Category Archive: 5) Global Macro

Weekly Market Pulse: Is It Time To Panic Yet?

Until last week you hadn’t heard much about the bond market rally. I told you we were probably near a rally way back in early April when the 10 year was yielding around 1.7%. And I told you in mid-April that the 10 year yield could fall all the way back to the 1.2 to 1.3% range.

Read More »

Read More »

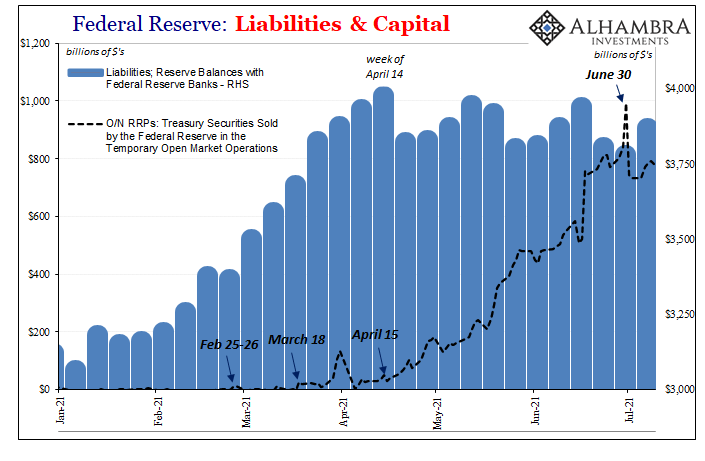

RRP No Collateral Coincidences As Bills Quirk, Too

So much going on this week in the bond market, it actually overshadowed the ridiculous noise coming from the Fed’s reverse repo. Some maybe too many want to make a huge deal out of this RRP if only because the numbers associated with it have gotten so big.

Read More »

Read More »

Jeff Snider On Shadow Money, History, Eurodollar System, Central Banks, Repo, Collateral (RCS 117)

Topics- Were the Dot-Com Bubble and the Housing Bubble caused by the exponential growth of shadow money since the late 80s? Risk, liquidity, Credit Bubble of ’95, China, Eurodollar System. Rehypothecation and how it works: return, leveraging assets, Repo Market, treasuries, repledging, collateral, derivatives. Central Banks, Global Monetary System, Salomon Brothers. Collateral shortage: is that the problem?

Read More »

Read More »

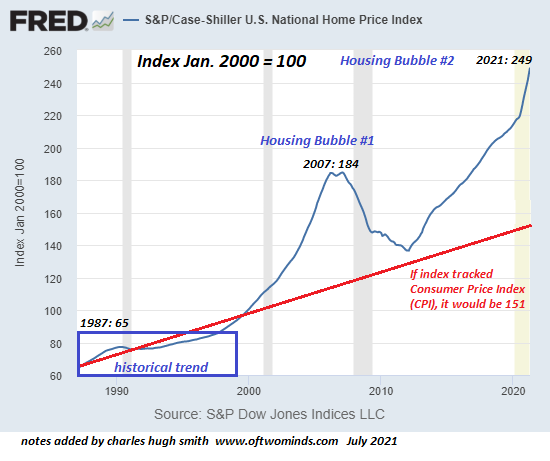

Housing Bubble #2: Ready to Pop?

The expansion of Housing Bubble #2 is clearly visible in these two charts of house valuations, courtesy of the St. Louis Federal Reserve database (FRED). The first is the Case-Shiller Index, which as you recall tracks the price of homes on an "apples to apples" basis, i.e. it tracks price movements for the same house over time. Note that this is an index chart where the index is set at 100 as of January 2000. It is not a chart of median housing...

Read More »

Read More »

