Category Archive: 6a) Gold & Monetary Metals

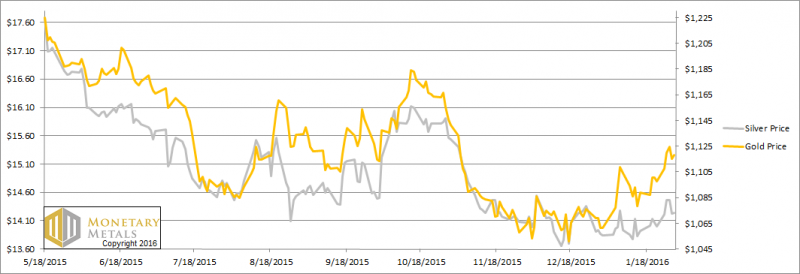

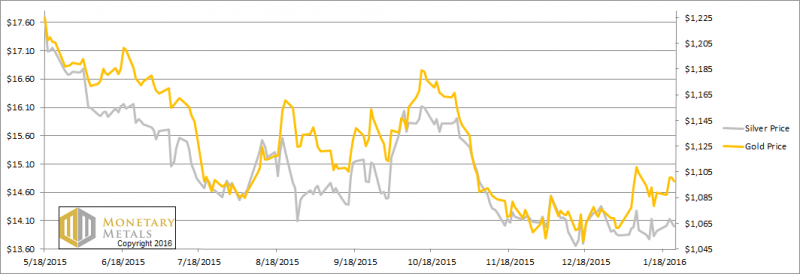

Possible Sign of Silver Turn, Report 31 Jan, 2016

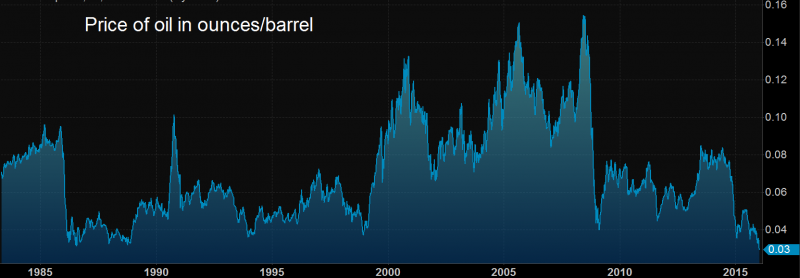

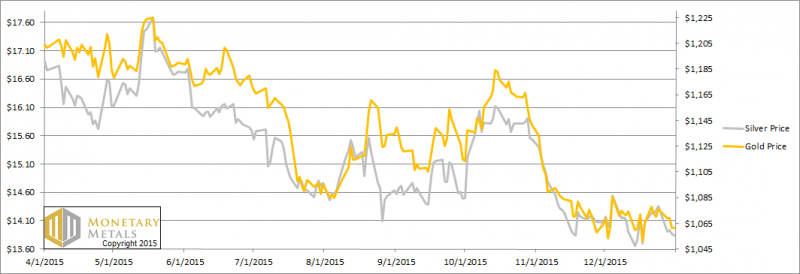

The price of the dollar was down 50mg gold, to 27.8mg, or if you prefer 0.04g silver to 2.18g. Why do we measure the volatile dollar in terms of gold and silver? There’s nothing else to measure it, certainly not the dollar-derivatives called euro, po...

Read More »

Read More »

Marc Faber – Stock Market Crash coming

Marc Faber, an analyst says a crash is coming and reconfirms it. Market high was May last year he confirms and markets have crashed large percentages since. Support: http://www.micahgallant.com/support https://www.Tubebuddy.com/enuts

Read More »

Read More »

Monetary Metals Brief 2016

We have consistently been making the contrarian call for a falling silver price and a rising gold to silver ratio for years. This ratio has risen a lot during this time. So are we ready to change our call yet?

Read More »

Read More »

Will Gold Outperform Stocks?

Will stocks go up more, or will gold outperform? With the paperocentric theory, this is hard to answer. We have to estimate rates of inflation (meaning increases in the quantity of dollars) and calculate how much inflation (meaning rising prices of all things, consumer and asset) that will cause. Then we have to somehow put a value on gold. It boils down to a guess.

Read More »

Read More »

Outlook 2016

We have consistently been making the contrarian call for a falling silver price and a rising gold to silver ratio for years. This ratio has risen a lot during this time. So are we ready to change our call yet? This being the start of a new year, we w...

Read More »

Read More »

Silver Goes Foom, Report 24 Jan, 2016

This will be a brief report, as we’re focused on releasing our Outlook 2016 Report which is over 8,000 words of our assessment of the gold, silver, currency, and credit markets. Also, this was a holiday-shortened week (Monday was Martin Luther King D...

Read More »

Read More »

Zero 2016 01 21

EvilSpeculator is dedicated to identifying trends in the financial markets. To that end, we post market updates several times a week and engage in pertinent discussions. Risk Disclosure: https://evilspeculator.com/risk/ Zero indicator running against the ES futures - more details at http://evilspeculator.com.

