Category Archive: 5) Global Macro

Even The People ‘Printing’ The ‘Money’ Aren’t Seeing It

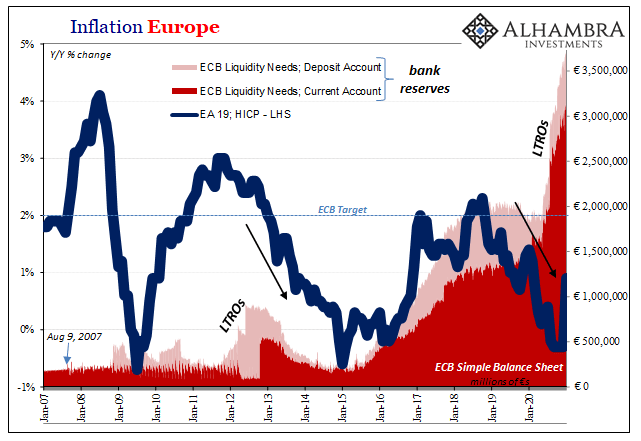

Everyone in Europe has long forgotten about what was going on there before COVID. First, an economy that had been stuck two years within a deflationary downturn central bankers like Italy’s new recycled top guy Mario Draghi clumsily mistook for an inflationary takeoff. Both the inflation puzzle and ultimately a pre-pandemic recession have taken a back seat to everything corona.Whereas Draghi spent those years howling for inflationary conditions...

Read More »

Read More »

The Top 10percent Is Doing Just Fine, The Middle Class Is Dying on the Vine

Please study these charts as a means of understanding the inevitability of economic stagnation and a revolt of the decapitalized middle class.

Read More »

Read More »

Dollar Consolidates Its Gains Ahead of Jobs Report

Senate Democrats are setting the table for passage of President Biden’s proposed $1.9 trln relief bill; there were glimmers of possible bipartisanship in some of the votes; US January jobs data is the highlight; Canada also reports January jobs data; Colombia reports January CPI.

Read More »

Read More »

Our Fragile, Brittle Stock Market

This heavily managed 'market structure' is far from equilibrium and extremely prone to instability.

Read More »

Read More »

Silver Swans, Maginot Lines and the Unforeseen Risks of Collapse

Our Nobility's assessment of risk and their war-gaming of vulnerabilities are fatally deficient. Many people have heard of Nassim Taleb's black swan but fewer understand how few events qualify as black swans. Per Wikipedia, a black swan is

an unpredictable or unforeseen event, typically one with extreme consequences, an event that is beyond what is normally expected of a situation and has potentially severe consequences.

Read More »

Read More »

Dollar Remains Firm Despite Dovish Fed Hold

The FOMC delivered a dovish hold, as we expected; we get our first look at Q4 GDP; Fed manufacturing surveys for January will continue to roll out; weekly jobless claims data will be closely watched.

Read More »

Read More »

The Coming Revolt of the Middle Class

That's how Neofeudal systems collapse: the tax donkeys and debt-serfs finally

rebel and start demanding the $50 trillion river of capital take a new course.

The Great American Middle Class has stood meekly by while the New Nobility stripmined

$50 trillion from the middle and working classes. As this RAND report documents, $50 trillion has

been siphoned from labor and the lower 90% of the workforce to the New Nobility and their

technocrat...

Read More »

Read More »

Dollar Trading Sideways as FOMC Meeting Begins

The FOMC begins its two-day meeting today with a decision out tomorrow afternoon; Senate Minority Leader McConnell has finally agreed to a power-sharing deal based on the 2001 model; President Biden signaled willingness to negotiate his stimulus proposal in order to get a bipartisan deal; Fed manufacturing surveys for January will continue to roll out; Brazil reports mid-January IPCA inflation

Read More »

Read More »

Dollar Flat as Markets Await Fresh Drivers

Discussions on President Biden’s proposed $1.9 trln fiscal package are getting off to a rocky start; Fed manufacturing surveys for January will continue to roll out. ECB Governing Council member Olli Rehn viewed yield curve control for the region as “not sensible”;

Read More »

Read More »

Dollar Weakness Continues Ahead of ECB Decision

Joe Biden became the 46th President of the US; three Democratic Senators were also sworn in; weekly jobless claims data will be the highlight of an otherwise quiet week; Fed manufacturing surveys for January will continue to roll out; Brazil kept rates on hold at 2.0%, as expected ECB is expected to keep policy unchanged; Norges Bank kept rates steady at 0%, as expected;

Read More »

Read More »

Dollar Continues to Soften Ahead of Inauguration

President-elect Biden will be inaugurated and becomes the 46th President of the United States at noon; he will hit the ground running by announcing a raft of executive orders upon taking office; Janet Yellen’s confirmation hearing was revealing; Canada and Brazil are expected to keep rates unchanged.

