Category Archive: 5) Global Macro

The Upside of a Stock Market Crash

A drought-stricken forest choked with dry brush and deadfall is an apt analogy. While a stock market crash that stairsteps lower for months or years is generally about as welcome as a trip to the guillotine in Revolutionary France, there is some major upside to a crash.

Read More »

Read More »

SMART BOURSE – L’invité de la mi-journée : Thomas Costerg (Pictet WM)

Lundi 23 août 2021, SMART BOURSE reçoit Thomas Costerg (Économiste sénior US, Pictet WM)

Read More »

Read More »

The Smart Money Has Already Sold

Generations of punters have learned the hard way that their unwary greed is the tool the 'Smart Money' uses to separate them from their cash and capital.

Read More »

Read More »

Afghanistan: how the Taliban weakened America | The Economist

The Taliban’s swift return to power in Afghanistan has shocked the world and humiliated America. What effect will this have on the international standing of the US and on global security? Our experts answer your questions.

Further content:

Find more of our coverage on Asia: https://econ.st/3srkBjq

Read more about the Taliban’s terrifying triumph in Afghanistan:https://econ.st/3stoa91

Joe Biden is shirking responsibility for Afghanistan:...

Read More »

Read More »

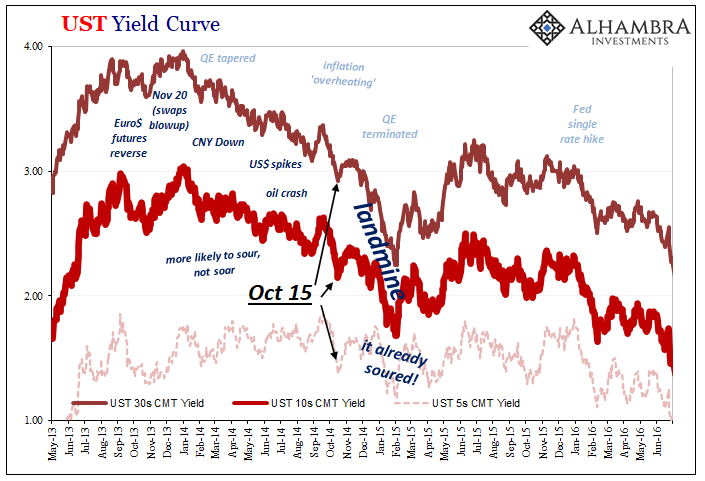

Taper *Without* Tantrum

Whomever actually coined the term “taper”, using it in the context of Federal Reserve QE for the first time, it wasn’t actually Ben Bernanke. On May 22, 2013, the central bank’s Chairman sat in front of Congressman Kevin Brady and used the phrase “step down in our pace of purchases.” No good, at least from the perspective of a media-driven need for a snappy one-word summary.

Read More »

Read More »

Why the Global Economy Is Unraveling

Global supply chain logjams and global credit/financial crises aren't bugs, they're intrinsic features of Neoliberalism's fully financialized global economy. To understand why the global economy is unraveling, we have to look past the headlines to

the primary dynamic of globalization: Neoliberalism, the ideological orthodoxy which holds that introducing market dynamics to sectors that were closed to global markets generates prosperity for all.

Read More »

Read More »

Weekly Market Pulse: Happy Anniversary!

Today is the 50th anniversary of the “Nixon shock”, the day President Richard Nixon closed the gold window and ended the post-WWII Bretton Woods currency agreement. That agreement, largely a product of John Maynard Keynes, pegged the dollar to gold and most other currencies to the dollar.

Read More »

Read More »

Should covid-19 vaccines be mandatory?

Most governments recognise that vaccination is the fastest way out of the pandemic, but in many places hesitancy is hindering the roll-out. Should employers—or even governments—force people to have the vaccine? We answer your questions.

Read more of our covid-19 coverage: https://econ.st/37AvUfF

Listen to “The Jab” podcast from Economist Radio: https://econ.st/3CJKBv8

Listen to our podcast about vaccine incentives: https://econ.st/2XmrDL9

How...

