The price of gold dropped $31, and that of silver fell even more by proportion, $2.14. The gold-silver ratio hit a hit of over 126 before closing the week around 119. This exceeds the high in the ratio last hit in the George H.W. Bush recession.

Last week, we were warming up to silver, if not recommending it. We said:

“While we would not recommend betting on silver with leverage at this moment, we certainly would not be short silver right now. If you don’t own any, this looks like a good time to buy some. If you have some, you could do worse than buying more here.

…

That said, the Monetary Metals Gold:Silver Ratio Fundamental shows the fundamental as high or higher than the market ratio.

…

This should be watched for a turn. A historic opportunity is coming.”

We will look at this below. But before that, this week, we heard the term “paper gold” more times than we recall in a long time. So permit us this little rant.

Rant

Put three things out of your mind. They are just myths, and no good comes of adults who believe in them: Santa Clause, the Tooth Fairy, and the Shadowy Cartel Who Sells Paper Gold. There is no such thing as a piece of paper that, while unconnected to gold in any way, they sell in lieu of gold, that soaks up gold demand, or that anyone would buy.

It does not exist.

The sooner you accept the unpleasant truth that a fat man with a white beard does not fly his reindeer sleigh to your roof, where he somehow gets down your chimney with his beard unsoiled, the better off you will be. The sooner you know that if you lose a tooth, there is no magical fairy to put money (well, dollars) under your pillow, the better. The sooner you learn a bit about how the gold market works, the better you will do in your investing and trading.

Sorry if the above offends anyone. The truth sometimes gives offense (though it shouldn’t).

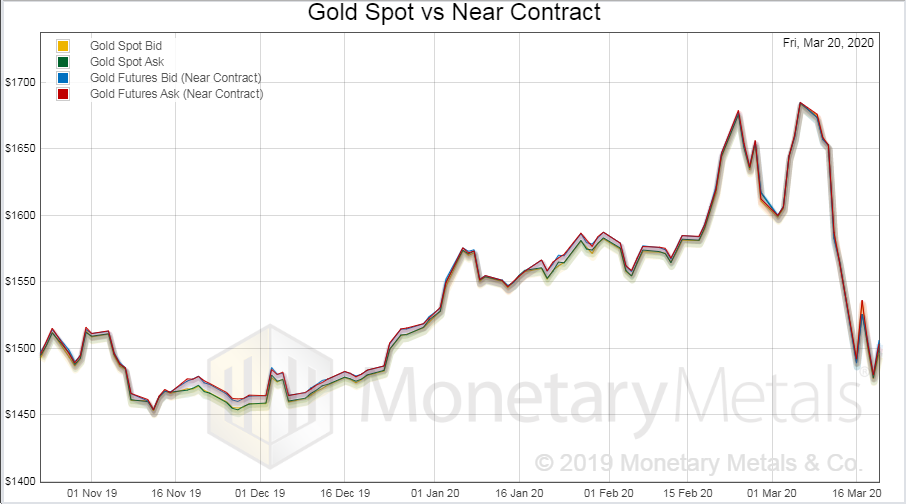

| The price of gold in the spot market somehow tracks very closely to the price of gold in the futures market. When we say gold, we refer to commercial sized (large) bars. We will address small bars and coins, below. Did you ever wonder how this works? There is a mechanism that keeps them tightly correlated. And in markets, such mechanisms mean someone makes a profit to make it work.

Here is a graph of the price of gold in both markets (with bid and ask prices). The spread between spot and future is so small, that one can barely see it on a price graph. One needs to see it on a basis graph. This profit is called arbitrage. It is possible, under normal conditions, to simultaneously buy gold metal and sell a gold future—and make a profit. To make this profit, the trader—a warehouseman—carries gold. He holds the gold until the maturity of the contract, when he will have to deliver it. Or until the party who bought the contract wants to close it, often as the contract heads into expiration. |

Gold Spot vs Near Contract, 2019-2020 |

The profit that the arbitrager makes can be quoted as an annualized rate, which is the basis we publish every day.

In extraordinary conditions, it is possible to sell physical gold and buy a gold future. This is called decarrying, and the profit one makes if quoted in annualized terms is the cobasis. When the cobasis is positive, that is called gold backwardation. Backwardation should never happen in gold, ever. But it does, because the monetary system is breaking down.

These two trades, carry and decarry, keep the price of gold in the futures market very close to the price of gold in the spot market.

The price of small bars and coins, which are retail products, can vary considerably from the price of gold in the spot market. This is because manufacturing capacity, especially for minted bars and coins, is finite. Mints are reluctant to buy expensive machines (with debt financing, of course) to expand capacity for a boom that they know from prior experience can be fleeting.

So what happens when retail demand spikes above this capacity? It pulls the inventory out of the supply chain. And then demand runs into a wall. Supply is inelastic. So the premium on small bars and coins can rise, as it has now.

This says nothing about whether the gold price is fair or unfair, manipulated, suppressed, or free to move up or down. It does not say that the downward price action is somehow nefarious.

