Category Archive: 5) Global Macro

Solar tech company aims to cut Germany’s reliance on Russian gas amid Ukraine war | Tech In Trend

Europe is facing a major energy crisis amid the ongoing Russia-Ukraine war. However, there is a Solar tech company named WeDoSolar that aims to cut Germany's reliance on Russian gas.

Read More »

Read More »

Fossil fuels will have to end. Are batteries the new ‘oil’?

There is an urgent need to cut greenhouse gas emissions in order to avoid global warming and create a society without fossil fuels. The solution is emission-free electrification 3 scientists received the 2019 Nobel Prize for their work on lithium-ion batteries.

Read More »

Read More »

US Security Advisor: Iran will supply combat drones to Russia | Latest English News

Jake Sullivan, the White House national security advisor said that Iran is planning to supply hundreds of drones with combat weapon capabilities to Russia for use in Ukraine.

Read More »

Read More »

4 Social Security Changes to Expect in 2023

Looking into a crystal ball and prognosticating the future is always a risky endeavor, but when it comes to Social Security and the year 2023 there are 4 things that have a high probability of happening.

Read More »

Read More »

Russian rockets hit central Ukraine, Zelensky call it ‘an act of terrorism’ | World News | WION

Russian missiles struck a city in central Ukraine. The strike killed 21 people and wounded about 90 more. Ukrainian president Zelensky called it 'an act of terrorism'.

Read More »

Read More »

US Dollar Strength: “Unintended Consequences” Or “The Empire Strikes Back”?

How unintended can these consequences be? My guess: not very. A great many people got the U.S. dollar trade wrong. The conventional view held that "printing money", i.e. expanding the supply of money, would automatically devalue the currency. It isn't quite so simple, it seems.

Read More »

Read More »

Gravitas: Ukraine war: Putin renews old friendships

Europe is on the edge after the Russian Nord Stream gas link was shutdown. President Vladmir Putin is making fresh moves. He will travel to Iran next week. Palki Sharma tells you what to expect.

#Gravitas #Ukraine #VladimirPutin

Read More »

Read More »

The Economist Reviews Pandemic Goods Boom 2020-22 [Eurodollar University, Ep. 261]

The Economist recounts how the pandemic led to a goods-consumption-boom and whether post-pandemic economics means normalization, or a services boom or a recession.

Read More »

Read More »

Calm Before the Tempest?

Is it beyond conception that the core actually strengthens for a length of time before the unraveling reaches it?Let's start by stipulating the obvious: no one knows the future, and most of the guesses--oops, I mean forecasts--will be wrong. Arguing about the forecasts now won't make any difference as to which ones are correct and which ones are wrong.

Read More »

Read More »

The Economist Notes UK’s Economy was Maimed 15 Years Ago [Eurodollar University, Ep. 260]

The Economist admits to, warns of and draws attention to Britain's 15-year economic depression, labeling it a "slow-burning crisis", "long-standing", "stagnation nation" and "a chronic disease". There are many devastating socioeconomic, geopolitical consequences. It's not just Britain, it's the world.

Read More »

Read More »

Black holes: why they matter

NASA’s James Webb Telescope has captured this stunning image of stars around a black hole. Yet black holes remain among the biggest mysteries of the universe. What are they and why are they so important?

Read More »

Read More »

Ukraine: Harvest season makes farmers anxious, estimated 22 million tons of grain blocked | WION

Harvest season begins in September and is often marked by festivities in other parts of the world but in Ukraine farmers are anxious especially with the ports blocked and warehouses filled with last times harvest, what miseries will come this season along with the raging Russia-Ukraine war?

Read More »

Read More »

Why Nations Fail

The irony is that the suppression of dissent is the suppression of competing ideas that generate systemic stability via rapid adaptation. Nations that appear stable may fail once they're under pressure.

Read More »

Read More »

Possibility of peace talks: Putin says not rejecting peace negotiations | World English News

Amid the ongoing Russian invasion of Ukraine, Russian President Vladimir Putin said that he is not rejecting peace negotiations. He added that the West wants to defeat him and Russia.

Read More »

Read More »

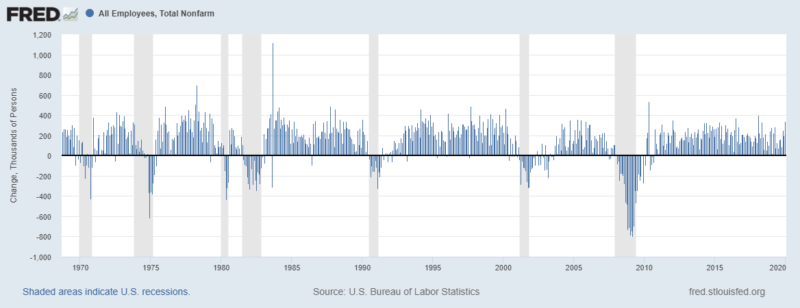

Weekly Market Pulse: A Most Unusual Economy

The employment report released last Friday was better than expected but the response by bulls and bears alike was exactly as expected. Both found things in the report to support their preconceived notions about the state of the economy.

Read More »

Read More »

Zelensky calls for modern military aid as assault in Eastern Ukraine intensifies

It has been several months since the Russian invasion of Ukraine rages on. Scores of civilians have lost their lives in the conflict. Now, Zelensky calls for modern military aid as the assault in Eastern Ukraine intensifies.

Read More »

Read More »

MacroVoices #331 Jeff Snider: The Eurodollar Curve Says Deflation Not Inflation

MacroVoices Erik Townsend and Patrick Ceresna welcome Jeff Snider to the show. Jeff says that monetary inflation is NOT the cause of out-of-control consumer prices, and he doesn’t see stagflation as a big risk.

Read More »

Read More »

No end to the Ukraine-Russia war in sight as Ukrainian President Zelensky visits Dnipro | WION

The Russian invasion of Ukraine has been raging on for months now and there is still no end to the Ukraine-Russia war in sight. Now, Ukrainian President Zelensky visits Dnipro.

Read More »

Read More »

The Market Is Playing Tug of War With the Fed

On the eve of one of the most consequential Jobs Fridays maybe ever, Jeffrey Snider says markets reflect an ongoing struggle between central bankers and investors. The former believe they must continue on their rate-hiking path.

Read More »

Read More »

You Know What Would Be Really Irritating? A Crazy Rally to New Highs

It would be very irritating to have a rally suck in all the bears salivating for a crash from a bear-market rally peak and then decimate the shorts with a rally that soars rather than collapses to new lows. As a contrarian, I'm always squinting at the consensus and wondering if it is really that easy to be right.

Read More »

Read More »