In this issue of “All Inflation Is Transitory, The Fed WIll Be Late Again.“

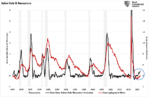

Market Review And Update

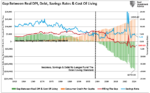

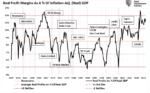

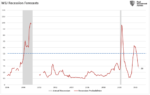

All Inflation Is Temporary

The Fed Should Be Hiking Now

Portfolio Positioning

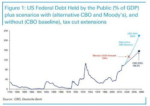

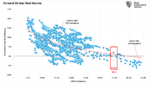

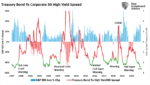

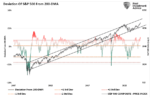

#MacroView: No. Bonds Aren’t Overvalued.

Sector & Market Analysis

401k Plan Manager

Follow Us On: Twitter, Facebook, Linked-In, Sound Cloud, Seeking Alpha

Catch Up On What You Missed Last Week

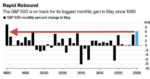

Market Review & Update

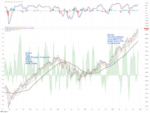

Last week, we said:

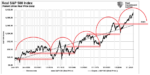

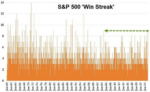

“The market is trading well into 3-standard deviations above the 50-dma, and is overbought by just about every measure. Such suggests a short-term ‘cooling-off’ period is likely. With the weekly ‘buy signals’ intact, the markets should hold above key support levels during the next consolidation phase.”

“As shown above, that is what is currently occurring. While

Read More »