Category Archive: 6a) Gold & Monetary Metals

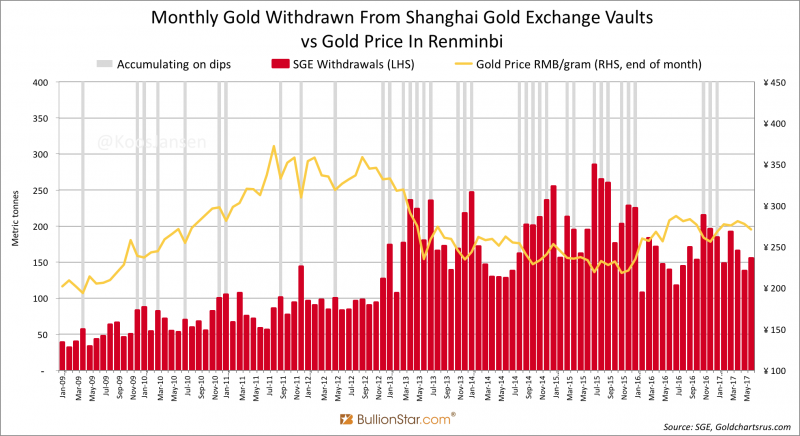

Estimated Chinese Gold Reserves Surpass 20,000t

My best estimate as of June 2017 with respect to total above ground gold reserves within the Chinese domestic market is 20,193 tonnes. The majority of these reserves are held by the citizenry, an estimated 16,193 tonnes; the residual 4,000 tonnes, which is a speculative yet conservative estimate, is held by the Chinese central bank the People’s Bank of China.

Read More »

Read More »

Frank Holmes: Silly Money Printing & Restricted Supply Form a “Great Scenario for Gold”

Read the full transcript here: https://goo.gl/SdELvx Frank Holmes, CEO of U.S. Global Investors reveals some very bullish fundamentals that he sees developing for the precious metals in the coming months and also shares some information on an exciting new gold fund. Don’t miss another great interview with The Mining Journal’s gold fund manager of the …

Read More »

Read More »

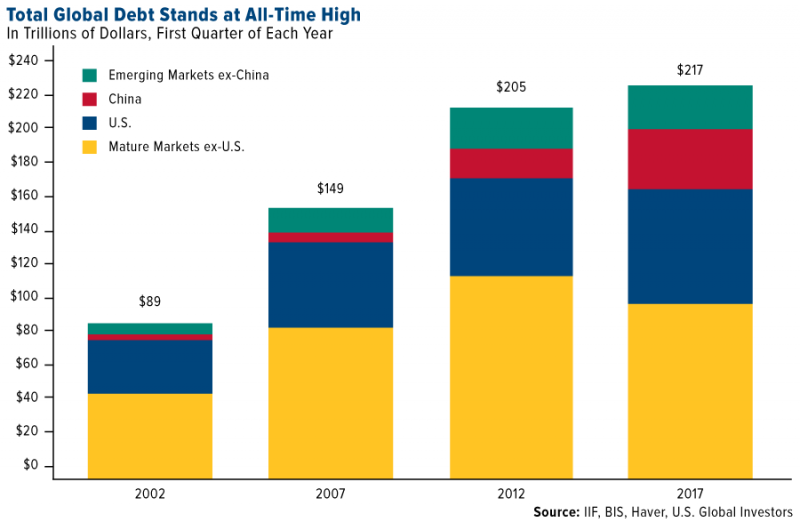

Gold A Good Store Of Value – Protect From $217 Trillion Global Debt Bubble

‘Mother of all debt bubbles’ keeps gold in focus. Global debt alert: At all time high of astronomical $217 T. India imports “phenomenal” 525 tons in first half of 2017. Record investment demand – ETPs record $245B in H1, 17. Investors, savers should diversify into “safe haven” gold. Gold good ‘store of value’ in coming economic contraction.

Read More »

Read More »

Why Surging UK Household Debt Will Cause The Next Crisis

Easy credit offered by UK banks is endangering “everyone else in the economy”. UK banks are “dicing with the spiral of complacency” again. Bank of England official believes household debt is good in moderation. Household debt now equals 135% of household income. Now costs half of average income to raise a child. Real incomes not keeping up with real inflation. 41% of those in debt are in full-time work. £1.537 trillion owed by the end of May...

