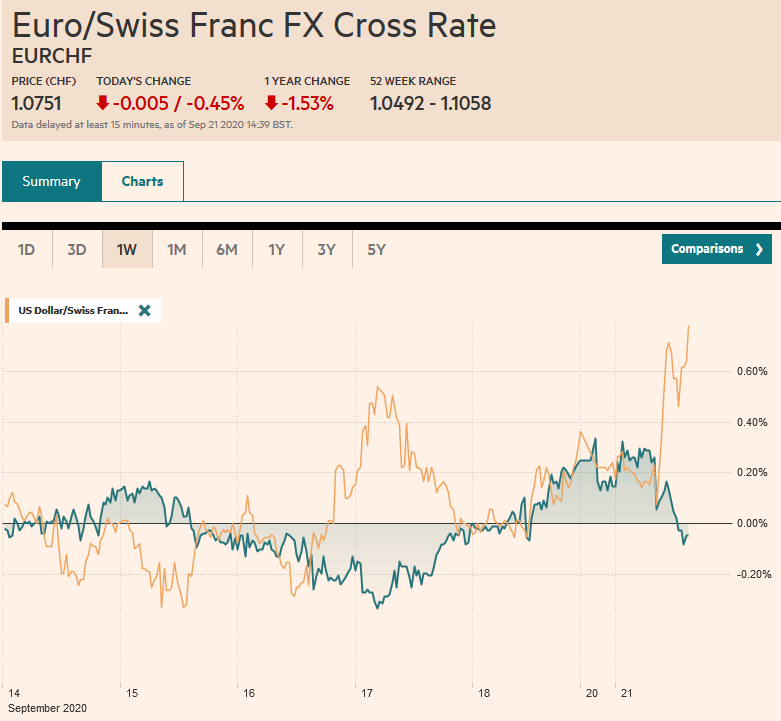

Swiss FrancThe Euro has fallen by 0.45% to 1.0751 |

EUR/CHF and USD/CHF, September 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Global equity markets are off to a poor start to the week, and the dollar appears to be enjoying a safe-haven bid. Tokyo markets are closed until Wednesday, while Asia-Pacific stocks tumbled, and the regional index is unwinding last week’s gains. The Dow Jones Stoxx 600 is off around 2.7% near midday in Europe. It is the third down session and looks to be the biggest loss in tat lest three months. US shares are also trading around 2% lower. Bond markets are bid, except the periphery of Europe, and the US 10-year yields are about 66 bp. The dollar is strengthening against most of the world’s currencies. Among the majors, the yen is resisting, and the greenback is testing the important JPY104 area. In the emerging market currency space, the Mexican peso, South African rand, and Hungarian forint are leading the way lower with more than 1% declines. Gold is heavy and has been sold through last week’s lows near $1933. The lower end of the range is closer to $1900. November WTI rallied almost 10% last week and is off around 2% to near $40 a barrel. |

FX Performance, September 21 |

Asia Pacific

China published a list of punishments for companies on its “unreliable list,” which includes the restriction on investment and visas. Some companies, like HSBC and Standard Charter are seen as vulnerable, and the shares sold-off sharply. Meanwhile, US President Trump has agreed in principle to the Oracle (12.5%) and Walmart’s (7.5%) minority stake in the new US arm of TikTok, though Bytedance would retain control and the technology. Bytedance also said that it learned about the $5 bln “donation” to US education in the media. A US court gave an injunction that prevents the dropping of WeChat from the app stores.

Tensions in the Taiwan Strait escalated as China flew several fight planes and bombers past the mid-point that had been previously respected (1999-March 2019) on both Friday and Saturday. It forced Taiwan to scramble its forces. Beijing has also engaged in “scenario-based” exercises that seemed to have mock attacks on Taiwan. US and Taiwan forces are also in joint military exercises in the area.

Not surprisingly, China’s Prime Loan Rate was left unchanged for the fifth consecutive month at 3.85% and 4.65% respectively for the one and five-year benchmarks. South Korea report trade figures for the first 20-day of September. Although the headline looks to have risen by 3.6%, it was inflated by two extra working days. The average daily rate was down 9.8% year-over-year after a 10% decline in August. Still, some promising signs, exports of semiconductors (and rising DRAM prices) autos, and machinery exports rose.

The dollar has not traded below JPY104 since mid-March. The low for the year was set near JPY101.20. There is speculation about what level Japanese officials express concerns. Recall that when the dollar fell to the year’s low, there was little talk about intervention. Initial resistance is now seen near JPY104.40. Given the risk-off mood, the Australian dollar is holding in well and remains above last week’s low near $0.7250. A break of it could spur another half-cent loss. A six-day advance had lifted the New Zealand dollar to new highs for the year before the weekend (almost $0.6800). That streak is ending, and the Kiwi looks headed for the $0.6675 area. The RBNZ meets this week and is widely expected to leave policy on hold, and while a negative cash rate is possible at some juncture, it seems unlikely in Q4. Although the Chinese yuan has strengthened for the past eight weeks, today is the third consecutive daily pullback, albeit small. We anticipate the dollar recovering into the CNY6.79-CNY6.80 area.

