Category Archive: 6a) Gold & Monetary Metals

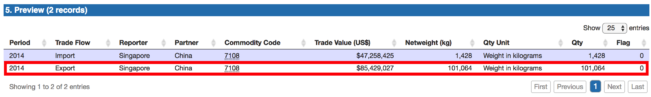

China’s Secret Gold Supplier Is Singapore

Since 2013 China continues to absorb physical gold from the rest of the world at a staggering pace. Worth noting is that gold imported into the Chinese domestic market is not allowed to be returned in the foreseeable future. Because ownership and the disposition of these volumes of gold likely will be of great importance next time around the international monetary system is under stress, it’s well worth tracking China’s progress of imports –...

Read More »

Read More »

Jamie Dimon Warns Of Potential ‘Market Panic’

Jamie Dimon Warns Of Potential ‘Market Panic’. JPMorgan Chase CEO Jamie Dimon sees ‘chance of market panic’. In annual letter to shareholders Dimon warns of increased inflation and interest rates. Concerned QE unwinding could cause chaos as ‘markets will get more volatile’.

Read More »

Read More »

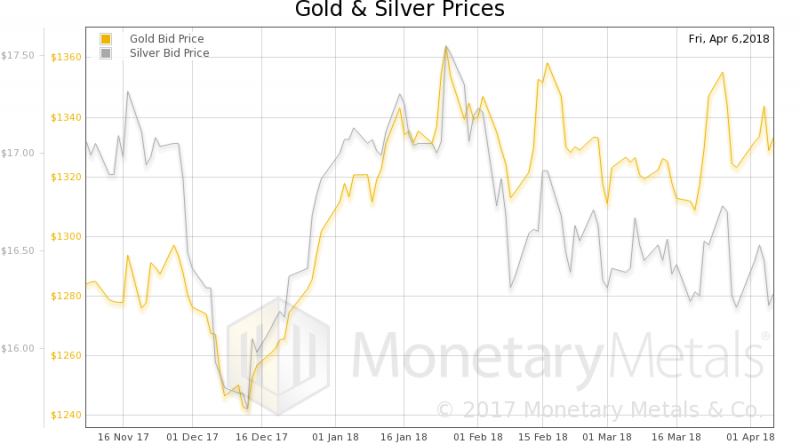

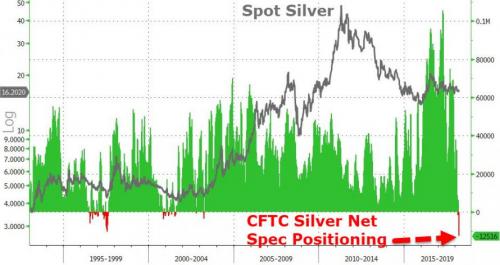

Silver Bullion: Should We Be Worried About Silver?

Silver Bullion: Should We Be Worried About Silver? Bloomberg’s Mike McGlone silver “set to test the $18 an ounce resistance level”. LBMA report: volume of silver ounces transferred in February fell by 24%. Standard Chartered: gold-silver ratio and supply/demand fundamentals favour silver. Gold/silver ratio at near two-year high on silver’s underperformance. Silver COT reports remain more bullish than at any time in history.

Read More »

Read More »

David Morgan: Silver Market Set Up Is “Best I’ve Seen for a Very Long Time”

Read the full transcript here: https://www.moneymetals.com/podcasts/2018/04/06/confiscation-gold-silver-platinum-001451 Check silver prices at Money Metals: https://www.moneymetals.com/precious-metals-charts/silver-price David Morgan of The Morgan Report highlights a very interesting set-up in the silver market that could lend itself to significantly higher prices. David also shares his thoughts on the price levels he wants to see before getting...

Read More »

Read More »

Brexit, Stagflation Pressures UK High Street

Brexit, Stagflation Pressures UK High Street. UK high street and wider consumer market feeling effects of financial crisis, Brexit and inflation. 350,000 retails jobs expected to disappear between 2016 and 2020. Centre for Retail Research predicts 9,500 shops to close this year and 10,200 in 2019. UK is ‘worst performing’ European market for new car registrations – Moody’s. UK’s growth outlook is the ‘worst in the G20’ – Institute of Fiscal...

Read More »

Read More »

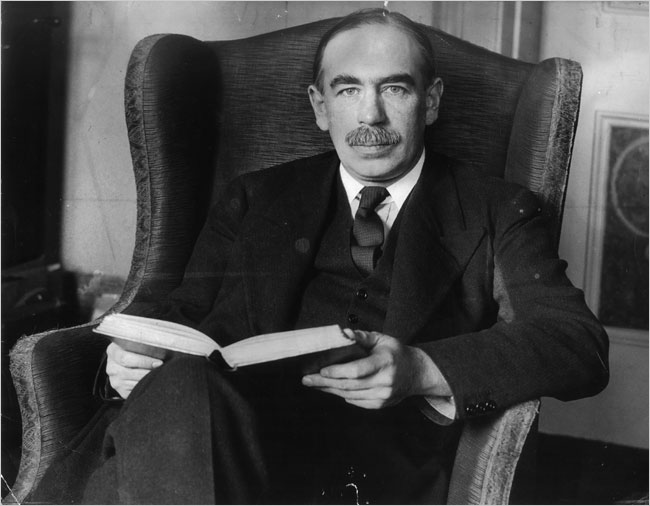

Gold Is Money While Currencies Today Are “IOU Nothings”

Now that the international monetary system we have long known has broken down, and the world is groping through monetary reform for a new one, it is time to consider some fundamentals. What is money anyway? First, it is a means of payment or medium of exchange. I prefer that first phrase. It is simpler. We all use money to pay our bills, to buy goods and services. We also accept money when we sell.

