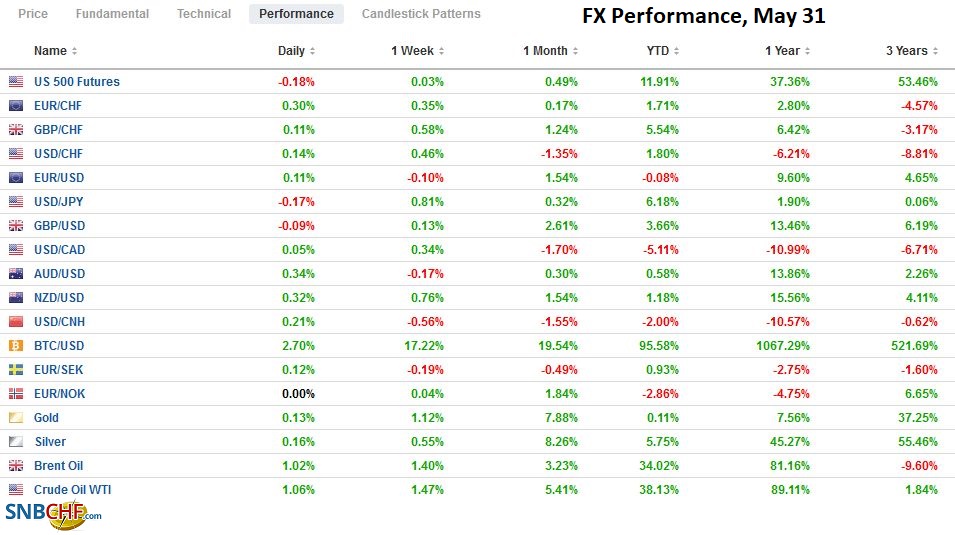

Swiss FrancThe Euro has risen by 0.22% to 1.0986 |

EUR/CHF and USD/CHF, May 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: US and UK markets are closed for holidays today, contributing to the rather subdued price action today. The MSCI Asia Pacific Index rallied two percent last week, the most in three months, and most markets began off the week with modest gains. Japan, Australia, and Singapore, for notable exceptions. Europe’s Dow Jones Stoxx 600 took a seven-day advance into today’s action and is struggling to extend it. US futures have edged slightly higher. European bond yields have edged higher. The dollar is little changed against the major currencies. Outside of the Australian dollar, which is about 0.3% higher, around $0.7735, the other major currencies are +/- 0.15%. Emerging market currencies are mostly firmer, led by the Turkish lira, which was helped by a stronger than expected Q1 GDP (1.7% quarter-over-year and 7% year-over-year). The JP Morgan Emerging Market Currency Index is extending its advance for the fourth consecutive session. Gold is holding above $1900, while oil is firm, and July WTI is extending last week’s 4.3% rally as it tries to solidify a foothold above $67 ahead of tomorrow’s OPEC+ meeting. Industrial commodities, such as copper, iron ore, and steel rebar have moved higher to build on the recovery seen at the end of last week. |

