Category Archive: 5) Global Macro

Helicopter Money and the End of Taxes

Rather than right the ship, the "easy fix" is to distribute "free money"--not just to billionaires and corporations but to everyone.

Read More »

Read More »

What’s Zambia Got To With It (everything)

As one of Africa’s largest copper producers, it seemed like a no-brainer. Financial firms across the Western world, pension funds from the US or banks in Europe, they lined up for a bit of additional yield. This was 2012, still global recovery on the horizon – at least that’s what “they” all kept saying.

Read More »

Read More »

Will covid kill globalisation?

Covid-19 has been the third major disruption to globalisation within the past twelve years. The pandemic will not kill globalisation off, but it will deepen the cracks.

Read More »

Read More »

Dollar Softens as Risk-Off Sentiment Ebbs

The dollar continues to soften as risk-off sentiment ebbs; the first presidential debate will take place tonight. House Democrats have staked out their latest position at $2.2 trln; there is a fair amount of US data out today; Brazil has come under renewed pressure from fiscal concerns.

Read More »

Read More »

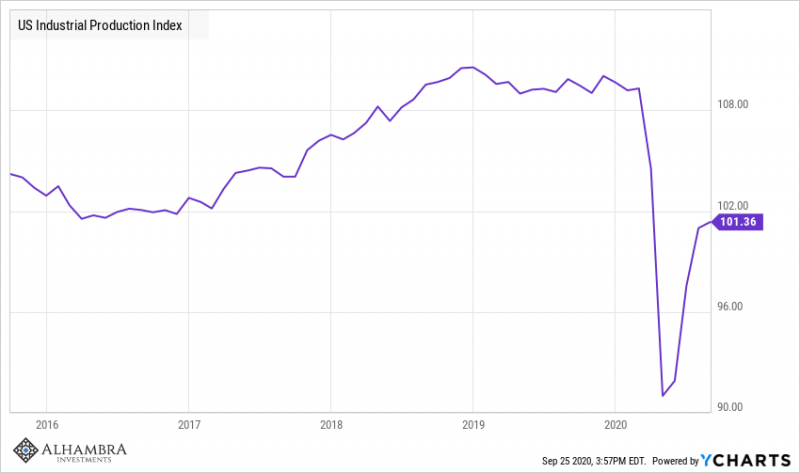

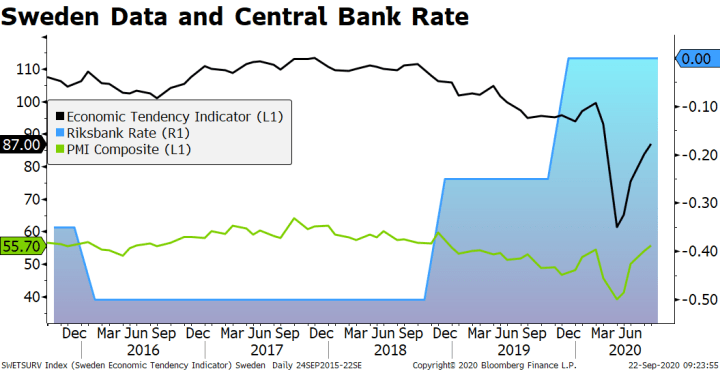

Monthly Macro Monitor – September 2020

The economic data over the last month continued to improve but the breadth of improvement has narrowed. Additionally, while most of the economic data series are still improving, the rate of change, as Jeff pointed out recently, has slowed. I guess that isn’t that surprising as the initial phase of the recovery comes to an end.

Read More »

Read More »

Charles Hugh Smith: Radical Changes in Jobs Market Now & in Future

Economy," "Get a Job, Build a Real Career and Defy a Bewildering Economy" and most recently, "A Radically Beneficial World: Automation, Technology and Creating Jobs for All." His work is published on a number of popular financial websites including Zero Hedge, Financial Sense, and David Stockman's Contra Corner.