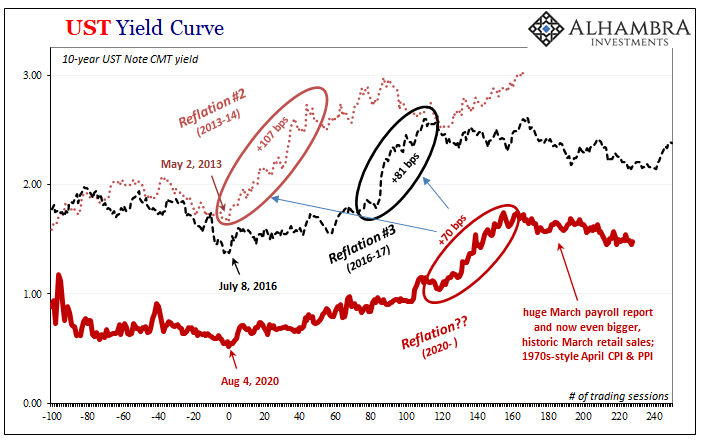

Bond Reversal In Japan, But Pay Attention To It In Germany

Yield curve control, remember that one? For a little while earlier this year, the modestly reflationary selloff in bonds around the world was prematurely oversold as some historically significant beginning to a massive, conclusive regime change.

Read More »

Read More »

SMART BOURSE – L’invité de la mi-journée : Thomas Costerg (Pictet WM)

Jeudi 8 juillet 2021, SMART BOURSE reçoit Thomas Costerg (Économiste sénior US, Pictet WM)

Read More »

Read More »

Covid-19: why your life will never be the same again | The Economist

Across much of the world, covid-19 restrictions are starting to ease. The Economist has crunched the data to calculate how close countries are to pre-pandemic levels of normality—but will life ever be the same again? Read more here: https://econ.st/3AG9siz

Search the interactive normality tracker: https://econ.st/3hDGHum

How life is halfway back to pre-covid norms?: https://econ.st/3dQSy70

Read all of coronavirus coverage:...

Read More »

Read More »

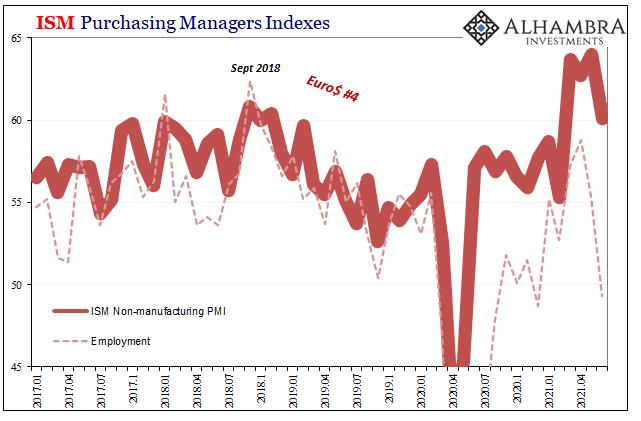

ISM’s Nasty Little Surprise Isn’t Actually A Surprise

Completing the monthly cycle, the ISM released its estimates for non-manufacturing in the US during the month of June 2021. The headline index dropped nearly four points, more than expected. From 64.0 in May, at 60.1 while still quite high it’s the implication of being the lowest in four months which got so much attention.

Read More »

Read More »

A Few Things About Reinforced Concrete High-Rise Condos

The second most remarkable thing about the sudden collapse of the Florida condo building was the rush to assure everyone that this was a one-off catastrophe: all the factors fingered as causes were unique to this building, the implication being all other high-rise reinforced concrete condos without the exact same mix of causal factors were not in danger.

Read More »

Read More »

Virus Z: A Thought Experiment

Let's run a thought experiment on a hypothetical virus we'll call Virus Z, a run-of-the-mill respiratory variety not much different from other viruses which are 1) very small; 2) mutate rapidly and 3) infect human cells and modify the cellular machinery to produce more viral particles.

Read More »

Read More »

Mass extinction: what can stop it? | The Economist

The world’s animals and wildlife are becoming extinct at a greater rate than at any time in human history. Could technology help to save threatened species?

Read our latest technology quarterly on protecting biodiversity: https://econ.st/3dqdkKN

Listen to our Babbage podcast episode on the biodiversity crisis: https://econ.st/3dqfPww

Sign up to The Economist’s daily newsletter to keep up to date with our latest stories:...

Read More »

Read More »

Anyone Remember That Whole SLR Cliff?

Does anyone remember the SLR “cliff?” Of course you don’t, because in the end it didn’t seem to make any difference. For a few weeks, it was kind of ubiquitous if only in the sense that it was another one of those deep plumbing issues no one seems able to understand (forcing all the “experts” to run to Investopedia in order write something up about it).

