Category Archive: 6a) Gold & Monetary Metals

Who Lends to the Fed?

This leads to our present question. To speak of borrowing and a ready market in which the Fed can borrow, means there is a lender. Who is the lender to the Fed?

Read More »

Read More »

Yes, the Dollar Should Be Backed by Gold…

A Return to Gold BUENOS AIRES, Argentina – “What if you were appointed to head the Fed? In your first week on the job, what would you do?” The question was not exactly serious. Neither was the answer. “We’d call in sick.” Sorry boys and girls, y...

Read More »

Read More »

Gold Stocks Break Out

No Correction Yet Late last week the HUI Index broke out to new highs for the move, and so did the XAU (albeit barely, so it did not really confirm the HUI’s breakout as of Friday). Given that gold itself has not yet broken out to a new high for th...

Read More »

Read More »

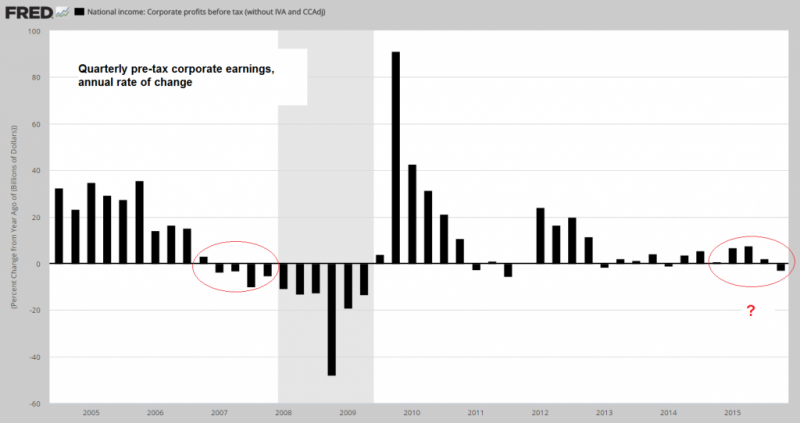

Why Janet Yellen Can Never Normalize Interest Rates

Bill Bonner explains why the Fed will normalize interest rates.

With higher rates, Yellen risks corporate profits and bond defaults.

With higher rates, Yellen risks not only bond defaults, but also bank defaults.

Read More »

Read More »

BANK BAIL-INS – with Goldcore.com Mark O’Byrne

Bank Bail-Ins are coming and people need to prepare by owning bullion outside the banking system. They will be counterproductive and could lead to financial collapse. “Unfortunately, we don’t learn the lessons of history to our own downfall!”. For more information http://www.GoldCore.com

Read More »

Read More »

Max Keiser Interview Mark O’Byrne of GoldCore.com re gold and silver bullion

Max Keiser interviews Mark O’Byrne about the gold and silver bullion markets, cryptobullion, the confetti masters on Wall Street and the Federal Reserve which is not federal and has no reserves.

Read More »

Read More »

Why Silver Bullion Is Set To Soar – GoldCore Interview

Jan Skoyles presents a Get REAL special on silver. She talks to Mark O’Byrne of www.GoldCore.com about how silver bullion is set to soar and the importance of owning physical silver coins and bars. GoldCore now offer silver coins VAT free in the UK and throughout the EU.

Read More »

Read More »

GoldCore on What Driving Gold Prices Up Now

www.GoldCore.com give detailed insight on the gold bullion coin and bar market, answering questions about sudden rise of physical gold prices, the British Economy in the run up to Brexit Referendum and it’s influence on the gold bullion market. Sign Up For News, Research & Special Offers from GoldCore Here – http://info.goldcore.com/goldcore_email_subscription_preferences

Read More »

Read More »

Bail-In Regimes Are “Insane” – GoldCore Warn On Bail-Ins

Mark O’Byrne, founder of the hugely successful Irish bullion broker GoldCore recently spoke to WAM’s Josh Sigurdson and John Sneisen about the value of silver & gold bullion as well as the many problems with central banks and the printing of worthless IOU note currency. During the 40 minute interview, Mark spoke about the coming …

Read More »

Read More »

Dr. Marc Faber: Federal Reserve Won’t Stop Printing $$$

Jason Burack of Wall St for Main St interviewed returning guest, editor & publisher of the Gloom Boom Doom Report http://www.gloomboomdoom.com/, Dr. Marc Faber. Marc has decades of experience investing in global financial markets and he has wrote the book, Tomorrow’s Gold- Asia’s Age of Discovery. During this 30+ minute interview, Jason opens the interview …

Read More »

Read More »

Gold Bullion Demand From China Causing Paradigm Shift – GoldCore.com

Gold bullion coins and bars surging demand and the ongoing paradigm shift that is China’s gradual move to become a dominant player, if not the dominant player, in the global gold market continues according to www.GoldCore.com. China was the largest buyer of gold in the world again in 2015. Sign Up For News, Research & …

Read More »

Read More »

