Category Archive: 5) Global Macro

Charles Hugh Smith-No “Free Trade”-Only Darwinian Game of Trade

Charles Hugh Smith, author of OfTwoMinds.com, explains what he means by stating, No “Free Trade”- Only Darwinian Game of Trade.

Read More »

Read More »

Bi-Weekly Economic Review: Embrace The Uncertainty

There’s something happening here What it is ain’t exactly clear There’s a man with a gun over there Telling me I got to beware I think it’s time we stop, children, what’s that sound Everybody look what’s going down There’s battle lines being drawn Nobody’s right if everybody’s wrong Young people speaking their minds Getting so much resistance from behind It’s time we stop, hey, what’s that sound Everybody look what’s going...

Read More »

Read More »

Is male fertility in crisis? | The Economist

Sperm counts have fallen by more than 50% in the past four decades. To understand what’s going wrong, we need to stop seeing fertility as a woman’s problem Click here to subscribe to The Economist on YouTube: http://econ.st/2GcJHhr Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films visit: http://econ.st/2GcButA Check …

Read More »

Read More »

Decrypting the Appointment of John Bolton

So perhaps the dominant wing of the Deep State is finally willing to cut a deal with Trump. To many observers, the appointment of John Bolton as national security advisor is the functional equivalent of appointing the Anti-Christ--or maybe worse. Indeed, these observers would, when comparing the two, find grudging favor with the Anti-Christ.

Read More »

Read More »

Jeff Snider // US Treasury Yield Curve Deep Dive

Jeffrey Snider, Erik Townsend and Patrick Ceresna welcome Jeffrey Snider to MacroVoices. Erik and Jeff discuss: — What does the yield curve tell us? — US Treasury Curve — Changes from an. Erik Townsend welcomes Jonathan Tepper to MacroVoices. Erik and Jonathan discuss the excess liquidity generated by central bank policy and the impact to …

Read More »

Read More »

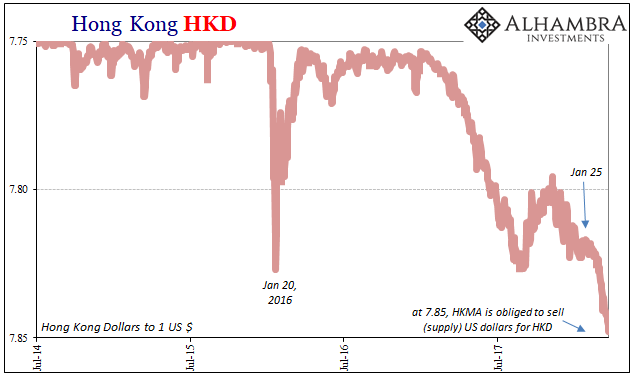

Just A Few More Pips

On Page 1, Chapter 1 of the Central Banker Crisis Handbook it states very clearly, “do not make it worse.” It’s something like the Hippocratic oath where monetary authorities must first assess what their actions might do to an already fragile system. It’s why they take great pains to try and maintain composure, appearing calm and orderly while conflagration rages all around. The last thing you want to do is confirm the run.

Read More »

Read More »

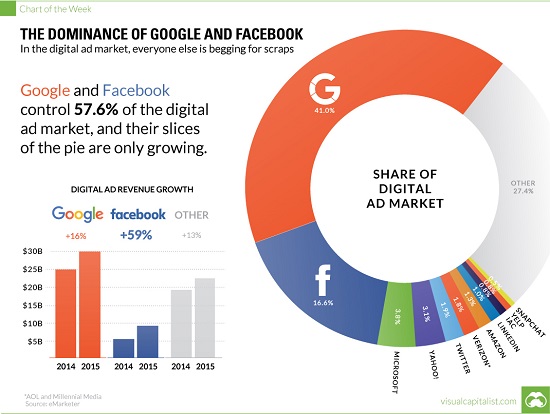

Should Facebook and Google Pay Users When They Sell Data Collected from Users?

Let's imagine a model in which the marketers of data distribute some of their immense profits to the users who created and thus "own" the data being sold for a premium. It's not exactly news that Facebook, Google and other "free" services reap billions of dollars in profits by selling data mined/collected from their millions of users. As we know, If you're not paying for it, you're not the customer; you're the product being sold, also phrased as if...