Besides, with the Fed primed to print trillions, you are a buyer of gold at $1,475 and especially silver at $12.60. Right? You are, aren’t you? Buyers are happy to see what they want to buy go on sale.

Rant

Obviously, the mints will ramp up to produce as much as they can. They can sell product now for a higher premium than before. I.e. it is more profitable for them than it was until recently. They operate on the same incentives as the warehousemen in the futures market.

Also obviously, they will be buying as much metal in the form of large bars as they can, to make into small bars and coins. This is marginal demand coming into the market, which hadn’t been there before.

It is noteworthy that the price jump starting last June was not only without retail buying, it occurred despite retail selling. Now, retail is buying all over the world.

However, it may be less obvious that there is selling by high net worth and institutional investors. Let’s look at why.

We have spoken with some business owners. A trend stands out to us. For example, a medical practice was, until a month ago, at or beyond its capacity to see patients. However, by this week, the doctors were going home early. There are no more elective surgeries. And patients are cancelling even permissible office visits.

This medical practice is now seeking to open a credit line (whether any bank will extend new credit right now, remains to be seen). They anticipate that they may have a cash flow crunch and seek to put cash on their balance sheet now, while they can.

We believe this must be the same thought going through the heads of every business manager, everywhere.

Businesses seek to stock up on cash, the way consumers are seeking to stock up on toilet paper. And for the same reason—fear that tomorrow, it may not be available.

And this brings us back to gold. If you need cash, and you have both real estate and gold, which do you sell? Gold has a bid. If you need cash, and you have both BBB bonds and gold, which do you sell?

Gold is serving its time-tested role: preserving wealth, especially in times of crisis. Unlike real estate, which anyone who needs to sell urgently right now will soon discover. If there is a bid on real estate at all, it may be a very weak bid.

This is the first of two major forces in the gold market. Gold sellers are desperate to raise cash.

The buyers should be obvious to observers of the gold space. Everyone knows that a one-two punch is coming to hit the dollar. Fiscal policy may include $1,000 checks to everyone, bailouts to the banks, and subsidies to businesses large and small. All paid for with borrowed dollars, of course. Monetary policy will include more Fed asset purchases, perhaps including overpaying for impaired bonds. The Fed will expand its balance sheet massively, and keep pushing interest rates down.

| This is the second major force in the gold market. Gold buyers seek to avoid this coming dollar disaster.

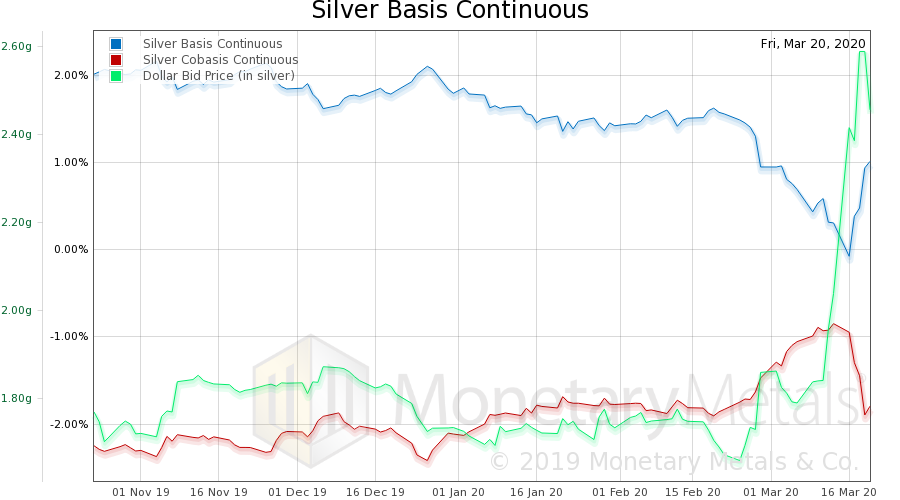

In the end, buyers will have to win. But in the short term, desperate sellers can push the price from $1,700 to $1,500 (and silver from $18 to $12). Are you a buyer or a seller? Here is a graph of the silver basis and price of the dollar in silver (which is the inverse of the price of silver in dollar terms). As the dollar rises (i.e. price of silver drops) we see a drop in the scarcity of silver (i.e. cobasis, the red line). A big drop. Silver became much less scarce in this selloff. |

Silver Basis Continuous, 2019-2020 |

It should be obvious what this means. For every monster box of coins bought at retail, desperate sellers are selling a 1,000oz bar. Sorry, but the truth is the truth (and if you don’t agree, we encourage you to write your own theory based on the same facts: (1) big price drop, (2) retail buying of coins, (3) big drop in cobasis, and (4) desperate rush to raise cash from all parties).

The one consolation is that on Friday, we see a drop in the dollar (i.e. silver went up) and the scarcity rose also. Slightly. Price in this market is not set in the paper silver world. It is about buying and selling of metal bars and coins.

That historic opportunity did not come this week, though Friday’s turn may indicate it is close.

© 2020 Monetary Metals

Full story here Are you the author? Previous post See more for Next postTags: Basic Reports,Credit Crisis,newsletter