Category Archive: 6a) Gold & Monetary Metals

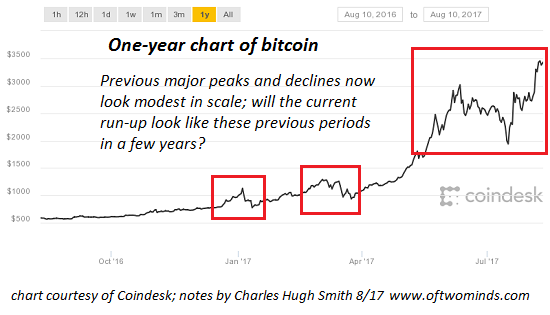

What the Mainstream Doesn’t Get about Bitcoin

The real demand for bitcoin will not be known until a global financial crisis guts confidence in central banks and politicized capital controls. I've been writing about cryptocurrencies and bitcoin for many years. For example: Could Bitcoin Become a Global Reserve Currency? (November 7, 2013) I am an interested observer, not an expert. As an observer, it seems to me that the mainstream--media, financial punditry, etc.--as a generality don't really...

Read More »

Read More »

“Dr. Doom” Marc Faber: Aktiencrash von bis zu 40 Prozent möglich – jetzt Gold kaufen (Teil 1)

Interview Marc Faber Teil 2: https://youtu.be/M8wg-DYuwi4 Börsenguru, Crash-Prophet, “Dr. Doom” oder einfach Marc Faber. Der Schweizer Investor ist Herausgeber und Verfasser des Gloom, Boom & Doom Reports (www.gloomboomdoom.com). Die Finanzpublikation zählt an den internationalen Börsenplätzen zur Pflichtlektüre. Marc Faber hat mit seinen Prognosen schon oft ins Schwarze getroffen und etliche Börsencrashs richtig vorhergesehen,...

Read More »

Read More »

Silver Mining Production Plummets 27 percent At Top Four Silver Miners

Silver Mining Production Plummets 27% At Top Four Silver Miners by SRSRocco Report

In an interesting change of events, production at four of the top primary silver miners plummeted during the second quarter of 2017. This goes well beyond normal fluctuations in mining companies production figures during different quarterly reporting periods.

Read More »

Read More »

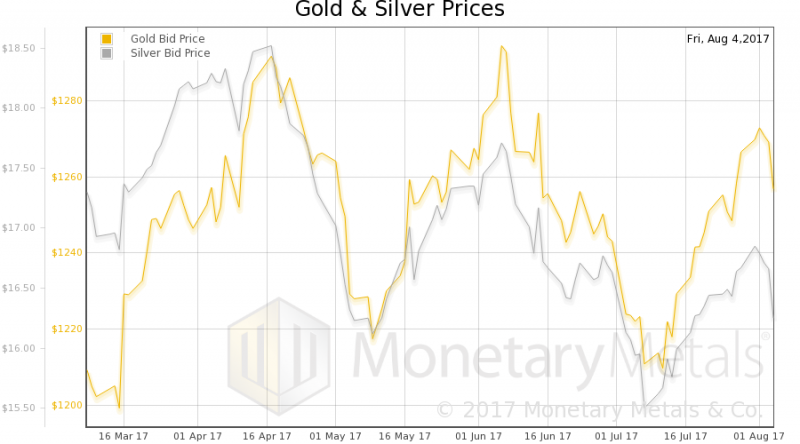

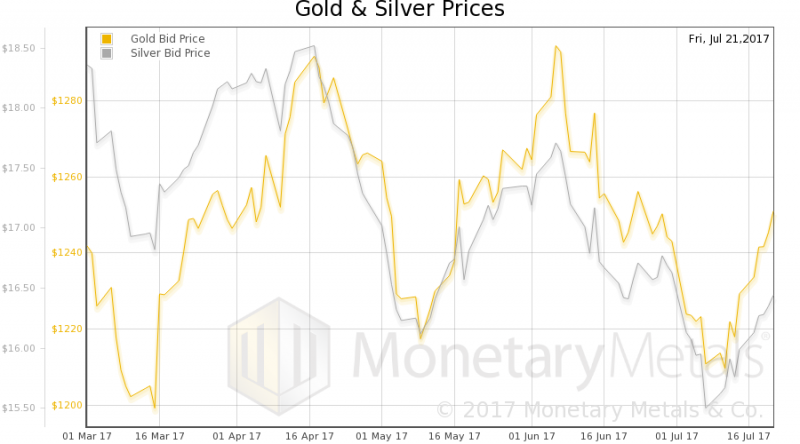

Gold Consolidates On 2.5percent Gain In July After Dollar Has 5th Monthly Decline

Gold consolidates on 2.5% gain in July as the dollar has fifth monthly decline. Trump administration and vicious “civil war” politics casting shadow over America and impacting dollar. All eyes on non farm payrolls today for further signs of weakness in U.S. economy. Gold recovers from 1.7% decline in June as dollar falls. Gold outperforms stocks and benchmark S&P 500 YTD.

