“Sell Energy Stocks” Was Originally Published At Marketwatch.com

Sell energy stocks? Such certainly seems counter-intuitive advice given high oil prices, geopolitical stress, and surging inflation. However, some issues suggest this could indeed be the time to “sell high.”

Before we go further, it is essential to state that I am not recommending selling energy stocks in total. As is always the case, portfolio management is about minimizing risk and preserving capital. Reducing energy exposure by selling portions of existing positions is more prudent.

As shown, there is a high correlation between the price of oil, the energy sector as represented by SPDR Energy ETF (XLE,) and even oil stocks like Exxon Mobil (XOM.) Therefore, if oil prices decline, energy stocks will also. Profit-taking helps to preserve the accumulated gains.

It is worth noting that while oil prices have surged sharply since 2020, oil stocks have not had the same recovery. Oil prices are pushing more extreme overbought conditions and are ripe for a correction back into the $70 range.

In an isolated environment, such a correction would provide an ideal opportunity to increase exposure to, rather than selling in its entirety, energy stocks.

We are concerned about other dynamics that could signal a more significant correction in the making.

Backwardation

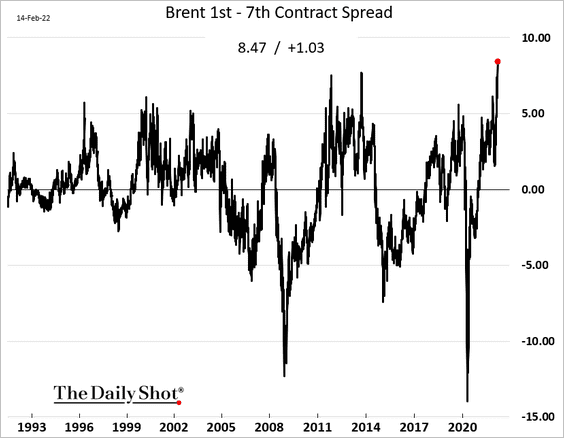

The first is “backwardation.”

Should a futures contract strike price be lower than today’s spot price, it means there is the expectation that the current price is too high and the expected spot price will eventually fall in the future. This situation is called backwardation.

For traders and investors, lower futures prices or backwardation is a signal that the current price is too high. As a result, they expect the spot price will eventually fall as the expiration dates of the futures contracts approaches.

Backwardation can occur as a result of a higher demand for an asset currently than the contracts maturing in the future through the futures market. The primary cause of backwardation in the commodities’ futures market is a shortage of the commodity in the spot market. Manipulation of supply is common in the crude oil market. For example, some countries attempt to keep oil prices at high levels to boost their revenues. Traders that find themselves on the losing end of this manipulation and can incur significant losses. – Investopedia

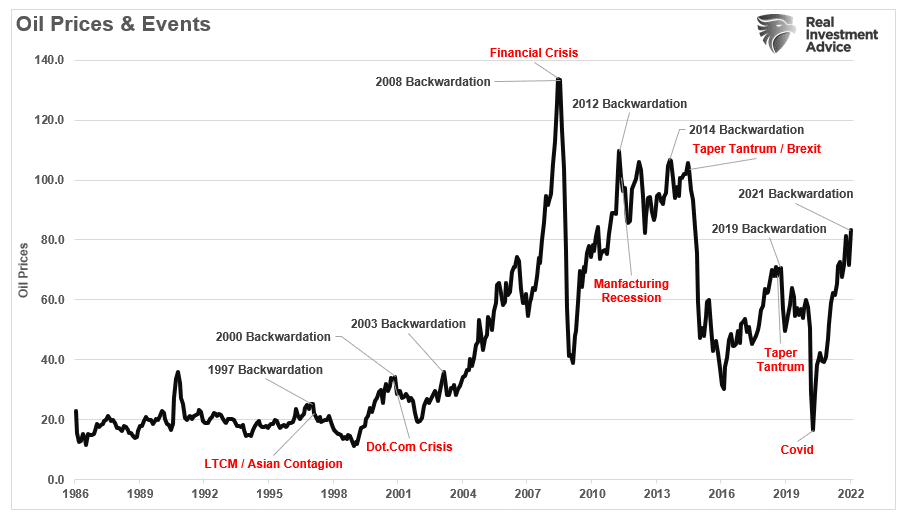

Currently, the backwardation in the Brent Crude market is at the highest level since 1992.

If we look at those peaks in backwardation, they align with previous peaks and more severe financial events.

Given the extreme level of backwardation currently, such suggests that considering a process to reduce oil-related risk (aka sell energy stocks) may be prudent.

However, it isn’t just backwardation we need to consider.

Fed Tightening

The surge in “artificial inflation” from the flood of liquidity against a supply shortage will eventually revert to a disinflationary trend. Debt and demographics will also continue to drive deflationary pressures leading to a reversal of the inflation trade.

