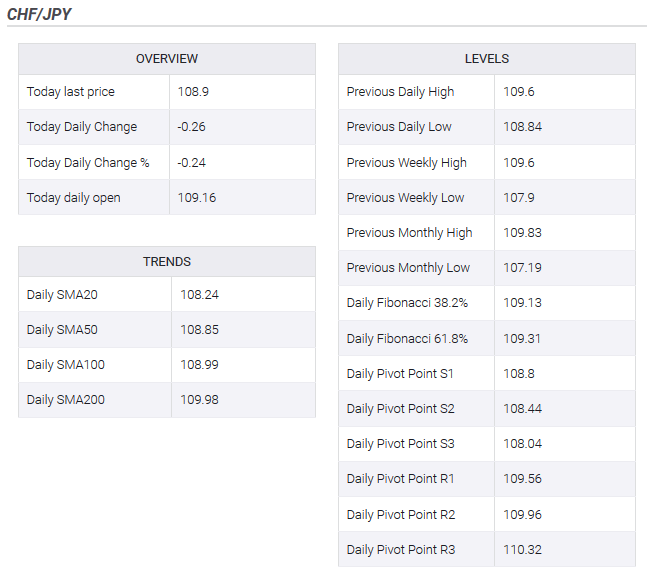

CHF/JPY: Eyes on central banks and geopolitics

This week the BoJ will hold its regular policy meeting. Global uncertainty, linked to the trade war and Brexit, has strengthened the value of the Swiss franc and Yen. CHF/JPY is struggling to maintain the upside as the Yen picks up a safe haven bid, anchored on geopolitical developments following a textbook risk-off response in global financial markets following the strike on Saudi Arabia’s oil facilities over the weekend.

Read More »

Read More »

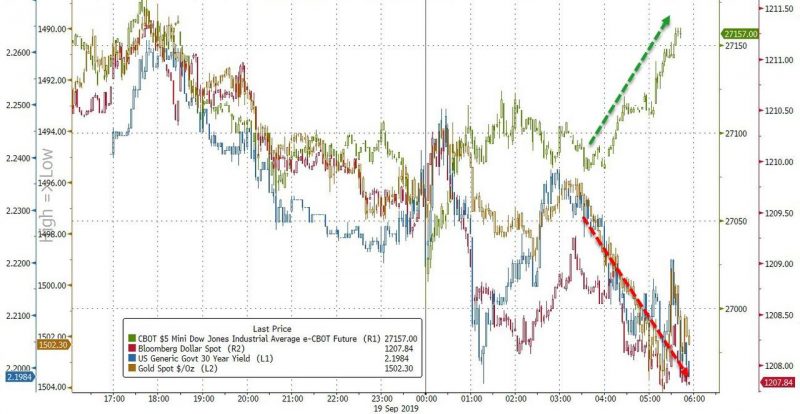

EUR/JPY rallies the hardest vs EUR/CHF as CHF/JPY spikes following ECB

EUR/JPY rallies hard following hawkish ECB cut and trade war optimism. EUR/JPY tracking positive sentiment in financial and commodity markets. While the trade war tensions seem to be easing, with stocks climbing and risk appetite returning in droves to financial and commodity markets, EUR/JPY is up 0.79% on the US session so far following what has been perceived as a hawkish rate cut from the European Central Bank earlier today.

Read More »

Read More »

Since 2014, European Banks Have Paid €23 Billion To The ECB… And Now Face Disaster

Earlier this morning, there was an added wobble in European bond prices after an unconfirmed MNI report said the ECB could delay the launch of QE on Thursday and make it data dependent. While skeptics quickly slammed the story, saying it was just a clickbait by MarketNews...

Read More »

Read More »

100-franc note enters circulation today

SNB banknote app with information on all new denominations. Issuance of the new 100-franc note presented a week ago begins today, 12 September. The complete version of the Swiss National Bank’s ‘Swiss Banknotes’ app is now also available. It has been updated to include the 100-franc note and features information on all six new denominations.