Europe

S&P is concerned that Spain’s political climate may struggle to pass the 2021 budget and continue to press ahead with reforms. While leaving the A-rating, it cut the outlook to negative from stable before the weekend. Recall that a little more than a year ago, S&P had upgraded Spain’s rating to A from A-. Ahead of the weekend, Moody’s, anticipating a robust recovery next year, left its Baa1 (BBB+) alone. The third major rating agency, Fitch, affirmed Spain’s A rating in June.

The Financial Times reports that two anonymous officials confirmed that the ECB has launched a large-scale review of the Pandemic Emergency Purchase Plan and the flexibility around the capital key of its purchases. This will be discussed at next month’s meeting. Bundesbank President Widemann has already put down his marker, insisting that PEPP ends with the crisis. There is little doubt that the region’s economy is growing strongly here in Q3. There is some thought to give the other asset purchase program (APP) some of the flexibility of the PEPP. Part of the subtext seems to be the old German court decision earlier this year that the self-imposed rules were the key to its legality. PEPP was a relaxation of the self-imposed limitations. Many member governments, including Germany, will continue to experience elevated levels of government borrowing and large budget deficit.

Amid acrimonious talks between the UK and the EC, common ground was found. Germany, France, and the UK issued a joint statement rejecting US efforts to re-impose sanctions on Iran. They argued that after quitting the 2015 treaty, the US did not have the standing to do so. Meanwhile, London Mayor Khan is preparing new social restrictions in the face of the rising virus. Reports suggest that Chancellor of the Exchequer Sunak is considering extending the emergency business loan program and appears to still be under pressure to extend the employee furlough subsidies.

Several European central banks meet this week, including Sweden, Norway, and Switzerland. None seem ready to adjust policy. Turkey’s central bank also meets this week, and there is some speculation that it could lift the upper end of its rate corridor as it seeks to avoid an outright rate hike. The dollar is at new record highs against the lira today, pushing above TRY7.60.

The euro made a high a couple of ticks above the pre-weekend high near $1.1870 before reversing lower near $1.1775 in the European morning. Last week’s low was a little below $1.1735, and additional support is seen around $1.1700, the lower end of the two-month range. The intraday technicals are stretched. Sterling encountered offers over the last three sessions around $1.30, and today it has been sold down to $1.2835. This month’s low was set near $1.2765, which is the next target and just above the 200-day moving average (~$1.2730). It has not traded below the 200-day moving average since late July. The intraday technicals are stretched here too.

America

The US Commerce Department utilizing Treasury’s foreign exchange model, will report today on the Chinese yuan. A couple of months ago, an anti-dumping case was launched against twist-ties. Since February, Commerce can include foreign exchange valuation for assessing the magnitude of subsidy under the US Tariff Act of 1930. A little more than a year ago, the US controversially cited China as a currency manipulator and a few months later lifted the label. The US secured an agreement from China not to devalue the yuan. However, currency stability, as we noted at the time, is a two-edged sword. Previously, the US penchant for pressuring other countries to revalue their currencies was brought to bear on Europe and Japan. The agreement for foreign exchange stability between the yuan and the dollar blunts the US ability to do the same now to China. Just as importantly, the G7 and G20 agreed to defer policing of the foreign exchange market to the IMF precisely to avoid deterioration to the lowest common denominator of beggar-thy-neighbor. The recent issue of the Economist warns that the turn in US trade policy may be more sustained after the November election than many would suspect.

There is a light economic calendar for North America today. The US data highlight this week is the August new and existing home sales and durable goods orders. The preliminary PMI is so on tap. Powell and Mnuchin testify before Congress for a few days starting tomorrow. Canada has a quiet data week, but the new session of Parliament opens midweek, and the Trudeau government is expected to announce more fiscal support. The highlight for Mexico is the central bank meeting. Although many are playing up the risk of a 25 bp rate cut, we suspect that given the uptick in inflation, they may be disappointed.

The US dollar flirted with the 20-day moving average against the Canadian dollar ahead of the weekend around CAD1.3145 and bounced as the risk-off sentiment deepened. Today the greenback is nearly a big figure higher to near last week’s high (~CAD13250). The upper end of the recent range extends toward CAD1.3260-CAD1.3270. The US dollar jumped about 1.25% against the Mexican peso before the weekend and is up a little more than that ahead of the start of the North American session. Remember, the peso has appreciated for the past six weeks. Although the dollar’s gains today to almost MXN21.46 have stretched the intraday technicals, the next important chart area is closer to MXN21.63, where a retracement objective and the 200-day moving average are found.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,China,Currency Movement,ECB,Featured,Mexico,newsletter,NZD,Spain,Taiwan