Category Archive: 5) Global Macro

MACRO ANALYTICS – 07 14 17 – The Road to Financialization w/ Charles Hugh Smith

Anyone interested in how we got to where we are today will enjoy this tutorial discussion of the chronology of US & Global Monetary Events regarding the

Read More »

Read More »

Emerging Markets: What has Changed

China announced that it will remove foreign ownership limits on banks and other measures to open up the financial sector. Central Bank of Turkey lowered commercial bank FX reserve requirements in an effort to support the lira. US-Turkey relations appear to be thawing slightly. Middle East tensions are rising on a variety of fronts. Argentina central bank unexpectedly hiked rates again.

Read More »

Read More »

Maybe Hong Kong Matters To Someone In Particular

Hong Kong stock trading opened deep in the red last night, the Hang Seng share index falling by as much as 1.6% before rallying. We’ve seen this behavior before, notably in 2015 and early 2016. Hong Kong is supposed to be an island of stability amidst stalwart attempts near the city to mimic its results if not its methods.

Read More »

Read More »

03-05-13-Macro Analytics – The Global End Game – with Charles Hugh Smith

Charles Hugh Smith’s recent article The Global End Game in Fourteen Points is the basis for this discussion on the traditional Business Cycle, the Credit Cycle

Read More »

Read More »

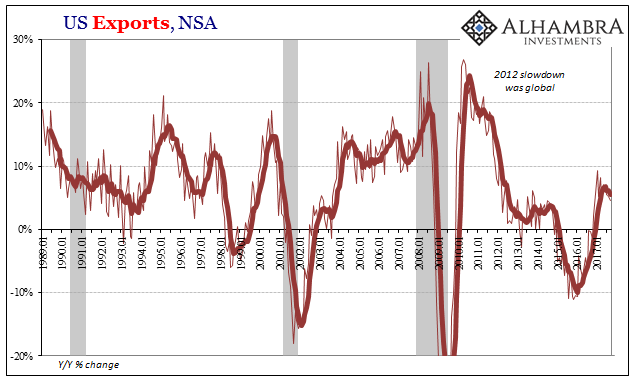

Synchronized Global Not Quite Growth

Going back to 2014, it was common for whenever whatever economic data point disappointed that whomever optimistic economist or policymaker would overrule it by pointing to “global growth.” It was the equivalent of shutting down an uncomfortable debate with ad hominem attacks. You can’t falsify “global growth” because you can’t really define what it is.

Read More »

Read More »

The struggles for independence and the impact of redrawing borders | The Economist

From Catalonia to Kurdistan and Quebec, many people are demanding independence. What does it take to transform a cultural identity into a nation-state? And what is the impact? Click here to subscribe to The Economist on YouTube: http://econ.st/2zpWFnB The number of countries in the United Nations has grown over the decades – from 51 states …

Read More »

Read More »

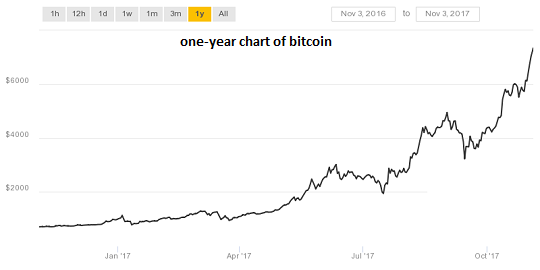

How Will Bitcoin React in a Financial Crisis Like 2008?

Whenever I raise the topic of bitcoin and cryptocurrencies, I feel like an agnostic in the 30 Years War between Catholics and Protestants. There is precious little neutral ground in the crypto-is-a-bubble battle; one side is absolutely confident that bitcoin and the other cryptocurrencies are in a tulip-bulb type bubble, while the other camp is equally confident that we ain't seen nuthin' yet in terms of bitcoin's future valuation.

Read More »

Read More »

Four Point One

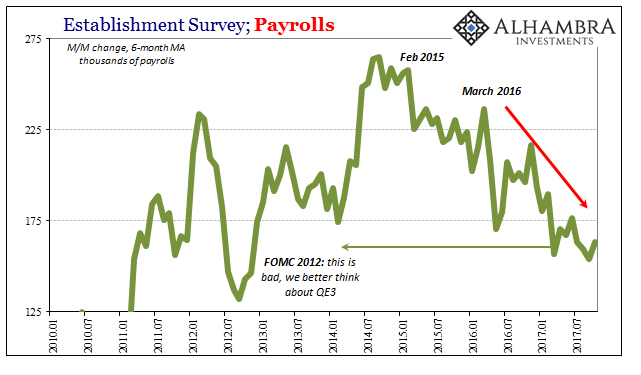

The payroll report for October 2017 was still affected by the summer storms in Texas and Florida. That was expected. The Establishment Survey estimates for August and September were revised higher, the latter from a -33k to +18k. Most economists were expecting a huge gain in October to snapback from that hurricane number, but the latest headline was just +261k.

