Category Archive: 6a) Gold & Monetary Metals

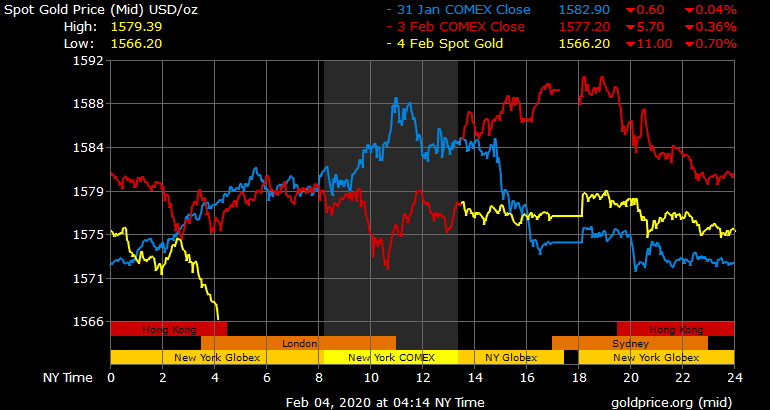

Gold Falls 0.6percent After Having A Seven Year Weekly High Close and 4percent Gain In January

Gold falls from seven year high weekly close ◆ Gold prices fell 0.6% today after reaching a seven year weekly high close at $1587.90/oz on Friday, gold’s highest weekly price settlement since March 2013, a 4% gain in January and its second straight monthly climb.

Read More »

Read More »

Hawaii Representatives Consider Ending Taxation on Sound Money

Introduced by Representative Okimoto (R-36), House Bill 1830 removes sales and use tax against gold and silver bullion and currency in Hawaii. Under current law, Hawaii citizens are discouraged from insuring their savings against the devaluation of the dollar because they are penalized with taxation for doing so. Passage of this measure would remove disincentives to holding gold and silver for this purpose.

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 1.31.20

Eric Sprott discusses the impact the coronavirus will have on the global economy and how this will drive gold and silver prices in the weeks and months ahead.

Read More »

Read More »

Gerald Celente Speaks Out on Iran, Coronavirus, Gold, and Global Protests

Interview begins at 5:47 Full Transcript ?: https://www.moneymetals.com/podcasts/2020/01/31/coronavirus-market-volatility-uncertainty-rise-001958 Cryptocurrency Prices ??: https://www.moneymetals.com/cryptocurrency-prices ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ★★FOLLOW MONEY METALS EXCHANGE ★★ FACEBOOK ➤ https://www.facebook.com/MoneyMetals TWITTER ➤...

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 1.31.20

Eric Sprott discusses the impact the coronavirus will have on the global economy and how this will drive gold and silver prices in the weeks and months ahead.

Read More »

Read More »

Peru cracks down on illegal gold mining

Wildcat mining has devastated large chunks of the Peruvian Amazon, where gold is extracted and makes its way to the refineries and banks in Switzerland.swissinfo.ch visited the southeastern region of Madre de Dios and spoke to artisanal miners who have benefited from the gold rush to educate their families and create jobs, as well as those who have fallen afoul of the law.

Read More »

Read More »

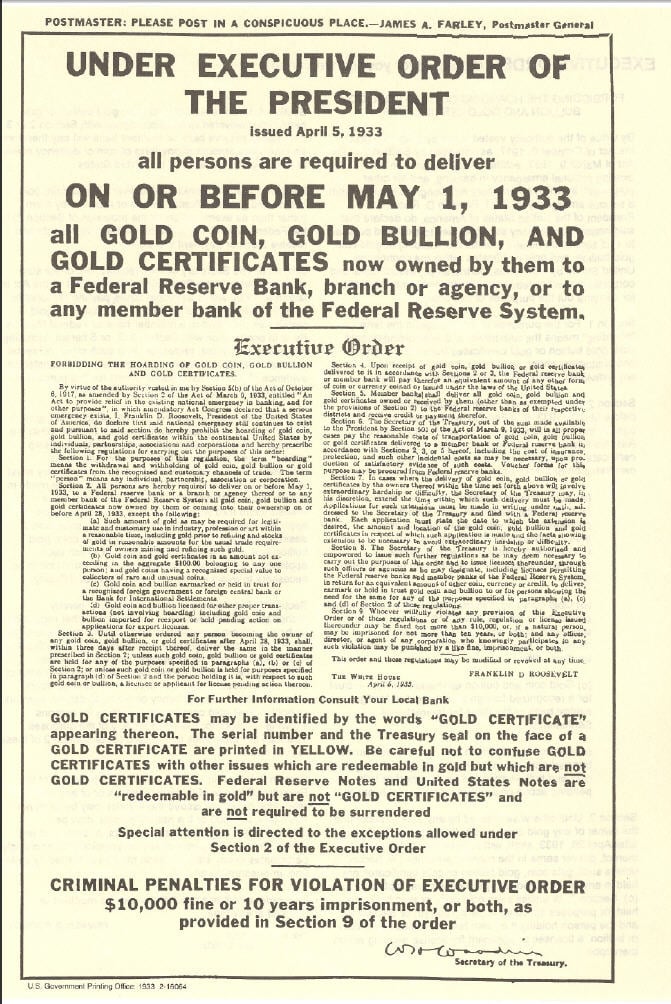

Freedom and Prosperity: The Importance of Sound Money

Sound money is a key to a free and prosperous society. That principle was clearly reflected in the monetary system that the Constitution established when it called the federal government into existence.