Read More »

Read More »

FINMA establishes new rules for Libra in Switzerland

Libra asked for clarity and FINMA delivered. New guidelines are out for stablecoins as Facebook’s Libra currency tries to gain momentum in Switzerland. Subscribe to our YouTube channel: https://www.youtube.com/c/CNNMoneySwitzerlandTV Subscribe to our Newsletter: http://bit.ly/cnnmsnewsletter Watch us live on TV: https://bit.ly/wheretowatchus More videos can be watched on our website: https://www.cnnmoney.ch/

Read More »

Read More »

CHF is ‘not strong in real terms’ – no need for SNB intervention

A note from Standard Chartered on the Swiss National Bank and the Swiss franc. The SNB monetary policy meeting is next week, September 19.In brief, Stan Chart argue the franc is not strong in real termsadjusting EUR/CHF for inflation leaves CHF around 10% weaker than (non-adjusted) current spotno need for SNB to intervene to try to weaken ittherefore the SNB is not likely to cut rates at their meeting, nor intervene in forex markets in the near...

Read More »

Read More »

Finma formuliert Anforderungen an Facebook-Währung Libra

Donnerstag, 12. September 2019 Finma formuliert Anforderungen an Facebook-Währung Libra | Sky Schweiz Finance Die Facebook-Währung Libra könnte in der Schweiz nur mit Bewilligung der Eidgenössischen Finanzmarktaufsicht Finma umgesetzt werden. Die Finma hat nun am Mittwoch nach einer Anfrage der Libra Association mit Sitz in Genf erste Hinweise zu den Anforderungen des Projekts gegeben. Ein …

Read More »

Read More »

CoinGeco TrustScore 2.0, Coinbase IEO, FINMA i stablecoiny, Mastercard R3 – Krypto-Newsy #155

#bitcoin #blockchain #kryptowaluty [1:29]Chiny likwidują ICO – https://cointelegraph.com/news/chinese-police-reportedly-close-office-of-ico-startup [2:34]Joe Lubin dołącza do Hyperledgera – https://www.coindesk.com/ethereum-co-founder-joe-lubin-joins-hyperledger-board [4:00]Telefon od PundiX – https://www.coindesk.com/pundixs-blockchain-phone-is-now-called-bob-and-its-coming-soon [5:19]Coingecko i Trust Score 2.0 –...

Read More »

Read More »

#CryptoCorner: FINMA Publishes Guidelines Pertaining to Stablecoins and Libra, Coinbase Considering

Source: https://www.spreaker.com/user/investorideas/cryptocorner-finma-publishes-guidelines-_1 #CryptoCorner: FINMA Publishes Guidelines Pertaining to Stablecoins and Libra, Coinbase Considering Initial Exchange Offering

Read More »

Read More »

App “Swiss Banknotes” – Application “Swiss Banknotes” – ‘Swiss Banknotes’ app

Entdecken Sie die neue 100-Franken-Note mit der SNB-App "Swiss Banknotes". - Découvrez le nouveau billet de 100 francs avec l'application "Swiss Banknotes" de la BNS. - Discover the new 100-franc note with the SNB's banknotes app. - Scoprite la nuova banconota da 100 franchi con l'App per banconote della BNS.

Weitere Informationen: - Informations complémentaires: - Further information: - Ulteriori informazioni:...

Read More »

Read More »

App “Swiss Banknotes” – Application “Swiss Banknotes” – ‘Swiss Banknotes’ app

Entdecken Sie die neue 100-Franken-Note mit der SNB-App “Swiss Banknotes”. – Découvrez le nouveau billet de 100 francs avec l’application “Swiss Banknotes” de la BNS. – Discover the new 100-franc note with the SNB’s banknotes app. – Scoprite la nuova banconota da 100 franchi con l’App per banconote della BNS. Weitere Informationen: – Informations complémentaires: …

Read More »

Read More »

Negativzinsen – Resultat des chaotischen SNB-Konzepts

Nach der Freigabe der Wechselkurse zu Beginn der 1970er Jahre bestand das geldpolitische Konzept der SNB in sogenannten „Geldmengenzielen“. Es wurde für das kommende Jahr ein Geldmengenziel angestrebt in der Meinung, so die Inflation unter Kontrolle zu halten. Trotzdem: Die Inflation hüpfte damals aufgrund der Angebotsschocks nach Belieben rauf und runter und die SNB schaute konsterniert zu.

Read More »

Read More »