Category Archive: 5) Global Macro

Can you really fight corruption? | The Economist

What does it take to clean up a corrupt state? In one of the European Union’s most corrupt countries a prosecutor has taken on the establishment, convicting over 1,000 Romanian officials. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films …

Read More »

Read More »

Our “Prosperity” Is Now Dependent on Predatory Globalization

Nowadays, trade and "prosperity" are dependent on currencies that are created out of thin air via borrowing or printing. So here's the story explaining why "free" trade and globalization create so much wonderful prosperity for all of us: I find a nation with cheap labor and no environmental laws anxious to give me cheap land and tax credits, so I move my factory from my high-cost, highly regulated nation to the low-cost nation, and keep all the...

Read More »

Read More »

Where is the world’s most liveable city? | The Economist

Where is the world’s most liveable city? The Economist Intelligence Unit has ranked 140 cities based on their liveability. Melbourne, Australia, has been ranked the world’s most liveable city for the past seven years but it has lost the top spot to Vienna. See the full report: eiu.com/liveability Click here to subscribe to The Economist …

Read More »

Read More »

Capital Controls Next? Lira Rebounds After Turkey Bank Regulator Limits FX Swap Operations

In the first tentative step toward the final option available for Erdogan to halt the Lira's accelerating collapse - which crashed as low as 7.2362 earlier after the Wellington FX open following the the Turkish president's latest belligerent comments - namely capital controls, the Turkish Banking Regulation and Supervision Agency imposed a limit on the amount of foreign currency and lira swap and swap-like transactions, which are not to exceed 50%...

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX came under greater pressure last week as the situation in Turkey deteriorated. With no weekend developments as of this writing, we expect Turkish assets to remain under pressure this week. Five worst EM currencies YTD are TRY (-41%), ARS (-36%), RUB (-15%), BRL (-14.5%), and ZAR (-12%). All five have serious baggage that warrants continued underperformance.

Read More »

Read More »

NEWS: CHARLES HUGH SMITH – Economic Slowdown 2018

NEWS: CHARLES HUGH SMITH – Economic Slowdown 2018 ►►► THANKS FOR WATCHING ◄◄◄ AND DON’T FORGET TO LIKE COMMENTS AND SUBSCRIBE! Thank you! ==================================================== ► Gerald Celente: http://bit.ly/2w1taF5 ► Finance Today: http://bit.ly/2w0vBHP ► RonPaulLibertyReport: http://bit.ly/2w0h5zS

Read More »

Read More »

Jim Rogers – Making China Great Again! (Video)

We are delighted to announce a very special guest for our next episode of the Goldnomics Podcast, due for release later this week. We recently had the opportunity to speak with the legendary investor and adventure capitalist Jim Rogers. Jim is an American businessman, investor, traveler, financial commentator and author. He is the Chairman of Rogers Holdings and Beeland Interests, Inc. He was the co-founder of the Quantum Fund and creator of the...

Read More »

Read More »

What Chinese Trade Shows Us About SHIBOR

Why is SHIBOR falling from an economic perspective? Simple again. China’s growth both on its own and as a reflection of actual global growth has stalled. And in a dynamic, non-linear world stalled equals trouble. Going all the way back to early 2017, there’s been no acceleration (and more than a little deceleration). The reflation economy got started in 2016 but it never went anywhere. For most of last year, optimists were sure that it was just the...

Read More »

Read More »

Africa: Islamic State’s next frontier | The Economist

Islamic State has been largely driven out of its territory in the Middle East. But the terrorist organisation’s ideology lives on and is taking root in Africa where jihadist violence has increased by 300% since 2010. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Daily Watch: mind-stretching short films throughout the working week. …

Read More »

Read More »

The Fantasy of “Balanced Returns” Funding Retirement

The fantasy that a "balanced portfolio" yielding "balanced returns" will fund a stable retirement for decades to come is widely accepted as a sure thing: inflation will stay near-zero essentially forever, assets such as stocks and bonds will continue yielding hefty income and capital gains, and all the individual or fund needs to do is maintain a "balanced portfolio" of various asset classes that yield "balanced returns," i.e. some safe "value"...

