Central Banks Remain Calm, Investors Not So MuchThe avalanche of central bank meetings is rapidly winding down. We’ve had cuts, holds and a raise. The surprises have been minimal. Yet it didn’t prevent the inevitable knee-jerk reactions in the market. In truth, put together as a whole, we are no wiser nor better or worse off. I count that as a success. Especially because there was no projection of panic in any of the decisions. Despite on-going, and universal, expressions of concern for the global economy. Special hat tip to the SNB and Norges Bank. |

The Fed is said to have orchestrated a “hawkish cut.” Not really.[ZH: Stocks once again decouple from bonds, the dollar, and gold] |

| Keeping the expansion alive remains a top priority. And while the obvious differences of opinions within the board are interesting, the chairman said the most important thing of all: That where interest rates will be a year from now is just a forecast. You would think that wouldn’t have to be constantly repeated after the experiences of the last year.

Futures traders still expect a greater likelihood of another rate cut this year. At the end of the day, that will turn out to be the dominant dot for asset prices until proven otherwise. And we’ll see what data and events have to say going forward. Any short-term market movements in response to what was said and projected need to be taken cautiously. Which, to be fair, doesn’t necessarily make it any less real. |

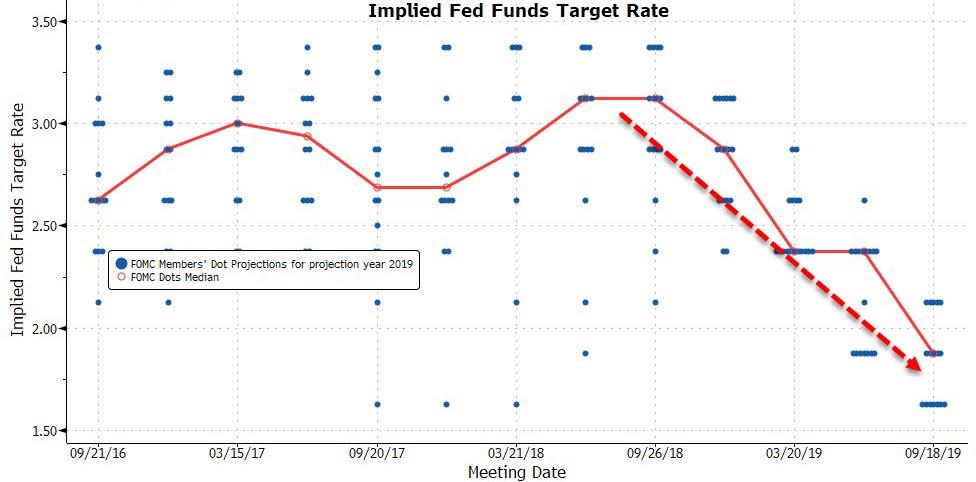

Implied Ferd Funds Target Rate, 2016-2019 |

| The ad hominem attacks on the chairman, by the way, have reached the farce stage. I’m sure it is unpleasant to be on the receiving end, but imagine the chagrin is lessening with every occurrence. They are becoming laugh lines. The timing of which is the type of thing that leads to office pools.

The funding squeeze that we have been experiencing has certainly not reflected well on the preparedness of the Fed. That fact could have longer repercussions than the actual rate spike. But if there is any silver-lining it is that the issue is now very much on the global radar screen. The lingering problem, however, is that the issue still isn’t really understood by many market participants and has unnerved them. I even got a worried call from an analyst asking how he would know if any of the banks he covers might be in trouble. Assurances that there are short-term actions that can calm things down, while a longer-term fix is planned, seem to be falling on a lot of deaf ears. So it behooves the Fed to be very proactive. |

. |

Effects are still being expressed overnight in cross-currency basis trading as evidence of disappointment that a permanent solution wasn’t already presented by the Fed. “Just make it go away” seems to be the prevailing attitude. And as we approach year-end, it won’t be enough to tell traders “this too will pass”. Even if it will.

So far this week, trading has been much quieter than anyone would have expected given all the news. It’s hard to think this can last. Too many assets seem to be in play and trying to decide whether they will hold all sorts of important technical levels that are acting as magnets. Which isn’t a sign of lack of interest but of real indecision and confusion. This is the kind of market that causes a lot of traders to get bad nights’ sleep

Full story here Are you the author? Previous post See more for Next postTags: newsletter