Category Archive: 5) Global Macro

03-23-13-Macro Analytics – Market Clearing Event – Charles Hugh Smith

QUESTIONS ON THE TABLE 1- How Large can Central Bank’s Balance Sheets actually get before too much is too much? 2- Is Public Debt Monetization A

Read More »

Read More »

Aligning Politics To economics

There is no argument that the New Deal of the 1930’s completely changed the political situation in America, including the fundamental relationship of the government to its people. The way it came about was entirely familiar, a sense from among a large (enough) portion of the general population that the paradigm of the time no longer worked. It was only for whichever political party that spoke honestly to that predicament to obtain long-term...

Read More »

Read More »

09 15 15 MACRO ANALYTICS – Its Getting Ugly out there! w/ Charles Hugh Smith

with Charles Hugh Smith & Gordon T Long 28 Minutes – 21 Slides Charles Hugh Smith and Gordon T Long discuss the US Equity Market Technicals.

Read More »

Read More »

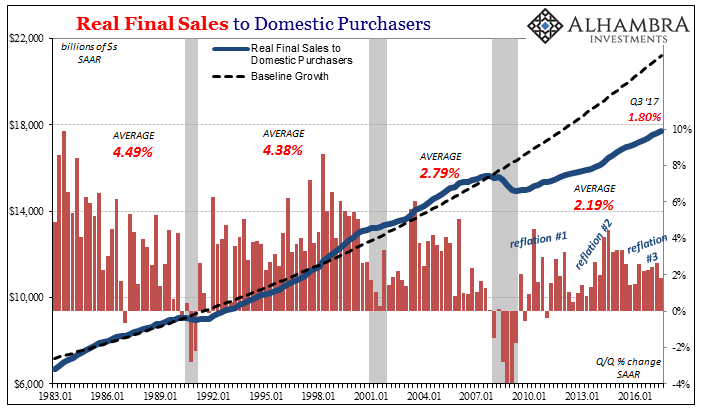

MACRO ANALYTICS – 07 14 17 – The Road to Financialization w/ Charles Hugh Smith

Anyone interested in how we got to where we are today will enjoy this tutorial discussion of the chronology of US & Global Monetary Events regarding the

Read More »

Read More »

Emerging Markets: What has Changed

China announced that it will remove foreign ownership limits on banks and other measures to open up the financial sector. Central Bank of Turkey lowered commercial bank FX reserve requirements in an effort to support the lira. US-Turkey relations appear to be thawing slightly. Middle East tensions are rising on a variety of fronts. Argentina central bank unexpectedly hiked rates again.

Read More »

Read More »

Maybe Hong Kong Matters To Someone In Particular

Hong Kong stock trading opened deep in the red last night, the Hang Seng share index falling by as much as 1.6% before rallying. We’ve seen this behavior before, notably in 2015 and early 2016. Hong Kong is supposed to be an island of stability amidst stalwart attempts near the city to mimic its results if not its methods.

Read More »

Read More »