Category Archive: 6a) Gold & Monetary Metals

The Silver Blaze Report, 14 Feb, 2016

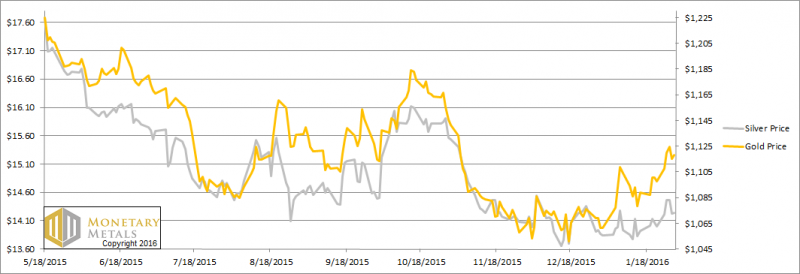

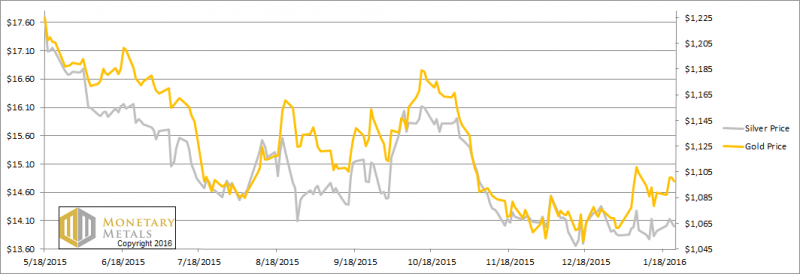

Again, we had another big drop in the dollar this week. No, we don’t mean against the dollar derivatives known as the euro, pound, etc. We mean by the only standard capable of measuring it: gold. The dollar fell 1.4 milligrams, to 25.1mg gold. Or, if...

Read More »

Read More »

Marc Faber on Gold, Hyperinflation and the Thai Economy

ThaiLawForum interviews Marc Faber, the investor and editor and publisher of the Gloom Boom Doom report. http://www.gloomboomdoom.com/ Enjoy this video? Follow ThaiLawForum for more! TLF Facebook: https://www.facebook.com/thailawforum TLF Twitter: https://twitter.com/thailawforum TLF Google+: https://plus.google.com/+ThaiLawForum… TLF Website: http://www.thailawforum.com TLF Blog: http://www.thailand-lawyer.com Content Disclaimer: The views,...

Read More »

Read More »

Monetary Metals Hires Bron Suchecki

Scottsdale, AZ—Monetary Metals is pleased to announce that it has hired Bron Suchecki as Vice President, Operations. Bron will help the company develop new products and processes. “We are excited to be able to attract someone of Bron’s caliber. We ar...

Read More »

Read More »

Marc Faber: Over 5 Thousand Years We’ve Never Had Negative Rates

Air Date: Feb. 11th, 2016 This video may contain copyrighted material. Such material is made available for educational purposes only. This constitutes a ‘fair use’ of any such copyrighted material as provided for in Title 17 U.S.C. section 107 of the US Copyright Law.

Read More »

Read More »

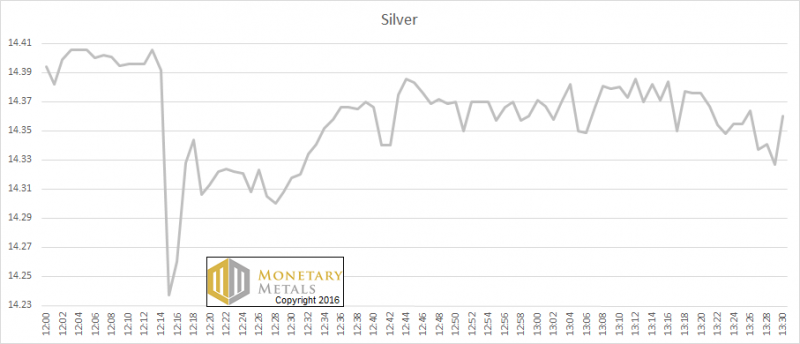

They Broke the Silver Fix (Part I)

Last Thursday, January 28, there was a flash crash on the price chart for silver. Here is a graph of the price action. The Price of Silver, Jan 28 (All times GMT) If you read more about it, you will see that there was an irregularity around the silve...

Read More »

Read More »

They Broke the Silver Fix

Part I Last Thursday, January 28, there was a flash crash on the price chart for silver. Here is a graph of the price action. The Price of Silver, Jan 28 (All times GMT) If you read more about it, you will see that there was an irregularity around th...

Read More »

Read More »

Possible Silver U-Turn Report, 7 Feb

Wow, did the dollar move down this week! It dropped more than it has in quite a while. It fell 1.3mg gold, or 0.1g silver. Gold and silver bugs of course are excited, as they look at it as the prices of the metals going up $55 and 72 cents respective...

