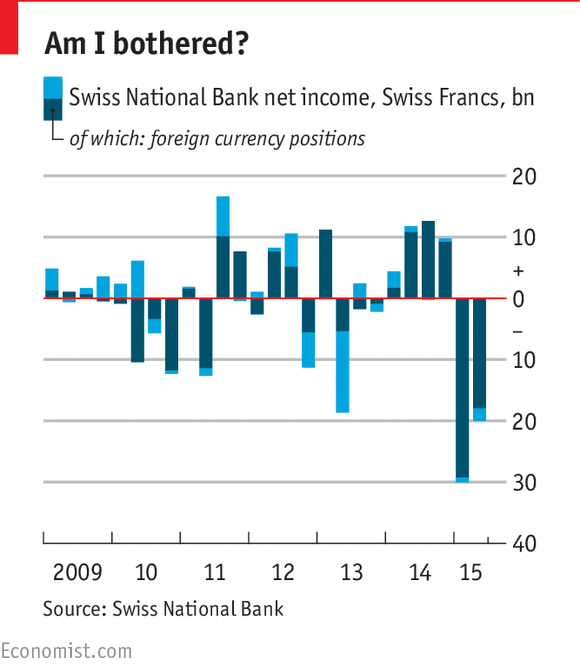

ON FRIDAY, the Swiss National Bank (SNB), Switzerland’s central bank, reported second quarter losses of SFr20 billion ($20 billion). Following an equally bad first three months of the year, the SNB’s losses so far for 2015 now amount to a whopping SFr50.1 billion, equivalent to 7.5% of Switzerland's GDP.

Read More »

Category Archive: 1) SNB and CHF

Julius Bär’s Acket Talking Nonsense: Too Much Transparency on SNB Sight Deposits?

Julius Baer's Chief Economist Janwillem Acket argues that by publishing weekly sight deposits, the SNB is telling the market too much. George Dorgan responds that this hiding of economic data will need to happen also in trade data, in GDP data and even in the disclosure of Swiss company results. For Adam Button, this contradicts the people's desire of transparency.

Read More »

Read More »

Tristan Fletcher and Izabella Kaminska – artificial intelligence in financial markets

Tristan Fletcher and Izabella Kaminska speaking at Playfair Capital’s Machine Intelligence 2015 event in London. Tristan Fletcher heads up the machine learning team at Thought Machine – a startup revolutionizing personal finance with AI. He’s an expert in applying state of the art machine learning techniques in the practical domain: from algorithmic trading, portfolio management, …

Read More »

Read More »

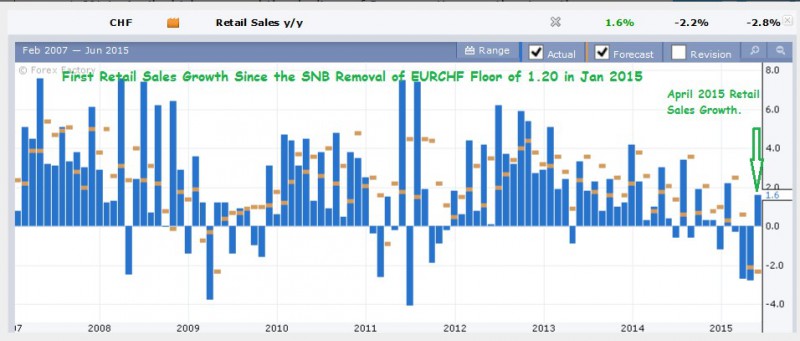

Impressive Swiss Recovery After SNB Peg Removal

Retail data shows that the SNB peg removal in January 2015 as early as April 2015 with minimal adverse impact on the economy.

Trade surplus showed that Switzerland had fully recovered its lost trade surplus in May and expectations crossed an important threshold into positive territory in June.

CHF strengthened since May end, as the market caught wind of the Swiss recovery, and the Grexit would further strengthen the CHF if it were to occur.

Read More »

Read More »

SNB interventions June 2015

Latest update for June 2015: The pace of SNB intervention is slowing. Sight deposits, the indicator for SNB interventions, rise by 0.5 billion francs per week.

April and May: Sight deposits rise by 1.5 billion CHF per week. Thanks to this intervention the SNB is able to maintain the EUR/CHF around 1.0450.

