Category Archive: 5) Global Macro

“Inflation” and America’s Accelerating Class War

Those who don't see the fragmentation, the scarcities and the battlelines being drawn will be surprised by the acceleration of the unraveling. I recently came across the idea that inflation is a two-factor optimization problem.

Read More »

Read More »

If Dollar Is Fixed By Jay’s Flood, Why So Many TIC-ked At Corporates in July?

When the eurodollar system worked, or at least appeared to, not only did the overflow of real effective (if virtual and confusing) currency “weaken” the US dollar’s exchange value, its enormous excess showed up as more and more foreign holdings of US$ assets.

Read More »

Read More »

27.3 US Retail Sales and Industrial Production in AUG

What do the latest figures tell us about the world's most important consumer? Jeff Snider reviews retail sales, industrial production and asks what is it that is missing from our post 2007-08 economy that precludes robust recovery.

Read More »

Read More »

Reopening Inertia, Asian Dollar Style (Still Waiting On The Crash)

Why are there still outstanding dollar swap balances? It is the middle of September, for cryin’ out loud, and the Federal Reserve reports $52.3 billion remains on its books as of yesterday.

Read More »

Read More »

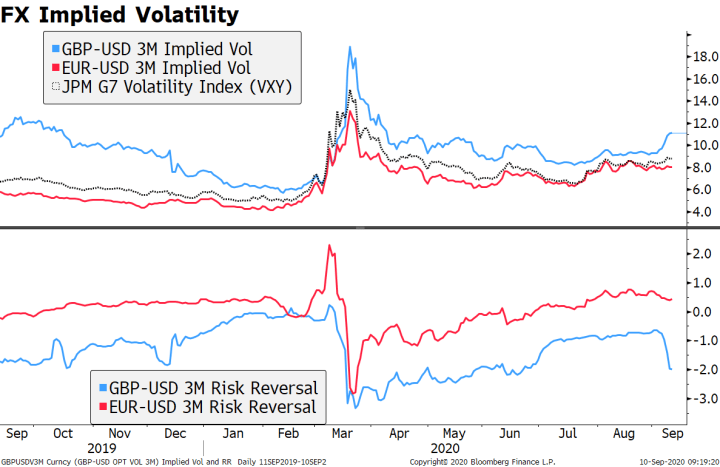

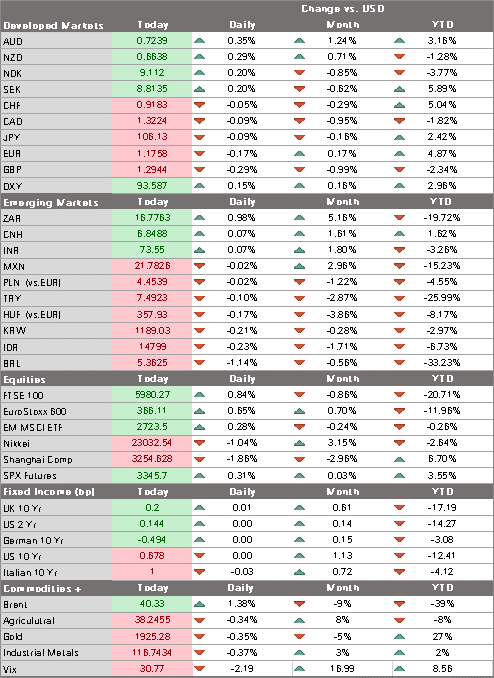

Risk Appetite Ebbs Ahead of BOE Decision

The dollar has gotten some limited traction despite the dovish FOMC decision; the FOMC delivered no surprises. We are seeing some more movement on fiscal stimulus; August retail sales disappointed yesterday.

Read More »

Read More »

Putin, the poisoning and Belarus: what’s really going on? | The Economist

Vladimir Putin has been rattled by protests in Belarus and Russia’s far east—and stands accused of poisoning Alexei Navalny, his only real political rival at home. What does Putin really fear?

Further content:

Sign up to The Economist’s daily newsletter to keep up to date with our latest coverage: https://econ.st/3c7QSUD

Watch our film about covid-19 in Russia: https://youtu.be/7tziw5i3vy8

Read about the uprising—and violent government...

