Category Archive: 6a) Gold & Monetary Metals

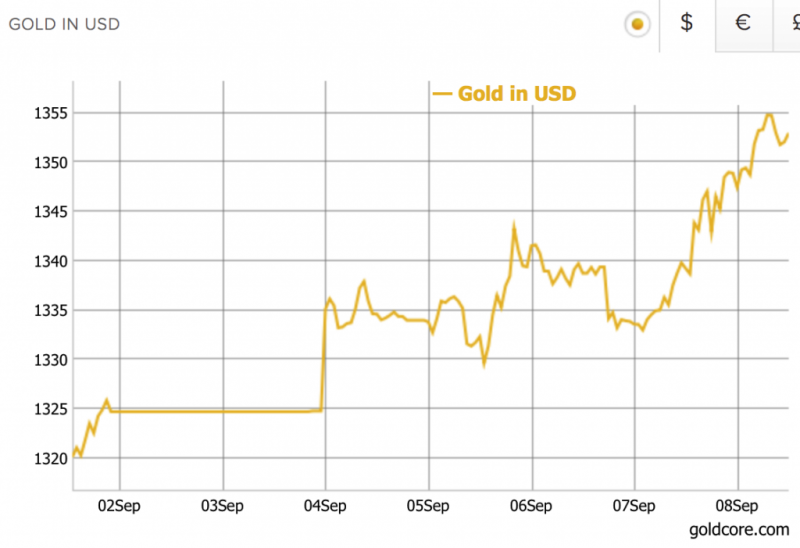

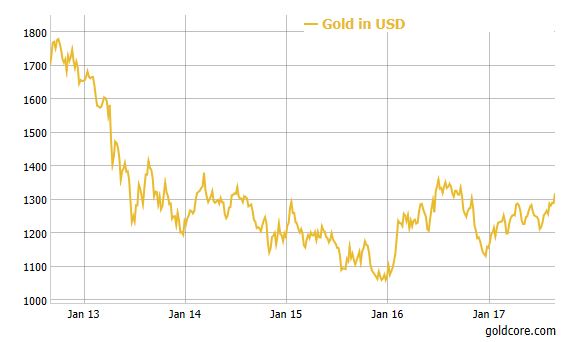

Gold Has 2 percent Weekly Gain, 18 percent Higher YTD – Trump’s Debt Ceiling Deal Hurts Dollar

Gold hits $1,355/oz as USD at 32-month low -concerns about Trump, US economy. Silver and platinum 2.3% and 1.2% higher in week; palladium 3% lower. Euro Stoxx flat for week – S&P 500, Nikkei down 0.65% and 2.2%. Geo-political concerns including North Korea, falling USD push gold 2.1% in week. Gold prices reach $1,355 this morning following Mexico earthquake. Safe haven demand sees gold over one year high, highest since August 2016.

Read More »

Read More »

Le retour de l’or sur la scène monétaire mondiale?

Mars 2009, le gouverneur de la Banque populaire de Chine M Zhou Xiaochuan revint dans le cadre d’une conférence intitulée Reform the international Monetary System sur la vision de Keynes au sujet du bancor.Pour lui, le système centré sur le dollar américain et les taux de changes flottants, plus ou moins librement, devrait être repensé.

Read More »

Read More »

Currywurst? That’ll be 0.0019 bitcoins please

The traditional favourite snack of late night revellers - the currywurst, or curried sausage – has just entered the digital world. It can now be paid for using the cryptocurrency bitcoin in Switzerland. The Wurst & Moritzexternal link company has responded to repeated demand from customers to spend their hard-earned bitcoins in its restaurants in Zurich and Bern.