Read More »

Read More »

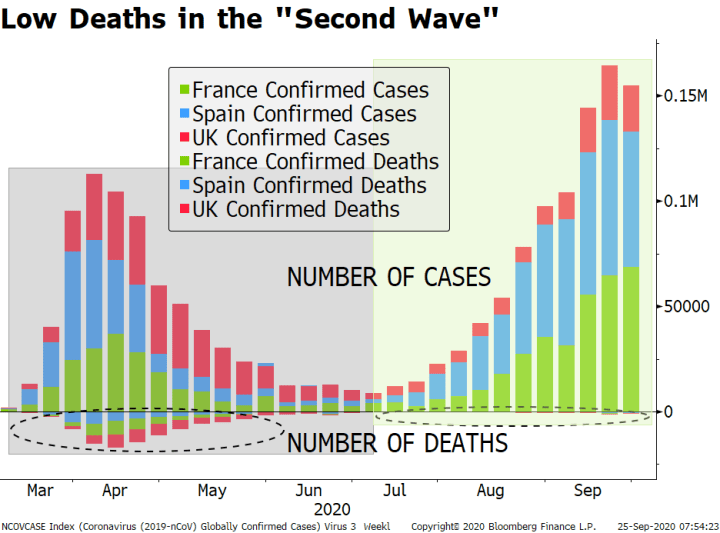

Dollar Soft as Markets Ignore Virus Numbers and Switch to Risk-On Mode

Virus numbers are rising across Europe and the US; the dollar is softening as risk-off sentiment ebbs. It is a fairly quiet day in the US; there is a glimmer of hope about a fiscal deal in the US; recent US data support the widely held view that more stimulus is needed.

Read More »

Read More »

People Are Now Aware Of What Will Happen

Recently, people are more aware of what can happen. This awareness raises in economic conditions and political realities make people think. Every new choice is a new beginning for people.

Read More »

Read More »

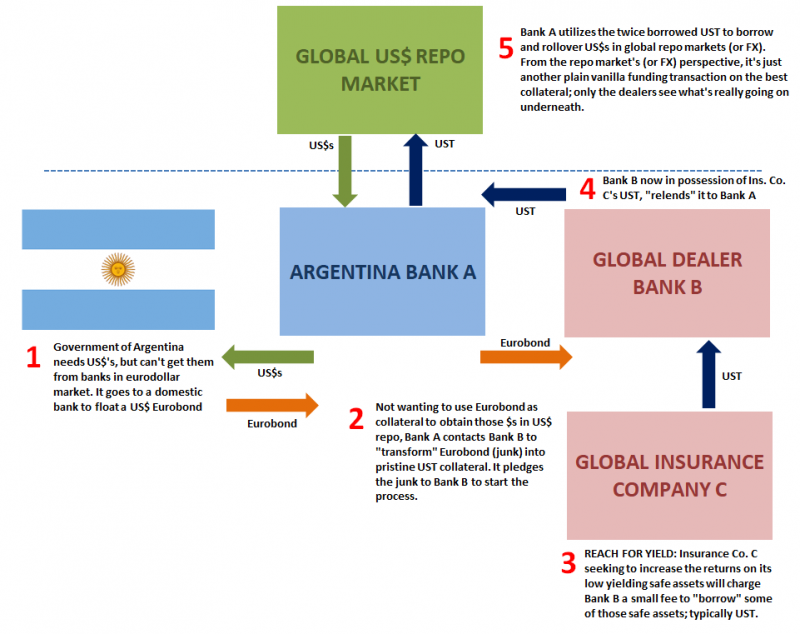

Jeff Snider’s Eurodollars and Lacy Hunt’s monetary policy in 10 Minutes

I've been watching videos from Jeff Snider, Lacy Hunt, Steve Van Meter and Brent Johnson for months and I've slowly built up a mental framework for what they are talking about.

