| Markit Economics released the flash results from several of its key surveys. Included is manufacturing in Japan (lower), as well as composites (manufacturing plus services) for the United States and Europe. Within the EU, Markit offers details for France and Germany.

Given the nature of sentiment surveys, we tend to ignore these most months unless they suggest either pending changes or extremes. Beginning with the US, the Composite PMI rose to 55.7, a three-month high. In truth, it has been flat to lower going back to last summer. Since this particular index has followed along with estimates for Real GDP pretty closely, the indication of a prolonged plateau in sentiment further suggests a much lower ceiling on the current upswing. That’s an important distinction particularly where mainstream convention now associates 2+% growth with good times. The post-crisis economy has been anything but, largely because it never really achieves any sort of liftoff, meaning symmetry. In other words, the upswings are too shallow to ever make up for the downswings, leaving the economy on average for both conditions with far too little growth. A lower ceiling on this particular one especially when compared to the peak in 2014 reveals a big economic risk for more than just the US economy. It is one that Markit’s Composite PMI failed to register during the second half of 2015 (when it really mattered). Then, the index stayed steady, as now, while the US decelerated to almost recession conditions. The PMI didn’t pick up that stark weakening until February 2016. |

US Markit PMI and GDP, Jul 2012 - May 2018(see more posts on U.S. Gross Domestic Product, U.S. Markit Composite PMI, ) |

| What that represents is how fragile these upswings may actually be, where the economy weakens substantially before there is any consensus that it is happening – or already happened.

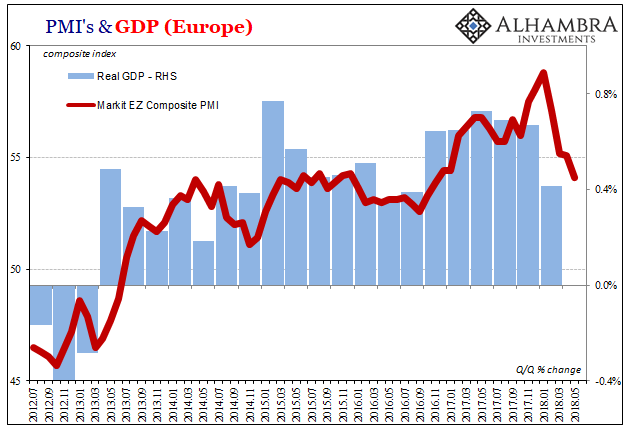

Which brings us to Europe. The European economy more than most has been characterized as booming. Compared to the past five years, it may well have seemed that way. From the point of view of Markit’s PMI, conditions did appear to be substantially brighter. |

Eurozone Markit PMI and GDP, Jul 2012 - May 2018(see more posts on Eurozone Gross Domestic Product, Eurozone Markit Composite PMI, ) |

| Remember, the corresponding GDP growth rates shown above are still themselves historically low. Even during 2017, Real GDP growth was never above 0.75% (Q/Q), a level that used to be more like a floor than this apparent ceiling. It’s a very real disconnect between sentiment and actual growth.

Still, the Composite PMI rose sharply especially in December 2017 and January 2018. Over the last several months, however, it’s as if whatever grade economic upswing hit a wall. And we know quite well what that wall consisted of: The PMI, meaning economic sentiment, has led the rising euro against the dollar. That makes sense given what is, or was, largely behind the falling dollar reflation trend. Predicated on this idea of globally synchronized growth, as economic prospects appeared better (relatively) what followed was a monetary rebound consistent with perceived opportunity. It was European banks more than anyone else this time in the lead. What happened starting in January, liquidations, registered first as a clear pause in sentiment and then appears to have hardened into more serious doubts – economy as well as money, meaning euro. Leading the reversal in the Composite PMI has been Germany. The engine of Europe has sputtered since the “rising dollar” threatened to reemerge. According to Markit’s numbers, Germany’s composite fell to a 20-month low in May (flash), with services at a 20-month low and manufacturing dropping to a 15-month low. |

Eurozone Markit PMI and GDP, Mar 2015 - May 2018(see more posts on Eurozone Gross Domestic Product, Eurozone Markit Composite PMI, ) |

From IHS Markit:

Germany’s economy is like China’s most sensitive to the whole “global growth” process. Eurodollar disruption is first and foremost a direct threat to global growth.

|

HKD/USD and USD/EUR, Jan 2017 - May 2018 |

| What these PMI’s together indicate is a stalling upswing perhaps rolling over from a starkly lower ceiling. In currency terms, it’s an indication of serious risk particularly to macro sensitive economies downstream of Germany and China; like the EM’s. It helps explain why since mid-April the latest “rising dollar” has come on so fast and hit those particularly hard. |

Europe Core HICP, jan 2007 - 2018 |

Tags: $EUR,Composite PMI,currencies,dollar,downturn,economy,Euro,EuroDollar,Eurozone Gross Domestic Product,Eurozone Markit Composite PMI,Federal Reserve/Monetary Policy,IHS Markit,manufacturing,Markets,newslettersent,PMI,real GDP,services,U.S. Gross Domestic Product,U.S. Markit Composite PMI