Read More »

Read More »

The Swiss economy: True to form

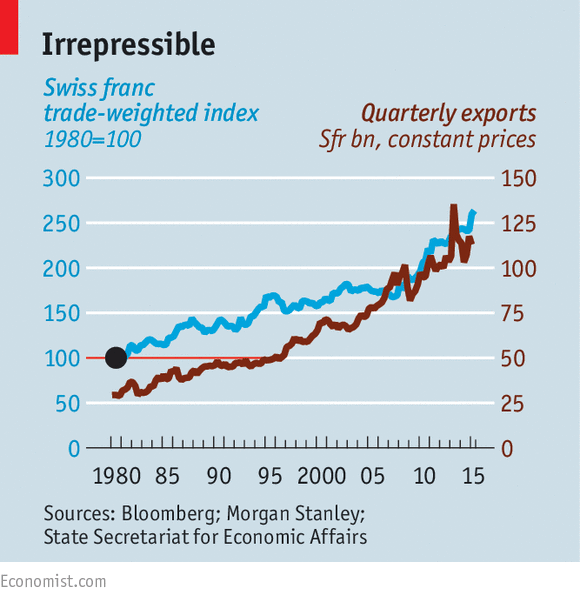

FOREIGN skiers were bound to suffer. So was the Swiss economy, most assumed, after the Swiss National Bank (SNB) suddenly abandoned the Swiss franc’s peg to the euro in January. The franc rose by 30% against the euro in a matter of minutes, and remains about 15% higher than it was. This made Swiss exports more expensive for foreigners, and foreign goods cheaper for the Swiss.

Read More »

Read More »

Q1/2015: Swiss Real GDP Rises by 15 percent … in Euro Terms

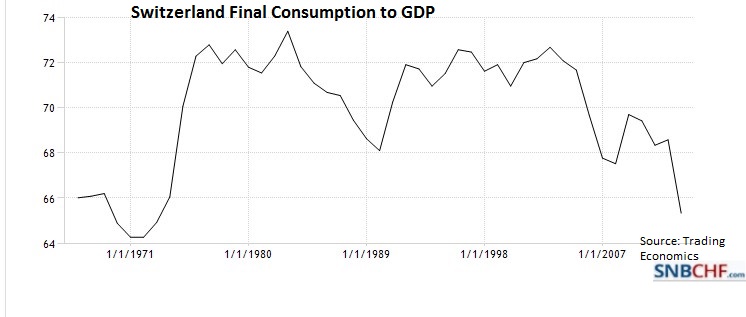

George Dorgan shows that Gross Domestic Product (GDP) is a measurement in the local currency. Effectively, Swiss real GDP rose by 15% in Euro terms, but fell slightly in CHF. He also emphasizes that Switzerland needs a big rebalancing of its economy, away from exports towards consumption. The Swiss National Bank was right to remove the euro peg. The move towards consumption is only possible when the Swiss franc is stronger because consumers will...

Read More »

Read More »

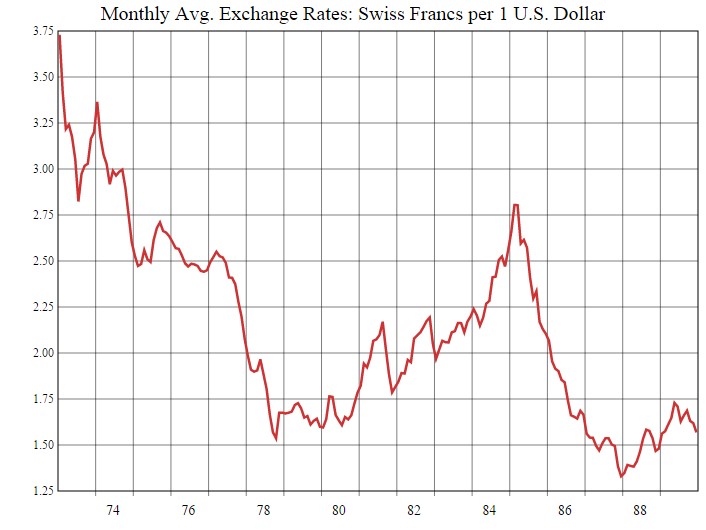

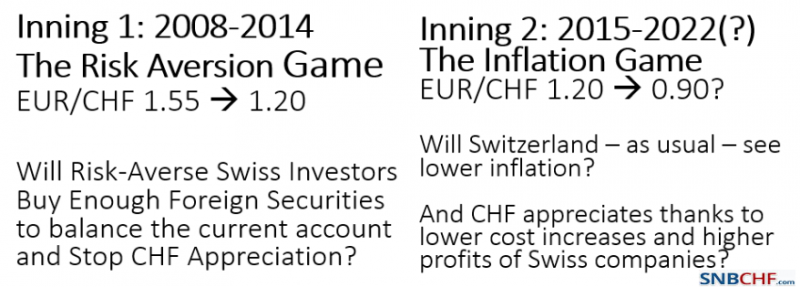

The two phases of CHF appreciation… and what is in between

We show the two phases or "two innings" of Swiss franc appreciation: The risk aversion phase and the high inflation phase.

With the weakening of emerging markets and the strengthening of the United States in 2013/2014, the Swiss National Bank (SNB) had won the first battle in the war against financial market, the "risk aversion game", the first inning in two-part match. Risk aversion is lower because the United States recovered with weaker oil...