Read More »

Read More »

Romania’s last orphanages | The Economist

Over 100,000 children were abandoned in Romania’s orphanages during the communist dictatorship of Nicolae Ceausescu. Nearly 30 years on Romania, like most other countries, is closing down the last of them. Click here to subscribe to The Economist on YouTube: http://econ.trib.al/rWl91R7 Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films …

Read More »

Read More »

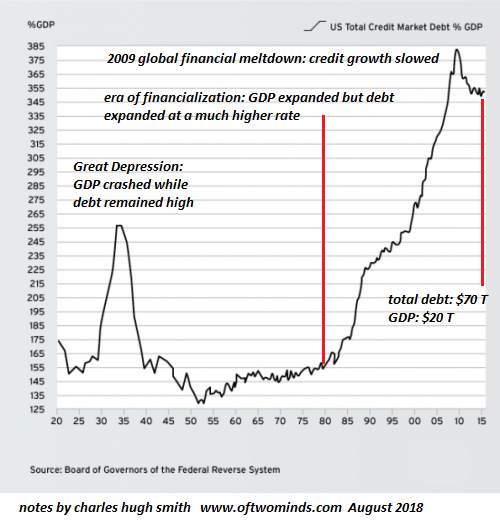

We’ll Pay All Those Future Obligations by Impoverishing Everyone (How to Destroy Our Currency In One Easy Lesson)

The only way to pay all these future obligations is by creating new money. I've been focusing on inflation, which is more properly understood as the loss of purchasing power of a currency, which when taken to extremes destroys the currency and the wealth/income of everyone forced to use that currency.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX has come under pressure again due to ongoing trade tensions and rising US rates but saw some modest relief Friday after the PBOC announcement on FX forwards. This helped EM FX stabilize, but we do not think the negative fundamental backdrop has changed. Best performers last week were MXN, PHP, and PEN while the worst were TRY, ZAR, and KRW.

Read More »

Read More »

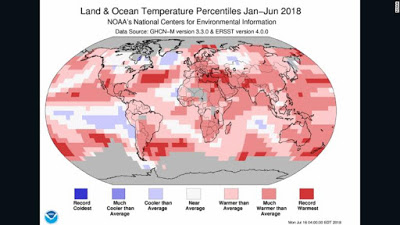

Wildfires explained | The Economist

Wildfires are sweeping through the northern hemishphere as summer temperatures hit record highs. We are losing the battle against climate change. Find out more about The Economist’s cover story this week. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Daily Watch: mind-stretching short films throughout the working week. For more from Economist Films …

Read More »

Read More »