Our ancestors didn’t trust government officials with power. They believed that the greatest threat to their own freedom and well-being lay not with some foreign regime but rather with their own government.

Read More »

Read More »

Gold May Top $2,000 As “Prices Surge On Global Fear”

Gold was one of the few investments heading higher Monday as worries about the coronavirus outbreak led to a steep market slide. Gold is now up more than 20% in the past year, and trading near $1,600 an ounce, its highest level since 2013. Other precious metals, such as silver and platinum, have rallied too. Meanwhile, the Dow was down nearly 350 points in midday trading.

Read More »

Read More »

Michael Pento: THIS ONE THING Will Tell Us When the Bubble Economy Is Bursting…

Interview begins at 5:52 Full transcript ?: https://www.moneymetals.com/podcasts/2020/01/24/ray-dalio-gold-cash-is-trash-001954 Cryptocurrency Prices ??: https://www.moneymetals.com/cryptocurrency-prices ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ★★FOLLOW MONEY METALS EXCHANGE ★★ FACEBOOK ➤ https://www.facebook.com/MoneyMetals TWITTER ➤ https://twitter.com/MoneyMetals INSTAGRAM ➤...

Read More »

Read More »

Marc Faber – 2020 The Fed Crisis Started

Credit Suisse, Deutsche Bank, Petro-Dollar, Interest Rate Swaps, Gold price, Euro-Swissy, Consider JPMorgue, REPO market, subprime bond crisis, Chinese bitch coulee, Gold in their reserves, major banks, Global Economic RESET, golden crypto-currencies, Gold Trade, Chinese cryptos, The Dollar Crisis, Causes, Consequences, Cures, Revised Global recession, Silver, Stocks, Dollar Crash-Gold, Stock Market, real economy, global financial crisis, currency...

Read More »

Read More »

Tether Launches Gold-Backed Stablecoin, Begins Trading On Bitfinex

Tether is now supporting a gold-backed stablecoin, Tether Gold (XAU₮), according to a Jan. 23 press release. One token represents ownership of one troy fine ounce of physical gold, currently worth approximately $1,550.

Read More »

Read More »

“All You Need To Do Is Own Gold and Silver” To Make Money In 2020

If you want to make money from investing, it’s simple: find a bull market and go long. And in 2020 gold and silver are in a bull market. by Dominic Frisby via the UK’s best-selling financial magazine Money Week

I ran into Jim Mellon at a party at the weekend, and we soon got talking about markets. One of his comments – stated with surety and simplicity – has stuck in my mind.

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 1.24.20

Eric Sprott discusses events that impacted gold and silver prices this week and looks ahead to a volatile end of the month.

Read More »

Read More »

What Times of Year Do Cryptocurrency Prices Fall?

https://www.moneymetals.com/cryptocurrency-prices#what-times-of-year-do-cryptocurrency-prices-fall –If you follow the trade market, you know that sometimes trade prices fall fast. While these sudden and dramatic price drops may seem random, they’re not. They follow a fairly consistent pattern from year to year. ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ★★FOLLOW MONEY METALS...

Read More »

Read More »

How are Cryptocurrency Prices Determined?

https://www.moneymetals.com/cryptocurrency-prices#how-are-cryptocurrency-prices-determined –The primary factors that determine trade prices are adoption and speculation. These factors can mean different things depending on the type of crypto you’re trading. ? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE ➤ http://bit.ly/mmx-youtube ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬ ★★FOLLOW MONEY METALS EXCHANGE ★★ FACEBOOK ➤...

Read More »

Read More »

Sprott Money News Weekly Wrap-up – 1.24.20

Eric Sprott discusses events that impacted gold and silver prices this week and looks ahead to a volatile end of the month.

Read More »

Read More »

Bitcoin Tumbles To Key Technical Level, Dalio Disses Diversification Into Digital Currency

After pushing up to two-month highs over the weekend, Bitcoin is accelerating lower this morning... Breaking down from the 200DMA and testing the 100DMA... Cryptos are all lower today (and this week)...

Read More »

Read More »

What Affects Cryptocurrency Prices?

https://www.moneymetals.com/cryptocurrency-prices#what-affects-cryptocurrency-prices –Trade prices change based on several market factors, which means that trade prices never stay the same for long. If you look at the trade market for each form of crypto, you’ll find that the value of each type of coin is affected by a few specific factors. How are Cryptocurrency Prices Determined? ► …

Read More »

Read More »

What is Cryptocurrency?

https://www.moneymetals.com/cryptocurrency-prices#what-is-cryptocurrency – Cryptocurrency is a secure form of digital currency used to exchange digital goods using blockchain technology. It can be bought and sold, and you can invest in different types. Cryptocurrency prices change daily, so it’s essential to understand when to invest, when to sell, and what your crypto is currently worth. What Affects …

Read More »

Read More »