Category Archive: 5) Global Macro

Which Nations Will Crumble and Which Few Will Prosper in the Next 25 Years?

Adaptability and flexibility will be the core survival traits going forward. What will separate the many nations that will crumble in the next 25 years and those few that will survive and even prosper while the status quo dissolves around them? As I explain in my recent book Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic, the factors that will matter are not necessarily cultural or financial; being hard-working and...

Read More »

Read More »

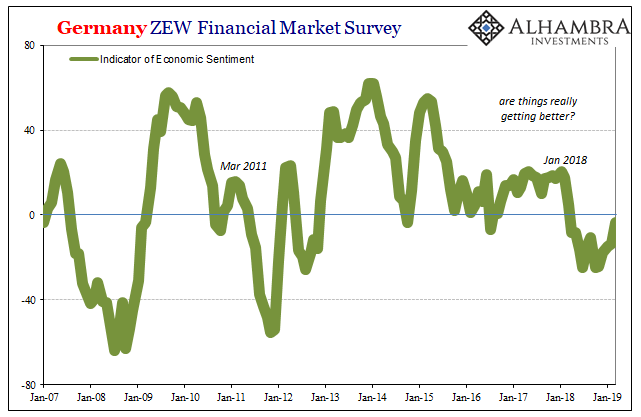

Slump, Downturn, Recession; All Add Up To Sideways

According to Germany’s Zentrum für Europäische Wirtschaftsforschung, or ZEW, the slump in the country’s economy has now reached its fourteenth month. The institute’s sentiment index has improved in the last two, but only slightly. As of the latest calculation released today, it stands at -3.6.

Read More »

Read More »

The Real End of the Bond Market

These things are actually quite related, though I understand how it might not appear to be that way at first. As noted earlier today, the Fed (yet again) proves it has no idea how global money markets work. They can’t even get federal funds right after two technical adjustments to IOER (the joke).

Read More »

Read More »

Why calories are a con | The Economist

Calorie-counting has been central to people’s understanding of weight loss for over a century. Given that the great majority of diets fail—could the calorie be one of the biggest delusions in dietary history? Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For decades people who want to control their weight have been told …

Read More »

Read More »

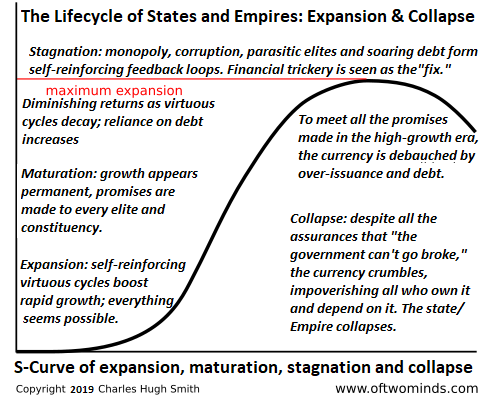

While the Nation Fragments Socially, the Financial Aristocracy Rules Unimpeded

If there is one central irony in American history, it is this: the citizenry that broke free of the chains of British Monarchy, the citizenry that reckoned everyone was equal before the law, the citizenry that vowed never to be ruled by an aristocracy that controlled the government and finance as a means of self-enrichment, is now so distracted by social fragmentation that the citizenry is blind to their servitude to a new and formidably informal...

Read More »

Read More »

