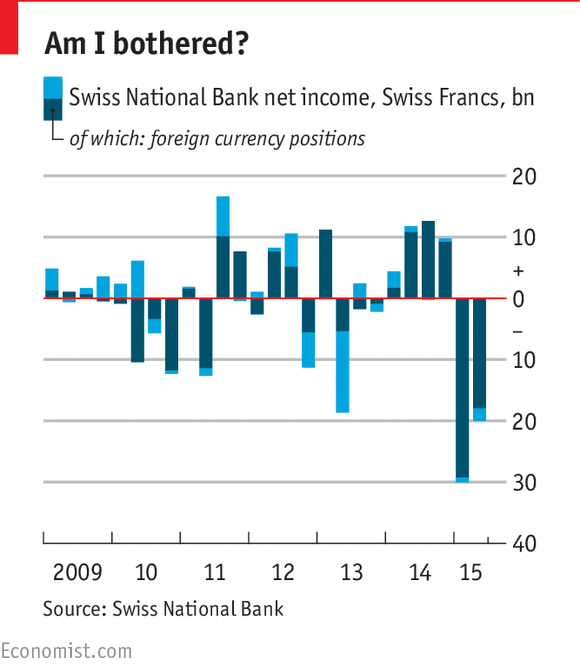

| ON FRIDAY, the Swiss National Bank (SNB), Switzerland’s central bank, reported second quarter losses of SFr20 billion ($20 billion). Following an equally bad first three months of the year, the SNB’s losses so far for 2015 now amount to a whopping SFr50.1 billion, equivalent to 7.5% of Switzerland’s GDP.

The SNB’s losses were large but not unexpected. For years, the Bank has intervened in foreign exchange markets to prevent the Swiss franc from appreciating above its euro exchange rate cap, set at 1.20 francs per euro in September 2011. In January, the SNB abruptly abandoned its currency peg as the European Central Bank geared up for its €1.1 trillion quantitative easing programme. That caused the franc to immediately jump in value by more than 20% against the euro. Scrapping the currency peg has had two nasty consequences. First, the appreciation of the franc made Swiss exports more expensive for foreigners, prompting the Swiss economy to start shrinking in the first quarter of 2015. Second, the depreciation of the euro against the franc led to significant currency losses on the SNB’s $550 billion foreign-exchange reserves, of which some $230 billion is held in the single currency. This alone accounted for 94% of the central bank’s losses in the first half of the year. The SNB must now strike a delicate balance. On the one hand, the Bank says that the Swiss franc is still significantly overvalued and has shown that it is willing to use a variety of tools, including buying foreign exchange and negative deposit rates, to keep its currency in check. On the other hand, with $230 billion in euro-denominated reserves, any depreciation of the euro translates into billions in losses on the SNB’s balance sheet. This could mean lower dividends for Switzerland’s central and regional governments, which could land the Bank in political hot water. And it yet again opens up the nasty question of whether central banks should be allowed to make big losses on their balance sheets. |

Swiss National Bank net income, Swiss Francs(see more posts on Swiss National Bank, ) |

Full story here Are you the author? Previous post See more for Next post

Tags: European central bank,Swiss National Bank