Read More »

Read More »

Why do we swear? | The Economist

Swear words are an important part of all languages. In English, words like “shit”, “cock” and “bastard” can be used as a curse or an insult and, let’s face it, saying them can feel good. Scientists believe swearing has a special place in our brains. *This film contains strong language. Obviously*. Click here to subscribe …

Read More »

Read More »

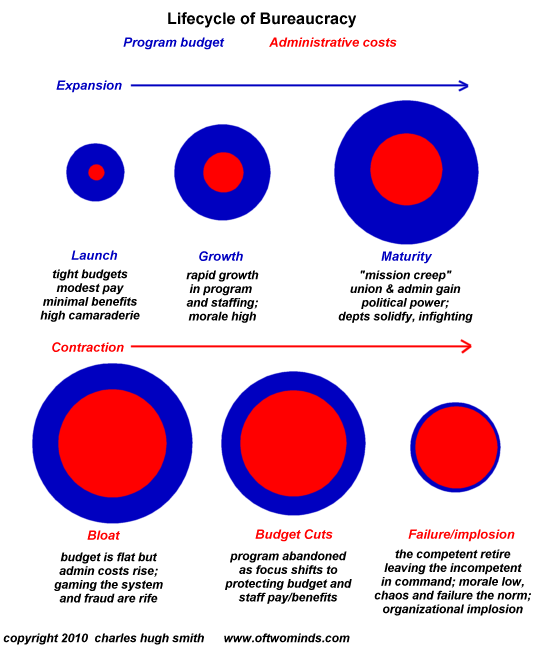

Solutions Only Arise Outside the Status Quo

Solutions are only possible outside these ossified, self-serving centralized hierarchies. Correspondent Dan F. asked me to reprint some posts on solutions to the systemic problems I've outlined for years, most recently in How Much Longer Can We Get Away With It? and Checking In on the Four Intersecting Cycles. I appreciate the request, because it's all too easy to dwell on what's broken rather than on the difficult task of fixing what's broken.

Read More »

Read More »

Is Profit-Maximizing Data-Mining Undermining Democracy?

As many of you know, oftwominds.com was falsely labeled propaganda by the propaganda operation known as ProporNot back in 2016. The Washington Post saw fit to promote ProporNot's propaganda operation because it aligned with the newspaper's view that any site that wasn't pro-status quo was propaganda; the possibility of reasoned dissent has vanished into a void of warring accusations of propaganda and "fake news" --which is of course propaganda in...

Read More »

Read More »

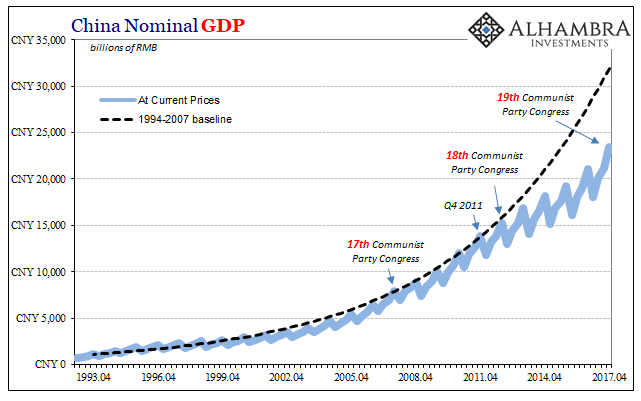

The Boom Reality of Uncle He’s Globally Synchronized L

Top Chinese leadership is taking further shape. With Xi Jinping’s continuing consolidation of power going on right this minute, most of the changes aren’t really changes, at least not internally. To the West, and to the mainstream, what the Chinese are doing seems odd, if not more than a little off. Unlike in the West, however, there is determined purpose that is in many ways right out in the open. Many here had been expecting that outgoing PBOC...

Read More »

Read More »

How can banks be used to stop human trafficking? | The Economist

Human trafficking is devastating for the victims but low-risk for the criminals, whose activities are largely hidden from view. To disrupt it, law enforcement is turning to some unlikely new partners—banks. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 German police raid homes across the country as part of a move to take …

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM ended Friday under renewed selling pressures, and capped off a mostly softer week. COP, THB, and TWD were the best performers last week, while TRY, RUB, and ZAR were the worst. Despite a widely expected 25 bp hike, this week’s FOMC meeting still has potential to weigh on EM.

Read More »

Read More »

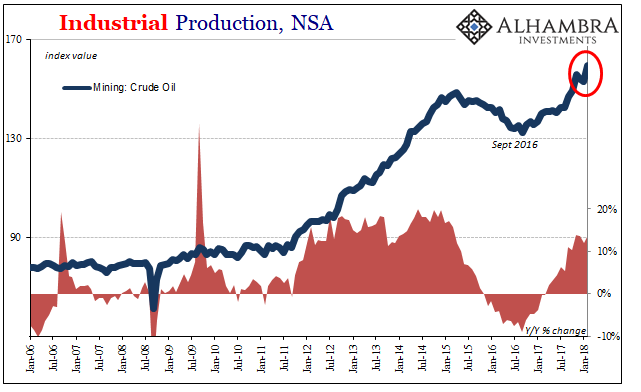

US Industry Experiences The Full 2014 Again in February

In February 2018, it was like old times for the US industrial sectors. Prior to the 2015-16 downturn, the otherwise moribund economy did produce two genuine booms. The first in the auto sector, the other in energy. Without them, who knows what the no-recovery recovery would have looked like. They were for the longest time the only bright spots.