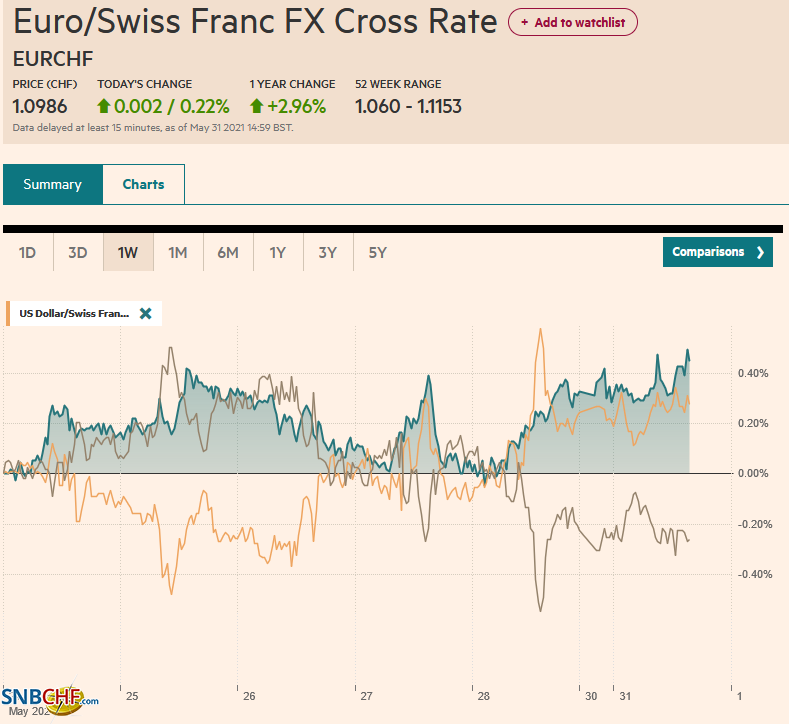

FX Performance, May 31 |

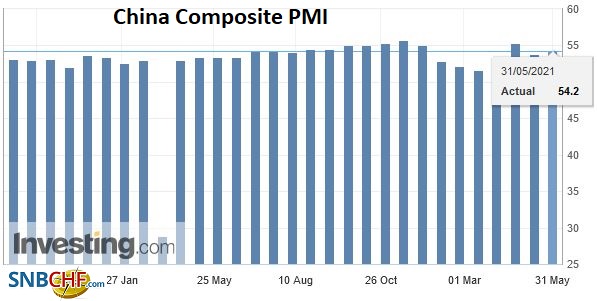

ChinaChina’s composite May PMI crept up to 54.2 from 53.8. |

China Composite PMI, May 2021 Source: Investing.com - Click to enlarge |

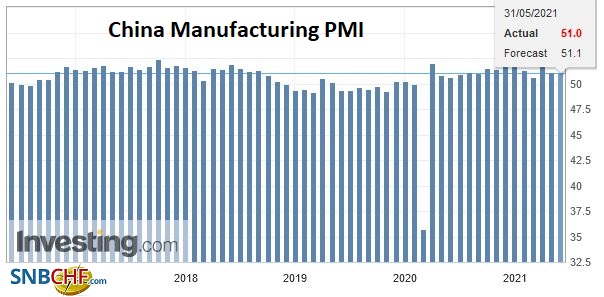

| It was the result of a slightly disappointing manufacturing reading that slipped from April’s 51.1 to 51.0. |

China Manufacturing PMI, May 2021(see more posts on China Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

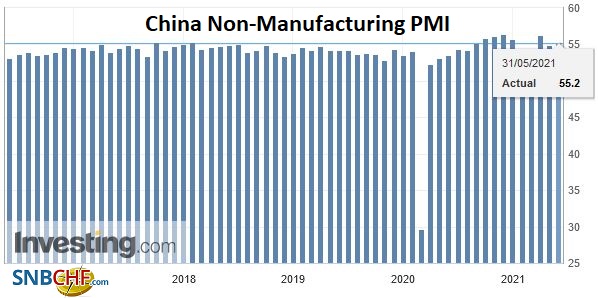

| The non-manufacturing PMI, however, was stronger than expected, rising from 54.9 to 55.2. The recovery appears to be morphing into a steady pace expansion. Caixin PMI is next (manufacturing PMI tomorrow) with May trade figures and reserves possibly before the end of the week. |

China Non-Manufacturing PMI, May 2021(see more posts on China Non-Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

Asia Pacific

Japan has extended the formal emergency to June 20, with Opening Ceremonies for the Olympics scheduled for July 23. The emergency threatens to delay the economic recovery. April industrial output, retail sales, and housing starts were reported earlier today. Industrial production is aided by exports and rose 2.5%. While better than March’s 1.7%, it still fell shy of projections for a nearly 4% gain. Retail sales, however, sorely missed forecasts and illustrates, at least in part, the impact of the social restrictions on consumption. The 4.5% month-over-month fall was more than twice the decline expected and was the biggest slump since last April. The broader measure of household spending is due out later this week. Housing starts were a bright spot. The 7.1% year-over-year advance bested expectations and was the first back-to-back gain in two years. Next up, the final manufacturing PMI reading. The preliminary report showed a slower pace of expansion (52.5 from 53.6).

The Reserve Bank of Australia meets first thing tomorrow. No change is expected, but the statement will be scrutinized for clues for what officials will decide next month when it reviews its asset purchases and three-year interest rate target. Shortly after the central bank meeting, Q1 21 GDP will be reported. A 1.1% quarterly advance is expected after a 3.1% expansion in Q4 20.

A series of comments by Chinese officials appeared to talk the yuan lower, emphasizing that the recent gains were unlikely to last due to speculation, potential Fed tightening, and or rate adjustments in the emerging markets. It was having a little impact until the PBOC announced a two percentage point increase in reserve requirements for foreign exchange positions. The new requirement starts June 15, and the reserve requirement will stand at 7%. The PBOC’s reference rate for the dollar, set at CNY6.3682 (compared with expectations for CNY6.3656, the median in Bloomberg’s survey, also seemed to be a protest. The offshore yuan recovered on the announcement.

The US dollar was rebuffed ahead of the weekend after a brief foray above JPY110 for the first time since early April. The greenback was sold in the European morning to around JPY109.65. Support is seen in the JPY109.40-JPY109.60 area.

The Australian dollar is firm in the upper end of the pre-weekend range when it approached $0.7750. Recall that it had tested the month’s low (~$0.7675) and rebounded back above $0.7700, where it has remained today. The $0.7800 is the real nemesis for the Aussie bulls.