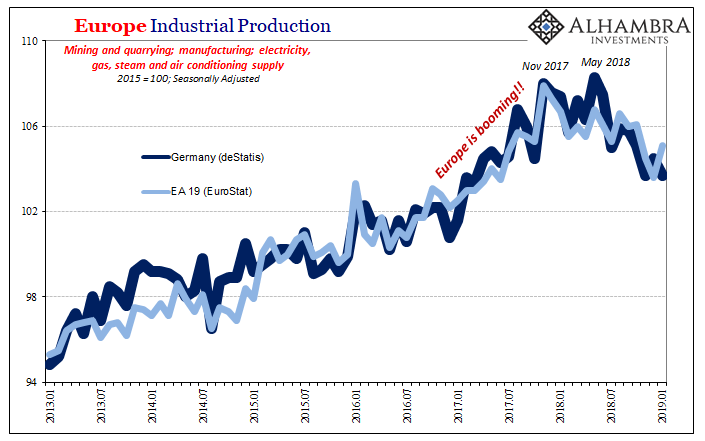

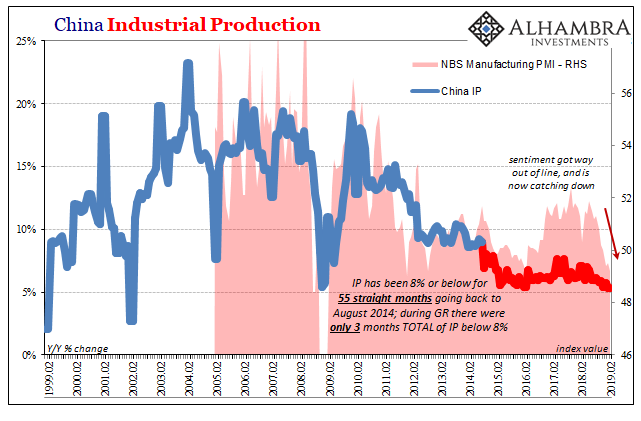

The World Economy’s Industrial Downswing

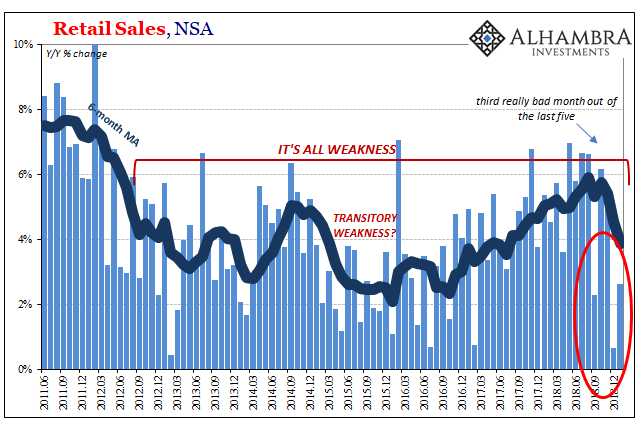

As economic data for 2019 comes in, the numbers continue to suggest more slowing especially in the goods economy. Perhaps what happened during that October-December window was a soft patch. Even if that was the case, we should still expect second and third order effects to follow along from it.

Read More »

Read More »

Are lab-grown diamonds the future? | The Economist

Scientists now have the technology to make synthetic diamonds in a laboratory. They are far cheaper than mined stones, but can they replace the real thing? Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy It’s the biggest disrupter the diamond industry has faced. Machines are now growing diamonds in a matter of weeks …

Read More »

Read More »