Read More »

Read More »

The Systemic Risk No One Sees

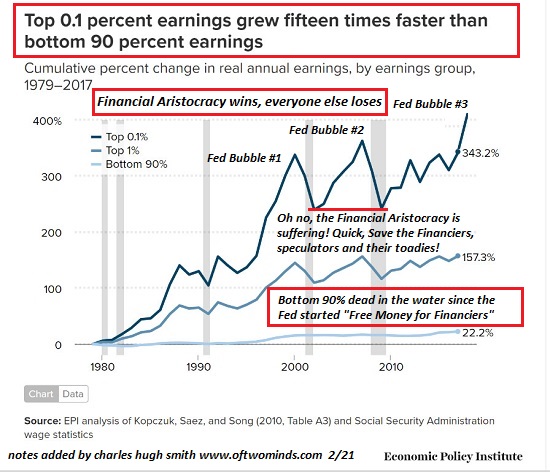

My recent posts have focused on the systemic financial risks created by Federal Reserve policies that have elevated moral hazard (risks can be taken without consequence) and speculation to levels so extreme that they threaten the stability of the entire financial system.

Read More »

Read More »

When Expedient “Saves” Become Permanent, Ruin Is Assured

The belief that the Federal Reserve possesses god-like powers and wisdom would be comical if it wasn't so deeply tragic, for the Fed doesn't even have a plan, much less wisdom. All the Fed has is an incoherent jumble of expedient, panic-driven "saves" it cobbled together in the 2008-2009 Global Financial Meltdown that it had made inevitable.

Read More »

Read More »

A Clear Balance of Global Inflation Factors

Back at the end of May, Germany’s statistical accounting agency (deStatis) added another one to the inflationary inferno raging across the mainstream media. According to its flash calculations, German consumer prices last month had increased by the fastest rate in 13 years.

Read More »

Read More »

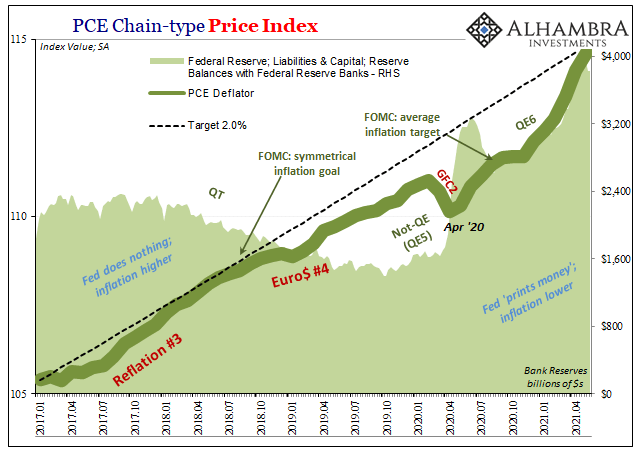

Inflation Isn’t Just The Outlier, The Inflation In It Is, Too

Following the same recent pattern as the BLS and its CPI, the Bureau of Economic Analysis’s (BEA) PCE Deflator ran up hotter in May 2021 than its already high increase during April. The latter’s headline consumer basket rose 3.91% year-over-year, its fastest pace since August 2008.

Read More »

Read More »

America’s Social Order is Unraveling

What kind of nation boasts a record-high stock market and an unraveling social order? Answer: a failed nation, a nation that has substituted artifice for realism for far too long, a nation that now depends on illusory phantoms of capital, prosperity and democracy to prop up a crumbling facade of "wealth" that the populace now understands is largely in the hands of a few families and corporations, most of which pay little to support the citizenry...

Read More »

Read More »

China’s economy: what’s its weak spot? | The Economist

The number of working-age people in China is shrinking. Could this threaten the country’s rise as an economic superpower? Read more here: https://econ.st/3dgzqz0

Find all of our coverage about China here: https://econ.st/3qpd7wz

Read our special report about Chinese youth: https://econ.st/2TXmwzd

Is China’s population shrinking? https://econ.st/3vTXxu2

Listen to an episode of “The Intelligence” podcast about China’s census:...

Read More »

Read More »

SMART BOURSE – L’invité de la mi-journée : Thomas Costerg (Pictet WM)

Jeudi 24 juin 2021, SMART BOURSE reçoit Thomas Costerg (Économiste sénior US, Pictet WM)

Read More »

Read More »