Read More »

Read More »

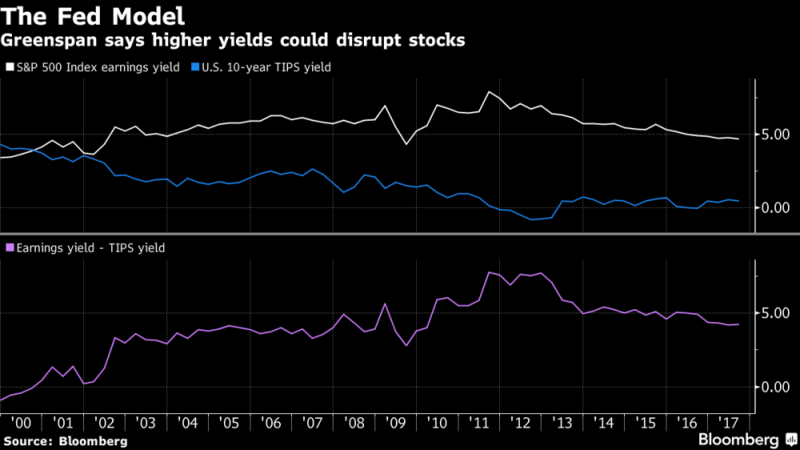

Greenspan Warns Stagflation Like 1970s “Not Good For Asset Prices”

‘We are experiencing a bubble, not in stock prices but in bond prices. This is not discounted in the marketplace.’ There are a lot of warnings on Bloomberg, CNBC and other financial media these days about a bubble in the stock market, particularly in FANG stocks and the tech sector.

Read More »

Read More »

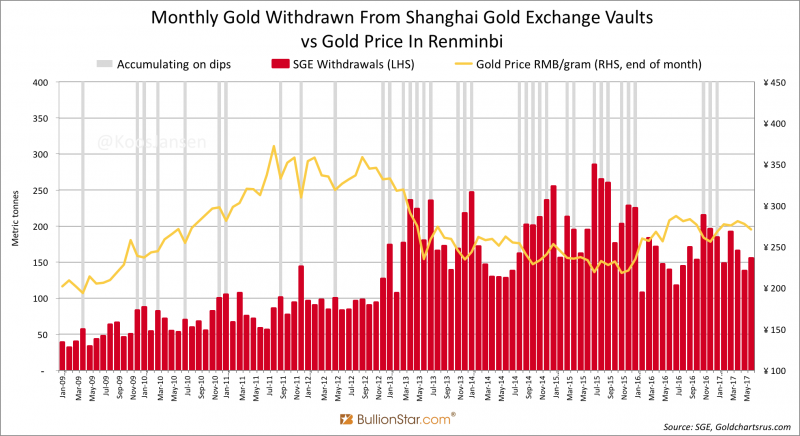

Estimated Chinese Gold Reserves Surpass 20,000t

My best estimate as of June 2017 with respect to total above ground gold reserves within the Chinese domestic market is 20,193 tonnes. The majority of these reserves are held by the citizenry, an estimated 16,193 tonnes; the residual 4,000 tonnes, which is a speculative yet conservative estimate, is held by the Chinese central bank the People’s Bank of China.

Read More »

Read More »

Frank Holmes: Silly Money Printing & Restricted Supply Form a “Great Scenario for Gold”

Read the full transcript here: https://goo.gl/SdELvx Frank Holmes, CEO of U.S. Global Investors reveals some very bullish fundamentals that he sees developing for the precious metals in the coming months and also shares some information on an exciting new gold fund. Don’t miss another great interview with The Mining Journal’s gold fund manager of the …

Read More »

Read More »

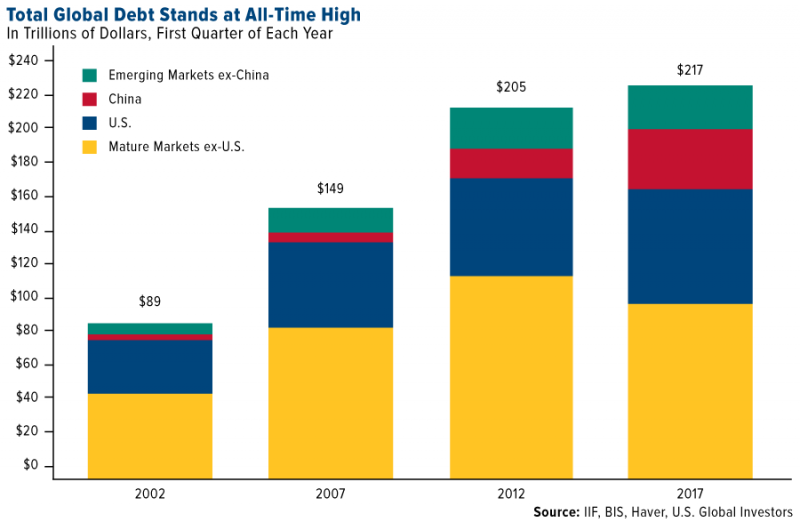

Gold A Good Store Of Value – Protect From $217 Trillion Global Debt Bubble

‘Mother of all debt bubbles’ keeps gold in focus. Global debt alert: At all time high of astronomical $217 T. India imports “phenomenal” 525 tons in first half of 2017. Record investment demand – ETPs record $245B in H1, 17. Investors, savers should diversify into “safe haven” gold. Gold good ‘store of value’ in coming economic contraction.