Read More »

Read More »

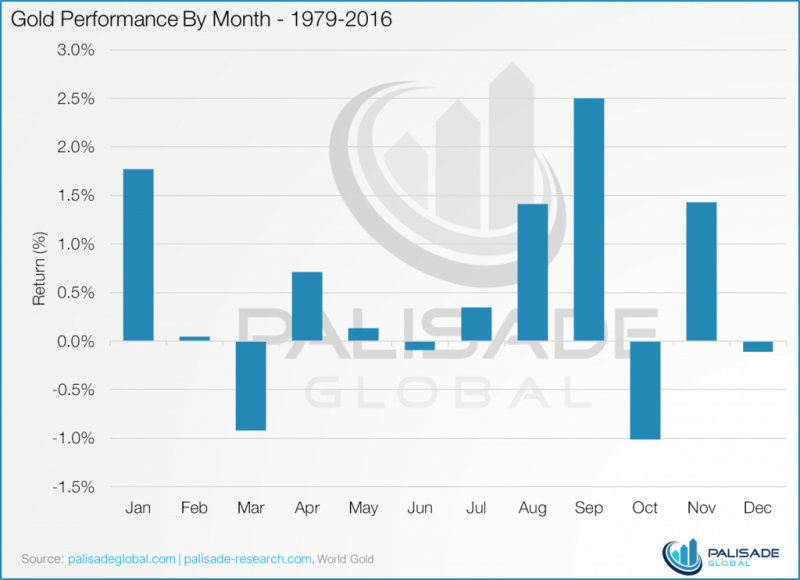

Gold Seasonal Sweet Spot – August and September – Coming

Gold seasonal sweet spot – August and September – is coming. Gold’s performance by month from 1979 to 2016 – must see table. August sees average return of 1.4% and September of 2.5%. September is best month to own gold, followed by January, November & August.

Read More »

Read More »

Why is Gold Being ‘Talked Down’ So Much? – Marc Faber

Ignore the recent weakness in gold, the metal is still trading higher this year as it did in 2016, points out one famed economist. So why is it being “talked down” so much? Marc Faber, editor and publisher of the Gloom, Boom & Doom Report, told Kitco News he doesn’t understand the negative outlook on … Continue...

Read More »

Read More »

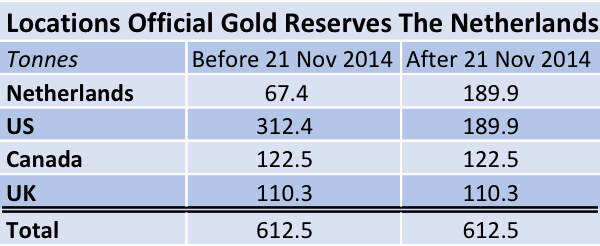

Did The Dutch Central Bank Lie About Its Gold Bar List?

Head of the Financial Markets Division of the Dutch central bank, Aerdt Houben, stated in an interview for newspaper Het Financieele Dagblad published in October 2016 that releasing a bar list of the Dutch official gold reserves “would cost hundreds of thousands of euros”. In this post we’ll expose this is virtually impossible – the costs to publish the bar list should be close to zero – and speculate about the far reaching implications of this...

Read More »

Read More »

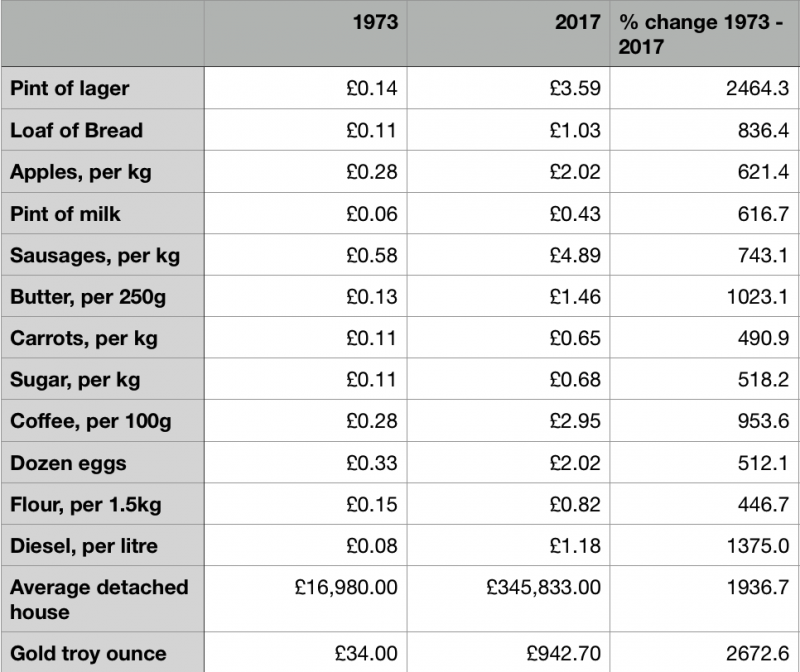

Gold Hedge Against Currency Devaluation and Cost Of Fuel, Food, Beer and Housing

Gold hedge against currency devaluation – cost of fuel, food, housing. True inflation figures reflect impact on household spending. Household items climbed by average 964%. Pint of beer sees biggest increase in basket of goods – rise of 2464%. Bread rises 836%, butter by 1023% and fuel (diesel) up by 1375%. Gold rises 2672% and hold’s its value over 40 years.

