Category Archive: 5) Global Macro

Dollar Runs Out of Steam as Sterling Leads the Way

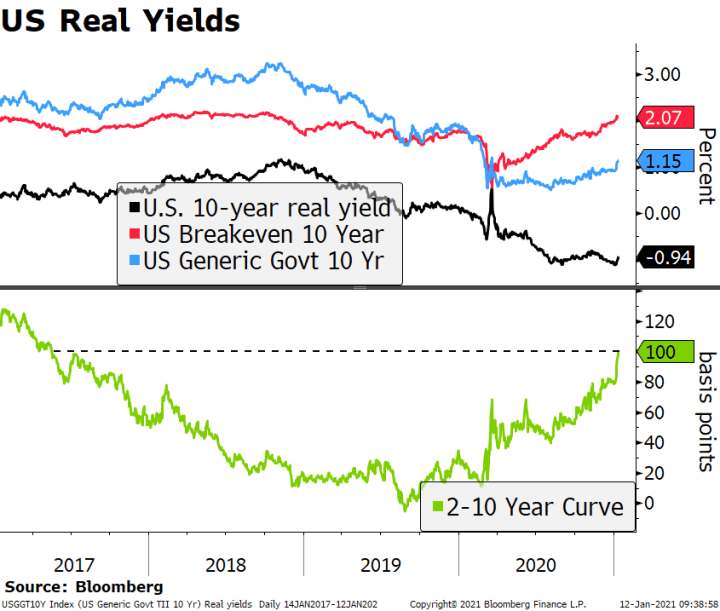

The US curve continues to steepen; real US yields have become less negative; UST supply will remain an issue as $38 bln of 10-year notes will be sold today; Brazil reports December IPCA inflation.

Read More »

Read More »

SMART BOURSE – L’invité de la mi-journée : Thomas Costerg (Pictet WM)

Lundi 11 janvier 2021, SMART BOURSE reçoit Thomas Costerg (Économiste sénior US, Pictet WM)

Read More »

Read More »

2021: If It Wasn’t For Bad Luck, We Wouldn’t Have No Luck At All

If we have indeed begun a sustained "reversal of fortune", it might be prudent to consider the possibility we're only in the first inning of a sustained run of back luck.

Read More »

Read More »

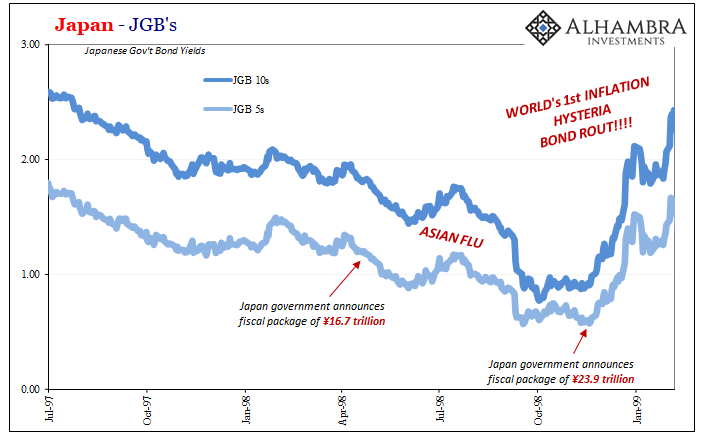

They’ve Gone Too Far (or have they?)

Between November 1998 and February 1999, Japan’s government bond (JGB) market was utterly decimated. You want to find an historical example of a real bond rout (no caps nor exclamations necessary), take a look at what happened during those three exhilarating (if you were a government official) months.

Read More »

Read More »

There’s Always A First Time

Is it a race against time? Or is it trying to set aside today so as to focus entirely on a specific kind of tomorrow? It’s easy to do the latter especially when today is what it is; you can’t change what’s already gone on.

Read More »

Read More »

Inflation: could covid-19 cause prices to rise? | The Economist

In the past two decades inflation has puzzled economists by remaining low in good times and bad. Could the pandemic cause it to rise?

Sign up to The Economist’s daily newsletter to keep up to date with our latest coverage: https://econ.st/3aor3kg

Find all of our finance and economics coverage: https://econ.st/3nsEfZm

Read our special report about how inflation is losing its meaning as an economic indicator: https://econ.st/3noSaPY

How to...

Read More »

Read More »

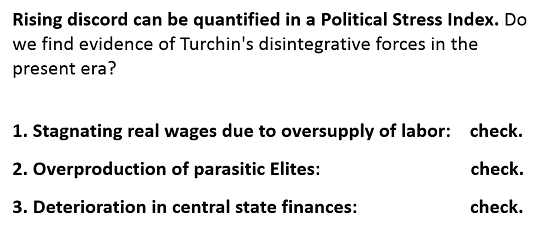

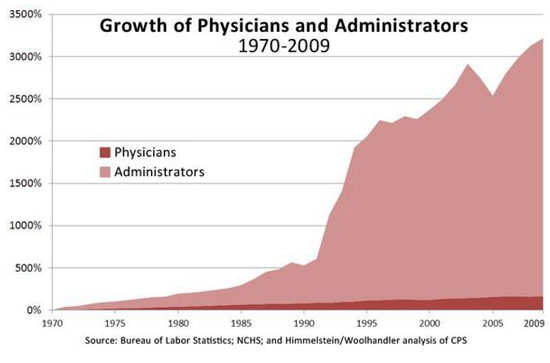

The Tyranny Nobody Talks About

All the tricks to hide our unaffordable cost structure have reached marginal returns.