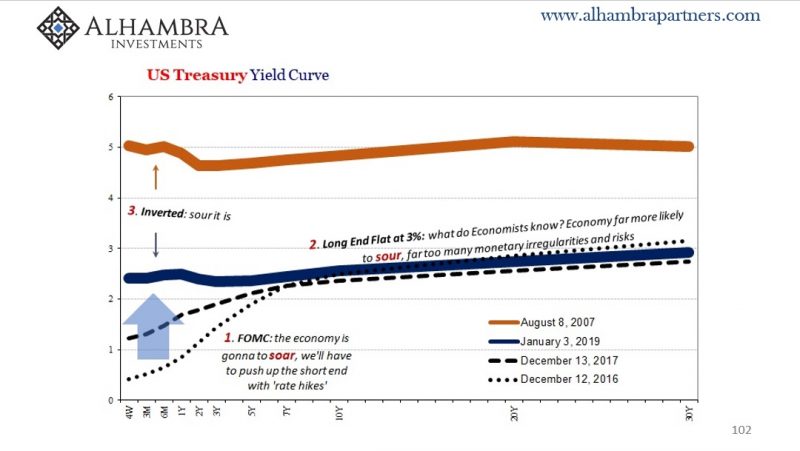

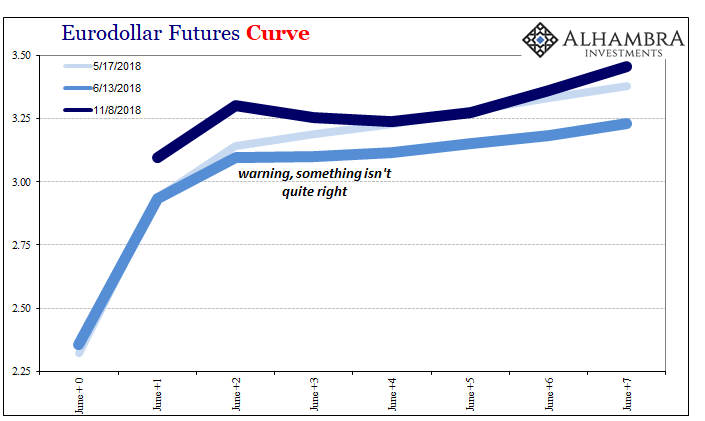

Chart(s) of the Week: Reviewing Curve Warnings

Quick review: stocks hit a bit of a rough patch right during the height of inflation hysteria. At the end of January 2018, just as the US unemployment rate had finally achieved the very center of attention, global markets were rocked by instability. Unexpectedly, of course.

Read More »

Read More »

What’s the point of NATO? | The Economist

NATO was set up in 1949 to counter the Soviet threat. Its North American and European members must continue to change the alliance if it is to remain relevant in the 21st century. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full …

Read More »

Read More »

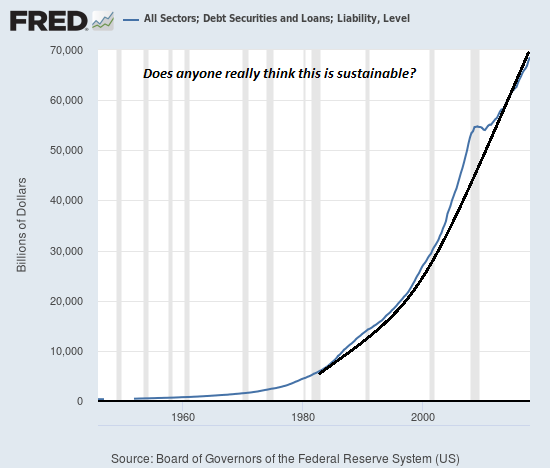

The Coming Crisis the Fed Can’t Fix: Credit Exhaustion

Having fixed the liquidity crisis of 2008-09 and kept a perversely unequal "recovery" staggering forward for a decade, central banks now believe there is no crisis they can't defeat: Liquidity crisis? Flood the global financial system with liquidity. Interest rates above zero? Create trillions out of thin air and use the "free money" to buy bonds. Mortgage and housing markets shaky?

Read More »

Read More »

Why St Patrick’s Day went global | The Economist

St Patrick’s Day is celebrated by 149m people in America alone. How did Ireland’s saint’s day become a global event? Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video catalogue: http://econ.st/20IehQk Like The Economist on Facebook: https://www.facebook.com/TheEconomist/ Follow The Economist on …...

Read More »

Read More »

No Sign of Stimulus, Or Global Growth, China’s Economy Sunk By (euro)Dollar

Najib Tun Razak was elected as Malaysia’s Prime Minister in early 2009. Taking office that April amid global turmoil and chaos, Najib’s first official visit was to Beijing in early June. His father, also Malaysia’s Prime Minister, had been the first among Asian nations to open formal diplomatic relations with China thirty-five years before.

Read More »

Read More »

What Sort of “Democracy” Do We Have If Everyone’s Goal Is Maximizing Their Government Swag?

