Category Archive: 5) Global Macro

Africa: Islamic State’s next frontier | The Economist

Islamic State has been largely driven out of its territory in the Middle East. But the terrorist organisation’s ideology lives on and is taking root in Africa where jihadist violence has increased by 300% since 2010. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Daily Watch: mind-stretching short films throughout the working week. …

Read More »

Read More »

The Fantasy of “Balanced Returns” Funding Retirement

The fantasy that a "balanced portfolio" yielding "balanced returns" will fund a stable retirement for decades to come is widely accepted as a sure thing: inflation will stay near-zero essentially forever, assets such as stocks and bonds will continue yielding hefty income and capital gains, and all the individual or fund needs to do is maintain a "balanced portfolio" of various asset classes that yield "balanced returns," i.e. some safe "value"...

Read More »

Read More »

Romania’s last orphanages | The Economist

Over 100,000 children were abandoned in Romania’s orphanages during the communist dictatorship of Nicolae Ceausescu. Nearly 30 years on Romania, like most other countries, is closing down the last of them. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films …

Read More »

Read More »

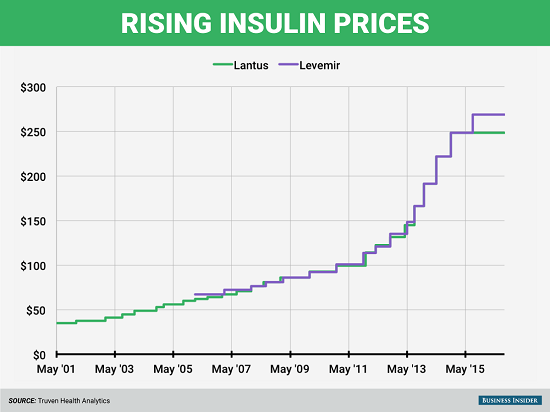

We’ll Pay All Those Future Obligations by Impoverishing Everyone (How to Destroy Our Currency In One Easy Lesson)

The only way to pay all these future obligations is by creating new money. I've been focusing on inflation, which is more properly understood as the loss of purchasing power of a currency, which when taken to extremes destroys the currency and the wealth/income of everyone forced to use that currency.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX has come under pressure again due to ongoing trade tensions and rising US rates but saw some modest relief Friday after the PBOC announcement on FX forwards. This helped EM FX stabilize, but we do not think the negative fundamental backdrop has changed. Best performers last week were MXN, PHP, and PEN while the worst were TRY, ZAR, and KRW.

Read More »

Read More »

Wildfires explained | The Economist

Wildfires are sweeping through the northern hemishphere as summer temperatures hit record highs. We are losing the battle against climate change. Find out more about The Economist’s cover story this week. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films …

Read More »

Read More »

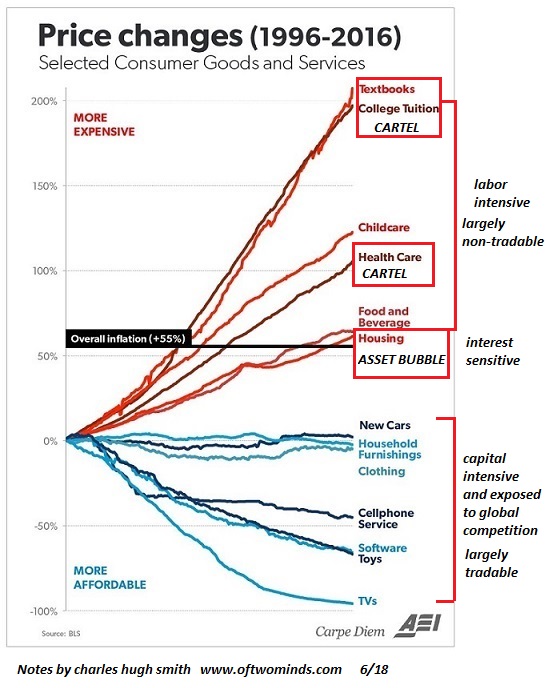

The 21st Century Misery Index: Labor’s Share of the Economy and Real-World Inflation

In the late 1970s and early 1980s, an era of stagflation, the Misery Index was the unemployment rate plus inflation, both of which were running hot. Now those numbers are at 50-year lows: both the unemployment rate and inflation are about as low as they can go, reaching levels not seen since the mid-1960s.