Read More »

Read More »

Has Switzerland blown its crypto-opportunity?

Legendary United States crypto investor Tim Draper believes Switzerland has missed the boat in establishing itself as an attractive global hub for blockchain start-ups. Draper has invested in Tezos, which ran into a damaging governance row in Switzerland shortly after its initial coin offering (ICO) fundraiser.

Read More »

Read More »

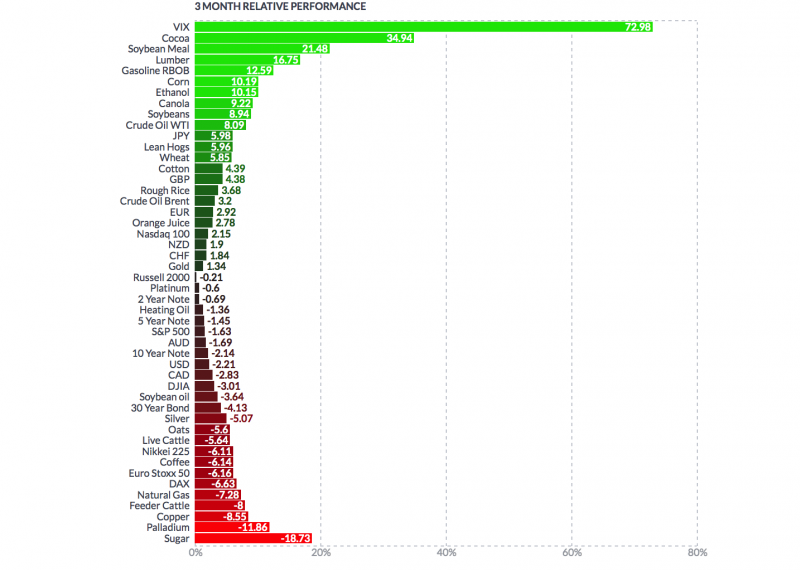

Gold Outperforms Stocks In Q1, 2018

Gold Outperforms Stocks In Q1, 2018. Gold signs off Q1 2018 with best run since 2011. Gold price supported by safe haven demand, interest-rate concerns and inflation. Trade wars and concerns over equity market have sent investors towards gold. ETF holdings highest in nearly a decade. Goldman Sachs: ‘The dislocation between the gold prices and U.S. rates is here to stay’.

Read More »

Read More »

“Stars Are Slowly Aligning For Gold” – Frisby

“Stars Are Slowly Aligning For Gold” – Frisby. Gold ends March with a third-quarterly gain, a feat not seen since 2011. Impressive gains seen despite tightening of monetary policy from Federal Reserve. Frisby – gold is set to break through technical resistance of $1,360. Gold’s safe haven role back in focus with Trump trade wars and increasing geopolitical tensions. Now is opportune time for investors to buy gold, ahead of next quarter.

Read More »

Read More »

Uncle Sam Issuing $300 Billion In New Debt This Week Alone

US needs to borrow almost $300 billion this week alone. This is the largest debt issuance since 2008 financial crisis. Trump threatens trade war with its biggest creditor – China. Bond auctions have seen weak demand due to large supply and trade war concerns. $20 trillion mark reached in early September 2017; $1 trillion added in just 6 months. US total national debt level now exceeds $21.05 trillion and is accelerating higher.

Read More »

Read More »

Central Banks Care about the Gold Price – Enough to Manipulate it!

In early March, RT.com, the Russian based media network, asked me for comments and opinion on the subject of central bank manipulation of gold prices. The comments and opinion that I supplied to RT became the article that RT then exclusively published on its website on 18 March under the title “Central banks manipulating & suppressing gold prices – industry expert to RT“. This article is now transcribed below, here on the BullionStar website.

Read More »

Read More »

Silver Futures Report and JP Morgan Record Silver Bullion Holding Is Extremely Bullish

Silver Futures Report, JP Morgan Record Silver Bullion Holding Is Extremely Bullish. JP Morgan Continues Adding To Massive Silver Bullion Holdings (see chart). Silver Speculators Go Short – Which Is Extremely Bullish. Stunning Silver COT Report: One For the Ages (see chart).

Read More »

Read More »

MARC FABER : MARKET CURRENT LEVEL से 10 % और CORRECTION हो सकता है !

NIFTY TRADING STRATEGY ,NIFTY OPTIONS TRADING STRATEGIES ,BANK NIFTY TRADING STRATEGIES ,BANK NIFTY OPTION TRADING STRATEGY ,Stock Trading Tips, Stock Trading Strategies, Share Trading Tips, Share Trading Strategies , Intraday Trading Strategies , Intraday Trading Tips , MULTIBAGGER STOCKS 2018, POSITIONAL TRADING STRATEGY,

Read More »

Read More »

Zee Exclusive conversation with famous Swiss investor Marc Faber

Watch this segment to know what famous Swiss investor Marc Faber has to say about India and its economy. In an exclusive interview to Zee Business today, famous Swiss investor Marc Faber said that the Sensex can still fall over 20 per cent, slipping below the 30,000 mark. About Zee Business ————————– Zee Business is …

Read More »

Read More »