Read More »

Read More »

Let’s Clear Up One Confusion About Bitcoin

If bitcoin can be converted into fiat currencies at a lower transaction cost than the fiat-to-fiat conversions made by banks and credit card companies, it's a superior means of exchange. One of the most common comments I hear from bitcoin skeptics goes something like this: Bitcoin isn't real money until I can buy a cup of coffee with it. In other words, bitcoin fails the first of the two core tests of "money": that it is a means of exchange and a...

Read More »

Read More »

Space tourism will lift-off in 2018 | The Economist

Space tourism will take-off in 2018. As the race between spaceflight companies Virgin Galactic and SpaceX heats up, those who can afford it will be able to travel to low Earth orbit and possibly even around the moon. Click here to subscribe to The Economist on YouTube: http://econ.st/2he5ZAb In late 2018, tourists will be heading …

Read More »

Read More »

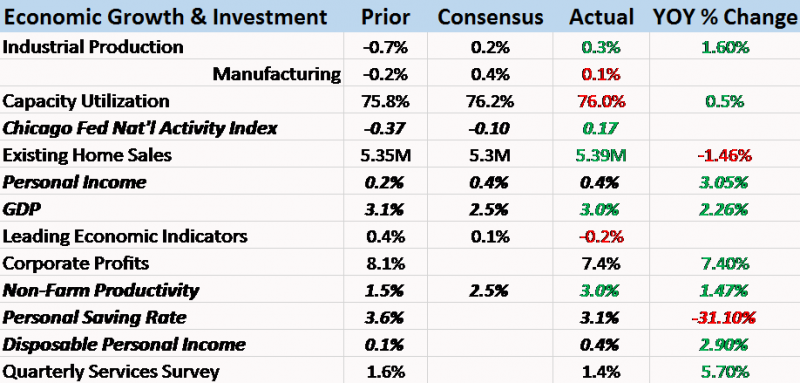

Bi-Weekly Economic Review: Gridlock & The Status Quo

The good news is that the economy just printed its second consecutive quarter of 3% growth, a feat not accomplished since Q2 and Q3 2014. The bad news is that the growth spurt in 2014 was better, quantitatively and qualitatively. Those two quarters produced gains of 4.6% and 5.2% (annualized) in GDP, much better than the most recent 3.1% and 3% prints of Q2 and Q3 2017.

Read More »

Read More »

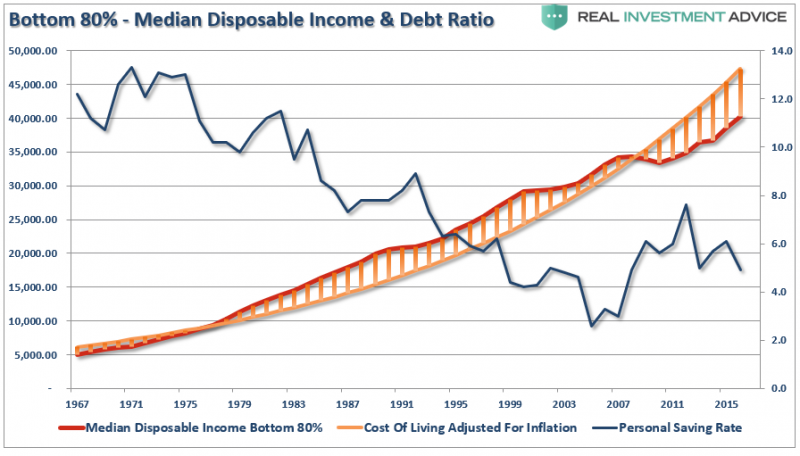

The Savings Rate Conundrum

The economy is booming. Employment is at decade lows. Unemployment claims are at the lowest levels in 40-years. The stock market is at record highs and climbing. Consumers are more confident than they have been in a decade. Wages are finally showing signs of growth.

Read More »

Read More »

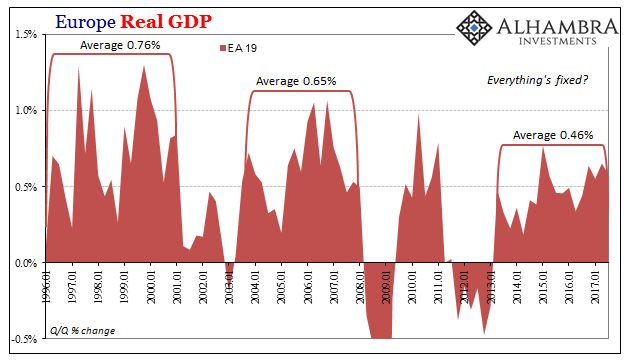

Europe Is Booming, Except It’s Not

European GDP rose 0.6% quarter-over-quarter in Q3 2017, the eighteenth consecutive increase for the Continental (EA 19) economy. That latter result is being heralded as some sort of achievement, though the 0.6% is also to a lesser degree. The truth is that neither is meaningful, and that Europe’s economy continues toward instead the abyss.

Read More »

Read More »