Category Archive: 5) Global Macro

2021: If It Wasn’t For Bad Luck, We Wouldn’t Have No Luck At All

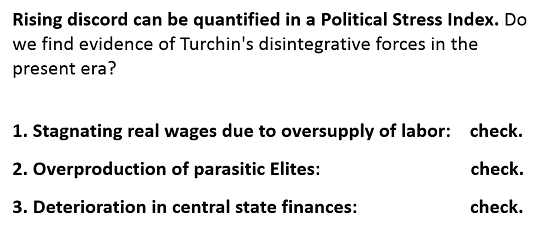

If we have indeed begun a sustained "reversal of fortune", it might be prudent to consider the possibility we're only in the first inning of a sustained run of back luck.

Read More »

Read More »

They’ve Gone Too Far (or have they?)

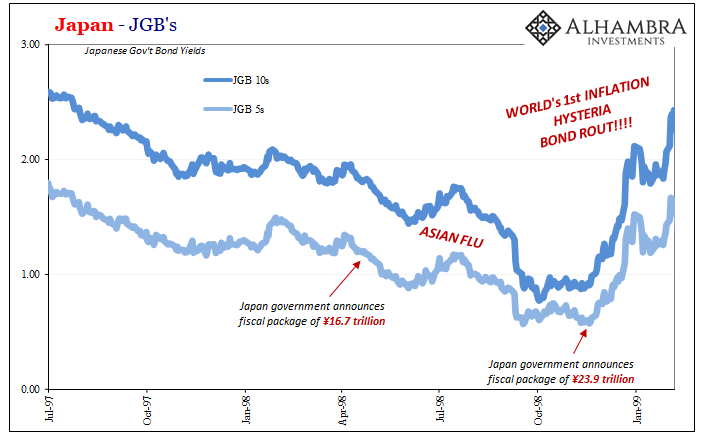

Between November 1998 and February 1999, Japan’s government bond (JGB) market was utterly decimated. You want to find an historical example of a real bond rout (no caps nor exclamations necessary), take a look at what happened during those three exhilarating (if you were a government official) months.

Read More »

Read More »

There’s Always A First Time

Is it a race against time? Or is it trying to set aside today so as to focus entirely on a specific kind of tomorrow? It’s easy to do the latter especially when today is what it is; you can’t change what’s already gone on.

Read More »

Read More »

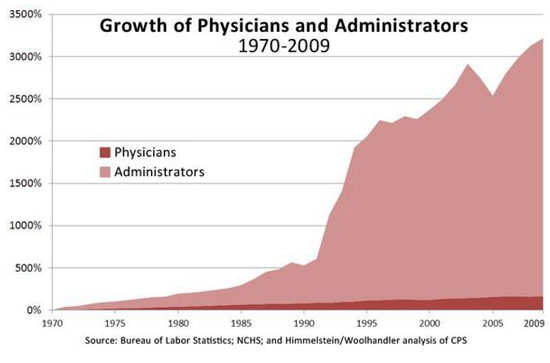

The Tyranny Nobody Talks About

All the tricks to hide our unaffordable cost structure have reached marginal returns.

Reality is about to intrude.

There is much talk of tyranny in the political realm, but little is said about the tyrannies

in the economic realm, a primary one being the tyranny of high costs: high costs

crush the economy from within and enslave those attempting to start enterprises or keep their

businesses afloat.

Traditionally, costs are broken down into...

Read More »

Read More »

Seizing The Dirt Shirt Title

In mid-December 2019, before the world had heard of COVID, China’s Central Economic Work Conference had released a rather startling statement for the world to consume. In the West, everything was said to be on the up. Central banks had responded, forcefully, many claimed, more than enough to deal with that year’s “unexpected” globally synchronized downturn.

Read More »

Read More »

The Coming War on Wealth and the Wealthy

Here's looking at you, Federal Reserve--thanks for perfecting 'legalized looting' and neofeudalism in America.

Read More »

Read More »

2020 Was a Snack, 2021 Is the Main Course

One of the dishes at the banquet of consequences that will surprise a great many revelers is the systemic failure of the Federal Reserve's one-size-fits-all "solution" to every spot of bother: print another trillion dollars and give it to rapacious financiers and corporations.

Read More »

Read More »

2020 the “Worst Year Ever”–You’re Joking, Right?

So party on, because "the worst year ever" is ending and the rebound of financial markets, already the greatest in recorded history, will only become more fabulous.

Read More »

Read More »

Big Media: Selling the Narrative and Crushing Dissent for Fun and Profit

The profit-maximizing Big Tech / Big Media Totalitarian regime hasn't just strangled free speech and civil liberties; it's also strangled democracy.

Read More »

Read More »

Drivers for the Week Ahead

As of this writing, a stimulus deal is close and a US government shutdown Monday may have been avoided; the Fed gave US banks the go-ahead to resume stock buybacks Friday; Fed manufacturing surveys for November will continue to roll out; weekly jobless claims will be reported on Wednesday due to the holiday.

Read More »

Read More »

When Social Capital Becomes More Valuable Than Financial Capital

This devaluation of financial wealth--and its transformation to a dangerous liability--

will reach extremes equal to the current extremes of wealth-income inequality.

