Category Archive: 5) Global Macro

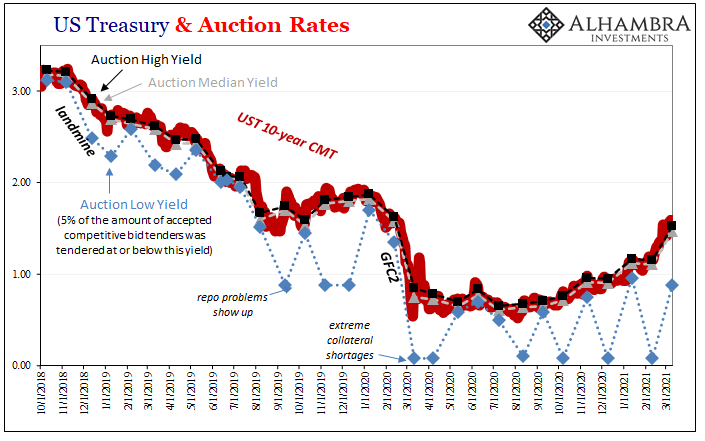

What Gold Says About UST Auctions

The “too many” Treasury argument which ignited early in 2018 never made a whole lot of sense. It first showed up, believe it or not, in 2016. The idea in both cases was fiscal debt; Uncle Sam’s deficit monster displayed a voracious appetite never in danger of slowing down even though – Economists and central bankers claimed – it would’ve been wise to heed looming inflationary pressures to cut back first.

Read More »

Read More »

How covid-19 is boosting innovation | The Economist

Covid-19 has accelerated the adoption of technologies and pushed the world faster into the future. As businesses and organisations look towards the post-pandemic era, what lessons can be learned about innovation? Read more here: https://econ.st/3t6T7yM

Chapters

00:00 - How has covid-19 boosted innovation?

01:20 - Drone deliveries

04:20 - How crises lead to innovation

06:47 - How restaurants have innovated

09:29 - Inequality between companies

10:48...

Read More »

Read More »

4 Social Security Planning Steps BEFORE You’re Ready to Retire

Social Security is an important part of almost every retirement plan, whether you’ve saved enough or not. That’s why it’s important to know as much about your Social Security situation as possible. And you don’t want to wait until you’re about to retire to gather the facts and take appropriate steps. Social Security planning needs to start 5 years before your target retirement date.

Read More »

Read More »

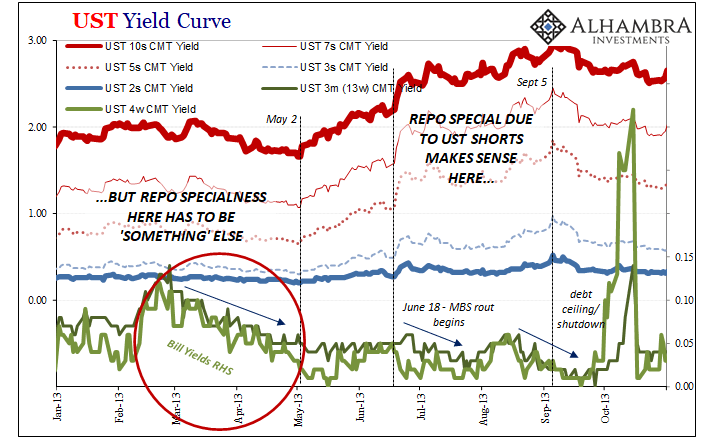

Deja Vu: Treasury Shorts Meet Treasury Shortages

Investors like to short bonds, even Treasuries, as much as they might stocks and their ilk. It should be no surprise that profit-maximizing speculators will seek the best risk-adjusted returns wherever and whenever they might perceive them.