Read More »

Read More »

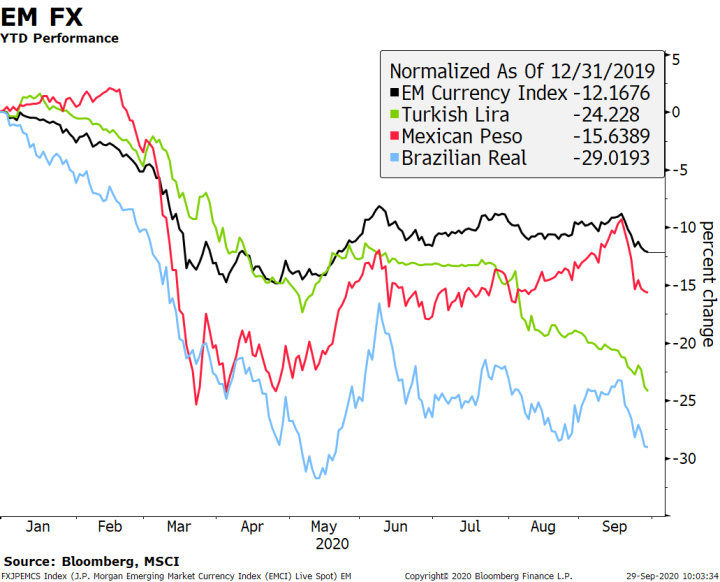

EM Preview for the Week Ahead

Persistent risk-off impulses weighed on EM last week and that may continue this week. The Asian currencies outperformed last week while MXN, ZAR, and COP underperformed, and we expect these divergences to continue. Despite optimism about a stimulus package in the US, we think it remains a long shot. Meanwhile, virus numbers are rising in Europe and the US, with data from both regions likely to continue weakening.

Read More »

Read More »

Dollar Firm as Markets Digest Rising Virus Numbers

Markets are digesting the rising infection rates across Europe; the dollar is taking another stab at the upside. Speculation is picking up that a compromise on a stimulus package could be reached; reports suggest House Democrats are working on a new $2.4 trln package as a basis for these negotiations.

Read More »

Read More »

28 Brent Johnson and Jeff Snider (also ‘George Gobel’)

Brent Johnson, CEO of Santiago Capital, joins Jeff Snider to discuss central banks, public relations, modern monetary theory, politically-directed investment and whether the future ahead is a bright or dark one. Also, brown shoes.

Read More »

Read More »

America’s pandemic election: what could go wrong? | The Economist

America’s 2020 presidential election will be a contest like no other. From the effects of mass mail-in voting to the threat of disinformation and delayed results—how ugly could it get? Sign up to our free webinar The US elections and the economy here: https://econ.st/3cApChN

Further content:

Sign up to “Checks and Balance”, our weekly newsletter on American politics: https://econ.st/3iT2b5z

Find The Economist’s latest coverage of the 2020...

Read More »

Read More »

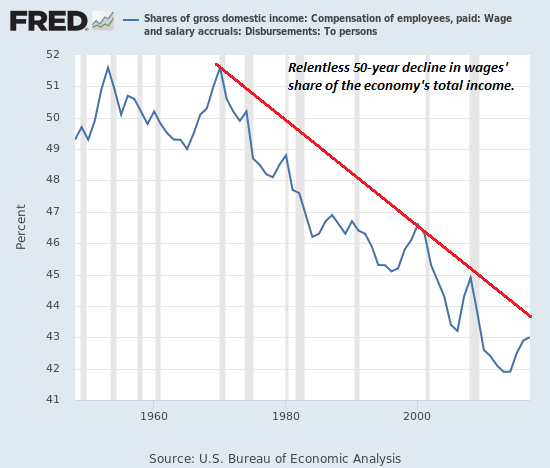

The Silent Exodus Nobody Sees: Leaving Work Forever

The "take this job and shove it" exodus is silently gathering momentum. The exodus out of cities is getting a lot of attention, but the exodus that will unravel our economic and social orders is getting zero attention: the exodus from work. Like the exodus from troubled urban cores, the exodus from work has long-term, complex causes that the pandemic has accelerated.