However, for now, as the fear of inflation rose, investors piled into the commodity trade. While commodity prices rose due to the supply shortage, the reversal of that liquidity, and rebuilding of inventories, will ultimately undermine those assets. Such will coincide with a rather sharp decline in interest rates as deflation sets in.

Of course, slowing economic growth and deflationary pressures will contribute to the decline in oil prices. One of the things that could generate that environment, sooner than later, is the Federal Reserve tightening its monetary policy.

Historically, when the Fed has hiked rates or tapered its balance sheet, oil prices fall due to slower economic growth. Such should not be surprising since oil prices are a function of supply and demand.

While the recent rally in energy stocks has been quite strong, the Fed is about to aggressively tighten monetary policy with the sole goal of combating inflation. In other words, to bring down inflation, they will slow economic growth, which reduces demand for commodity-based products.

Unfortunately, I suspect it won’t be just oil prices and energy stocks that get brought down in the process.

High Prices

Lastly, the best cure for “high prices” in oil is “high prices.”

“The only way to balance this market over the medium term remains high oil prices to slow demand growth,” analysts at Energy Aspects via Bloomberg.

High oil prices do not exist in isolation. As oil prices, and other related commodities, increase in price, consumption will get negatively impacted. One of the indicators we continue to monitor is the yield curve. The chart below from Cory Venable shows the 10-2 yield spread as a ratio to oil prices.

The decline in the yield spread is enough to warrant caution about a rapidly slowing economy. However, combine already slowing economic growth with high oil prices and a Fed tightening monetary policy, and you have a perfect environment for a reduction of oil prices.

In other words, selling energy stocks to take profits may be a good idea.

Profit Taking Seems Prudent

When it comes to commodities and hard assets in general, they can be an exhilarating and profitable ride on the way up. However, as shown in the charts above, the trade ends badly.

Will this time be different? Such is unlikely to be the case for two reasons.

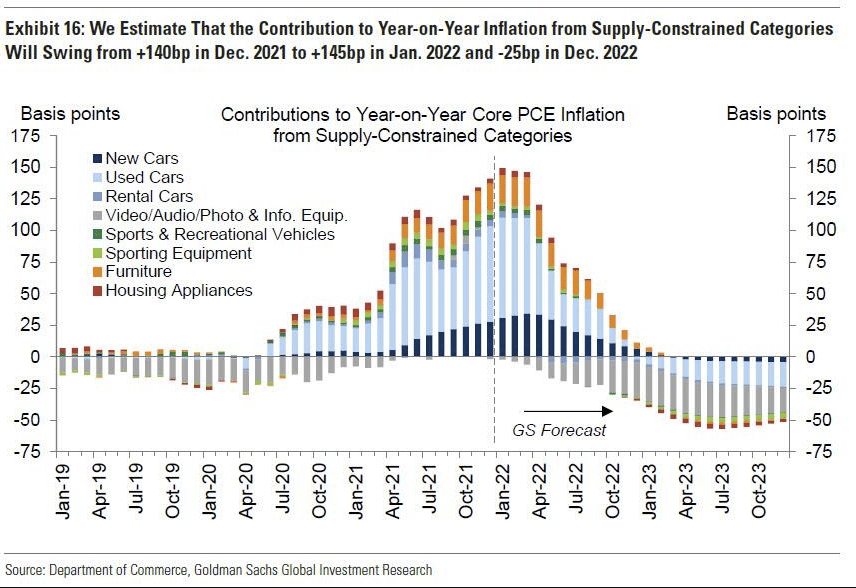

As shown by Goldman Sachs, inflation will reverse later this year.

Secondly, as the country moves toward a more socialistic profile, economic growth will remain constrained to 2% or less, with deflation remaining a consistent long-term threat. Dr. Lacy Hunt suggests the same.

Contrary to conventional wisdom, disinflation is more likely than accelerating inflation. Since prices deflated in the second quarter of 2020, the annual inflation rate will move transitorily higher. Once these base effects are exhausted, cyclical, structural, and monetary considerations suggest that the inflation rate will moderate lower by year-end and undershoot the Fed Reserve’s target of 2%. The inflationary psychosis that has gripped the bond market will fade away in the face of such persistent disinflation.

As he concludes:

The two main structural impediments to traditional U.S. and global economic growth are massive debt overhang and deteriorating demographics both having worsened as a consequence of 2020.

The last point is crucial. As the liquidity gets removed from the system, the debt overhang will slow consumption as incomes get diverted from productive activity to debt service. As such, the demand for commodities will weaken.

While the oil trade indeed “bloomed” with the rise of inflation and flood of liquidity in the economy, there is every indication we are very late into that trade.

For investors, selling energy stocks (taking profits) into current strength seems prudent.

The post Sell Energy Stocks? The Time May Be Approaching appeared first on RIA.

Full story here Are you the author? Previous post See more for Next postTags: Featured,Investing,newsletter,Technically Speaking