Read More »

Read More »

Precious Metals Supply Pipeline Getting Harder & Harder to Fill

Read full transcript here: https://goo.gl/pjYJuR David Smith of The Morgan Report and regular contributor to MoneyMetals.com joins Mike Gleason for another enlightening conversation. David tells Mike how much longer he thinks the upside move will last in the gold and silver markets and also weighs in on Bitcoin and the cryptocurrencies. #goldmarket #bitcoin #cryptocurrencies ================== …

Read More »

Read More »

Physical Gold In Vault Is “True Hedge of Last Resort” – Goldman Sachs

Physical gold is “the true currency of the last resort” – Goldman Sachs. “Gold is a good hedge against geopolitical risks when the event leads to a debasement of the dollar” . Trump and Washington risk bigger driver of gold than risks such as North Korea. Recent events such as N. Korea only explain fraction of 2017 gold price rally. Do not buy gold futures or ETFs rather “physical gold in a vault” [is] the “true hedge”.

Read More »

Read More »

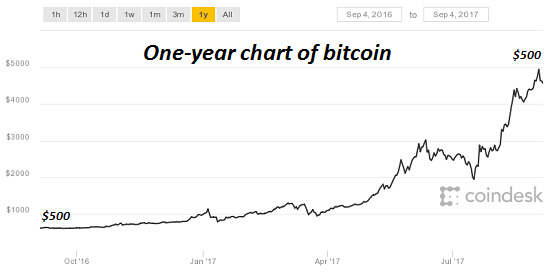

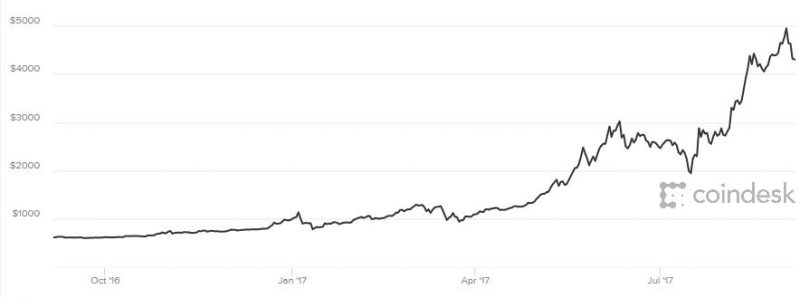

Bitcoin, Sour Grapes and the Institutional Herd

The point is institutional ownership of bitcoin is in the very early stages.

If I had a bitcoin for every time some pundit declared bitcoin is a bubble, I'd be a billionaire. There are three problems with opining that bitcoin and cryptocurrencies are bubblicious:

Read More »

Read More »

Bitcoin Falls 20 percent as Mobius and Chinese Regulators Warn

Bitcoin falls 20% as Mobius and Chinese regulators warn. “Cryptocurrencies are beginning to get out of control” – warns respected investor Mark Mobius. Mobius believes governments will begin to clamp down on cryptocurrencies sparking rush to gold. Yesterday China’s PBOC ruled Initial Coin Offerings (ICOs) are illegal and all related activity to halt. China is home to majority of bitcoin miners.

Read More »

Read More »

Michael Pento Exclusive: Gold Sniffing Out Coming Central Bank Failure; $2000+ Per Ounce?

Read the full transcript here: https://goo.gl/kAwFav Money Metals Exchange welcomes Michael Pento, President and founder of Pento Portfolio Strategies, and author of the book, The Coming Bond Market Collapse: How to Survive the Demise of the U.S. Debt Market. Michael is a well-known and successful money manager, and has been a regular guest on CNBC, …

Read More »

Read More »