Read More »

Read More »

Swiss Franc History: The Gold Standard and Bretton Woods

In this post we will show the history of the Swiss Franc until 1971, a monetary era driven by the gold standard and the Bretton Woods period, both periods with nearly fixed exchange rates.

Read More »

Read More »

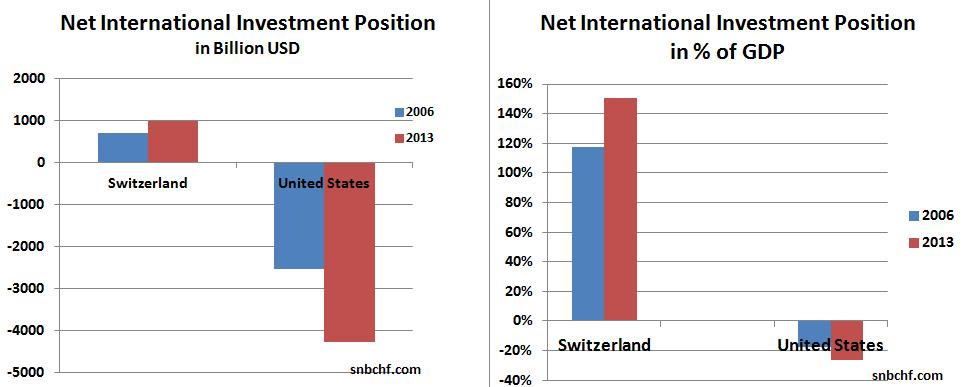

Ex-Post FX Evaluation: Is the Swiss Capital Account Able to Neutralise the Persistent Current Account Surpluses?

(post written originally in March 2013)

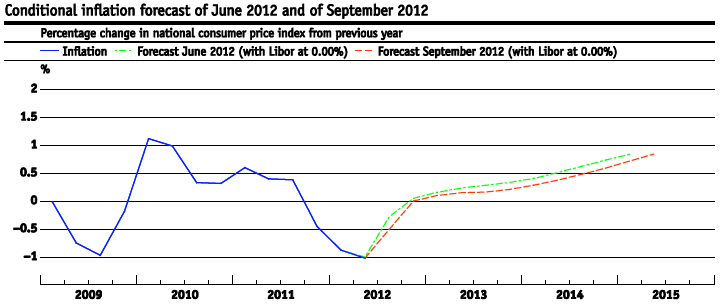

We reckon that the Swiss National Bank (SNB) will have issues maintaining the EUR/CHF floor in the longer term, because the expected yields on Swiss investments abroad will not be sufficiently higher than the yield on investments in Switzerland. Because of this insufficient risk-reward relationship, outflows in the capital account of the Swiss balance of payments will not cover the persistent Swiss current...

Read More »

Read More »

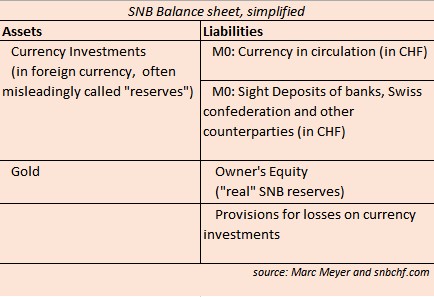

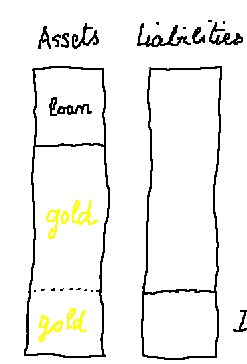

Rising Sight Deposits at SNB Means Rising SNB Debt

Money creation and sight deposits may have two points of view:

1. The central bank creates money - i.e. the SNB decides to increase sight deposits when it does currency interventions

2. Commercial banks create money - inflows in CHF on Swiss bank accounts make those banks increase their "sight deposits at the SNB. If inflows in CHF are higher than outflows then CHF must rise, unless the central bank does currency interventions.

We will present...

Read More »

Read More »

The Last Free Lunch for Holders of SNB’s High-Risk Share?

Marc Meyer, the maybe strongest opponent of the Swiss National Bank criticizes the misleading vocabulary in monetary policy that confuses central bank liabilities with assets. He identifies the intrinsic and time value of the SNB share. According to Meyer, the recent strong share price performance was caused by the free lunch at the shareholder assembly.

Read More »

Read More »

SNB’s IMF data

This IMF data on the SNB website shows SNB Forex and gold reserves in the last month. It is so-called "IMF Special Data Dissemination Standard (SNB Data)"

Read More »

Read More »

Where does SNB intervene against overvalued CHF, do they sell EUR & USD? (April Update)

In his first response to the Swiss financial tsunami on January 15, George Dorgan suggested that the EUR/CHF of 1.10 will not be reached any time soon. He explains where the SNB should intervene and if they sell Euros and dollars.

Read More »

Read More »