Read More »

Read More »

The changing face of tourism | The Economist

Tourism is one of the biggest industries in the world—and it’s rapidly changing. Chinese travellers have overtaken Americans as the biggest spenders and nearly all regions are welcoming more tourists. Except one. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Daily Watch: mind-stretching short films throughout the working week. For more from Economist …

Read More »

Read More »

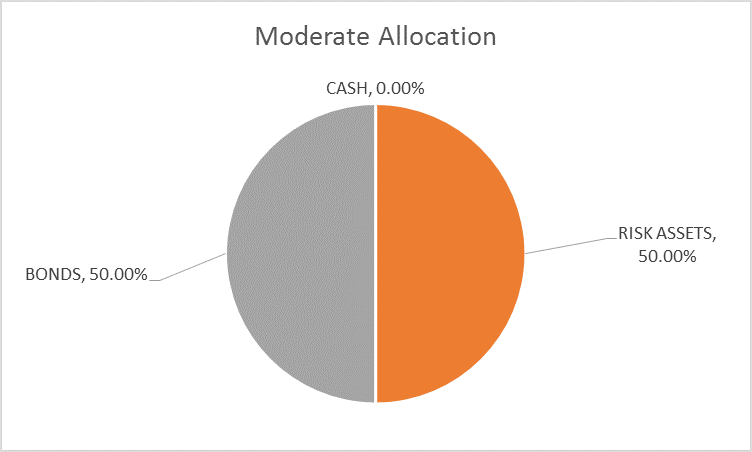

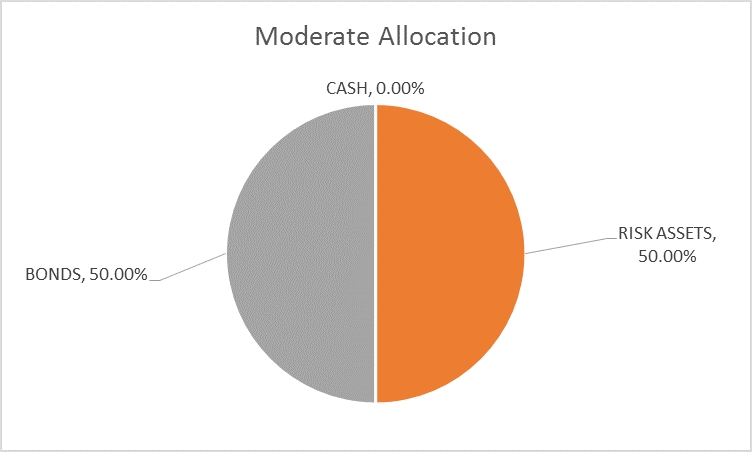

Global Asset Allocation Update

The risk budget is unchanged again this month. For the moderate risk investor, the allocation between bonds and risk assets is evenly split. The only change to the portfolio is the one I wrote about last week, an exchange of TIP for SHY.

Read More »

Read More »

Russia Sells 80 percent Of Its US Treasuries

Russia Sells 80% Of Its US Treasuries. Description: In just over 2 months Russia has sold-off over 85% of its holdings of U.S. Treasuries, should the U.S. be concerned? – Russia has liquidated 85% of its US Treasury holdings in just two months. – Russia dumps over $90 billion of Treasuries in April and May as holdings collapse from near $100 billion to just $9 billion.

Read More »

Read More »

Saudi Arabia: open for tourists | The Economist

Saudi Arabia is spending half-a-trillion dollars on coastal resorts and an entertainment complex to try and attract more tourists. It’s part of the crown prince’s plan to diversify the country’s economy away from oil. Will it work? Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Daily Watch: mind-stretching short films throughout the working …

Read More »

Read More »

Here’s What We’ve Lost in the Past Decade

The confidence and hubris of those directing the rest of us to race off the cliff while they watch from a safe distance is off the charts. The past decade of "recovery" and "growth" has actually been a decade of catastrophic losses for our society and nation. Here's a short list of what we've lost: 1. Functioning markets. Free markets discover price and assess risk.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX enjoyed a respite from the ongoing selling pressures, with most currencies up on the week vs. the dollar. Best performers were CLP, MXN, and ZAR while the worst were TRY, CNY, and COP. BOJ, Fed, and BOE meetings this week may pose some risks to EM FX.

Read More »

Read More »

Here’s How Systems (and Nations) Fail

These embedded processes strip away autonomy, equating compliance with effectiveness even as the processes become increasingly counter-productive and wasteful. Would any sane person choose America's broken healthcare system over a cheaper, more effective alternative?

