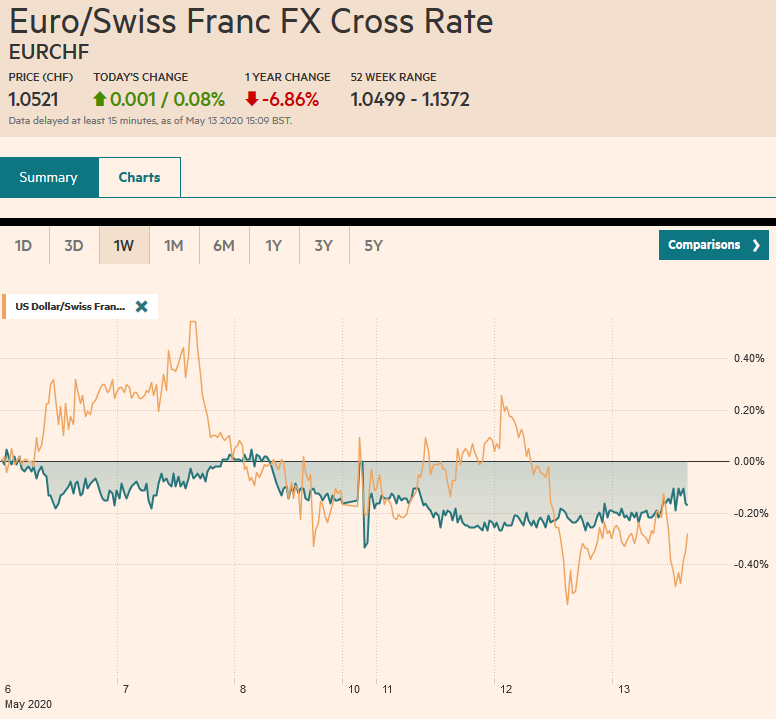

Swiss FrancThe Euro has risen by 0.08% to 1.0521 |

EUR/CHF and USD/CHF, May 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Another late sell-off in US shares, this one perhaps related to the sobering assessment by the leading medical adviser for the Trump Administration about the risks of opening too early, failed to deter investors in the Asia Pacific region. Although Japanese shares slipped, most other markets rose. India led the way (~2%) after a fiscal stimulus program was announced. European shares, though, are heavier, led by consumer discretionary and financial sectors. US shares are steady to firmer. After a slow start, European bonds have rallied and yields are 2-3 bp lower, with Italy’s benchmark off about 6 bp to 1.82%. Bond markets are mostly quiet, but the Reserve Bank of New Zealand’s increase in bond purchases and indication that negative rates are possible saw the benchmark yield fall around 12 bp and took the currency about 1% lower. The 10-year US Treasury is a little softer at 66 bp. Outside of the Kiwi, most of the major currencies are mostly firmer, led by the Norwegian krone and Canadian dollar. Emerging market currencies are mixed, with eastern and central European currencies a little heavier. Gold continues to hover are $1700 and July crude continues its broadly sideways drift. |

FX Performance, May 13 |

Asia PacificIndia announced a package of INR20 trillion or 10% of GDP. The details are not yet clear, but it does appear that officials have combined several previous commitments and central bank measures. The fresh initiatives, though, still appear substantial and are estimated around INR8-INR12 trillion (~4%-6% of GDP). The Reserve Bank of New Zealand doubled its bond-buying efforts to NZD60 bln. It left its cash rate target at 25 bp but suggested that negative rates are possible. Thus far, no country with a current account deficit has adopted negative interest rates. New Zealand’s current account deficit was about 3.3% of GDP in 2019. |

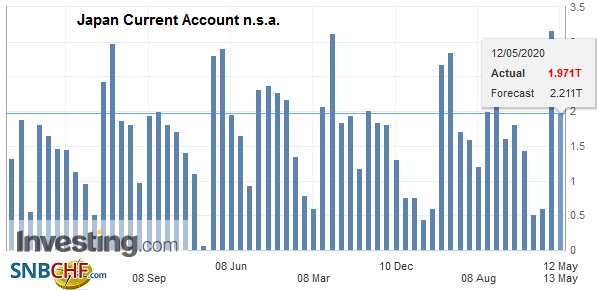

Japan Current Account n.s.a., March 2020(see more posts on Japan Current Account n.s.a., ) Source: investing.com - Click to enlarge |

The US dollar jumped to a little more than JPY107.75 to start the week after testing the JPY106 area while Japanese markets were closed in the first half of last week for the Golden Week holidays. Yesterday and today, the dollar has pared Monday’s gains and now is testing JPY107.00 where a nearly $900 mln option is set to expire. The dollar is third of a yen range today, and the upside looks to be blocked with the help of a $1.1 bln expiring option at JPY107.40. The Australian dollar fell nearly 1% over the past two sessions, but it found support near the 20-day moving average (~$0.6425), which it has not closed below in over a month. There is an option for A$1 bln at $0.6500 that expires today. The greenback is firm against the Chinese yuan as it holds in the upper end of the CNY7.05-CNY7.10 range that has largely contained it in recent weeks.