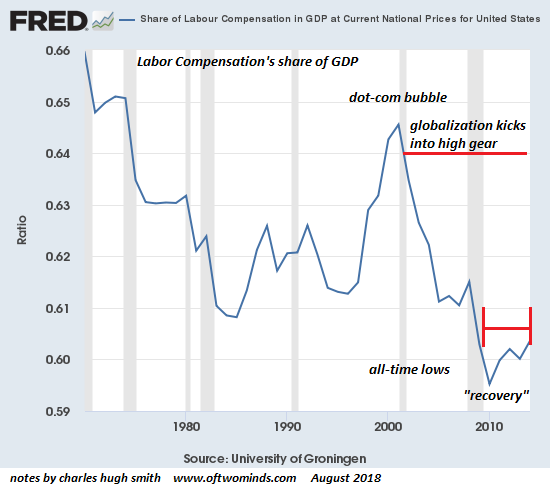

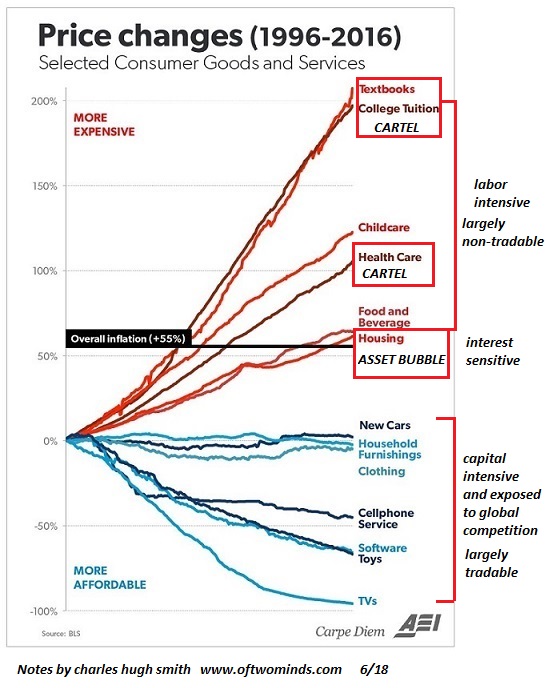

The 21st Century Misery Index: Labor’s Share of the Economy and Real-World Inflation

In the late 1970s and early 1980s, an era of stagflation, the Misery Index was the unemployment rate plus inflation, both of which were running hot. Now those numbers are at 50-year lows: both the unemployment rate and inflation are about as low as they can go, reaching levels not seen since the mid-1960s.

Read More »

Read More »

The changing face of tourism | The Economist

Tourism is one of the biggest industries in the world—and it’s rapidly changing. Chinese travellers have overtaken Americans as the biggest spenders and nearly all regions are welcoming more tourists. Except one. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Daily Watch: mind-stretching short films throughout the working week. For more from Economist …

Read More »

Read More »

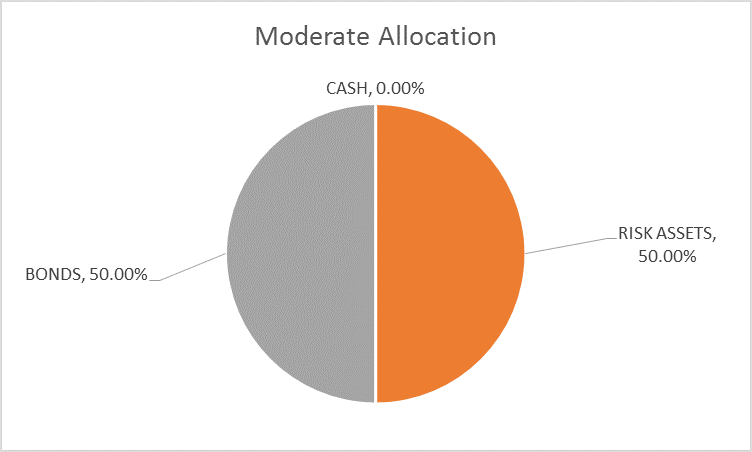

Global Asset Allocation Update

The risk budget is unchanged again this month. For the moderate risk investor, the allocation between bonds and risk assets is evenly split. The only change to the portfolio is the one I wrote about last week, an exchange of TIP for SHY.

Read More »

Read More »

Russia Sells 80 percent Of Its US Treasuries

Russia Sells 80% Of Its US Treasuries. Description: In just over 2 months Russia has sold-off over 85% of its holdings of U.S. Treasuries, should the U.S. be concerned? – Russia has liquidated 85% of its US Treasury holdings in just two months. – Russia dumps over $90 billion of Treasuries in April and May as holdings collapse from near $100 billion to just $9 billion.

Read More »

Read More »

Saudi Arabia: open for tourists | The Economist

Saudi Arabia is spending half-a-trillion dollars on coastal resorts and an entertainment complex to try and attract more tourists. It’s part of the crown prince’s plan to diversify the country’s economy away from oil. Will it work? Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy Daily Watch: mind-stretching short films throughout the working …

Read More »

Read More »