Read More »

Read More »

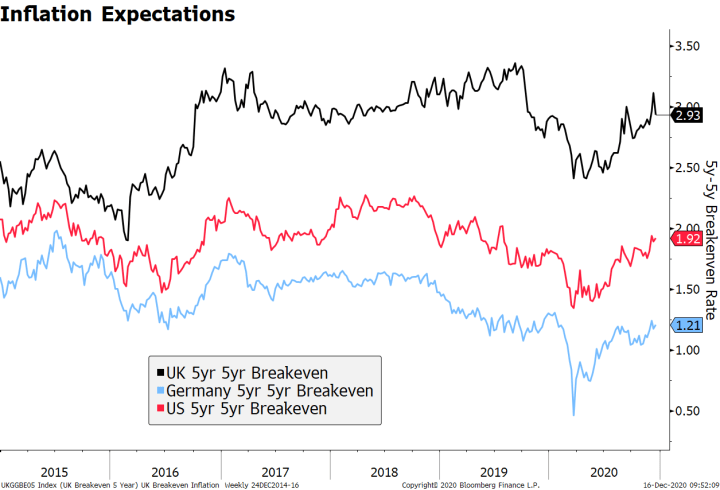

Dollar Continues to Soften Ahead of FOMC Decision

Optimism on a stimulus deal remains high; the FOMC decision will be key; the dollar tends to weaken on recent FOMC decision days November retail sales will be the US data highlight; Markit reports preliminary December PMI readings; Canada reports November CPI

Read More »

Read More »

Consumers, Too; (Un)Confident To Re-engage

There is a lot of evidence which shows some basis for expectations-based monetary policy. Much of what becomes a recession or worse is due to the psychological impacts upon businesses (who invest and hire) as well as workers being consumers (who earn and then spend).

Read More »

Read More »

What Did Hamper Growth ‘In A Few Months’

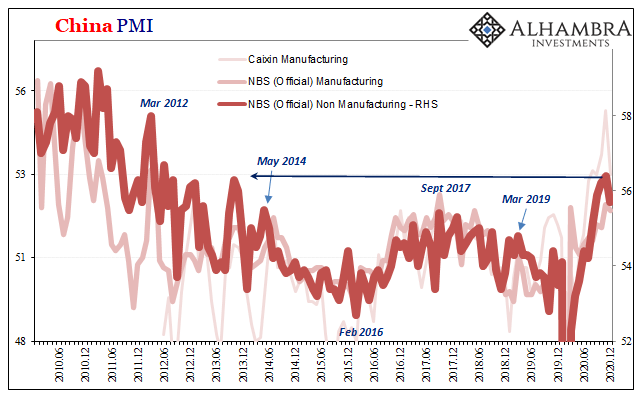

Over here, on the other side of that ocean, the US economy can only dream of the low levels Chinese industry has been putting up this late into 2020. At least those in the East are back positive year-over-year. Here in America, manufacturing and industry can’t even manage anything like a plus sign.

Read More »

Read More »

Some Thoughts on the Latest Treasury FX Report

The US Treasury’s latest “Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States” report named Switzerland and Vietnam as currency manipulators. Both countries came under scrutiny in the last report and so this week’s announcement was only surprising in that it was made by a lame duck administration that will be gone in a month.

Read More »

Read More »

Can 20 Years of Deflation Be Compressed into Two Years? We’re About to Find Out

Extremes become more extreme right up until they reverse, a reversal no one believes possible here in the waning days of 2020.

Read More »

Read More »

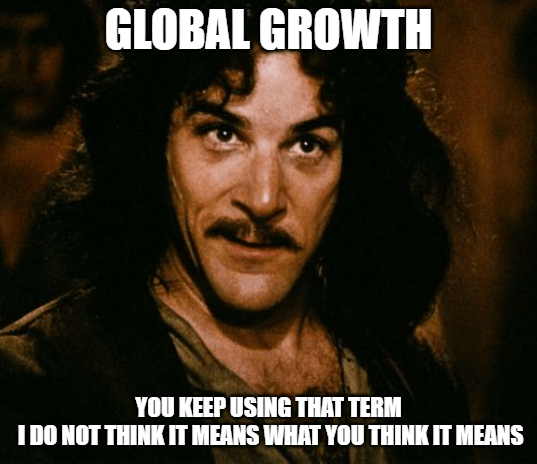

This Global Growth Stuff, China Still Wants A Word

Before there could be “globally synchronized growth”, it had been plain old “global growth.” The former from 2017 appended the term “synchronized” to its latter 2014 forerunner in order to jazz it up. And it needed the additional rhetorical flourish due to the simple fact that in 2015 for all the stated promise of “global growth” it ended up meaning next to nothing in reality.Oddly the same for 2017’s update heading into 2018 and...

Read More »

Read More »

FOMC Preview

The two-day FOMC meeting starts tomorrow and wraps up Wednesday afternoon. While no policy changes are expected, we highlight what the Fed may or may not do. We expect a dovish hold, with Powell underscoring the growing downside risks facing the US economy in the coming months.

Read More »

Read More »

One Little Problem with the “All-Electric” Auto Fleet: What Do We Do with all the “Waste” Gasoline?

Regardless of what happens with vaccines and Covid-19, debt and energy--inextricably bound as debt funds consumption-- will destabilize the global economy in a self-reinforcing feedback.

Read More »

Read More »

Drivers for the Week Ahead

The Senate passed a stopgap bill late Friday that will keep the government funded until midnight this Friday; optimism on a stimulus deal appears to be picking up; the two-day FOMC meeting ending with a decision Wednesday will be important.

Read More »

Read More »