Category Archive: 5) Global Macro

How AI is transforming the creative industries | The Economist

Artificial intelligence is helping humans make new kinds of art. It is more likely to emerge as a collaborator than a competitor for those working in creative industries. Film supported by Mishcon de Reya

Sign up to The Economist’s daily newsletter: https://econ.st/3dm9rp9

Find our most recent science and technology coverage: https://econ.st/2QTAukd

Listen to Babbage, The Economist’s science and technology podcast: https://econ.st/3ftaPJf...

Read More »

Read More »

Jeff Snider On Salomon Brothers, Repo Market, Velocity, Shadow Money, Banks, FED (RCS Ep 117)

Topics- Salomon Brothers, the eurodollar market, treasuries, collateral, derivative market: Jeff tells the story of what happened in the early 90s with the Treasury, Warren Buffett, FED, Primary Dealer Banks, Repo market. Velocity: money supply, shadow money, measuring the monetary system. Repo market as a real monetary market: missing data in the FED’s measurements. FED funds rate, banking system, monetary details.

Read More »

Read More »

Don’t Be the Victim of These 20 IRA Mistakes

Hey! It’s just an IRA. What is there to know? You put money in and it’s a tax deduction, you get to take it out after 59 ½ without paying a penalty, and at 72 the IRS makes you take some out. What else could there be?

In reality, there’s a lot more.

Read More »

Read More »

Weekly Market Pulse: Buy The Rumor, Sell The News

There’s an old saying on Wall Street that one should “buy the rumor, sell the news”, a pithy way to express the efficient market theorem. By the time an event arrives, whatever it may be, the market will have fully digested the news and incorporated it into current prices. And then the market will move on to anticipating the next event, large or small. What prompts this review of Wall Street folk wisdom is the most recent employment report.

Read More »

Read More »

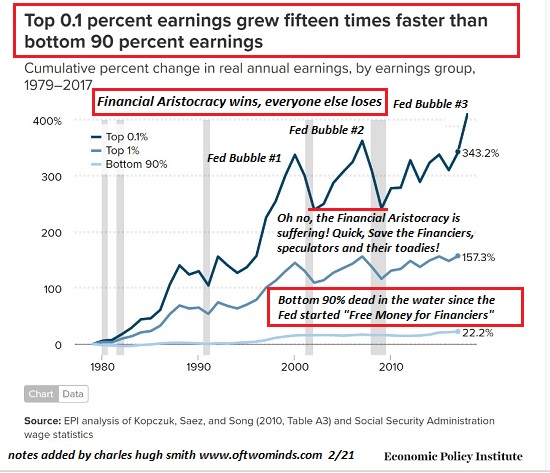

What’s Changed and What Hasn’t in a Tumultuous Year

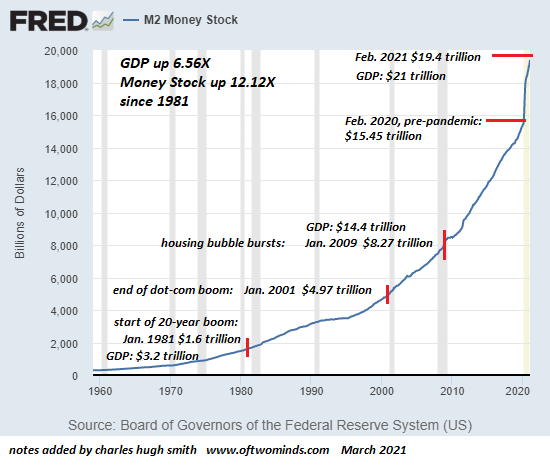

Inequality is America's Monster Id, and we're continuing to fuel its future rampage daily. What's changed and what hasn't in the past year? What hasn't changed is easy: 1. Wealth / income inequality is still increasing. (see chart #1 below)

2. Wages / labor's share of the economy is still plummeting as financial speculation's share has soared. (see chart #2 below)

Read More »

Read More »

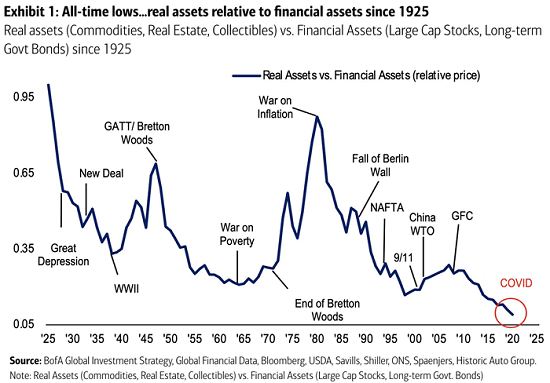

Our “Wealth”: Cloud Castles in the Sky

Buyers know there will always be a greater fool willing to pay more for an over-valued asset because the Fed has promised us it will always be the greater fool. I realize nobody wants to hear that most of their "wealth" is nothing more than wispy Cloud Castles in the Sky that will dissipate in the faintest zephyr, but there it is: that which was conjured out of thin air will return to thin air.