Read More »

Read More »

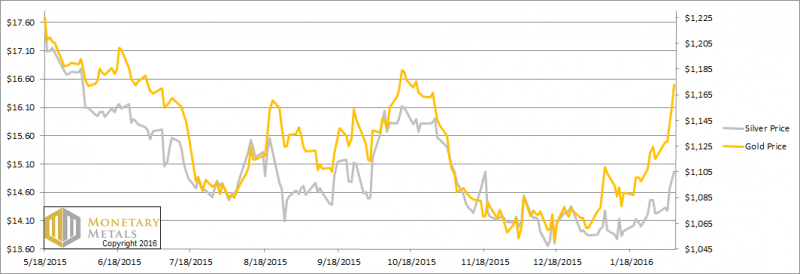

Great Graphic: Gold after its Trough?

It had taken out a three-month downtrend line, which we suggested was part of a triangle pattern. Gold also traced out a double bottom pattern. The triangle pattern pointed to a move toward $1110 and the double bottom projected to around $1135.

Read More »

Read More »

Marc Faber: The Experiment Of NIRP Will End Very Badly 31/01/16

Marc Faber, investor and author of the “Gloom, Boom & Doom Report”, joins the “Boom&Bust” show on Bloomberg TV Bulgaria. He talks about the slump on the Chinese stock market, the weakness of its economy, the new era of negative interest rates, where the Fed went wrong and the invesment opportunities in these turbulent times.

Read More »

Read More »

Possible Sign of Silver Turn, Report 31 Jan, 2016

The price of the dollar was down 50mg gold, to 27.8mg, or if you prefer 0.04g silver to 2.18g. Why do we measure the volatile dollar in terms of gold and silver? There’s nothing else to measure it, certainly not the dollar-derivatives called euro, po...

Read More »

Read More »

Marc Faber – Stock Market Crash coming

Marc Faber, an analyst says a crash is coming and reconfirms it. Market high was May last year he confirms and markets have crashed large percentages since. Support: http://www.micahgallant.com/support https://www.Tubebuddy.com/enuts

Read More »

Read More »

Monetary Metals Brief 2016

We have consistently been making the contrarian call for a falling silver price and a rising gold to silver ratio for years. This ratio has risen a lot during this time. So are we ready to change our call yet?

Read More »

Read More »

Will Gold Outperform Stocks?

Will stocks go up more, or will gold outperform? With the paperocentric theory, this is hard to answer. We have to estimate rates of inflation (meaning increases in the quantity of dollars) and calculate how much inflation (meaning rising prices of all things, consumer and asset) that will cause. Then we have to somehow put a value on gold. It boils down to a guess.

Read More »

Read More »

Outlook 2016

We have consistently been making the contrarian call for a falling silver price and a rising gold to silver ratio for years. This ratio has risen a lot during this time. So are we ready to change our call yet? This being the start of a new year, we w...

Read More »

Read More »

Silver Goes Foom, Report 24 Jan, 2016

This will be a brief report, as we’re focused on releasing our Outlook 2016 Report which is over 8,000 words of our assessment of the gold, silver, currency, and credit markets. Also, this was a holiday-shortened week (Monday was Martin Luther King D...

Read More »

Read More »

Zero 2016 01 21

EvilSpeculator is dedicated to identifying trends in the financial markets. To that end, we post market updates several times a week and engage in pertinent discussions. Risk Disclosure: https://evilspeculator.com/risk/ Zero indicator running against the ES futures - more details at http://evilspeculator.com.

Read More »

Read More »

Zero 2016 01 21

EvilSpeculator is dedicated to identifying trends in the financial markets. To that end, we post market updates several times a week and engage in pertinent discussions. Risk Disclosure: https://evilspeculator.com/risk/ Zero indicator running against the ES futures – more details at http://evilspeculator.com.

Read More »

Read More »

Won’t Get Fooled Again, Report 17 Jan, 2016

There is a great lyric in Won’t Get Fooled Again by The Who: Then I’ll get on my knees and prayWe don’t get fooled again Remember last week, when the price of silver spiked? On Thursday that week, the price was moving sideways around $14. Then around...

Read More »

Read More »

GSR interviews MARC FABER – Jan 14, 2016 Nugget

GoldSeek Radio’s Chris Waltzek talks to analyst Marc Faber http://www.goldseek.com/ http://radio.goldseek.com/

Read More »

Read More »

The Path to the Digital Gold Standard

Several Republican presidential candidates are floating the idea of returning to some form of a gold standard in the U.S., although none have gone into any great detail. So, how might a modern gold standard work?

It’s a question that requires us to do more than just look to the past with an eye toward “restoring,” “bringing back,” or “returning to” gold-backed money. Sound money advocates need to also think creatively about how to adapt hard...

Read More »

Read More »