A democratic republic is a government in which power flows from citizens to their elected representatives. The American revolutionaries did not make a big distinction between republic and democracy, for in the context of the late 1700s, the dominant political structure was monarchy, and democracy meant the people have the final say via elections.

Read More »

Read More »

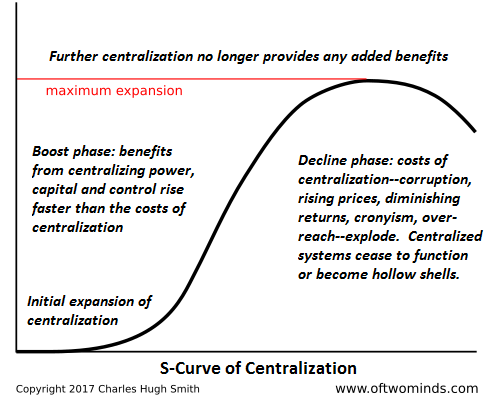

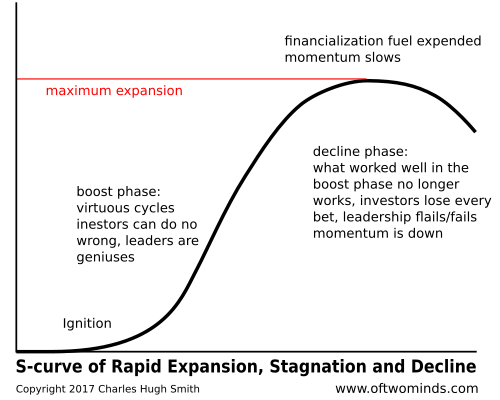

How States/Empires Collapse in Four Easy Steps

There is a grand, majestic tragedy in the inevitable collapse of once-thriving states and empires: it all seemed so permanent at its peak, so godlike in its power, and then slowly but surely, too many grandiose, unrealistic promises were made to too many elites and constituencies, and then as growth decays to stagnation, the only way to maintain the status quo is to appear to meet all the promises by creating money out of thin air, i.e. debauching...

Read More »

Read More »

Downturn Rising, No ‘Glitch’ In Retail Sales

You just don’t see $4 billion monthly retail sales revisions, in either direction. Advance estimates are changed all the time, each monthly figure will be recalculated twice after its initial release. Typically, though, the subsequent revisions are minor rarely amounting to a billion. Four times that?

Read More »

Read More »

Charles Hugh Smith The World is Awash in Debt and Can’t Raise Interest Rates & Trump May Not Run

If interest rates rise to normal historical levels then this will collapse the everything bubble. So the central banks will try to lower interest rates into negative territory to try and maintain their ability to maintain debt servicing which are taking more and more of the pie of what’s received in tax revenues. For example …

Read More »

Read More »

Is this the future of health? | The Economist

Artificial intelligence is already shaping the world, from driverless cars to dating. But according to Dr Eric Topol, a pioneer in digital medicine, perhaps its greatest impact will be on people’s health. Click here to subscribe to The Economist on YouTube: https://econ.st/2xvTKdy For more from Economist Films visit: http://films.economist.com/ Check out The Economist’s full video …

Read More »

Read More »

Downturn Rising, German Industry

You know things have really changed when Economists start revising their statements more than the data. What’s going on in the global economy has quickly reached a critical stage. This represents a big shift in expectations, a really big one, especially in the mainstream where the words “strong” and “boom” couldn’t have been used any more than they were.

Read More »

Read More »

Here’s The Problem: The Pie Is Shrinking

Scrape away the churn and distraction and the problem is simple: the pie of prosperity is shrinking, and the "fixes" are failing. The status quo arrangement is based on the endless expansion of "growth" and debt, which is the monetary fuel of more, more, more of everything: money, energy, resources, goods, services, jobs, wealth and income, all of which make up the elixir of prosperity.

Read More »

Read More »