Read More »

Read More »

Why Surging UK Household Debt Will Cause The Next Crisis

Easy credit offered by UK banks is endangering “everyone else in the economy”. UK banks are “dicing with the spiral of complacency” again. Bank of England official believes household debt is good in moderation. Household debt now equals 135% of household income. Now costs half of average income to raise a child. Real incomes not keeping up with real inflation. 41% of those in debt are in full-time work. £1.537 trillion owed by the end of May...

Read More »

Read More »

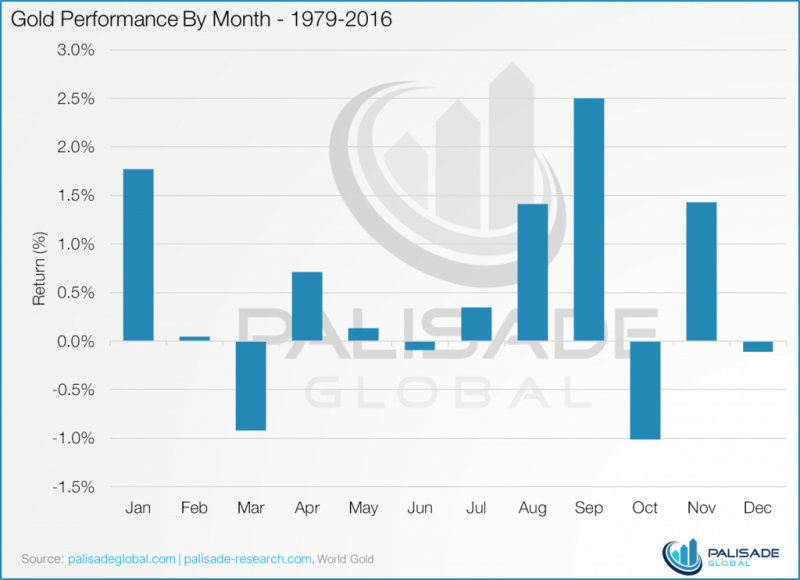

Gold Seasonal Sweet Spot – August and September – Coming

Gold seasonal sweet spot – August and September – is coming. Gold’s performance by month from 1979 to 2016 – must see table. August sees average return of 1.4% and September of 2.5%. September is best month to own gold, followed by January, November & August.

Read More »

Read More »

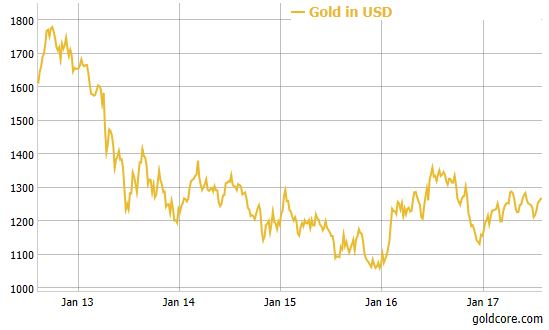

Why is Gold Being ‘Talked Down’ So Much? – Marc Faber

Ignore the recent weakness in gold, the metal is still trading higher this year as it did in 2016, points out one famed economist. So why is it being “talked down” so much? Marc Faber, editor and publisher of the Gloom, Boom & Doom Report, told Kitco News he doesn’t understand the negative outlook on … Continue...

Read More »

Read More »

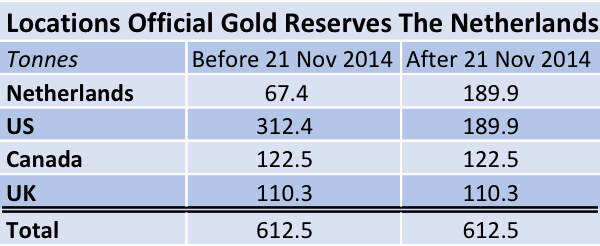

Did The Dutch Central Bank Lie About Its Gold Bar List?

Head of the Financial Markets Division of the Dutch central bank, Aerdt Houben, stated in an interview for newspaper Het Financieele Dagblad published in October 2016 that releasing a bar list of the Dutch official gold reserves “would cost hundreds of thousands of euros”. In this post we’ll expose this is virtually impossible – the costs to publish the bar list should be close to zero – and speculate about the far reaching implications of this...

Read More »

Read More »