- Retail data shows that the SNB peg removal in January 2015 as early as April 2015 with minimal adverse impact on the economy.

- Trade surplus showed that Switzerland had fully recovered its lost trade surplus in May and expectations crossed an important threshold into positive territory in June.

- CHF strengthened since May end, as the market caught wind of the Swiss recovery, and the Grexit would further strengthen the CHF if it were to occur.

(via Seeking Alpha)

The Swiss economy had done well despite the scrapping of the peg by the Swiss National Bank (SNB) in January 2015 for CHF1.20 for each euro. The CHF had strengthened to CHF0.93 against the euro, and the fears of the collapse of the Swiss economy based on the stronger CHF proved to be unfounded as the latest data would show. Today, we will be looking at the Swiss economic performance from the perspective of retail sales, trade balance and expectations of economic outlook.

Retail, Trade Surplus and Expectations Point To A Swiss Recovery

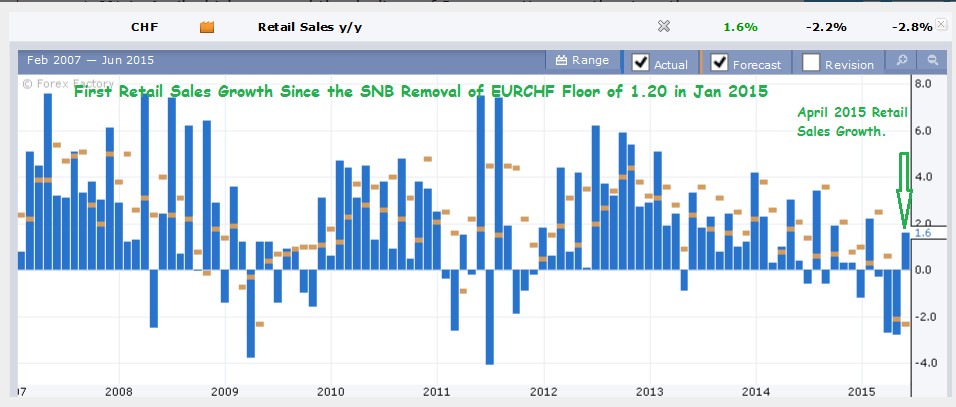

Starting with retail sales, Swiss Statistics reported that retail sales grew by 1.6% in April which reversed the declines of 3 consecutive months since the removal of the peg. This can be seen clearly from the historic retail sales chart below:

This shows that confidence is returning to the economy and Swiss citizens are getting used to the new exchange rate levels. This will be confirmed by the trade balance and economic outlook expectations later.

Despite the gloom and doom warnings after the SNB peg removal, the unemployment only went up 0.1% from 3.2% in January 2015 to 3.3% in April 2015 and unchanged in May. This proved that the economic impact was minimal on the Swiss economy. Consumers responded by increasing their retail purchases, which they cut back for 3 months, and this was better than the market expectation that retail sales will shrink by 2.2% for April 2015.

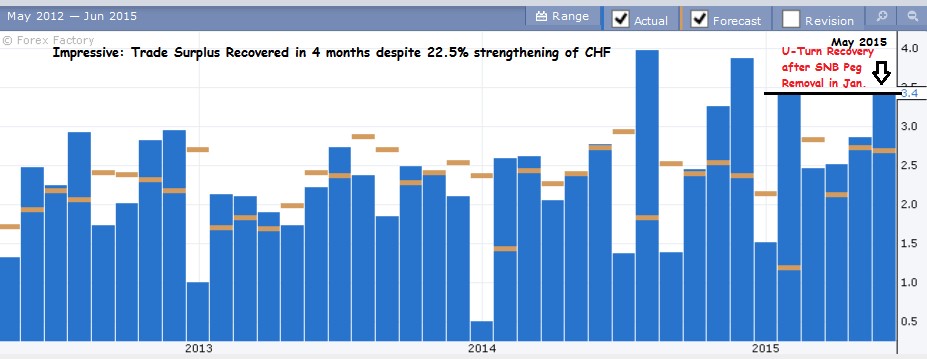

While a stronger Swiss franc is supposed to be detrimental to the export competitiveness, Switzerland was able to recover its lost exports within 4 months. If you look at the chart below, Switzerland’s net exports made a U-turn recovery. In January 2015, trade surplus was at CHF3.43 billion, which plunged sharply to CHF2.47 billion in February 2015. By May 2015, the trade surplus had returned back to CHF3.43 billion. It is remarkable to note that Switzerland accomplished this feat not only in a short time frame, but also when the CHF had strengthened by 22.5% from EURCHF 1.20 in January 2015 to the average price 0.93 in May 2015.

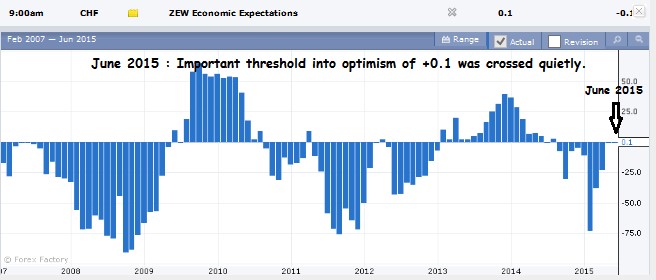

This shows the competitiveness of Swiss exports such that its clients are willing to pay more for the same basket of exports. Lastly, with all these data, it should not come as a surprise that the economic survey turned from pessimism in May 2015 to optimism in June 2015. The movement was not great at 0.2 between these 2 months, which moved from -0.1 to 0.1, but it is an important psychological threshold to cross.

While there is some time lag for these economic indicators, they were all released recently last week. The latest retail sales for April was released on June 15, 2015, and the May trade balance was released on June 18, 2015, and the June ZEW Economic Expectations survey was released on June 17, 2015.

Conclusion

As the CurrencyShares Swiss Franc Trust ETF (NYSEARCA:FXF) chart below shows, even prior to the release of the official data from Swiss Statistics, the CHF had been strengthening at the end of May. One can only surmise that local Swiss traders had seen anecdotal evidence of Swiss recovery on the ground and accumulated more CHF.

The CHF continued its strength after the release of the reports from June 15-18 and it was only recently on June 13, 2015, that it retraced. This is a normal event as traders take profit, but this is unlikely to last long. This is because the CHF would simply get more valuable now that it is clear that the Swiss economy had regained its economic competitiveness during the April and May 2015 period. The strong fundamental strength of the Swiss economy would push it further up.

On another note, there had been much heat during this month’s Greek debt negotiation with the threat of Grexit being aired in the media by the Creditors. The Greeks are willing to play along with the Creditors with the hopes of extracting concessions. However, Grexit is ultimately unlikely to happen, but in the small chance that it does, it would be bullish for the CHF as Europeans seek safe haven in a familiar country.

Additional disclosure: The author is long CHF.

See more for