Category Archive: 5) Global Macro

Bi-Weekly Economic Review: Who You Gonna Believe?

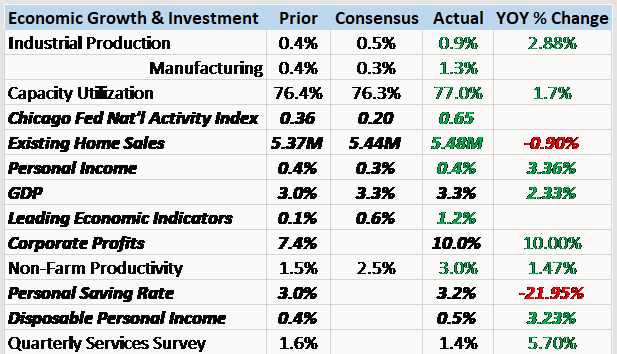

We’ve had a pretty good run of data recently and with the tax bill passing the Senate one would expect to see markets react positively, to reflect renewed optimism about economic growth. We have improving economic data on pretty much a global basis. It isn’t a boom by any stretch of the imagination but there is no doubt that the rate of change has recently been more positive.

Read More »

Read More »

North Korea’s nuclear threat in 2018 | The Economist

North Korea claims it can now launch missiles that can hit anywhere in mainland America. But in 2018 could the war of words between Kim Jong Un and Donald Trump spiral into nuclear catastrophe? Click here to subscribe to The Economist on YouTube: http://econ.st/2AAPWW3 In April 2018, North Korea will hold a national celebration to …

Read More »

Read More »

Shows Where To Invest When Almost Everything Is A Bubble CHARLES HUGH SMITH

Please click above to subscribe to my channel Thanks for watching! Financial News Silver News Gold Bix Weir RoadToRoota Road To Roota Kyle Bass Realist . Subscribe & More Videos: Thank for watching, Please Like Share And SUBSCRIBE!!! #jimrickards, #maneco64. Please Click Below to SUBSCRIBE for More Special Reports Videos Thanks for watching! Please click …

Read More »

Read More »

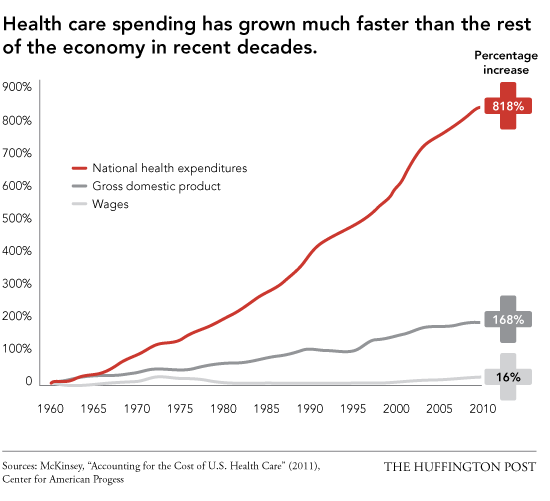

The Cost Basis of our Economy is Spiraling Out of Control

What will it take to radically reduce the cost basis of our economy? If we had to choose one "big picture" reason why the vast majority of households are losing ground, it would either be the stagnation of income or the spiraling out of control cost basis of our economy, that is, the essential foundational expenses of households, government and enterprise.

Read More »

Read More »

A plan for Palestine’s peace and prosperity | The Economist

Can Palestine become a prosperous and peaceful region? Munib al-Masri is the richest Palestinian in the world and he has a four-point plan to rebuild his homeland. Click here to subscribe to The Economist on YouTube: http://econ.st/2ATg55H This man is known as “The Godfather of Palestine’. He’s a self made billionaire. Munib al-Masri is the …

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended the week on a mixed note. US jobs data may refocus market attention on Fed tightening. Most EM inflation readings this week are expected to show easing price pressures, supporting a dovish EM central bank outlook. The major exceptions are Mexico and Turkey, whose central banks may be forced to tighten policy in the coming weeks.