Read More »

Read More »

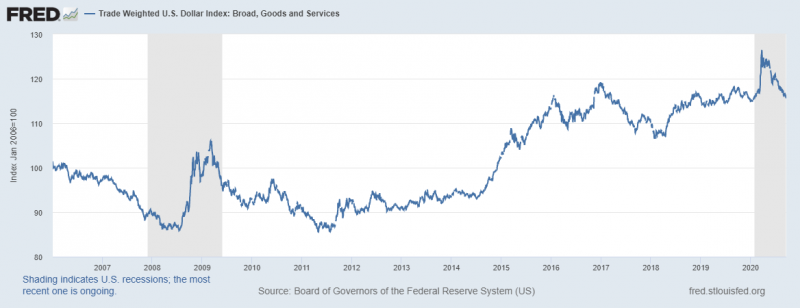

Uh Oh, The Dollar Has Caught A Bid

Anyone who follows Alhambra knows that we keep an eye on the dollar. It is a very important part of our process of identifying the economic environment. A rising dollar, when combined with a falling rate of growth, can be a lethal combination. That was the situation in March and of course during the financial crisis of 2008.

Read More »

Read More »

Jeff Snider: What happens if Dollar LOSES RESERVE STATUS? (RCS Ep75)

Topics: What would happen to the US economy long term if the Dollar is no longer the global reserve currency? US privilege/burden since Bretton Woods. Euro dollar system: what’s wrong with it? Hypothetically, how would it have been better/more sustainable?

Read More »

Read More »

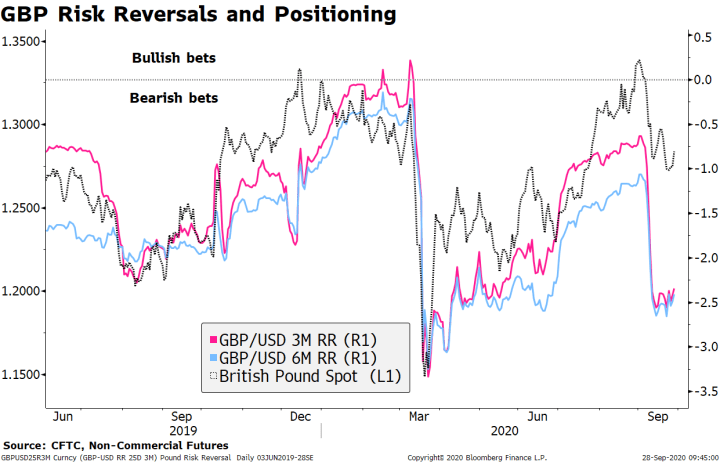

Dollar Remains Firm Ahead of Powell Testimony

The dollar remains firm on continued safe haven flows but we still view this situation as temporary. Fed Chair Powell appears before the House Financial Services Panel with Treasury Secretary Mnuchin; the text of Powell’s testimony was released already.

Read More »

Read More »

Inflation and “Socialism-Lite” Are Just What the Billionaires Want

After a bout of inflation and "socialism-light", we could end up with even more extreme inequality when the whole rotten structure collapses.

Read More »

Read More »

Charles Hugh Smith: What Would A Better System Look Like?

Writer, philosopher and long-time contributor to PeakProsperity.com, Charles Hugh Smith, returns to the podcast to explain the new socio-economic model he has just introduced to the world through his new book A Hacker’s Teleology: Sharing the Wealth of Our Shrinking Planet.

Read More »

Read More »

Dollar Gains from Risk-Off Trading Unlikely to Persist

Markets are starting the week in risk-off mode; the dollar is firm on some safe haven flows but this is likely to prove temporary. US politics is coming in to focus as the election nears; we fear that the likely horse-trading and arm-twisting will take away any residual desire to get another stimulus package done.

Read More »

Read More »