Read More »

Read More »

The Dangerously Diminishing Returns on Monetary and Fiscal Stimulus

Allow me to translate the risible claims of Jay Powell and Janet Yellen that their stimulus policies haven't boosted wealth inequality to the moon: "Let them eat cake."

Read More »

Read More »

Drivers for the Week Ahead

President-elect Biden will be inaugurated Wednesday; security in Washington DC and many state capitols has been beefed up due to concerns of violence; the Senate reconvenes Tuesday and will immediately begin work on confirming Biden’s cabinet choices; reports suggest that if asked, Yellen will disavow a weak dollar policy whilst affirming commitment to a market-determined exchange rate.

Read More »

Read More »

Politics Get Weird, Markets Don’t Care

A mob, led by a shirtless man wearing a Viking helmet, stormed the Capitol building a couple of weeks ago and five people died before order was restored. A man from upstate New York sat in a Senator’s office and smoked a joint. Another roamed the halls of Congress with a Confederate flag.

Read More »

Read More »

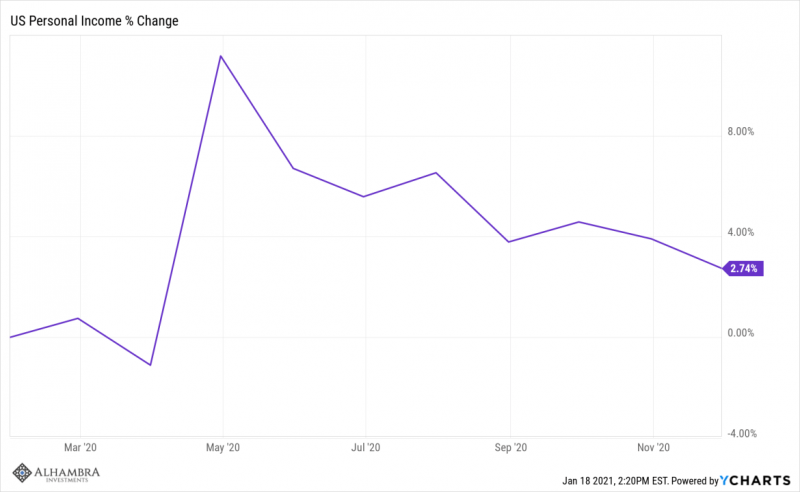

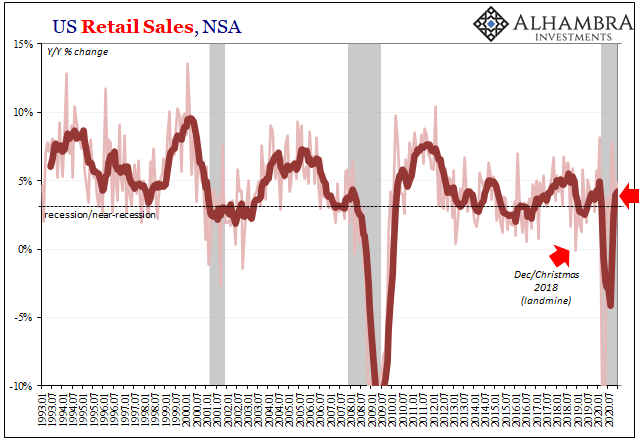

Consumers, Producers, and the Unsettled End of 2020

The months of November and December aren’t always easily comparable year to year when it comes to American shopping habits. For a retailer, these are the big ones. The Christmas shopping season and the amount of spending which takes place during it makes or breaks the typical year (though last year, there was that whole thing in March and April which has had a say in each’s final annual condition).