Read More »

Read More »

Zero 2016 01 21

EvilSpeculator is dedicated to identifying trends in the financial markets. To that end, we post market updates several times a week and engage in pertinent discussions. Risk Disclosure: https://evilspeculator.com/risk/ Zero indicator running against the ES futures – more details at http://evilspeculator.com.

Read More »

Read More »

Won’t Get Fooled Again, Report 17 Jan, 2016

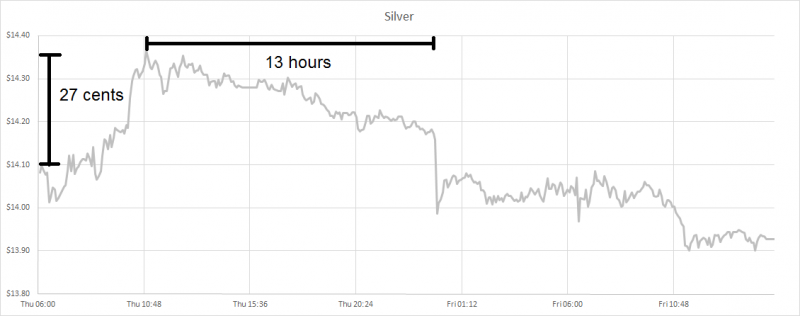

There is a great lyric in Won’t Get Fooled Again by The Who: Then I’ll get on my knees and prayWe don’t get fooled again Remember last week, when the price of silver spiked? On Thursday that week, the price was moving sideways around $14. Then around...

Read More »

Read More »

GSR interviews MARC FABER – Jan 14, 2016 Nugget

GoldSeek Radio’s Chris Waltzek talks to analyst Marc Faber http://www.goldseek.com/ http://radio.goldseek.com/

Read More »

Read More »

The Path to the Digital Gold Standard

Several Republican presidential candidates are floating the idea of returning to some form of a gold standard in the U.S., although none have gone into any great detail. So, how might a modern gold standard work?

It’s a question that requires us to do more than just look to the past with an eye toward “restoring,” “bringing back,” or “returning to” gold-backed money. Sound money advocates need to also think creatively about how to adapt hard...

Read More »

Read More »

Open Letter to the Banks

Jamie Dimon, JP Morgan ChaseBrian T. Moynihan, Bank of AmericaMichael Corbat, Citigroup Gentlemen: On Friday, I attended a digital money summit at the Consumer Electronics Show. I am writing to you to warn you about the disruption that is about to oc...

Read More »

Read More »

Silver Flash in the Pan, Report 10 Jan, 2016

No doubt, many people were excited on Thursday to see a spike in the silver price. The big news almost seemed like it would be a spike in the silver price. We were not quite so exuberant, tweeting (follow us on Twitter @Monetary_Metals):

Read More »

Read More »

Zero 2016-01-08

EvilSpeculator is dedicated to identifying trends in the financial markets. To that end, we post market updates several times a week and engage in pertinent discussions. Risk Disclosure: https://evilspeculator.com/risk/ Zero indicator running against the ES futures - more details at http://evilspeculator.com.

Read More »

Read More »

Zero 2016-01-08

EvilSpeculator is dedicated to identifying trends in the financial markets. To that end, we post market updates several times a week and engage in pertinent discussions. Risk Disclosure: https://evilspeculator.com/risk/ Zero indicator running against the ES futures – more details at http://evilspeculator.com.

Read More »

Read More »

Passive Strategie von Marc Faber (Dr. Doom) (#22)

Marc Faber ist ein schweizer Investor, der heute in Thailand lebt. Er ist Autor des „Gloom Boom & Doom Report”. Auf Grund seiner oft pessimistischen Einschätzung der Märkte trägt er auch den Spitznamen Dr. Doom. Besuchen Sie uns auf http://www.aix-capital.com/

Read More »

Read More »

Marc Faber: We Have Colossal Credit Bubble in China

Jan. 6 — Marc Faber, investor and author of the “Gloom, Boom & Doom Report,” talks with Francine Lacqua about his call that the Federal Reserve has launched a U.S. recession, the investment opportunity in 10-Year and 30-Year U.S. Treasuries, troubles in the Chinese economy, and his preference for emerging markets. He speaks on “The …

Read More »

Read More »

Monetary Innovation is the Path Forward

There is no shortage of sound money conferences. They’re regularly put on by think tanks, and dutifully attended by all the free market academics who can get travel budget. But I have a premonition. The move to the gold standard won’t be led, or driven by these events.

Read More »

Read More »

Murphy’s Law of Gold Analysis, Report 3 Jan, 2016

Perhaps it may be lesser known than his other Laws, but Murphy wrote one for the basis analysis. It goes like this. If we observe that the fundamental price of a metal is far removed from the market price, the two won’t likely converge the next week....

Read More »

Read More »