Read More »

Read More »

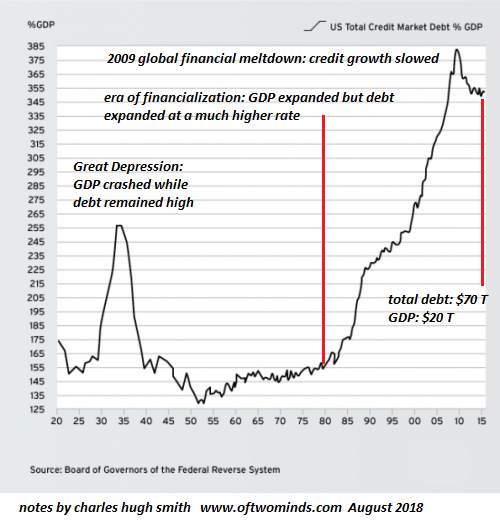

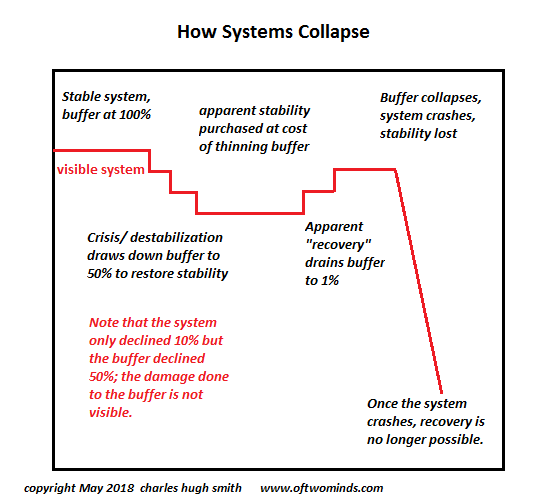

When Long-Brewing Instability Finally Reaches Crisis

The doom-and-gloomers among us who have been predicting the unraveling of an inherently unstable financial system appear to have been disproved by the reflation of yet another credit-asset bubble. But inherently unstable / imbalanced systems can stumble onward for years or even decades, making fools of all who warn of an eventual reset.

Read More »

Read More »

ABBA star, Bjorn Ulvaeus, on Mamma Mia and Brexit sadness | The Economist Podcast

Bjorn Ulvaeus, one of the stars of ABBA, sits down with Anne McElvoy, head of Economist Radio, to talk about music, politics and what it is like to hear world-famous actors sing your world-famous songs. Chapter One: On “Mamma Mia Here We Go Again” 00:06 The Economist asks about what it is like to meet …

Read More »

Read More »

Global Asset Allocation Update

Note: This will be a short update. We are shifting the timing of some of our reports. The monthly Global Asset Allocation update will now be published in the first week of the month, aiming for the first of each month. I’ll put out a full report next week. The Bi-Weekly Economic Review is shifting to a monthly update, published on the 15th of each month.

Read More »

Read More »

Mapping global population and the future of the world | The Economist

The world’s population has more than doubled since the 1970s. But a booming population is only part of the story—in some places populations are in decline. Click here to subscribe to The Economist on YouTube: https://econ.st/2tGuZ9h Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films visit: https://econ.st/2tGuZGj Check out The …

Read More »

Read More »

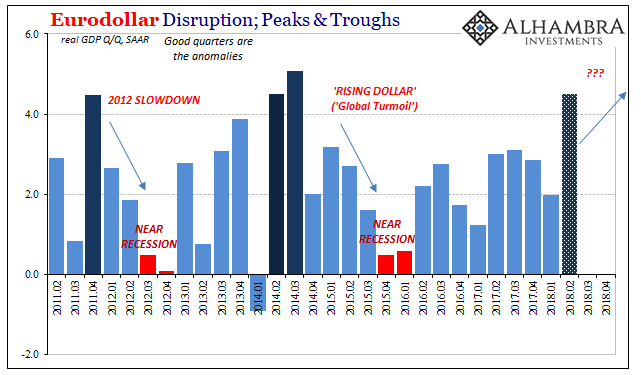

The Top of GDP

In 1999, real GDP growth in the United States was 4.69% (Q4 over Q4). In 1998, it was 4.9989%. These were annual not quarterly rates, meaning that for two years straight GDP expanded by better than 4.5%. Individual quarters within those years obviously varied, but at the end of the day the economy was clearly booming.

Read More »

Read More »