Read More »

Read More »

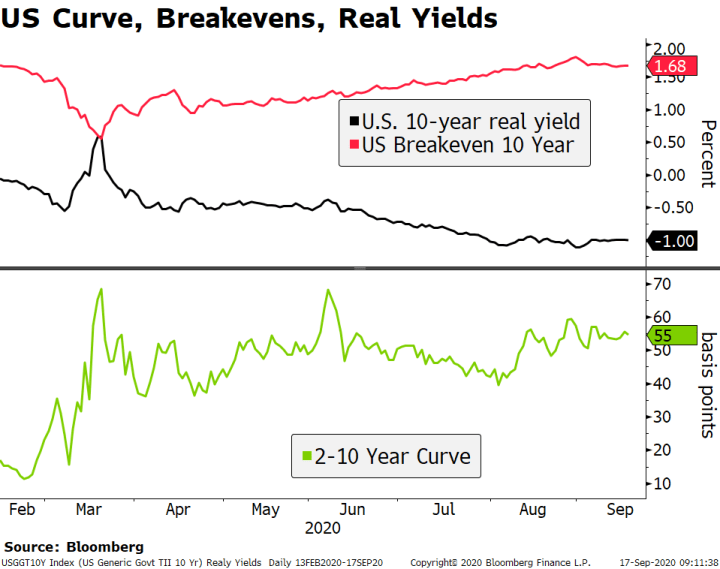

12 States That Keep Retirement Dollars in Your Pocket

“Will I outlive my money?” That’s one of the biggest concerns for most retirees. There’s the high cost of medical care, which gets more expensive all the time. There’s inflation, which raises the cost of goods and services, eating into your retirement budget.

Read More »

Read More »

David Attenborough talks about his new Netflix film | The Economist Podcast

Sir David Attenborough is about about to release his latest film—on Netflix. The 93-year old tells Economist Radio's Anne McElvoy about “A Life On Our Planet”, as well as offering his opinions on President Trump, Greta Thunberg and eating meat.

00:00 Sir David Attenborough’s career and new film

01:22 What's Chernobyl got to do with climate change?

02:51 Criticisms of being late to address climate change

03:51 Sir David’s first memory of climate...

Read More »

Read More »

Sacrifice for Thee But None For Me

The banquet of consequences for the Fed, the elites and their armies of parasitic flunkies and factotums is being laid out, and there won't be much choice in the seating. Words can be debased just like currencies. Take the word sacrifice.

Read More »

Read More »

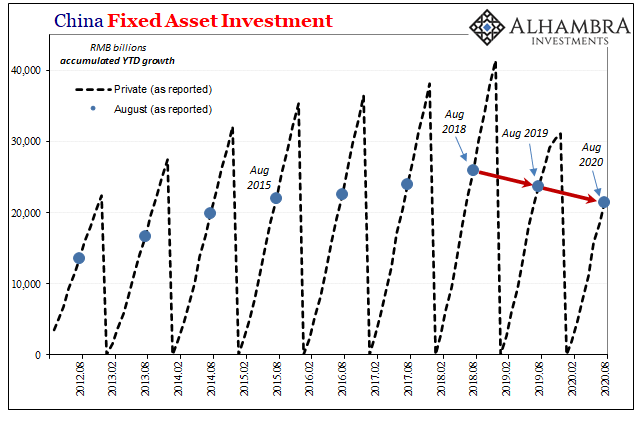

China’s Hole Puzzle

One day short of one year ago, on September 16, 2019, China’s National Bureau of Statistics (NBS) reported its updated monthly estimates for the Big 3 accounts. Industrial Production (IP) is a closely-watched indicator as it is relatively decent proxy for the entire goods economy around the world. Retail Sales in the post-Euro$ #2 context give us a sense of the Chinese economy’s persistent struggle to try to “rebalance” without the pre-2008 boost...

Read More »

Read More »

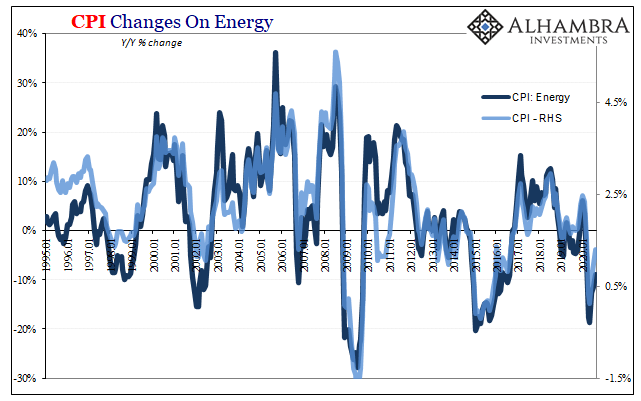

Inflation Karma

There is no oil in the CPI’s consumer basket, yet oil prices largely determine the rate by which overall consumer prices are increasing (or not). WTI sets the baseline which then becomes the price of motor fuel (gasoline) becoming the energy segment. As energy goes, so do headline CPI measurements.

Read More »

Read More »

The Four D’s That Define the Future

When the money runs out or loses its purchasing power, all sorts of complexity that were previously viewed as an essential crumble to dust. Four D's will define 2020-2025: derealization, denormalization, decomplexification and decoherence. That's a lot of D's. Let's take them one at a time.