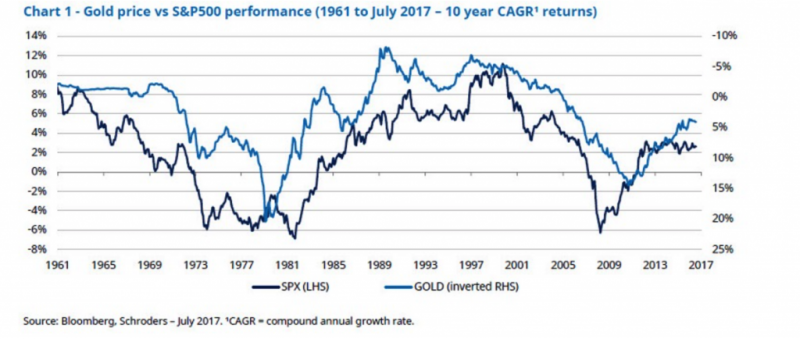

4 Reasons Why “Gold Has Entered A New Bull Market” – Schroders

4 reasons why “gold has entered a new bull market” – Schroders. Market complacency is key to gold bull market say Schroders. Investors are currently pricing in the most benign risk environment in history as seen in the VIX. History shows gold has the potential to perform very well in periods of stock market weakness (see chart). You should buy insurance when insurers don’t believe that the “risk event” will happen. Very high Chinese gold demand,...

Read More »

Read More »

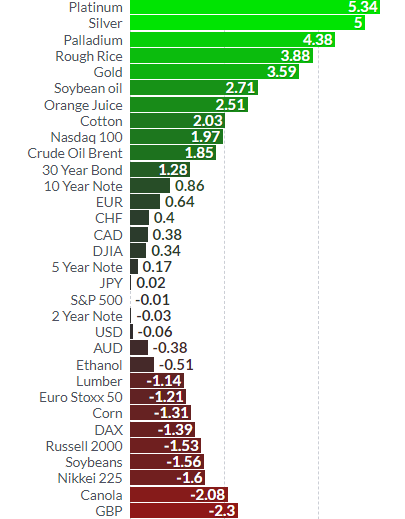

Precious Metals Outperform Markets In August – Gold +4 percents, Silver +5 percents

All four precious metals outperform markets in August. Gold posts best month since January, up nearly 4%. Gold reaches highest price since US election, climbs due to uncertainty and safe haven demand. S&P 500 marginally higher; Euro Stoxx, Nikkei lower for month. Platinum is best performing metal climbing over 5%. Palladium climbs over 4% thanks to seven year supply squeeze.

Read More »

Read More »

Gold Reset To $10,000/oz Coming “By January 1, 2018” – Rickards

Trump could be planning a radical “reboot” of the U.S. dollar. Currency reboot will see leading nations devalue their currencies against gold. New gold price would be nearly 8 times higher at $10,000/o. Price based on mass exit of foreign governments and investors from the US Dollar. US total debt now over $80 Trillion – $20T national debt and $60T consumer debt. Monetary reboot or currency devaluation seen frequently – even modern history. Buy...

Read More »

Read More »

Gold Surges 2.6 percent After Jackson Hole and N. Korean Missile

Gold surges as N. Korea fires ballistic missile over Japan. Safe haven buying sees gold break out to 10-month high after Jackson Hole and rising North Korea risk of attack on Guam. South Korea’s air force dropped eight MK 84 bombs near Seoul; simulating the destruction of North Korea’s leadership.

Read More »

Read More »

Thank God Its Friday with Marc Faber

Marc Faber, , Editor and Publisher, The Gloom, Boom & Doom Report talks about Indian real-estate, cryptocurrency and Indian stocks.

Read More »

Read More »

Diversify Into Gold On U.S. “Political Instability” Advise Blackrock

Gold set to shine as Washington stumbles. “Bet on gold’s diversifying properties rather than political stability”. World’s largest asset manager believes Trump and political drama in the U.S. means gold likely to rise. Real rates flattening out and rising political instability – Blackrock’s Koesterich. “For now my bias would be to stick with gold” – Blackrock. U.S. debt ceiling issue to be fractious as bankrupt U.S. hits $20 trillion debt....

Read More »

Read More »

The Truth About Bundesbank Repatriation of Gold From U.S.

Bundesbank has completed a transfer of gold worth €24B from France and U.S. Germany has completed domestic gold storage plan 3 years ahead of schedule. In the €7.7 million plan, 54,000 gold bars were shipped and audited.

Read More »

Read More »