Category Archive: 5) Global Macro

How Robert Mugabe wrecked Zimbabwe

President Mugabe’s economic mismanagement of Zimbabwe has brought the country poverty and malnutrition. After 36 years in charge, he’s looking to extend his rule by 5 more years. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Robert Mugabe has ruled for 36 years, but this despot’s country is on its knees. Zimbabwe is …

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended last week on a soft note, as some risk off sentiment crept back into the markets. The dollar gained broadly on Friday despite lower US rates as bonds rallied, the yen gained and equities sold off. Markit PMI for February Tuesday and FOMC minutes Wednesday could give the markets some further clues regarding Fed policy.

Read More »

Read More »

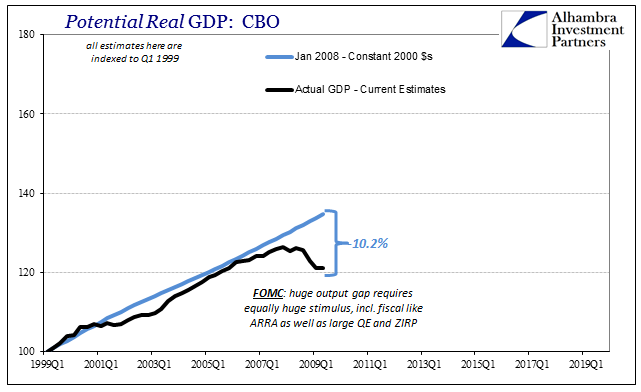

Their Gap Is Closed, Ours Still Needs To Be

There are actually two parts to examining the orthodox treatment of the output gap. The first is the review, looking backward to trace how we got to this state. The second is looking forward trying to figure what it means to be here. One final rearward assessment is required so as to frame how we view what comes next. As I suggested earlier this week, the so-called output gap started at the trough of the Great “Recession” at around 10% of the CBO’s...

Read More »

Read More »

Emerging Markets: What has Changed

Head of Samsung Group Jay Y. Lee was formally arrested on allegations of bribery, perjury, and embezzlement. The assassination of Kim Jong Un’s half-brother suggests the political situation in North Korea may be heating up. The Polish central bank is tilting more hawkish. The Turkish central bank said it will allow domestic companies to use liras to repay export loans.

Read More »

Read More »

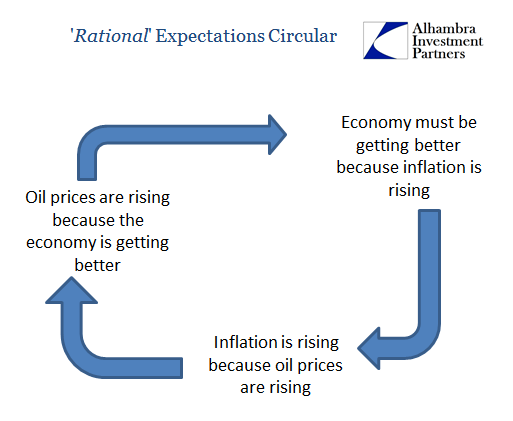

Why Aren’t Oil Prices $50 Ahead?

Right now there are two conventional propositions behind the “reflation” trade, and in many ways both are highly related if not fully intertwined. The first is that interest rates have nowhere to go but up. The Fed is raising rates again and seems more confident in doing more this year than it wanted to last year. With nominal rates already rising in the last half of 2016, and with more (surveyed) optimism than even 2014, it may at times seem the...

Read More »

Read More »

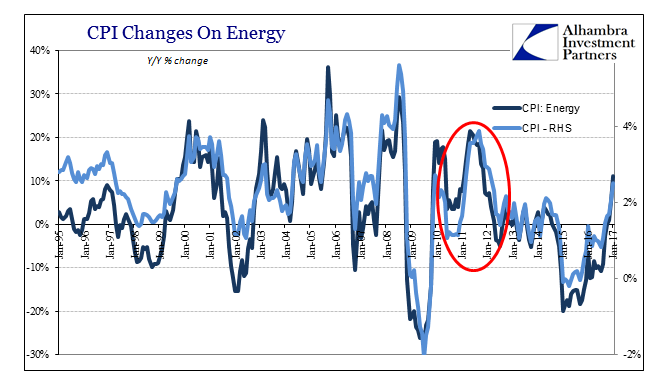

U.S. CPI after the energy push

The Consumer Price Index for January 2017 rose 2.5%, pulled upward by its energy component which thanks to oil prices now being comparing to the absolutely lows last year saw that part of the index rise 11.1% year-over-year. Given that oil prices bottomed out on February 11, 2016, this is the last month where oil prices and thus energy inflation will be at its most extreme (except, of course, should WTI actually rise between now and the end of...