Read More »

Read More »

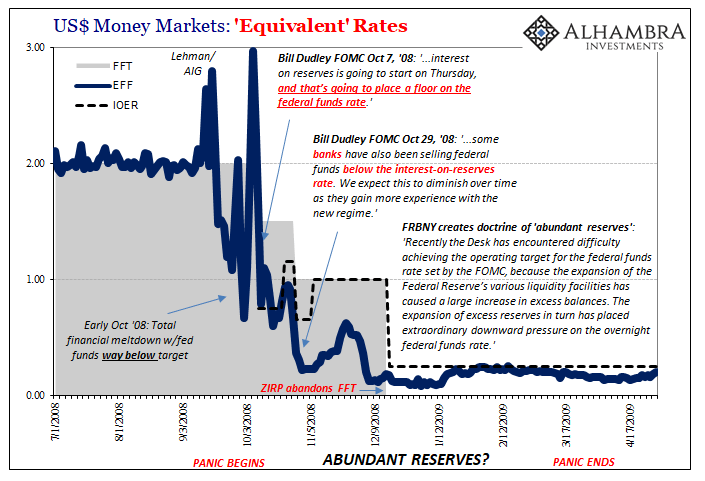

CPI’s At Fives Yet Treasury Auctions

A momentous day, for sure, but one lost in what would turn out to be a seemingly endless sea of them. October 8, 2008, right in the thick of the world’s first global financial crisis (how could it have been global, surely not subprime mortgages?) the Federal Reserve took center stage; or tried to.

Read More »

Read More »

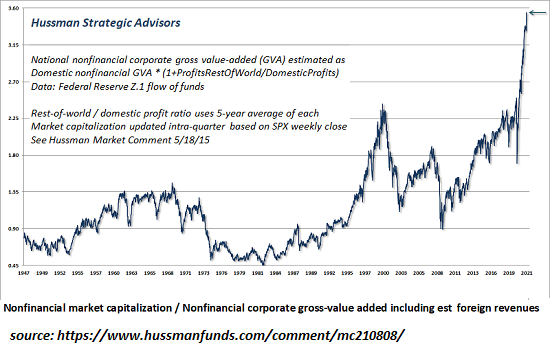

Dear Fed: Are You Insane?

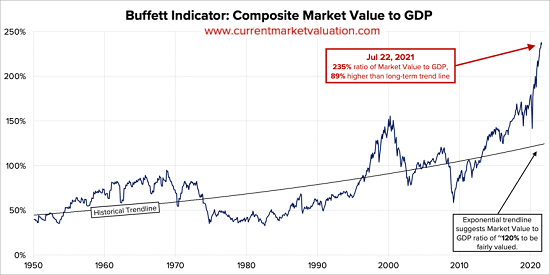

So sorry, America, but your central bank is certifiably insane, and it's not going to magically work out. History definitively shows that speculative bubbles always pop--always. Every speculative

bubble mania, regardless of its supposed uniqueness--"it's different this time"--pops.

Read More »

Read More »