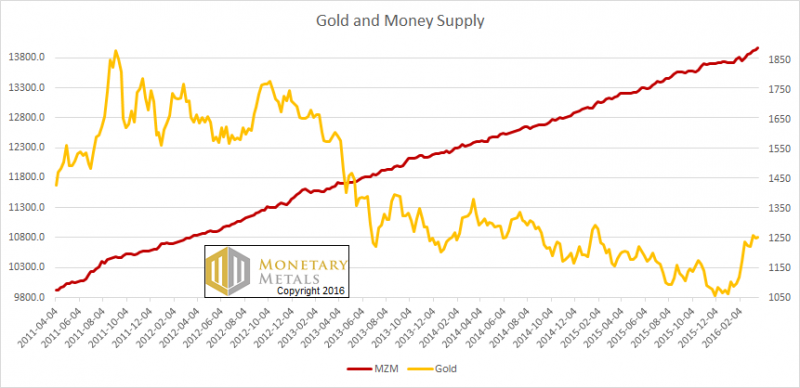

The Gold Money Supply Correlation Report, 3 Apr, 2016

There were some fireworks this week. Gold went up on Tuesday (it was a shortened week due to Easter Monday), from a low of $1,215 to $1,244 over the day, a move of over 2 percent. Silver moved from $15.02 to $15.44, almost 3 percent. What happened on...

Read More »

Read More »

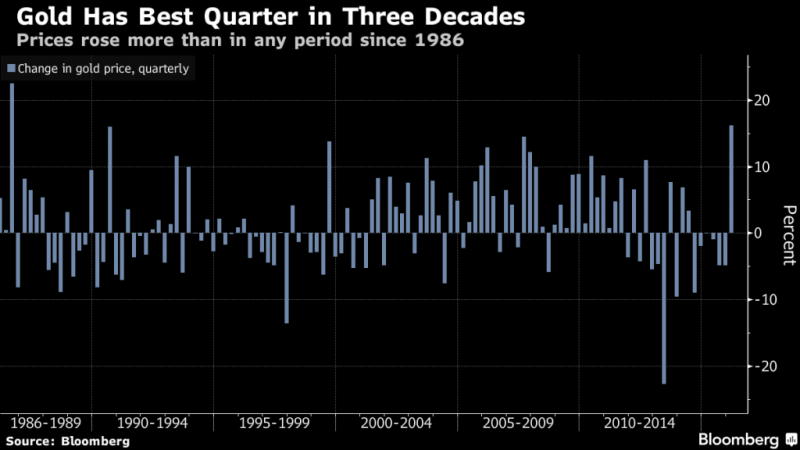

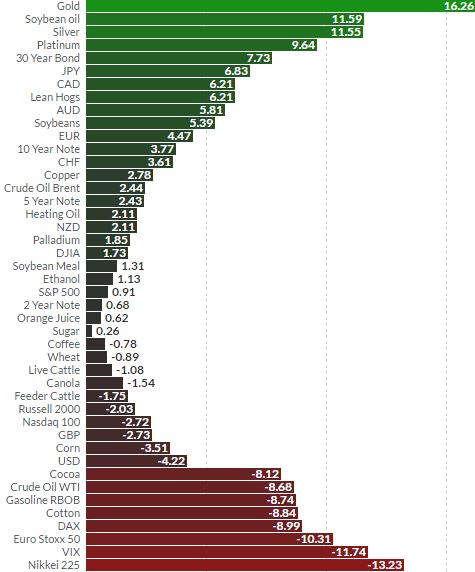

Gold Prices Rise 16% In Q1 – Best Quarter In 30 Years

Gold Prices Rise 16% In Q1 – Best Quarter In 30 Years

– Gold prices gained 16% in Q1 – best quarterly performance since 1986– Gains due to increasing global financial, macroeconomic and monetary risk– Stocks come under pressure – Flat in U.S.; Falls ...

Read More »

Read More »

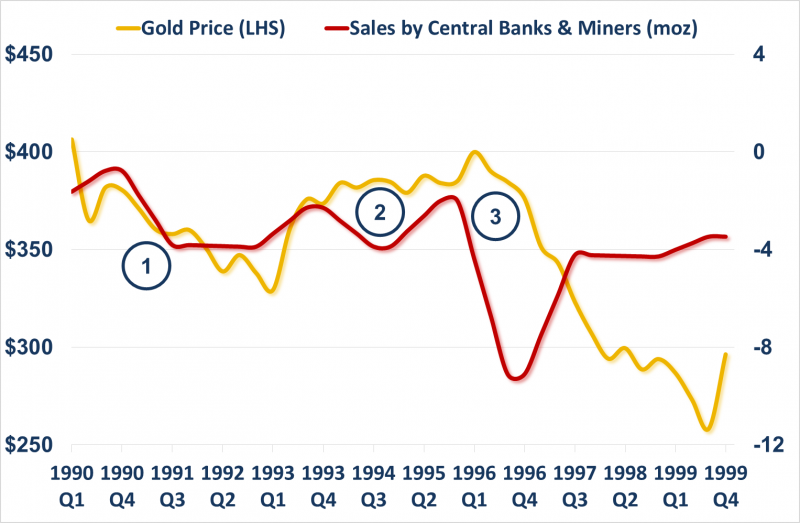

The Voldemort Effect: Gold Price and Gold Sales

Gold market analysts have for many years puzzled over the unusual behaviour of the gold market during the 1990s, specifically the bizarrely flat gold price from 1993 to 1996 in the face of sustained selling pressure from central banks and gold miners...

Read More »

Read More »

Marc Faber: The Most Desirable Currency Will Be Gold, SIlver, Platinum, & Palladium

Air Date: March 22nd, 2016 This video may contain copyrighted material. Such material is made available for educational purposes only. This constitutes a ‘fair use’ of any such copyrighted material as provided for in Title 17 U.S.C. section 107 of the US Copyright Law.

Read More »

Read More »