Read More »

Read More »

This Is How the Status Quo Unravels: As the Pie Shrinks, Everybody Demands Their Piece Should Get Bigger

The politics of the past 70 years was all about horsetrading who got what share of the growing pie: the "pie" being cheap energy, government revenues and consumption, sales and profits. Horsetrading over a growing pie is basically fun. There's always a little increase left for the losers, so there is a reason for everyone to cooperate in a broad political consensus.

Read More »

Read More »

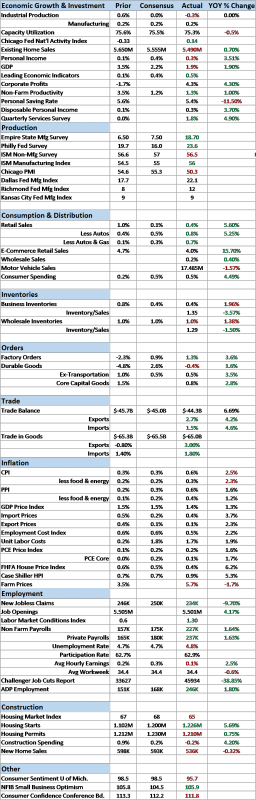

Bi-Weekly Economic Review

The economic data since my last update has improved somewhat. It isn’t across the board and it isn’t huge but it must be acknowledged. As usual though there are positives and negatives, just with a slight emphasis on positive right now. Interestingly, the bond market has not responded to these slightly more positive readings with nominal and real yields almost exactly where they were in the last update 3 weeks ago. In other words, there’s no reason...

Read More »

Read More »

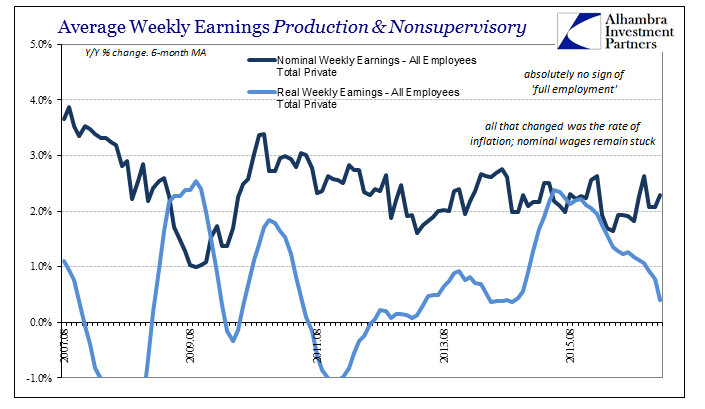

Real Wages Really Inconsistent

Real average weekly earnings for the private sector fell 0.6% year-over-year in January. It was the first contraction since December 2013 and the sharpest since October 2012. The reason for it is very simple; nominal wages remain stubbornly stagnant but now a rising CPI subtracts even more from them.

Read More »

Read More »

Donald Trump’s controversial pick for US ambassador to Israel | The Economist

David Friedman, President Trump’s nominee for US ambassador to Israel has no diplomatic experience and is known for making inflammatory comments. His right-wing views are out of step with years of American diplomacy. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films every day of the working week. For …

Read More »

Read More »

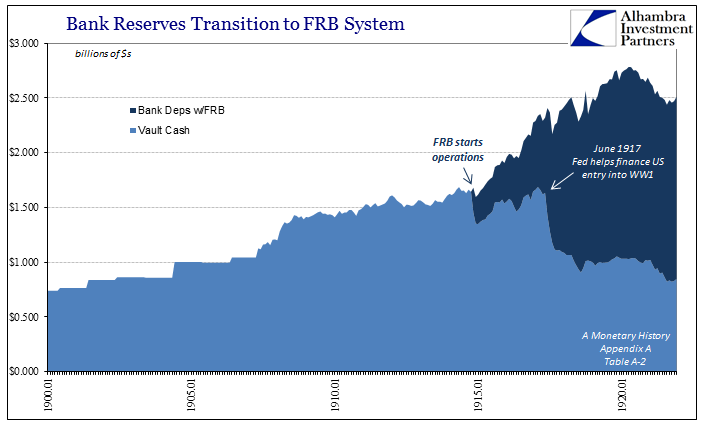

A New Frame Of Reference Is Really All That Is Necessary To Start With

In the middle of 1919, the United States was beset by a great many imbalances. Having just conducted a wartime economy, almost everything before then had been absorbed by the World War I effort. With fiscal restraint subsumed by national emergency, inflation was the central condition. Given that the Federal Reserve was by then merely a few years old, no one was quite sure what to do about it.

Read More »

Read More »

The world if robots take our jobs | The Economist

Computers are taking on increasingly sophisticated tasks, a trend which will cost many people their jobs. With so much automation to come, how many humans will still be needed? Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films every day of the working week. For more from Economist Films …

Read More »

Read More »

Want to Bring Back Jobs? It’s Impossible Unless We Fix these Four Things

It's your choice, America--you can keep your cartels and the captured government that enables and protects them, or you can fix what's broken and unaffordable. If there is any goal that might attract support from across the political spectrum, it's creating more fulltime jobs in the U.S. But this laudable goal is dead-on-arrival (DOA) unless we first fix these four things. Why is job growth stagnating? Many point to automation, and yes, that is a...