Read More »

Read More »

The UFO/Fed Connection

Perhaps the aliens' keen interest in Earth's central bank magic and its potential for destruction results from a wager. You've probably noticed the recent uptick in UFO sightings and video recordings from aircraft of the extraordinary flight paths of these unidentified objects.

Read More »

Read More »

The remote-working revolution: how to get it right | The Economist

It’s likely working from home is here to stay—for some workers, at least. But this “new normal” will have long-term implications for the relationship between employers and employees—from tax, to employment law, to physical and mental health.

Read more of our coverage on business : https://econ.st/3weF8t0

Listen to our podcast “Homework: the future of the office”: https://econ.st/3ddJo3u

How pandemic is affecting working mums:...

Read More »

Read More »

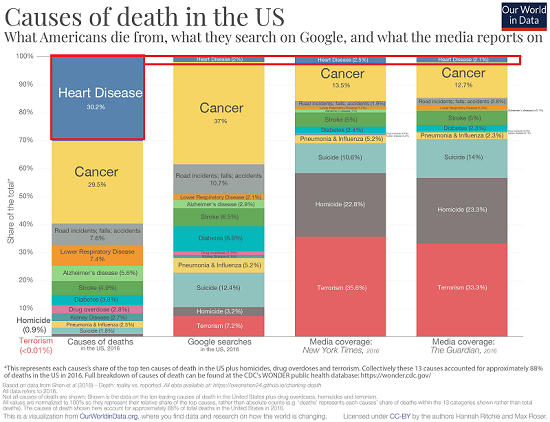

Health, Wealth and What Kills Most of Us

If health is wealth, and it most certainly is the highest form of wealth, then we would be well-served to take charge of our health-wealth in terms of what behaviors we can sustainably modify.

Read More »

Read More »

Can vaccine passports kickstart the economy? | The Economist

Vaccine passports are likely to become a feature of everyday life as lockdowns are lifted across the world. But as “green passes” kick-start economies, what are the potential drawbacks?

Read more of our coverage on coronavirus : https://econ.st/397Mkxq

Listen to "The Jab", our new vaccine-related podcast series: https://econ.st/3w2ZiGC

Listen to our daily podcast "The Intelligence": https://econ.st/3f7O1ic

How well will...

Read More »

Read More »

Israel’s election: what next for Netanyahu? | The Economist

Binyamin Netanyahu, Israel’s prime minister, is campaigning in the country’s fourth election in two years—while also standing trial on corruption charges. Will this election mark a shift in Israel’s political landscape?

00:00 - Four elections in two years: why?

00:57 - How is Netanyahu polling?

01:59 - Netanyahu’s corruption charges

03:03 - What’s next for the corruption trial?

04:33 - What led to government collapse

05:34 - Where has Netanyahu...

Read More »

Read More »

The future of shopping: what’s in store? | The Economist

The pandemic has upended the way people buy—online retail has soared as high-street shops and malls close. Brands are now racing to exploit one of the most important weapons in the battle for buyers: their customers’ data.

Read our special report on the future of shopping here: https://econ.st/2Q8XQC2

Read more of our business coverage: https://econ.st/2OsXUw2

Listen to “Money Talks” weekly podcast on markets, the economy and business:...

Read More »

Read More »

57a Jeff Snider Reacts Live to Paul Krugman Column

Will Stagnation Follow the Biden Boom? So asks New York Times columnist (and Nobel memorial prize winner) Paul Krugman. Jeff Snider listens and reacts to Krugman's lament that though the relief bill is done, recovery may be harder.

Read More »

Read More »

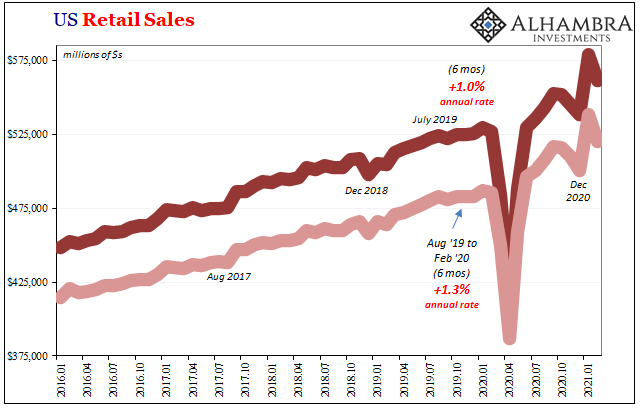

Spending Here, Production There, and What Autos Have To Do With It

While the global inflation picture remains fixed at firmly normal (as in, disinflationary), US retail sales by contrast have been highly abnormal. You’d think given that, the consumer price part of the economic equation would, well, equate eventually price-wise.

