Category Archive: 5) Global Macro

How the Amazon became a Wild West of land-grabbing

To save the Amazon rainforest, Brazil’s President Lula must work out who owns it. But with 22 different agencies registering land claims–and many of them overlapping–it’s not an easy task.

00:00 - How is Amazonian land distributed?

00:27 - How do land claims conflict?

01:15 - How is Lula helping?

Sign up to The Economist’s daily newsletter: https://econ.st/3QAawvI

Read our coverage on the Brazilian Amazon: https://econ.st/3NnFA2l

Why the...

Read More »

Read More »

Who made millions from the attack on Israel?

In the days before the October 7th attack short selling of Israeli stocks spiked in New York, making someone a lot of money. How likely is it that a Hamas insider was behind it?

00:00 - Pre-war stock market changes

00:33 - What happened to the stocks?

01:03 - Who was behind it?

Sign up to The Economist’s daily newsletter: https://econ.st/3QAawvI

Read our coverage on Israel and Hamas: https://econ.st/46Ka8Cy

Did Hamas make millions trading the...

Read More »

Read More »

The race to improve weather forecasting

As global warming makes weather more extreme and deadly, accurate and accessible weather forecasting has never been more needed.

00:00 - Hurricane Otis

00:40 - Extreme weather

01:33 - Democratic Republic of Congo

02:38 - Problems with forecasting

04:25 - Innovative solutions

05:41 - Arrival of AI

07:30 - Smallholder farmers

09:30 - Early warning systems

Read about the high-tech race to improve weather forecasting: https://econ.st/4a1pqpo

Listen...

Read More »

Read More »

How green is the energy revolution really?

We hear a lot about the need to get off fossil fuels. How is the energy transition really going and how fast is the world moving towards a green future?

00:51 How did the war in Ukraine impact the green revolution?

05:50 Why is green energy booming in unlikely places?

08:31 Rewiring the world for net zero

11:40 Is nuclear energy making a comeback?

14:20 Texas: the anti-green future of clean energy

18:09 Do environmentalists need to change?...

Read More »

Read More »

What’s wrong with lockdown drills for school shootings?

To teach students how to protect themselves from an active shooter most American schools run lockdown drills – but could they do more harm than good?

00:00 - What are lockdown drills?

00:43 - When did lockdowns become widespread?

01:25 - What are the national guidelines?

01:47 - The impact on children

Sign up to The Economist’s daily newsletter: https://econ.st/3QAawvI

Read our full investigation: https://econ.st/477yzLd

Inside America’s hoax...

Read More »

Read More »

Why some teachers in America are learning how to fire guns

Gun crime in American schools is increasing–but does training teachers how to shoot make classrooms any safer?

00:00 - Is arming teachers the solution?

00:50 - Meet the teachers learning to shoot

01:55 - Why they want to learn

03:17 - How effective is the training?

Sign up to The Economist’s daily newsletter: https://econ.st/3QAawvI

Read our full investigation: https://econ.st/477yzLd

Inside America’s hoax school shootings epidemic:...

Read More »

Read More »

Hoax school shootings: inside America’s epidemic

In America the fear of gun crime in schools is being weaponised. More and more SWAT teams are having to respond to hoax calls about school shootings.

00:00 - America’s hoax school shooting crisis

01:07 - Hoax calls are becoming more commonplace

02:00 - Aspen Elementary School

03:29 - What happened on February 22nd 2023?

05:10 - Who was behind it?

07:35 - The fight against SWAT hoax calls

Sign up to The Economist’s daily newsletter:...

Read More »

Read More »

The Invisible Court’s Verdict: You Are Hereby Exiled to Digital Siberia

As in the Gulag it replicates, the innocent are swept up with the guilty in a disconcertingly unjust ratio.

Read More »

Read More »

Trump’s trials: How much jeopardy is he really in?

Accusations of election manipulation and the mishandling of classified documents are just a few of the criminal charges former President Donald Trump faces across four criminal trials as the race for the White House gets underway. But is he really in jeopardy or will he succeed in turning his legal woes to his political advantage?

00:00 - How much jeopardy is Trump really in?

00:31 - The cases

03:05 - The risks

04:02 - Trump’s campaign

Sign up to...