Read More »

Read More »

How South Korea should deal with Kim Jong Un | The Economist

North Korea and its leader Kim Jong Un continue to unsettle world leaders by testing nuclear weapons and long-range rockets. South Korea—with a new caretaker president after an impeachment scandal—could use some tips on how to handle its northern neighbour from hell. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching …

Read More »

Read More »

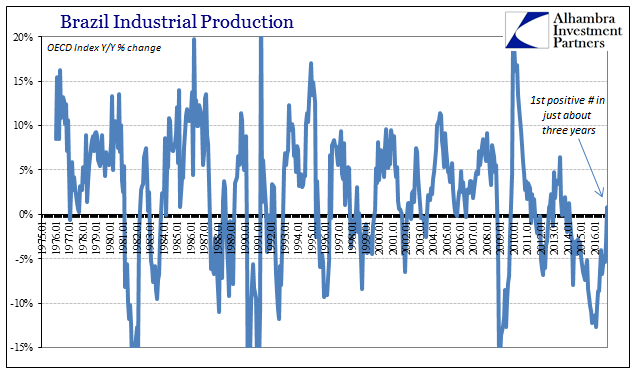

Brazil: Continuing Problems

The cruelest part, perhaps, of this economic condition globally is how it plays against type. In all prior cycles, economies of all kinds and orientations all over the globe would go into recession and then bounce right of it once at the bottom. It was often difficult to see the bottom, of course, but once recovery happened there was no arguing against it.

Read More »

Read More »

What makes financial bubbles burst? | The Economist

Financial bubbles have popped up throughout modern history—from Dutch tulip mania to the more recent sub prime lending boom. Our cartoonist Kal illustrates what makes them burst. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 When the price of an asset rises faster than can be explained by economic fundamentals it creates a …

Read More »

Read More »

Emerging Market Preview of the Week Ahead

EM FX ended last week on a firm note. Falling US rates allowed many foreign currencies to gain some traction. This week, a heavy US data slate is likely to test the market’s convictions on the Fed, with January PPI, CPI, IP, and retail sales all being reported. Yellen also testifies before Congress on Tuesday and Wednesday.

Read More »

Read More »

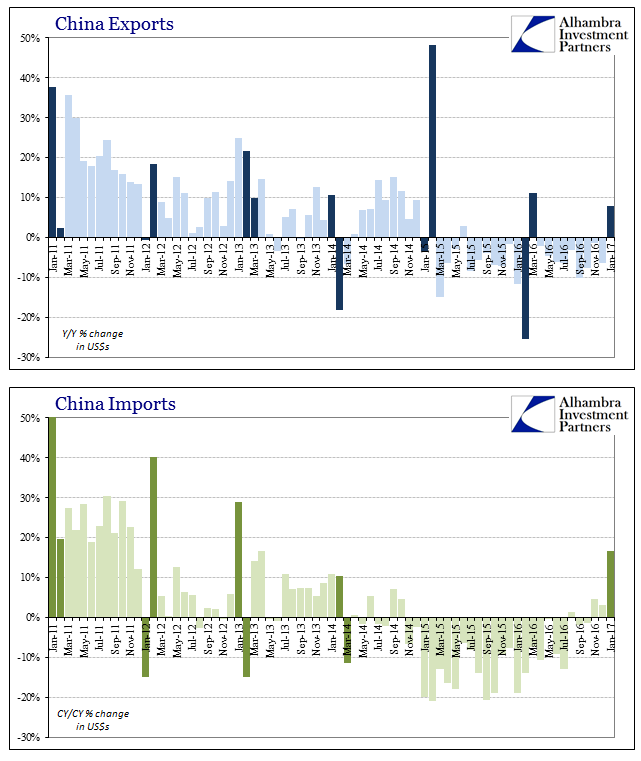

No China Trade Interpretations

The National Bureau of Statistics (NBS) of China does not publish any of the big three data series (Industrial Production, Retail Sales, Fixed Asset Investment) for the month of January. It combines January data with February data because of the large distortions caused by Lunar New Year holidays.

Read More »

Read More »

Emerging Markets: What Has Changed

Reserve Bank of India signaled an end to the easing cycle. S&P moved the outlook on Indonesia’s BBB- rating from stable to positive. The ruling Law and Justice party in Poland may be backing off of plans to force banks to convert $36 bln in foreign currency loans. Romanian Justice Minister Lordache resigned. Local press is reporting that Brazil’s central bank may cut the 2019 inflation target from 4.5% to 4.25%.

Read More »

Read More »