Read More »

Read More »

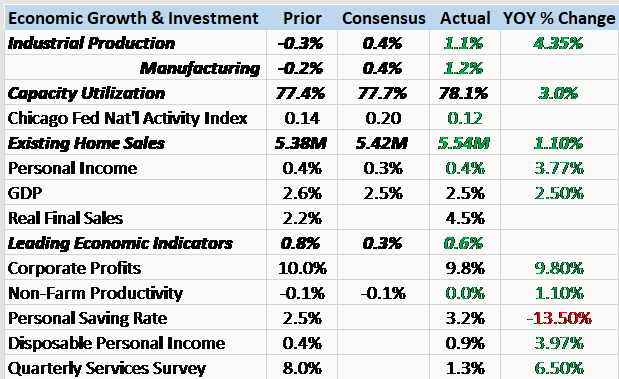

Bi-Weekly Economic Review

Bob Williams and Joseph Y. Calhoun talks about Bi-Weekly Economic Review for March 15, 2018.

Read More »

Read More »

Emerging Markets: What Changed

Hong Kong may impose a tax on unsold apartments as an effort to increase supply and cool off the housing market. Bank of Israel’s MPC had a split vote last month for the first time in three years. South Africa President Ramaphosa said the ANC wants Julius Malema of the opposition EFF to rejoin the party. Former South Africa President Zuma will face trial on 16 criminal charges.

Read More »

Read More »

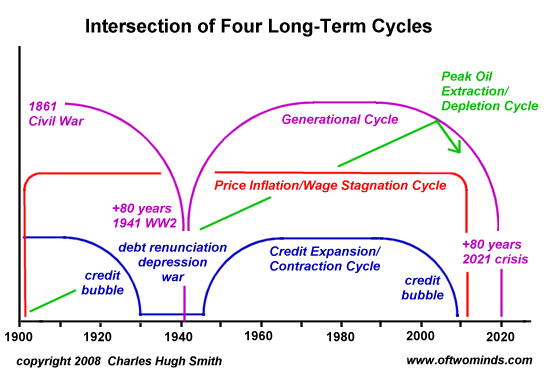

Checking In on the Four Intersecting Cycles

Correspondent James D. recently asked for an update on the four intersecting cycles I've been writing about for the past 10 years. Here's the chart I prepared back in 2008 of four long-term cycles: 1. Generational (political/social).2. Price inflation/wage stagnation (economic). 3. Credit/debt expansion/contraction (financial). 4. Relative affordability of energy (resources).

Read More »

Read More »

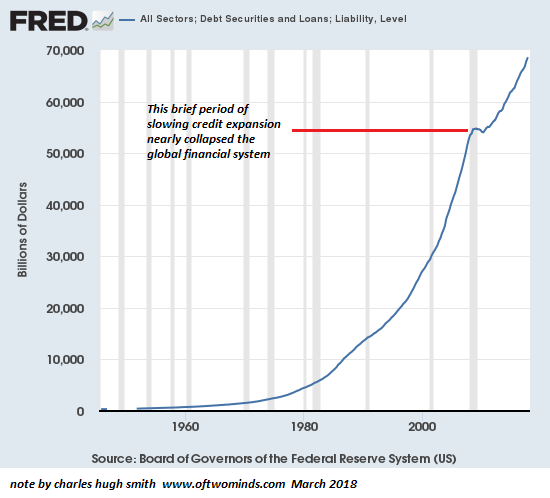

How Much Longer Can We Get Away With It?

Alas, fakery isn't actually a solution to fiscal/financial crisis.. This chart of "debt securities and loans"--i.e. total debt in the U.S. economy--is also a chart of the creation and distribution of new money, as the issuance of new debt is the mechanism in our financial system for creating (or "emitting" in economic jargon) new currency: when a bank issues a new home mortgage, for example, the loan amount is new currency created out of the...

Read More »

Read More »

Charles Hugh SMITH: ALERT USAS DAY OF ECONOMIC RECKONING 2017

Please click above to subscribe to my channel Thanks for watching! clif high halfpasthuman.com fighting against buttheads is our hobby no censorship predictive linguistics web bots woo woo. Please Click Below to SUBSCRIBE for More Special Report Radio Subscribe vesves More Videos: Thank for watching, Please Like Share And SUBSCRIBE!!! #dollarcollapse2017,. ALERT ! ! ! …

Read More »

Read More »

Putin’s games with the West | The Economist

As presidential elections take place in Russia, chess grandmaster Garry Kasparov talks about the games President Putin is playing with the West. Click here to subscribe to The Economist on YouTube: http://econ.st/2GBpCOs Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films visit: http://econ.st/2GDXPxf Check out The Economist’s full video catalogue: …

Read More »

Read More »