Read More »

Read More »

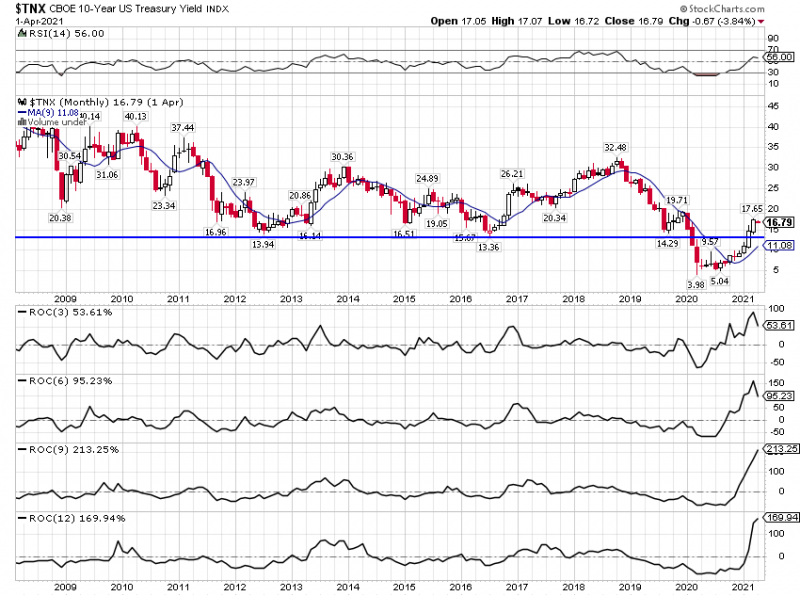

Ep 144- Yields Are Not Showing Inflation ft. Jeff Snider with Srivatsan Prakash

Jeff Snider is the Global Head of Research at Alhambra Investments, and well known for his disinflationary views and his Eurodollar University video. Here he talks about why yields' move higher isn't inflationary, why things are still not inflationary at all, and much more.

Read More »

Read More »

Stimulus Addiction Disorder: The Debt-Disposable Earnings Pyramid

One glance at this chart explains why the status quo is locked on "run to fail" and will implode in a spectacular collapse of the unsustainable debt super-nova.. For those who suspect the status quo is unsustainable but aren't quite sure why, I've prepared a simple chart that explains the financial precariousness many sense.

Read More »

Read More »

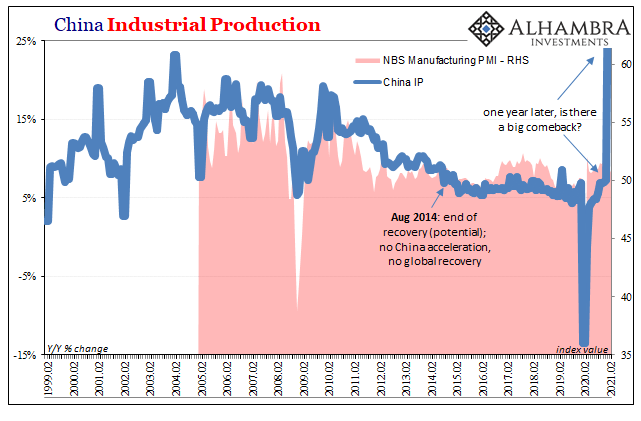

Looking Past Gigantic Base Effects To China’s (Really) Struggling Economy

The Chinese were first to go down because they had been first to shut down, therefore one year further on they’ll be the first to skew all their economic results when being compared to it. These obvious base effects will, without further scrutiny, make analysis slightly more difficult.

Read More »

Read More »

The Cannibalization Is Complete: Only Inedible Zombies Remain

Poor powerless Fed, poor starving cannibals, poor zombies turning to dust. That's the American economy once the curtains are ripped away. Setting aside the fictional flood of zombie movies for a moment, we find the real-world horror is

the cannibalization of our economy, a cannibalization that is now complete.

Read More »

Read More »

How to crunch covid-19 data | The Economist

Data analysis has been crucial to better understanding, tracking and preventing the spread of covid-19. The Economist's data journalists give an insider’s steer on how their analysis and presentation of data has shaped our coverage of the pandemic.

See all our data journalism in The Economist's graphic detail section: https://econ.st/3qEZnMD

Keep up to date with our data journalism by signing up to “Off the Charts,” our new weekly newsletter:...

Read More »

Read More »

JOLTS Revisions: Much Better Reopening, But Why Didn’t It Last?

According to newly revised BLS benchmarks, the labor market might have been a little bit worse than previously thought during the worst of last year’s contraction. Coming out of it, the initial rebound, at least, seems to have been substantially better – either due to government checks or, more likely, American businesses in the initial reopening phase eager to get back up and running on a paying basis again.

Read More »

Read More »