Read More »

Read More »

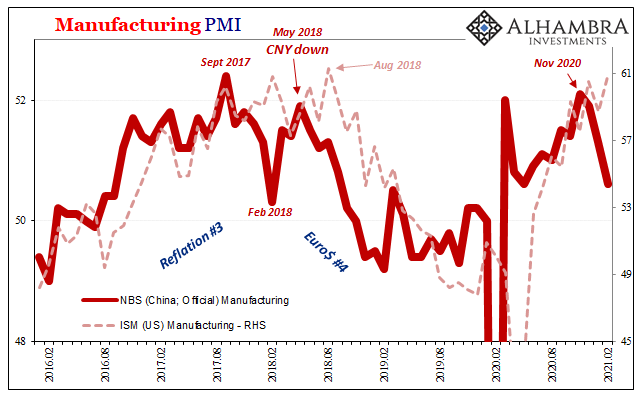

Too Busy Frontrunning Inflation, Nobody Sees the Deflationary Tsunami

Those looking up from their "free fish!" frolicking will see the tsunami too late to save themselves. It's an amazing sight to see the water recede from the bay, and watch the crowd frolic in the shallows, scooping up the flopping fish. In this case, the crowd doing the "so easy to catch, why not grab as much as we can?" scooping is frontrunning inflation, the universally expected result of the Great Reflation Trade.

Read More »

Read More »

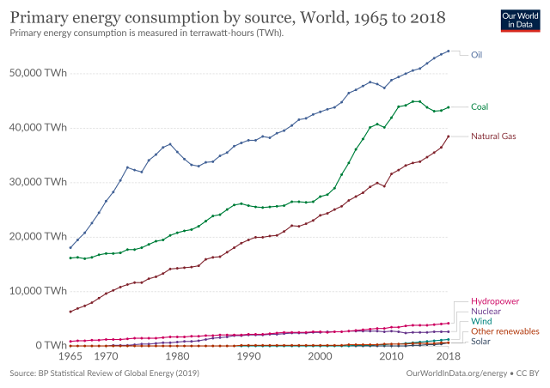

Nuclear power: why is it so unpopular? | The Economist

The meltdown at a nuclear power station in Fukushima, Japan, ten years ago stoked anxieties about nuclear energy. But nuclear is one of the safest, most reliable and sustainable forms of energy, and decarbonising will be much more difficult without it.

Further content:

Sign up to our newsletter about climate change: https://econ.st/38bLSO9

The Economist also has a new weekly newsletter, Simply Science: https://econ.st/3uWjw4b

Find all our...

Read More »

Read More »

There’s Two Sides To Synchronize

The offside of “synchronized” is pretty obvious when you consider all possibilities. In economic terms, synchronized growth would mean if the bulk of the economy starts moving forward, we’d expect the rest to follow with only a slight lag. That’s the upside of harmonized systems, the period everyone hopes and cheers for.

Read More »

Read More »

About That +6.8 percent GDP Forecast: Remember That GDP = Waste

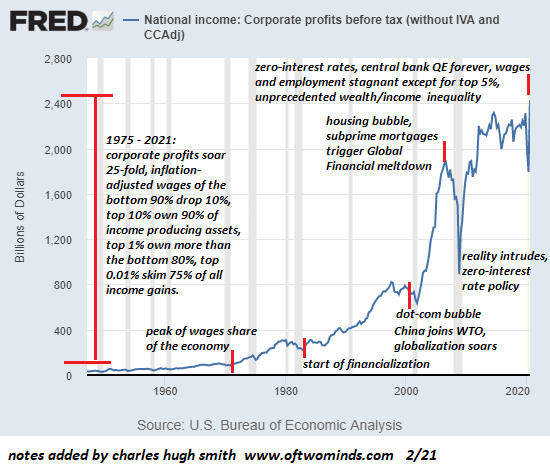

Any economy stupid enough to rely on the insane distortions of GDP "growth" as its primary measure will richly deserve a Darwin Award when it inevitably collapses in a putrid heap of squandered resources and capital.

Read More »

Read More »

What “Normal” Are We Returning To? The Depression Nobody Dares Acknowledge

Perhaps we need an honest national dialog about declining expectations, rising inequality, social depression and the failure of the status quo. Even as the chirpy happy-talk of a return to normal floods the airwaves, what nobody dares

acknowledge is that "normal" for a rising number of Americans is the social depression of downward mobility and social defeat.