Read More »

Read More »

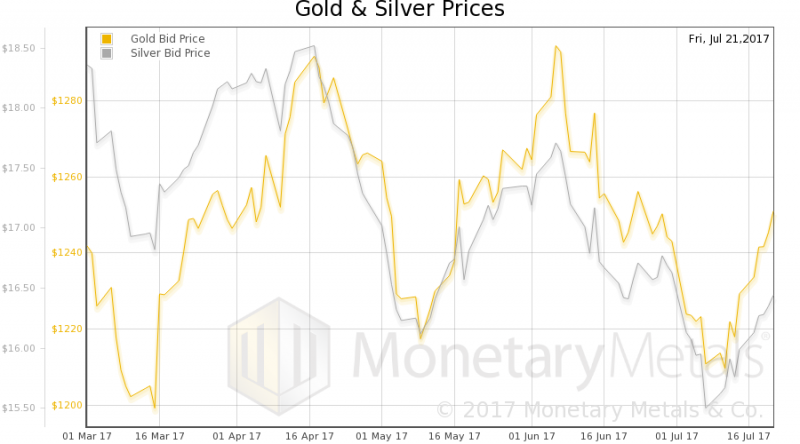

David Morgan: Gold and Silver at Breakout Point from 6-Year Downtrend

Read the interview transcript here: https://goo.gl/WtSMX9 David Morgan of The Morgan Report joins Mike Gleason of Money Metals Exchange for a wonderful discussion on the metals and the markets. He shares his insights on what the smart money is already doing, the dangers of complacency and the importance of limited counter party risk. Back by …

Read More »

Read More »

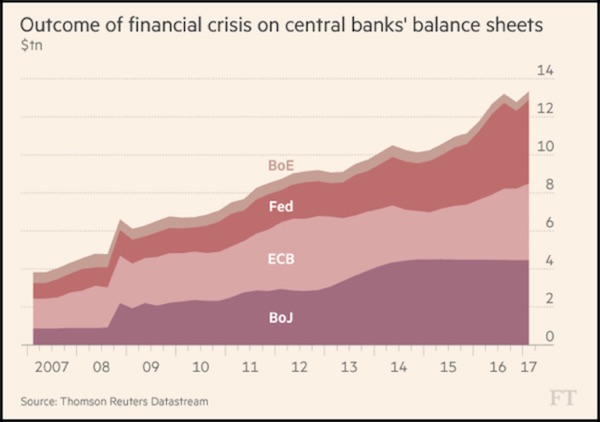

Bank Of England Warns “Bigger Systemic Risk” Now Than 2008

Bank of England warn that “bigger systemic risk” now than in 2008. BOE, Prudential Regulation Authority (PRA) concerns re financial system. Banks accused of “balance sheet trickery” -undermining spirit of post-08 rules. EU & UK corporate bond markets may be bigger source of instability than ’08. Credit card debt and car loan surge could cause another financial crisis. PRA warn banks returning to similar practices to those that sparked 08 crisis....

Read More »

Read More »

Sprott Money News Ask the Expert July 2017 – David Morgan

Silver expert David Morgan joins us to discuss wide range of topics related to silver and the precious metals.

Read More »

Read More »

“Financial Crisis” In 2017 Or By End Of 2018 – Prepare Now

John Mauldin of Mauldin Economics latest research note, Prepare for Turbulence, is excellent and a must read warning about the coming financial crisis. Mind refreshed from what sounds like a wonderful honeymoon and having had the time to read some books outside his “comfort zone” he has come to the conclusion that we are on the verge of a “major financial crisis, if not later this year, then by the end of 2018 at the latest.”

Read More »

Read More »

MARC FABER – The Upcoming Economic Recession in 2017 Has Begun

SUBSCRIBE for Latest on FINANCIAL CRISIS / OIL PRICE / PETROL/ GLOBAL ECONOMIC COLLAPSE / AGENDA 21 / DOLLAR COLLAPSE / GOLD / SILVER / BITCOIN / GLOBAL RESET / NEW WORLD ORDER / ECONOMIC COLLAPSE / DAVOS 2017

Read More »

Read More »