Category Archive: 1) SNB and CHF

Swiss ZEW Investor Survey Sees 1.20 per Euro Cap Gone within 2 Years

The Swiss ZEW investor sentiment has risen to 4.8 by 2.6 points, news that do not influence markets. More interesting is the following: Swiss ZEW Investor Survey Sees 1.20 per Euro Cap Gone within 2 Years * Majority see no change in euro/franc for next 6 months (Reuters) – The Swiss National Bank will most … Continue reading »

Read More »

Read More »

Swiss Franc History, 2012: CHF becomes a “safe” Risk-On Currency

At the end of May, SNB president Jordan admitted that the EUR/CHF floor will not raised (here also cited by Bloomberg): “We cannot arbitrarily manipulate our currency. In an even worse crisis situation this would be disastrous and counterproductive. The floor must be legitimized. The current minimum exchange rate is realistic and has helped the Swiss economy.”

Read More »

Read More »

SNB Monetary Assessment June 2013: Very risk-averse, nearly hawkish tone

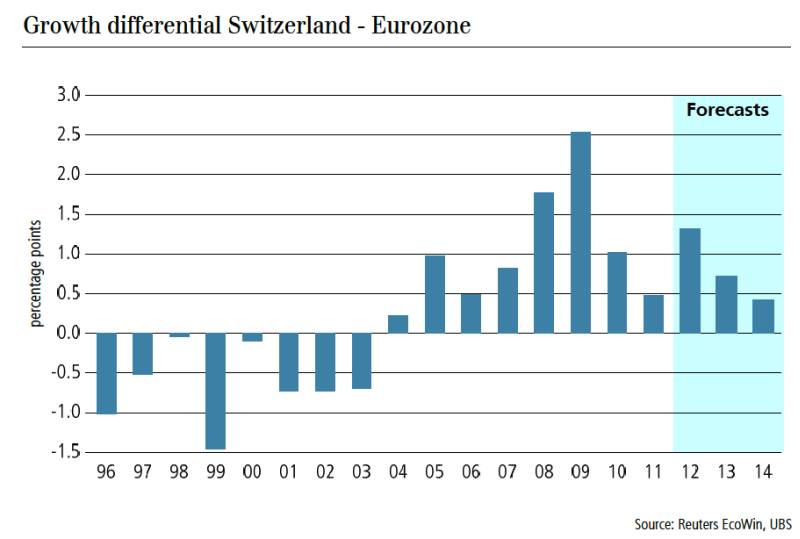

The Swiss National Bank (SNB) delivered a, for her standards, very hawkish monetary assessment with the focus on the risks in the financial sector. This does not come as a surprise for us. Each time, after the United States has recovered from a crisis – just like now – inflation and risks increased in Switzerland. …

Read More »

Read More »

Danthine’s Latest Statements Imply that SNB Might Remove Cap in 2014

SNB Vice Chairman Jean-Pierre Danthine is undoubtedly the most hawkish member of the governing board, an opposite personality to the rather interventionist and Keynesian hedge fund manager Philip Hildebrand. Danthine has perfectly understood that times for the SNB might get hard again in 2014. Jean-Pierre Danthine has made some comments recently: – Swiss franc stays …

Read More »

Read More »

SNB to Follow the Bank of Japan? Part1

Questions to George Dorgan Is there any chance that the SNB or other central banks could follow the BOJ and just depreciate the currency? George Dorgan: What did the BoJ do? Monetary easing and talk down the yen in a mercantilist style. A central bank is able to talk down a currency only if there … Continue reading »

Read More »

Read More »

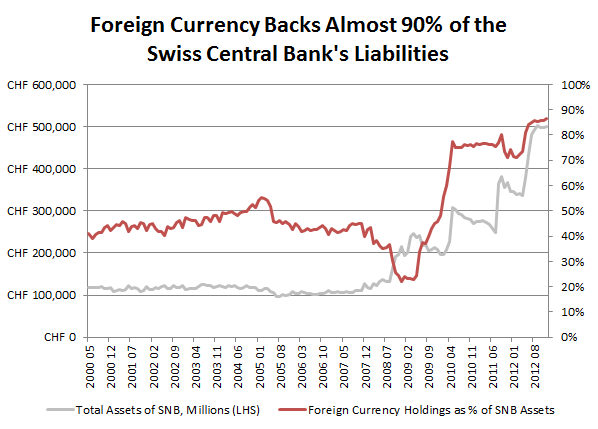

How Modern Monetary Policy Changed CHF from Gold-Backed to a USD and Euro-Backed Currency

we slowly move into an inflationary environment and prices of German Bunds and US Treasuries are falling.... ECB and Fed interest rates seem to be nailed to zero for years.

Read More »

Read More »

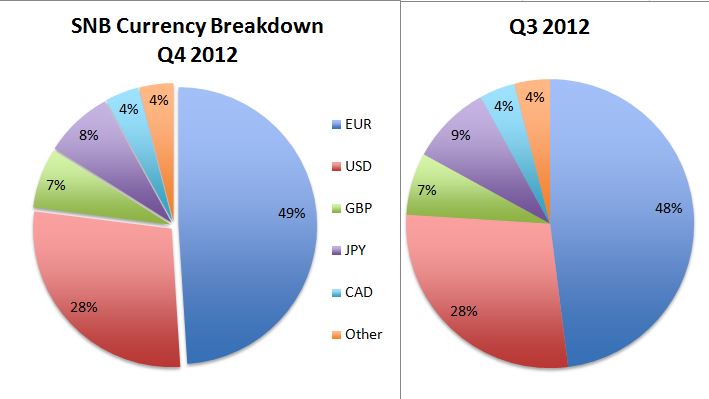

SNB Reserves Rise by 8 bln. CHF Thanks to Stronger USD, GBP, CAD and some FX Purchases

In March 2013, the foreign currency reserves of the Swiss National Bank (SNB) rose by 8 bln. CHF from 437 bln. to 445 bln. mostly thanks to valuation gains on US dollar, sterling and Canadian dollar. full details

Read More »

Read More »

IMF (2013): Sees Considerable Risks on SNB Balance Sheet

The International Monetary Fund (IMF) judges "that the SNB’s net revenue is subject to large fluctuations, and sizeable losses could occur if an appreciation of the Swiss franc was to take place before foreign exchange interventions were unwound."

Read More »

Read More »

SNB Monetary Assessment March 2013

In its monetary assessment the SNB maintains the EUR/CHF floor and warned against further risks in the euro zone. The SNB has downgraded the inflation path to -0.2% (previously-0.1%) in 2013 and +0.2% (+0.4%) in 2014.We do not completely agree.

Read More »

Read More »

What Ernst Baltensperger Got Wrong: Why SNB FX Losses Might Not Be Recovered By Income on Reserves

Opposed to Ernst Baltensperger, we think that the risk of losses on the SNB balance sheet and of an asset price bubble might be more important than the dangers of upcoming Swiss inflation.

Read More »

Read More »

SNB Liabilities (deposits & bank notes) at New Record High

SNB sight deposits are rising again, by 700 million CHF in one week. But the amount of cash in form of bank notes and coins has risen by 10% since September. It seems that the central bank is now not only virtually printing (via sight deposits) but also physically. SNB liabilities reached a new record high. Details

Read More »

Read More »

SNB Remains the Only Central Bank Currency Warrior: The Japanese do not Fight, they Talk

Central Bank data show that the Swiss National Bank (SNB) remains the only central bank that strongly participated in currency wars with FX intervention, while the Japan was just verbal intervention.

Read More »

Read More »