Read More »

Read More »

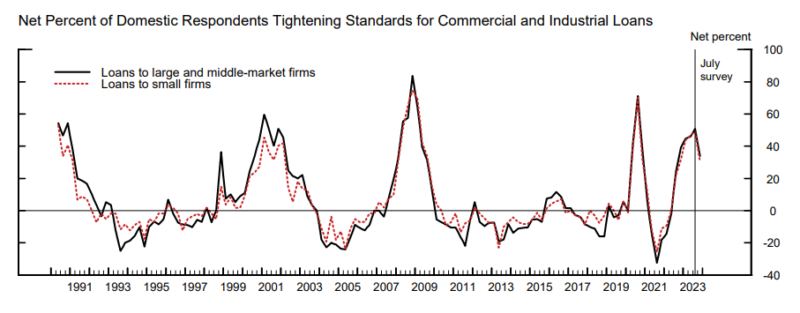

Macro: Banking: Senior Loan Officer’s Survey and Lending

Banks continue to tighten lending standards across all sectors. This has eased a bit from the July survey. Banks continue to widen spreads across all sectors. The percentage of banks widening spreads has also eased a tad.

Read More »

Read More »

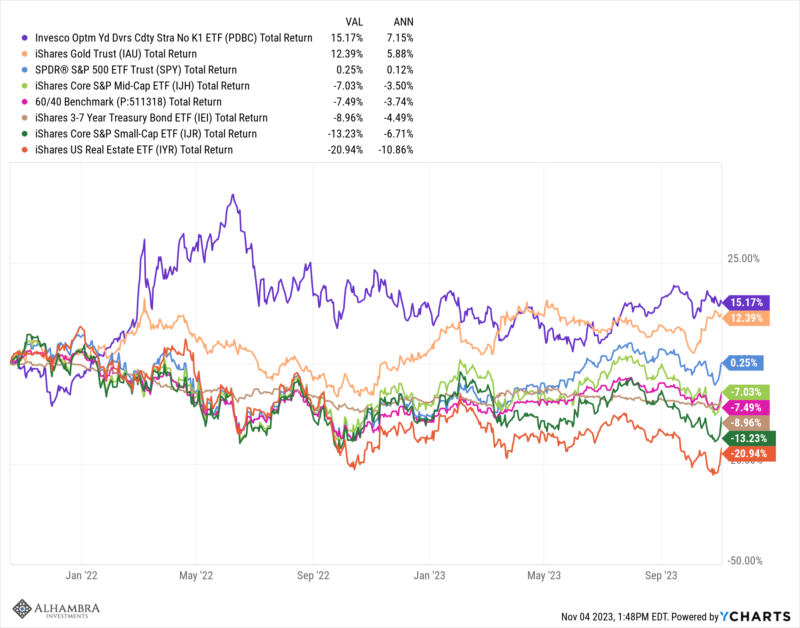

Weekly Market Pulse: Monetary Policy Is Hard

So, is that it? Have rates peaked? Is the long bear market finally over?

The market decided last week that interest rates have peaked for this cycle. And if rates have peaked then all the assets that have been pressured over the last two years can finally come up for air. Since October 18, 2021, over two years ago, investors have had few places to hide. Of the major asset classes we follow closely, only two – gold and commodities – were higher by...

Read More »

Read More »

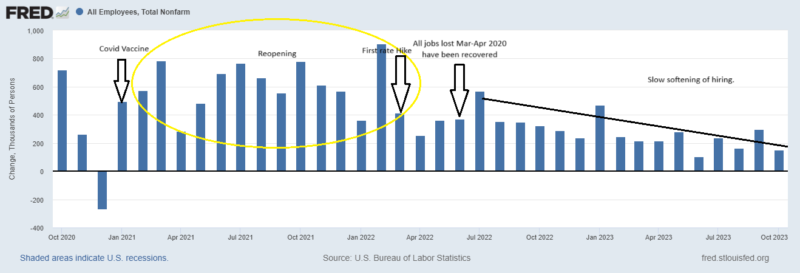

Macro: Employment Report

Wall street cheered the fact that we added fewer jobs (150,000) than expected (179,000) in October. This was a welcome relief after the hot September number that was revised down from 336,000 to 279,000.

Read More »

Read More »

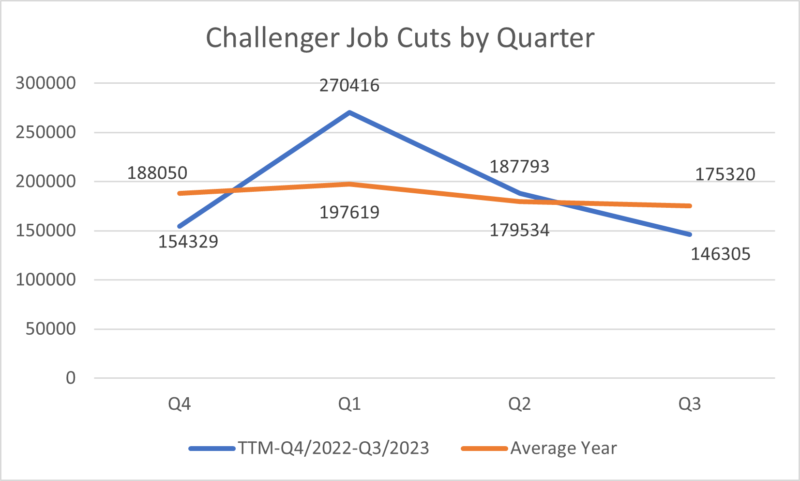

Macro: Challenger Job Cuts — Improvement throughout the year

We had a bad 1st quarter relative to historic averages for job cuts. But the situation has gotten better throughout the year. In the 3rd quarter of 2023 less people are losing their job relative to the average 3rd quarter going back to 1989.