Europe

The eurozone’s May inflation is front and center. French data before the weekend showed a 0.4% rise for a 1.8% year-over-year gain. It was up from 1.6% in April. Italy reported a flat month-over-month rate today, which lifts the year-over-year rate to 1.3%, both slightly softer than expected. Spain’s 0.5% increase matched expectations and lift the year-over-year rate to 2.4% from 2.0%. German states have reported, and the domestic measures were mostly 2.5-2.6% higher year-over-year. This warns of the possible upside risk to the national harmonized measure that rose 0.5% for a 2.1% year-over-year advance in April. The aggregate figure is out tomorrow. The risk is that the headline rises a little more than the 0.2% gain expected, which could see the year-over-year rate test 2%.

The fifth round of Europe-led talks to revised the 2015 pact that limits Iran’s nuclear developments began yesterday. This round of talks could be the last given the proximity of the June 18 Iranian elections. Separately, the possibility that a deal is struck and some Iranian oil can return to the market is part of the constellation of considerations for OPEC+ when it meets tomorrow to sort out its plans to boost output. It is generally expected to maintain current output quotas, with a rise expected (~840k barrels a day) in July. Meanwhile, it appears that after four inconclusive elections in four years, Israel may be on the verge of a new government that will not include Netanyahu after one of the Prime Minister’s key allies defected to the coalition being forged by former Finance Minister Lapid. Of note, that coalition may rely on an Arab party to secure a majority. The Israeli central bank meets today and is widely expected to maintain the 10 bp base rate.

The euro fell to a two-week low below $1.2135 before the weekend and rebounded to poke above $1.22 before the end of the session. According to Bloomberg data, the euro has settled between $1.2192 and $1.2195 for the past three sessions. It is confined to around a fifth of a cent range today, hovering around 10 ticks on either side of those settlements. The pre-weekend high was $1.2205, and the euro has been stopped just in front of it so far today. If it holds, it would be the fourth consecutive session of lower highs.

Sterling also appears to be going nowhere quickly. It closed above $1.42 last Thursday for the first time in years, but there has been no follow-through buying. It met sellers today as it tried to push back above $1.4200. Initial support is seen around $1.4150, but better support is closer to $1.41.

America

The disappointing US April employment report underscores the importance of this week’s May estimate. Moreover, a strong upward revision to the April series would seem to be consistent with other data inputs. Auto sales on Wednesday may also be important. After the surge in April (18.5 mln vehicles as a seasonally-adjusted rate), the chip shortage may take a toll. The median forecast in Bloomberg’s survey is for a 17.5 mln pace. Note that the chip shortage is seeing new car buyers opt for 2020 models and dealers buying cars with expiring leases as less than expected miles were driven last year, boosting the resale value. Fed president and governors have numerous speaking opportunities this week, and the general message has confirmed what the market already thought it knew, namely that a formal discussion on tapering is possible in the coming months. As we have noted, many are talking about the Jackson Hole Fed conference at the end of August and/or the September FOMC meeting as likely venues. Despite the talk, the 10-year yield settled just below 1.60% before the weekend. Chair Powell speaks on Friday at a Bank of International Settlements function.

Canada reports Q1 GDP figures tomorrow (expected 6.8% at an annualized pace after 9.6% in Q4 20), but the jobs data at the end of the week is more important. Like the US, Canada’s April report disappointed. It lost 129.4k full-time positions and 207k jobs overall. However, while the US job creation is expected to have accelerated, the median forecast in Bloomberg’s survey anticipates another loss of jobs (~25k). Mexico’s data highlights include worker remittances (which continue to exceed the trade surplus) and the PMI. However, the central bank’s inflation report on Wednesday is expected to solidify the cautious stance in light of the recent rise in price pressures. The market appears to be pricing in as much as 75 bp of tightening over the next year. In addition to April industrial production and May trade figures and PMI, Brazil reported Q1 GDP. It is expected to have grown by 0.8% after a 3.2% expansion in Q4 20. The year-over-year rate is expected to turn positive. Before the weekend, Fitch affirmed Brazil’s BB- rating and retained the negative outlook due to the risks that fiscal consolidation is not delivered.

The US dollar remains in its trough against the Canadian dollar. The CAD1.20 offers critical technical support, while the upside is blocked by the 20-day moving average (~CAD1.2115). The greenback briefly rose above the moving average last Thursday for the first time in a month, and those gains were quickly sold into, and the sideways churn continues.

The greenback was bid to two-week highs against the Mexican peso (~MXN20.0770) ahead of the weekend but also retreated to settle a little below MXN19.94. The MXN19.90 area offers initial support. The market may be reluctant to take the greenback above MXN20.00 in today’s thin activity. The dollar is testing support near BRL5.20. It has not traded below there since January. A break would target BRL5.0. The central bank meets on June 16 and already appears to have committed to the third 75 bp hike this year.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$CNY,Brazil,China,China Manufacturing PMI,China Non-Manufacturing PMI,Currency Movement,EUR/CHF,Featured,inflation,Japan,newsletter,PBOC,USD/CHF