Read More »

Read More »

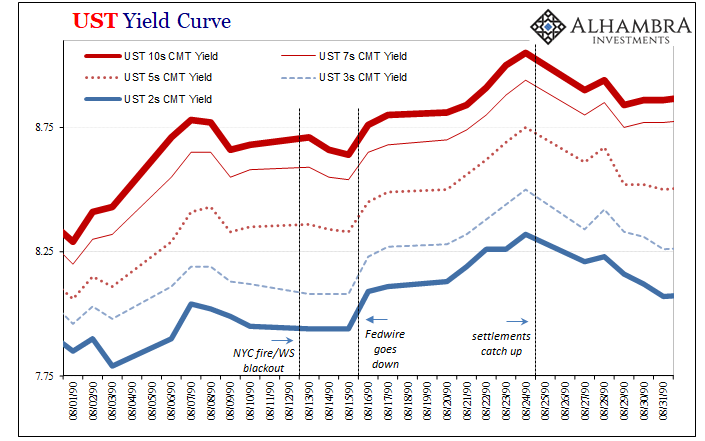

Three Things About Today’s UST Sell-off, Beginning With Fedwire

Three relatively quick observations surrounding today’s UST selloff.1. The intensity. Reflation is the underlying short run basis, but there is ample reason to suspect quite a bit more than that alone given the unexpected interruption in Fedwire yesterday.

Read More »

Read More »

Iran v America: what’s behind the feud? | The Economist

Iran and America’s decades-long feud has led to hostage-taking, sanctions and proxy wars that have shaped the Middle East. What is behind the feud, and can it be resolved?

Chapters

00:00 - The history of the feud

01:01 - 1951-53: The Persian Oil Crisis

02:04 - The 1953 coup

04:11 - 1978-1979: The Iranian revolution

05:12 - 1979-81: The hostage crisis

06:58 - 1980-88: The Iraq-Iran war

09:06 - 1983: US embassy bombing

09:50 - Hizbullah

11:00 - The...

Read More »

Read More »

Oil and Debt: Why Our Financial System Is Unsustainable

How much energy, water and food will the "money" created out of thin air in the future buy? Finance is often cloaked in arcane terminology and math, but the one dynamic that governs the future is actually very simple.

Read More »

Read More »

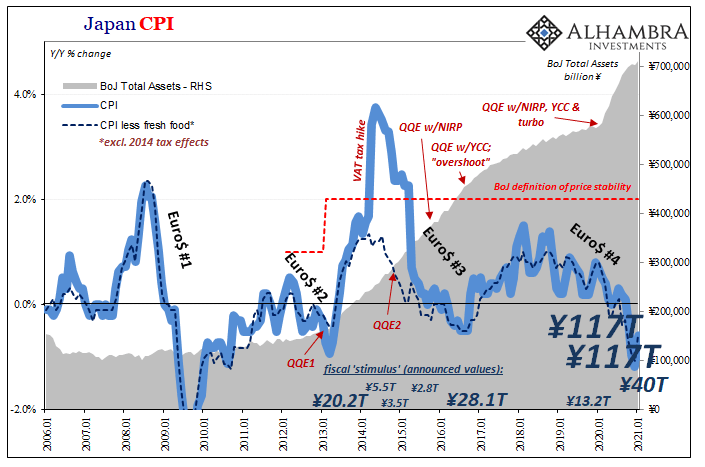

Nine Percent of GDP Fiscal, Ha! Try Forty

Fear of the ultra-inflationary aspects of fiscal overdrive. This is the current message, but according to what basis? Bigger is better, therefore if the last one didn’t work then the much larger next one absolutely will. So long as you forget there was a last one and when that prior version had been announced it was also given the same benefit of the doubt.