Read More »

Read More »

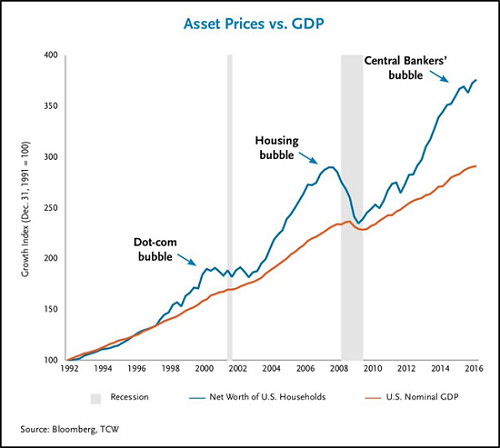

Stock Market 2018: The Tao vs. Central Banks

The central banks claim omnipotent financial powers, and their comeuppance is overdue. will be the first to admit that invoking the woo-woo of the Tao as the reason to expect a reversal of the stock market in 2018 smacks of Bearish desperation. With everything coming up roses in much of the global economy, there is precious little foundation for calling a tumultuous end to the global Bull Market other than variations of nothing lasts forever.

Read More »

Read More »

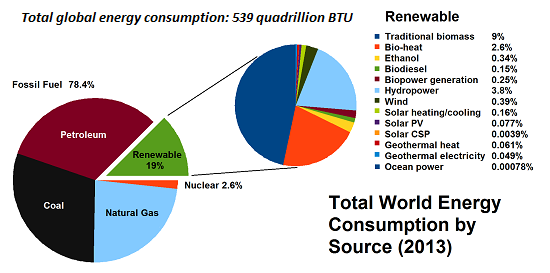

Did Anyone Do Even a Minimal Check on the Sensationalist Bitcoin Electrical Consumption Story?

Check the context before uncritically accepting sensationalist conclusions. Let's start with a primer on how to write a sensationalist story that can be passed off as "journalism:" 1. Locate credible-sounding data that can be de-contextualized, i.e. sensationalized. 2. Present the data as "fact" rather than data that requires verification by disinterested researchers.

Read More »

Read More »

Charles Hugh Smith Insights On Bitcoin and Cryptocurrencies

Click here for the full transcript with slides: http://financialrepressionauthority.com/2017/12/02/the-roundtable-insight-charles-hugh-smith-insights-on-bitcoin-and-cryptocurrencies/

Read More »

Read More »

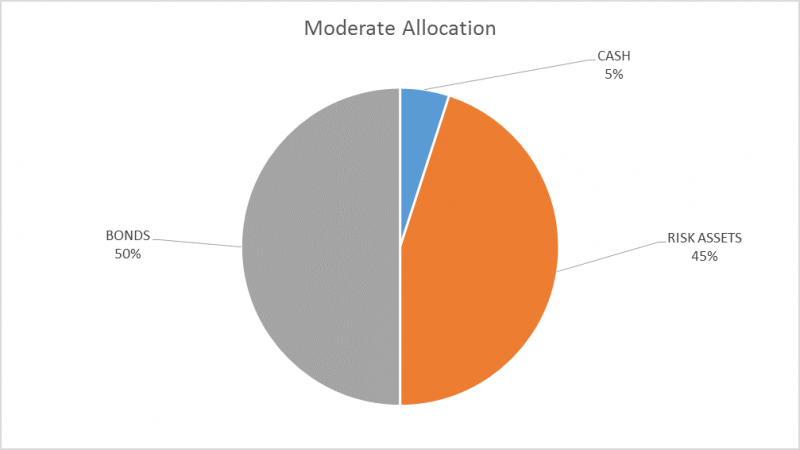

Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. The extreme overbought condition of the US stock market did not correct since the last update and so I will continue to hold a modest amount of cash.

Read More »

Read More »

Emerging Markets: What Changed

Bank of Korea hiked rates by 25 bp to 1.50%, the first hike in six years. Egypt central bank lifted the last remaining currency controls. S&P cut South Africa’s foreign currency rating one notch to BB with stable outlook. Turkey President Erdogan was implicated in an alleged plot to help Iran evade US sanctions. Moody’s upgraded Argentina one notch to B2 with stable outlook.

Read More »

Read More »

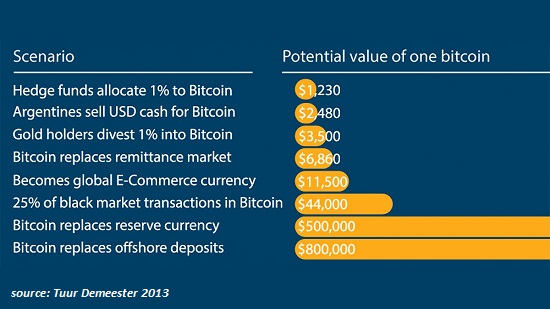

My Crazy $17,000 Target for Bitcoin Is Looking Less Crazy

The basis of this admittedly crazy forecast was simple: capital flows. I think we can all agree that bitcoin (BTC) is "interesting." One of the primary reason that bitcoin (and cryptocurrency in general) is interesting is that nobody knows what will happen going forward. Unknowns and big swings up and down are characteristics of open markets.It's impossible to forecast bitcoin's future price because virtually all the future inputs are unknown.