Read More »

Read More »

If the Fed’s Not In Consumer Prices, Then How About Producer Prices?

It’s not just that there isn’t much inflation evident in consumer prices. Rather, it’s a pretty big deal given the deluge of so much “money printing” this year, begun three-quarters of a year before, that consumer prices are increasing at some of the slowest rates in the data.

Read More »

Read More »

Rising Probability For A Second Payroll Minus (and its implications)

Revolving consumer credit declined again in November 2020, according to data released by the Federal Reserve last week. Though the monthly seasonally-adjusted change was small, it still represents significant uncertainty and material mistrust of the underlying economic condition among a broad section of consumers.

Read More »

Read More »

Is 2021 an Echo of 1641?

If you don't discern any of these dynamics in the present, what are you choosing not to see? The reason why history rhymes is that humanity is still using Wetware 1.0 and so humans respond to scarcity, abundance and conflicts over them in the same manner.

Read More »

Read More »

Dollar Regains Some Traction as Markets Search for Direction

House Democrats will move ahead with impeachment proceedings today; December CPI data will be the US highlight; heavy UST supply this week wraps up with a $24 bln sale of 30-year bonds; December monthly budget statement will be of interest the Fed releases its Beige Book report; several Fed officials pushed back against notions of tapering anytime soon

Read More »

Read More »

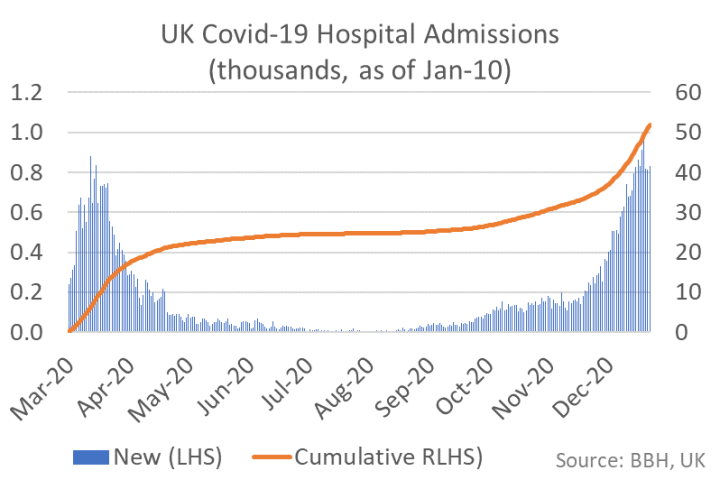

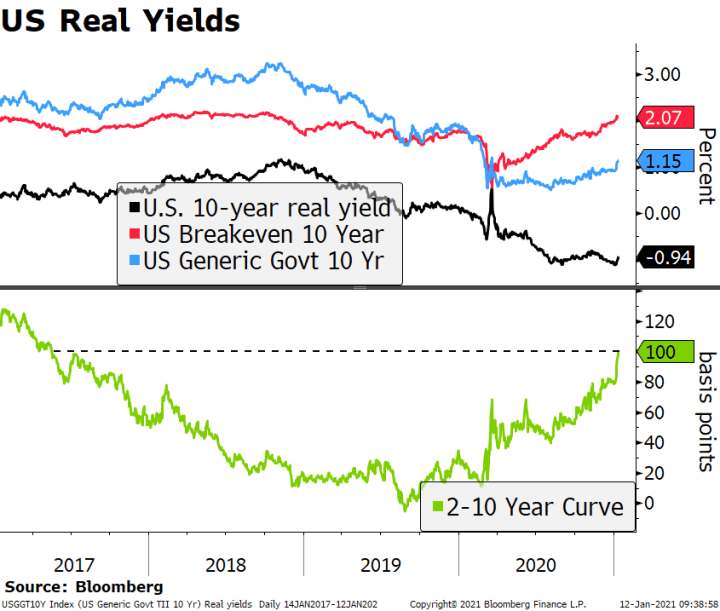

Dollar Runs Out of Steam as Sterling Leads the Way

The US curve continues to steepen; real US yields have become less negative; UST supply will remain an issue as $38 bln of 10-year notes will be sold today; Brazil reports December IPCA inflation.

Read More »

Read More »