Read More »

Read More »

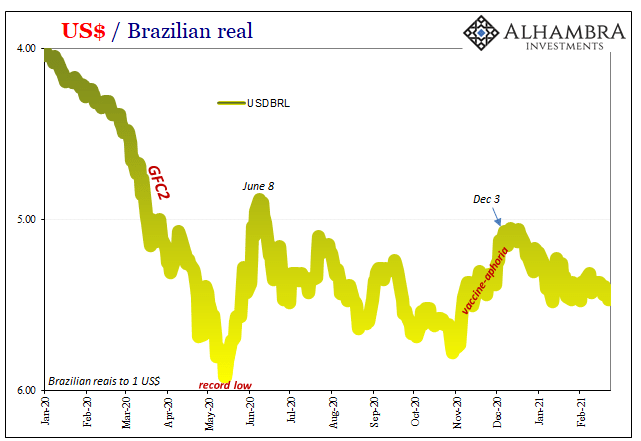

For The Dollar, Not How Much But How Long Therefore How Familiar

Brazil’s stock market was rocked yesterday by politics. The country’s “populist” President, Jair Bolsonaro, said he was going to name an army general who had served with Bolsomito (a nickname given to him by supporters) during that country’s prior military dictatorship as CEO of state-owned oil giant Petróleo Brasileiro SA. Gen. Joaquim Silva e Luna is being installed, allegedly, to facilitate more direct control of the company by the federal...

Read More »

Read More »

What Might Be In *Another* Market-based Yield Curve Twist?

With the UST yield curve currently undergoing its own market-based twist, it’s worth investigating a couple potential reasons for it. On the one hand, the long end, clear cut reflation: markets are not, as is commonly told right now, pricing 1979 Great Inflation #2, rather how the next few years may not be as bad (deflationary) as once thought a few months ago.

Read More »

Read More »

Weekly Market Pulse – Real Rates Finally Make A Move

Last week was only four days due to the President’s day holiday but it was eventful. The big news of the week was the spike in interest rates, which according to the press reports I read, “came out of nowhere”. In other words, the writers couldn’t find an obvious cause for a 14 basis point rise in the 10 year Treasury note yield so they just chalked it up to mystery.

Read More »

Read More »

Eurodollar University’s Making Sense; Episode 46; Part 3: Bill’s Reading On Reflation, And Other Charted Potpourri

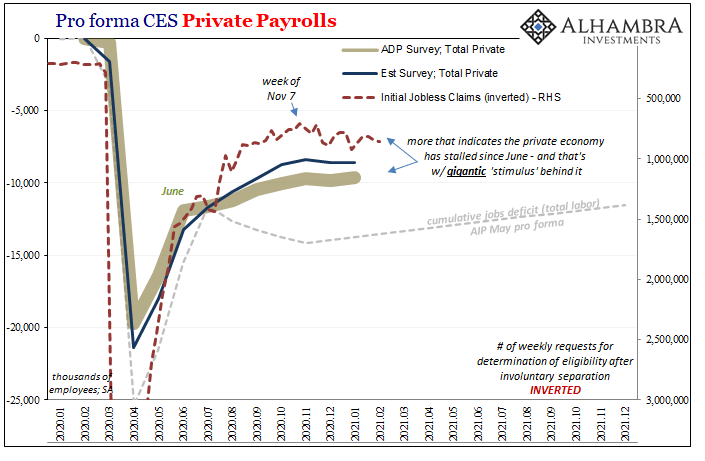

46.3 On the Economic Road to NothingGoodVilleRecent, low consumer price inflation readings combined with falling US Treasury Bill yields are cautionary sign posts that say this reflationary path may not be the road to recovery but a deflationary cul-de-sac.

Read More »

Read More »

How will covid-19 change travel? | The Economist

The covid-19 pandemic has devastated the travel industry. But as vaccines are rolled out and global travel slowly picks up, how will the industry evolve, and will holidays ever be the same again? Read more here: https://econ.st/3aA2row

Sign up to The Economist’s daily newsletter to keep up to date with our latest coverage: https://econ.st/3aor3kg

Read our special report about the future of tourism: https://econ.st/3bnP1vc

Read about why...

Read More »

Read More »

What Poisoned America?

America's financial system is nothing more than a toxic waste dump of speculation, fraud, collusion, corruption and rampant profiteering. What Poisoned America?

Read More »

Read More »