Read More »

Read More »

The Asymmetry of Bubbles: the Status Quo and Bitcoin

Regardless of one's own views about bitcoin/cryptocurrency, what is truly remarkable is the asymmetry that is applied to questioning the status quo and bitcoin. As I noted yesterday, everyone seems just fine with throwing away $20 billion in electricity annually in the U.S. alone to keep hundreds of millions of gadgets in stand-by mode, but the electrical consumption of bitcoin is "shocking," "ridiculous," etc.

Read More »

Read More »

Donald Trump’s big test in 2018 | The Economist

Donald Trump will face his biggest test as president in November 2018. A bad result in the mid-term elections could lead to his impeachment. Can Mr Trump unite and rally Republican voters? Click here to subscribe to The Economist on YouTube: http://econ.st/2zPS0MH In November 2018 President Donald Trump will face his biggest political test yet …

Read More »

Read More »

Keiser Report: Fetid Swamp of US Tax Reform (E1156)

Check Keiser Report website for more: http://www.maxkeiser.com/ In this episode of the Keiser Report, Max and Stacy discuss the housing crisis as wealth transfer. In the second half, Max interviews Charles Hugh Smith of OfTwoMinds.com about the fetid swamp of tax reform. WATCH all Keiser Report shows here: http://www.youtube.com/playlist?list=… (E1-E200) http://www.youtube.com/playlist?list=… (E201-E400)...

Read More »

Read More »

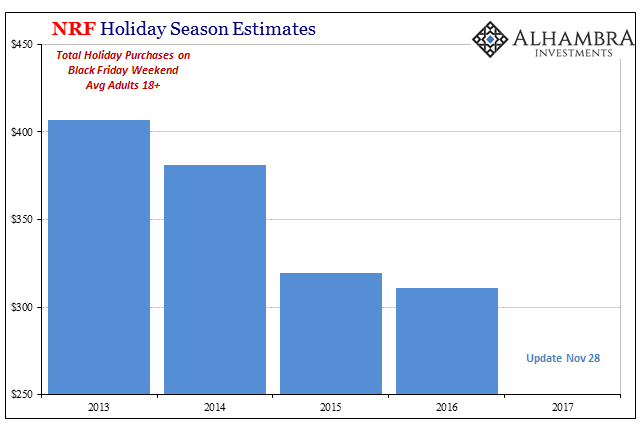

Fading Black Friday

Black Friday was once the king of all shopping. A retailer could make its year up on that one day, often by gimmicking its way to insane single-day volume. Those days, however, are certainly over. Though the day after Thanksgiving still means a great deal, as the annual flood of viral consumer brawl videos demonstrate, it’s just not what it once was.

Read More »

Read More »

Charles Hugh Smith sheds interesting light upon cause of the retail apocalypse

While much has been written about the massive retail decline in America, Charles Hugh Smith sheds interesting light upon another core cause of the retail . Charles Hugh Smith ( Sep 11, 2017 ) – sheds interesting light upon cause of the retail apocalypse #charleshughsmithhealthcare #charleshughsmithpodcast. While much has been written about the massive retail …

Read More »

Read More »

Can extreme poverty ever be eradicated? | The Economist

Poverty rates have fallen faster in the past 30 years than at any other time on record. The UN wants extreme poverty to disappear by 2030. We assess the data to see if this is achievable. Click here to subscribe to The Economist on YouTube: http://econ.st/2AfBchr It is estimated that somebody escapes extreme poverty every …

Read More »

Read More »

The Economy Will Rollover Charles Hugh & The Central Bankers Are Going To Shutoff The Spig

Today’s Guest: Charles Hugh Smith Websites: Of Two Minds Books: All of his books can be . The Central Bankers Are Going To Shutoff The Spigot And The Economy Will Rollover Charles Hugh. The Central Bankers Are Going To Shutoff The Spigot And The Economy Will Rollover Charles Hugh. Thanks for ing. The Central Bankers …

Read More »

Read More »

Emerging Market Preview: Week Ahead

EM FX ended the holiday-shortened week on a soft note. While most were up on the entire week, notable laggards were TRY, CLP, and ZAR. All three currencies underperformed due to rising political risks, and we suspect that will continue. We believe MXN and BRL are likely to rejoin the laggards in the coming days.

Read More »

Read More »