Reality is about to intrude.

There is much talk of tyranny in the political realm, but little is said about the tyrannies

in the economic realm, a primary one being the tyranny of high costs: high costs

crush the economy from within and enslave those attempting to start enterprises or keep their

businesses afloat.

Traditionally, costs are broken down into...

Read More »

Read More »

Charles Hugh Smith The Fourth Estate’s Role in Thrusting America into Fascism

Charles Hugh Smith explains the “Fourth Estate” that refers to the press and news media, both in explicit capacity of advocacy and implicit ability to frame political issues.

Read More »

Read More »

SMART BOURSE – L’invité de la mi-journée : Thomas Costerg (Pictet WM)

Jeudi 7 janvier 2021, SMART BOURSE reçoit Thomas Costerg (Économiste sénior US, Pictet WM)

Read More »

Read More »

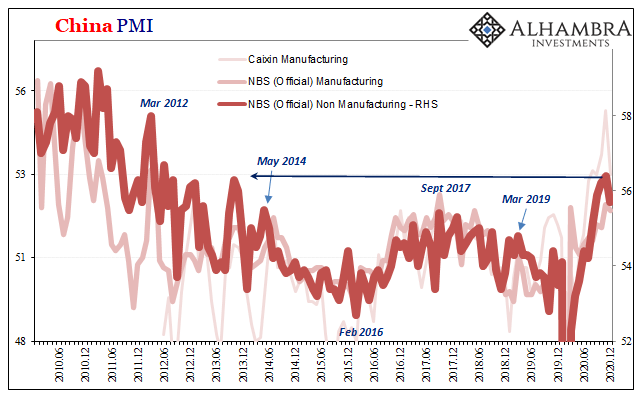

Seizing The Dirt Shirt Title

In mid-December 2019, before the world had heard of COVID, China’s Central Economic Work Conference had released a rather startling statement for the world to consume. In the West, everything was said to be on the up. Central banks had responded, forcefully, many claimed, more than enough to deal with that year’s “unexpected” globally synchronized downturn.

Read More »

Read More »

The Coming War on Wealth and the Wealthy

Here's looking at you, Federal Reserve--thanks for perfecting 'legalized looting' and neofeudalism in America.

Read More »

Read More »

SMART BOURSE – L’invité de la mi-journée : Thomas Costerg (Pictet WM)

Lundi 4 janvier 2021, SMART BOURSE reçoit Thomas Costerg (Économiste sénior US, Pictet WM)

Read More »

Read More »

2020 Was a Snack, 2021 Is the Main Course

One of the dishes at the banquet of consequences that will surprise a great many revelers is the systemic failure of the Federal Reserve's one-size-fits-all "solution" to every spot of bother: print another trillion dollars and give it to rapacious financiers and corporations.

Read More »

Read More »

Bill Gates: How to fund the green revolution | The Economist

Bill Gates outlines his vision for a global green revolution. He tells Zanny Minton Beddoes, our editor-in-chief, how renewable energy is merely the first step in combatting climate change.

00:00 - How to fund a green economy

00:38 - Lessons from the pandemic

01:52 - Behaviour change v innovation in technology

03:36 - Most promising renewable technologies

04:31 - Private sector investment in green technology

06:30 - How essential are carbon...

Read More »

Read More »

2020 the “Worst Year Ever”–You’re Joking, Right?

So party on, because "the worst year ever" is ending and the rebound of financial markets, already the greatest in recorded history, will only become more fabulous.

Read More »

Read More »

Misty Copeland: why ballet has so few black dancers | The Economist Podcast

Misty Copeland made history by becoming the first black female principal dancer at American Ballet Theatre. She talks to The Economist about the lack of diversity in ballet.

00:00 - Misty Copeland: superstar ballerina

00:24 - The power of the arts

02:15 - Ballet’s lack of diversity

04:28 - Is casting in ballet racist?

05:51 - Colour-blind casting in ballet

07:37 - Blackface in ballet

09:21 - The impact of Obama’s presidency

Listen to the full...

Read More »

Read More »

The World in 2021: five stories to watch out for | The Economist

The World in 2021 will start to look beyond covid-19: to the launch of an asteroid-smashing space probe, the next step in the fight against climate change and China’s supremacy at the box office. Here are five stories to watch out for.

00:00 - Top five stories for 2021

00:39 - Democracy under threat

04:17 - The electric revolution revs up

06:55 - A chance to turn a corner on climate change

10:39 - China v Hollywood: battle of the box offices

14:40...

Read More »

Read More »

Big Media: Selling the Narrative and Crushing Dissent for Fun and Profit

The profit-maximizing Big Tech / Big Media Totalitarian regime hasn't just strangled free speech and civil liberties; it's also strangled democracy.

Read More »

Read More »

Drivers for the Week Ahead

As of this writing, a stimulus deal is close and a US government shutdown Monday may have been avoided; the Fed gave US banks the go-ahead to resume stock buybacks Friday; Fed manufacturing surveys for November will continue to roll out; weekly jobless claims will be reported on Wednesday due to the holiday.

Read More »

Read More »

When Social Capital Becomes More Valuable Than Financial Capital

This devaluation of financial wealth--and its transformation to a dangerous liability--

will reach extremes equal to the current extremes of wealth-income inequality.

Read More »

Read More »