A Real Example Of Price Imbalance

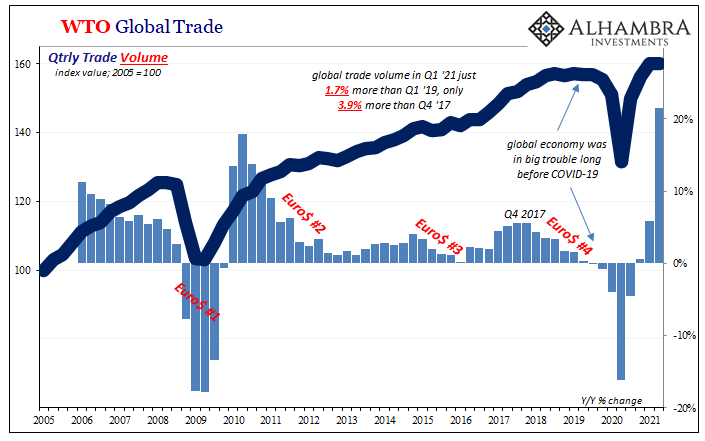

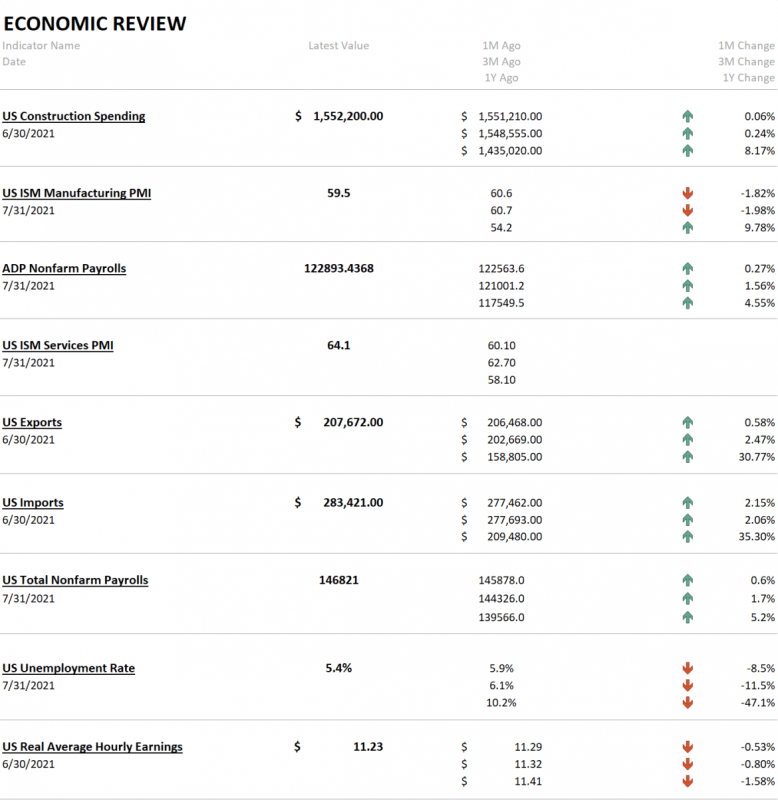

It’s not just the trade data from individual countries. Take the WTO’s estimates which are derived from exports and imports going into or out of nearly all of them. These figures show that for all that recovery glory being printed up out of Uncle Sam’s checkbook, the American West Coast might be the only place where we can find anything resembling Warren Buffett’s red-hot claim.

Read More »

Read More »

The Two Big Anniversaries of August: The Lost Decade (plus) Of The ‘Fiat’ Half Century

As my esteemed podcast co-host Emil Kalinowski has already mentioned (recurrently), we have, this year, two major anniversaries during these dog days of summer circled on our calendar. Today is, obviously, August 9 and for anyone the slightest familiar with the eurodollar story, that date is seared into their consciousness for as long as it will take to rebuild from the ashes created by the monetary fire lit that day. It has been, sadly, fourteen...

Read More »

Read More »

The End of Global Tourism?

Viewed as a complex non-linear system, the pandemic varinants can only be controlled by drastically pruning the physical connections between disparate global groups, which means effectively ending the unrestricted flow of individuals around the planet.

Read More »

Read More »

Weekly Market Pulse: What Is Today’s New Normal?

Remember “The New Normal”? Back in 2009, Bill Gross, the old bond king before Gundlach came along, penned a market commentary called “On the Course to a New Normal” which he said would be:

“a period of time in which economies grow very slowly as opposed to growing like weeds, the way children do; in which profits are relatively static; in which the government plays a significant role in terms of deficits and reregulation and control of the...

Read More »

Read More »

Should we be worried about technology? | The Economist

The covid-19 pandemic has reinforced humanity’s dependence on modern tech, but the same tools that enable remote working are also being used to spread disinformation and perpetuate cybercrime. Ambivalence towards technology is nothing new.

Read more of our coverage of Science & technology: https://econ.st/3CdkVa5

See our Technology Quarterlies: https://econ.st/3jldAN6

Why is pessimism about the impact of technology nothing new?...

Read More »

Read More »

While the Herd Slumbers, Risk Is Rocketing Higher

This wholesale transfer of risk from elites to the workers is finally becoming consequential as wealth / income / security inequality is reaching extremes that are destabilizing society and the economy.

Read More »

Read More »

Sophistry Dressed (as) Reallocation

Stop me if you’ve heard this before: About US$275 billion (about SDR 193 billion) of the new allocation will go to emerging markets and developing countries, including low-income countries.

Read More »

Read More »

What is net zero? | The Economist

More than 50 countries around the world have pledged to become net zero. But what does net zero actually mean—and is it achievable?

Find The Economist’s most recent coverage on climate change: https://econ.st/3zCt2uW

Sign up to The Economist’s daily newsletter to keep up to date with our latest stories: https://econ.st/3gJBH8D

Why do climate pledges fall short?: https://econ.st/3eVCYaI

What are nationally determined contributions to curb...

Read More »

Read More »

The Moment Wall Street Has Been Waiting For: Retail Is All In

The ideal bagholder is one who

adds more on every downturn (buy the dip) and who refuses to sell (diamond hands), holding

on for the inevitable Fed-fueled rally to new highs.

Old hands on Wall Street have been wary of being bearish for one reason, and no, it's not

the Federal Reserve: the old hands have been waiting for retail--the individual investor--

to go all-in stocks. After 13 long years, this moment has finally arrived:

retail is...

Read More »

Read More »

Golden Collateral Checking

Searching for clues or even small collateral indications, you can’t leave out the gold market. We’ve been on the lookout for scarcity primarily via the T-bill market, and that’s a good place to start, yet looking back to last March the relationship between bills and bullion was uniquely strong. It’s therefore a persuasive pattern if or when it turns up again.

Read More »

Read More »