Read More »

Read More »

Dollar Bounce Ends Ahead of ECB Decision

The dollar rally ran out of steam; US Senate will hold a vote today on its proposed “skinny” bill. US reports August PPI and weekly jobless claims; US will sell $23 bln of 30-year bonds today after a sloppy 10-year auction yesterday

BOC delivered a hawkish hold yesterday; Peru is expected to keep rates steady at 0.25%.

Read More »

Read More »

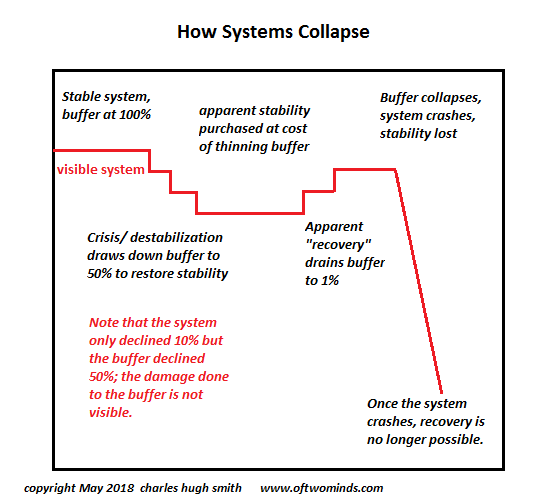

This Is How It Ends: All That Is Solid Melts Into Air

While the Federal Reserve and the Billionaire Class push the stock market to new highs to promote a false facade of prosperity, everyday life will fall apart. How will the status quo collapse? An open conflict--a civil war, an insurrection, a coup--appeals to our affection for drama, but the more likely reality is a decidedly undramatic dissolution in which all the elements of our way of life we reckoned were solid and permanent simply melt into...

Read More »

Read More »

Intolerance and Authoritarianism Accelerate Disunity and Collapse

Scapegoating dissenters only hastens the disunity and disarray that accelerates the final collapse. Authoritarianism is imposed on us, but its sibling intolerance is our own doing. Intolerance and authoritarianism are two sides of the same coin: as intolerance becomes the norm, the intolerant start demanding that the state enforce their intolerance by suppressing their enemies via increasingly heavy-handed authoritarian measures.

Read More »

Read More »

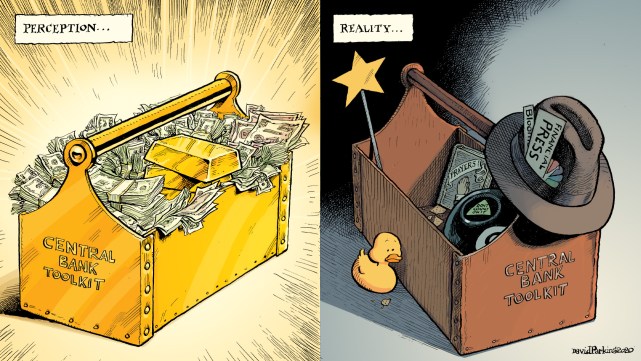

Re-recession Not Required

If we are going to see negative nominal Treasury rates, what would guide yields toward such a plunge? It seems like a recession is the ticket, the only way would have to be a major economic downturn. Since we’ve already experienced one in 2020, a big one no less, and are already on our way back up to recovery (some say), then have we seen the lows in rates?Not for nothing, every couple years when we do those (record low yields) that’s what “they”...

Read More »

Read More »

Netflix CEO: why you shouldn’t try to please your boss | The Economist Podcast

With 193m subscribers worldwide, Netflix has revolutionised the TV and film industry. Reed Hastings, the firm’s CEO, tells The Economist Asks podcast that its success is built on the radical management style he has created within the company.

00:00 How Netflix is managed

01:23 Why employees shouldn’t try to please their boss

03:09 Netflix's reputation for firing people

03:25 Unlimited holiday at Netflix

04:05 His management learning curve

Further...

Read More »

Read More »

Sterling Pounded by Brexit Developments

The dollar rebound continues; odds of a near-term stimulus bill in the US are falling; ahead of inflation readings later this week, the US holds a 10-year auction today. Bank of Canada is expected to keep policy steady; Mexico reports August CPI; Brazil reports August IPCA inflation.

Read More »

Read More »

ECB Preview

The ECB meets tomorrow and is widely expected to stand pat. Macro forecasts may be tweaked modestly and there are some risks of jawboning against the stronger euro, but it should otherwise be an uneventful meeting. Looking ahead, a lot of room remains for further ECB actions.

Read More »

Read More »