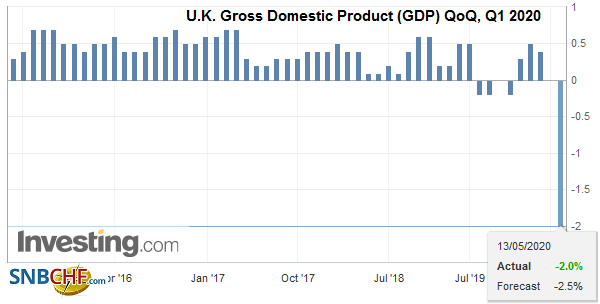

EuropeThe two main economic reports from Europe were not as dismal as expected. The eurozone reported industrial output in March fell 11.3%. The median forecast in the Bloomberg survey was more than a 12% slump. The UK economy contracted 2% in Q1 with the median estimates looking for a 2.6% decline in output. The monthly GDP estimate showed a 5.8% decline in March alone. The Bank of England is expected to increase its bond purchases as early as next month. The ECB is also likely to increase is Pandemic Emergency Purchase Program (PEPP) as well, but the timing is less clear. |

Eurozone Industrial Production YoY, March 2020(see more posts on Eurozone Industrial Production, ) Source: investing.com - Click to enlarge |

| On the fiscal front, the UK has extended its furlough program until the end of October and will not taper it until at least July. Italy’s cabinet approved the 55 bln euro stimulus package. Nearly 30% is for its employee furlough program. More than 10% is earmarked for what appears to be grants to small businesses. And nearly another 10% is for self-employed and seasonal workers. |

U.K. Gross Domestic Product (GDP) QoQ, Q1 2020(see more posts on U.K. Gross Domestic Product, ) Source: investing.com - Click to enlarge |

| The euro traded in a cent-range yesterday (~$1.0785-$1.0885) and today is in a little more than a quarter-cent range above $1.0830. The consolidation looks set to continue. Sterling fell to around $1.2255 yesterday, its lowest level in over a month. A marginal new low was made in Asia, before sterling was bid in Europe to toy with the $1.2300 area. There is potential toward back toward $$1.2340-$1.2350. |

U.K. Trade Balance, March 2020(see more posts on U.K. Trade Balance, ) Source: investing.com - Click to enlarge |

AmericaThere are three events in the US today to note. First, the US reports April producer prices. The deflationary shock is well recognized, and the collapse of oil price will send the headline PPI into negative territory. However, the core rate, which excludes food and energy, is likely to fare considerable better. The median forecast in the Bloomberg survey is for a 0.1% decline on the month for a 0.8% year-over-year gain. In yesterday’s April CPI, gasoline prices fell by over 20% while food prices rose 1.5%. Second, the EIA will make its weekly energy inventory report. API estimated that oil stocks increased by about 7.6 mln barrels, but at Cushing, they might have fallen by more than two million barrels. This would be the first decline in 10 weeks. Third, Federal Reserve Chairman Powell speaks at the Peterson Institute (9:00 am ET). He is expected to push back against ideas a negative funds rate. Despite the efforts of several regional presidents to play down this scenario, the fed funds futures strip starting next March imply slightly negative rates. Another common theme of Fed speakers have been that more support may be needed for the economy. This is seen as a balance sheet issue and fiscal policy. |

U.S. Crude Oil Inventories, May 13 2020(see more posts on U.S. Crude Oil Inventories, ) Source: investing.com - Click to enlarge |

After raising $100 bln in cash management bill sales, the Treasury sold $32 bln 10-year notes at a lower yield than the previous auction (70 bp vs 78 bp), with a higher bid-to-cover (2.69 vs 2.63), and more taken up by indirect bidders that include asset managers, hedge funds, and foreign central banks (66.1% vs 59.2%). More is coming. It is not just today’s $20 bln 30-year bond sale to round out the quarterly refunding and another $75 bln of cash management bills, but another large spending bill has begun its circuitous route to become law. The initial estimate of the House bill is about $3 trillion and that is on the day that the US reported a record $737.9 bln deficit for the month of April. Around a third of the bill is for states and local governments. There are also funds for another $1200 payment adults, which is means-tested, and money for elections and the postal service. The deduction for state and local taxes is also brought back. Of course, as the Senate Majority Leader noted it is aspirational. It must be negotiated with the Senate, and especially Trump Administration. However, the House took first-mover advantage and forces the GOP to be less “Rooseveltian” with the election now less than six months away.

The US dollar settled last week near CAD1.3925. It recovered 0.5% on Monday and again on Tuesday but has run out of steam near CAD1.4085. Support is seen in the CAD1.3980-CAD1.4000 area today. Similarly, the greenback finished last week around MXN23.65 and gained 1% on Monday and 2% yesterday to reach MXN24.40. It is trading softer now around MXN24.10. Dollar losses may be limited in North America today ahead of the Banxico rate decision tomorrow. Although a 50 bp cut is widely expected, there is scope for 75 bp move. More political problems for Brazil’s President Bolsonaro weigh on the real, which fell to new record lows yesterday (the US dollar rose above BRL5.89). Today, Brazil reports March retail sales and its economic activity index. The only question is how fast of a contraction is being experienced.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Brazil,EUR/CHF,Eurozone Industrial Production,federal-reserve,Fiscal,India,Japan Current Account n.s.a.,New Zealand,newsletter,u-k-trade-balance,U.K. Gross Domestic Product,U.K. Trade Balance,U.S. Crude Oil Inventories,USD/CHF