Read More »

Read More »

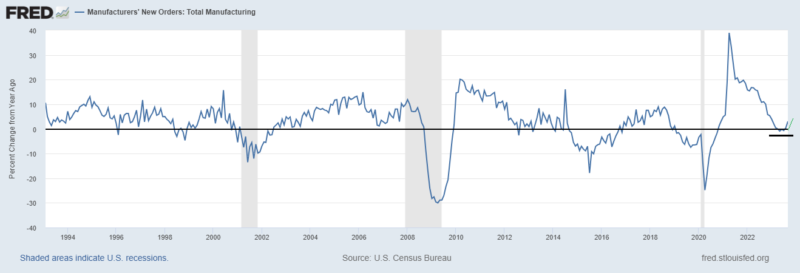

Macro: Factory Orders — revision

This was a slight downward revision. Nothing to cheer and really nothing to write home about.

September Durable Goods were revised down .1% MoM in Sept and .05% MoM in Aug.

Read More »

Read More »

What happens to your brain as you age

As the most complex organ in your body, your brain changes radically throughout your life. Starting from before birth and continuing even after you've died. This is what happens to your brain as you age.

00:00 - What happens to your brain when you age?

00:32 - In the womb

01:03 - Childhood

03:19 - Teenage years

04:48 - Early adulthood

05:27 - Middle age

07:04 - Later life

07:36 - Death

Sign up to The Economist’s daily newsletter:...

Read More »

Read More »

What is Hizbullah?

Hizbullah has been shooting rockets across the Israel-Lebanon border. If it intervenes in the Israel-Hamas conflict, it could lead to serious escalation.

00:00 - The origins of Hizbullah

01:06 - Its political rise

02:00 - How big a threat is it?

Sign up to The Economist’s daily newsletter: https://econ.st/3QAawvI

Why has Israel’s ground invasion been delayed?: https://econ.st/3tFIlFi

The firepower of Iran-backed militias:...

Read More »

Read More »

Is Israel breaking the rules of war?

The Economist’s defence editor Shashank Joshi spoke to legal experts to find out whether Israel’s response to Hamas’s terrorist attack is lawful.

00:00 - Is Israel breaking the rules of war?

00:59 - Blockade

01:32 - Bombardment

Sign up to The Economist’s daily newsletter: https://econ.st/3QAawvI

Is Israel acting within the laws of war?: https://econ.st/3tzVBv7

Joe Biden steers a risky course after a Gaza hospital blast: https://econ.st/3ty6RIl...

Read More »

Read More »

Are artificial wombs the future?

Scientists are hoping to build the world’s first clinically approved artificial womb. The purpose is to save the lives of more premature babies.

00:00 The dangers of premature birth

01:49 How to build an artificial womb

04:17 How does it work?

05:54 When will artificial wombs be rolled out?

Sign up to The Economist’s weekly science newsletter: https://econ.st/46wOpyv

Read our full quarterly report on fertility: https://econ.st/3S1LZnj

Watch...

Read More »

Read More »

Can Netanyahu’s leadership survive the war?

Many Israelis blame Prime Minister Binyamin Netanyahu for failing to stop Hamas’ terrorist attack. Can his leadership survive the war and its fallout?

00:28 - What will the war do to Netanyahu?

00:52 - Government’s absence

01:20 - Protests

01:52 - Positive changes

Sign up to The Economist’s daily newsletters: https://econ.st/3QAawvI

Read about how Hamas’ atrocities and Israel’s retaliation will change both sides forever: https://econ.st/3Qq13tL...

Read More »

Read More »

How powerful is Hamas?

On October 7th Hamas fighters launched a surprise attack on Israel and slaughtered more than 1,300 people, mostly civilians. What is Hamas and how powerful is it?

00:00 - What is Hamas?

00:55 - Hamas’s control of Gaza

01:18 - Growth of Hamas military capacity

01:32 - The latest attack on Israel

Sign up to The Economist’s daily newsletter: https://econ.st/3QAawvI

Hamas’s attack was the bloodiest in Israel’s history: https://econ.st/3ts3qD3

A...

Read More »

Read More »